The world is undergoing a financial revolution, with Web3 at the heart of this transformation. Web3, often called the decentralized web, is reshaping the way we interact with digital systems, particularly in finance.

At the center of this revolution are crypto-focused fintech platforms for Web3 revolution, which bridge traditional finance with blockchain-based innovations. These platforms are leading the charge by enabling secure, transparent, and decentralized financial solutions.

In this article, we’ll explore how crypto-focused fintech platforms for Web3 revolution are shaping the future of decentralized finance (DeFi).

What Is Web3 and How Is It Revolutionizing Finance?

Web3 refers to the third generation of internet services that prioritize decentralization, blockchain technology, and token-based economies. Unlike Web2, which relies heavily on centralized platforms, Web3 empowers users by giving them ownership of their data and assets.

Core Components of Web3

- Blockchain Technology: The backbone of Web3, ensuring data security and immutability.

- Cryptocurrencies: Digital assets that facilitate transactions without intermediaries.

- Decentralized Applications (DApps): Applications that run on blockchain networks, providing transparency and user control.

Financial Benefits of Web3

- Transparency: Every transaction is recorded on a public ledger, reducing fraud.

- Efficiency: Smart contracts automate processes, eliminating delays.

- Accessibility: Financial services become available to underbanked and unbanked populations globally.

Actionable Tip:

Consider exploring decentralized applications like Uniswap or Compound, which demonstrate how crypto-focused fintech platforms for Web3 revolution are making financial processes more accessible to users worldwide.

Why Crypto-Focused Fintech Platforms Are Essential for Web3?

Crypto-focused fintech platforms for Web3 revolution serve as the gateway for users to access Web3’s benefits. These platforms simplify the complexities of blockchain technology and make it more accessible to individuals and businesses.

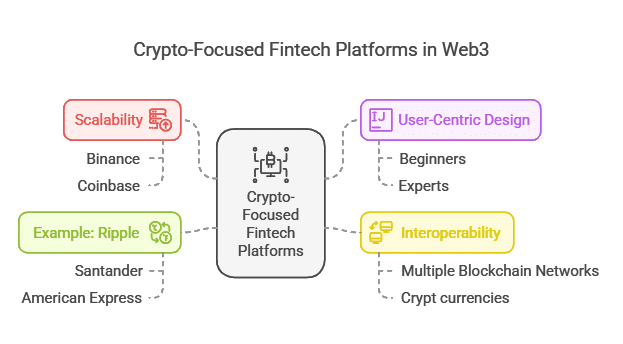

Key Features of Leading Platforms

- Scalability: Platforms like Binance and Coinbase ensure they can handle millions of users simultaneously.

- User-Centric Design: Intuitive interfaces make it easy for both beginners and experts to navigate.

- Interoperability: Support for multiple blockchain networks and cryptocurrencies.

Example:

Ripple’s partnerships with major financial institutions like Santander and American Express showcase how crypto-focused fintech platforms for Web3 revolution are creating scalable solutions for global payments.

Top 10 Crypto-Focused Fintech Platforms Leading the Web3 Revolution

Here are the 10 best crypto-focused fintech platforms for the web3 revolution.

1. Coinbase

Coinbase is one of the most trusted platforms for buying, selling, and managing cryptocurrency. It’s known for its robust security measures, ease of use, and broad cryptocurrency support.

Features include:

- User-Friendly Interface: Simplifies crypto trading for beginners.

- Advanced Trading Tools: Caters to professional investors with detailed analytics.

- DeFi Integration: Access to decentralized finance protocols directly from the platform.

Key Details of Coinbase

| Feature | Description |

| Supported Currencies | BTC, ETH, ADA, SOL |

| User Base | 100+ million users worldwide |

| Unique Offering | Industry-leading security and wallet |

Actionable Tip:

Use Coinbase Earn to learn about new cryptocurrencies and earn free tokens as rewards. Coinbase is an exemplary crypto-focused fintech platform for Web3 revolution.

2. Binance

Binance stands out for its extensive range of cryptocurrencies and advanced trading options. It has gained global recognition as a one-stop solution for crypto enthusiasts.

Highlights include:

- Low Transaction Fees: Ensures affordability for frequent traders.

- Robust DeFi Ecosystem: Offers staking, liquidity pools, and yield farming.

- Wide Crypto Support: Supports over 300 cryptocurrencies.

Key Details of Binance

| Feature | Description |

| Supported Currencies | BTC, ETH, SOL, AVAX, XRP |

| User Base | Over 120 million users globally |

| Unique Offering | Comprehensive trading and staking |

Example:

Binance’s Launchpad has helped fund innovative blockchain projects like Axie Infinity and Polygon, fostering the growth of the Web3 ecosystem. As a crypto-focused fintech platform for Web3 revolution, Binance is critical to the space.

3. Kraken

Kraken has built a reputation for prioritizing security and offering a diverse range of crypto services. It’s particularly popular among seasoned traders.

Core features include:

- Margin Trading and Futures: Advanced tools for experienced investors.

- High-End Security Protocols: Ensures the safety of user funds.

- Transparent Fee Structure: No hidden costs for users.

Key Details of Kraken

| Feature | Description |

| Supported Currencies | BTC, ETH, LTC, DOT |

| User Base | Over 9 million users globally |

| Unique Offering | Margin trading and futures options |

Actionable Tip:

Explore Kraken’s staking options to earn passive income from assets like ETH and Polkadot. Kraken continues to innovate as a crypto-focused fintech platform for Web3 revolution.

4. Ripple

Ripple is transforming cross-border payments with its blockchain-powered RippleNet. By focusing on real-time global payments, Ripple caters to banks and financial institutions.

Features include:

- Instant Transactions: Settlements in seconds, not days.

- Minimal Transaction Fees: Cost-efficient compared to traditional banking.

- Institutional Partnerships: Collaborations with top banks worldwide.

Key Details of Ripple

| Feature | Description |

| Supported Currencies | XRP |

| User Base | 300+ financial institutions |

| Unique Offering | Revolutionizing cross-border payments |

Example:

Ripple partnered with the Republic of Palau to develop a national digital currency, showcasing the platform’s versatility as a crypto-focused fintech platform for Web3 revolution.

5. BlockFi

BlockFi bridges the gap between traditional finance and cryptocurrency by offering innovative financial services that cater to retail and institutional clients.

Key features include:

- High-Yield Interest Accounts: Users can earn interest on crypto holdings like BTC, ETH, and USDC.

- Crypto-Backed Loans: Borrow cash by leveraging cryptocurrency assets without selling them.

- Credit Card with Crypto Rewards: BlockFi’s card offers Bitcoin rewards on everyday purchases.

Key Details of BlockFi

| Feature | Description |

| Supported Currencies | BTC, ETH, LTC, USDC |

| Unique Offering | High-yield savings and crypto loans |

Actionable Tip:

Use BlockFi’s credit card to earn up to 1.5% back in Bitcoin on every purchase. BlockFi is a trailblazer among crypto-focused fintech platforms for Web3 revolution.

6. ConsenSys

ConsenSys is a global blockchain technology company that focuses on Ethereum-based applications and solutions. Known for products like MetaMask, it plays a crucial role in the Web3 ecosystem.

Features include:

- DApp Development Tools: Simplifies blockchain development for developers and enterprises.

- MetaMask Wallet: A widely used Web3 wallet for accessing DeFi and NFTs.

- Blockchain Solutions for Enterprises: Supports companies in adopting blockchain technology.

Key Details of ConsenSys

| Feature | Description |

| Supported Currencies | ETH, USDT, DAI |

| Unique Offering | MetaMask and enterprise solutions |

Example:

ConsenSys partnered with JP Morgan to develop Quorum, a private blockchain for enterprises, solidifying its role as a key crypto-focused fintech platform for Web3 revolution.

7. Chainalysis

Chainalysis provides blockchain data analytics and compliance solutions to governments, businesses, and financial institutions. Its tools enhance transparency and trust in blockchain ecosystems.

Features include:

- Transaction Monitoring: Tracks and flags suspicious activity to prevent fraud.

- Compliance Tools: Ensures crypto businesses adhere to regulations.

- Data Insights: Provides detailed reports for policymakers and stakeholders.

Key Details of Chainalysis

| Feature | Description |

| Supported Currencies | BTC, ETH, XRP, USDC |

| Unique Offering | Blockchain analytics and compliance |

Example:

Chainalysis supported the U.S. Department of Justice in recovering $2.3 million worth of Bitcoin from a ransomware group, showcasing its importance in securing the crypto ecosystem.

8. BitPay

BitPay simplifies cryptocurrency payments for businesses, enabling merchants to accept crypto seamlessly while offering users convenient payment options.

Highlights include:

- Merchant Solutions: Allows businesses to accept crypto payments without volatility risks.

- Crypto Debit Cards: Users can convert crypto into fiat for everyday spending.

- Global Payment Options: Facilitates international transactions with minimal fees.

Key Details of BitPay

| Feature | Description |

| Supported Currencies | BTC, ETH, DOGE, USDC |

| Unique Offering | Merchant tools and debit cards |

Actionable Tip:

Integrate BitPay into your e-commerce platform to attract crypto-savvy customers. BitPay stands out as a user-centric crypto-focused fintech platform for Web3 revolution.

9. Fireblocks

Fireblocks provides an enterprise-grade platform for managing digital asset operations with top-tier security. Its innovative solutions cater to financial institutions, including hedge funds and exchanges.

Features include:

- Secure Asset Transfer: Ensures safe movement of assets between wallets and platforms.

- MPC Technology: Multi-party computation secures private keys.

- DeFi Integration: Seamlessly connects institutions to DeFi protocols.

Key Details of Fireblocks

| Feature | Description |

| Supported Currencies | BTC, ETH, SOL, USDC |

| Unique Offering | Institutional-grade security |

Example:

Fireblocks secures over $2 trillion in digital assets for major clients like Revolut and eToro, establishing itself as a leader among crypto-focused fintech platforms for Web3 revolution.

10. Circle

Circle is the issuer of USD Coin (USDC), a leading stablecoin in the cryptocurrency space. It offers payment and treasury infrastructure for businesses adopting blockchain technology.

Features include:

- USDC Stablecoin: Facilitates fast and cost-effective digital payments.

- Treasury Services: Helps businesses manage digital assets efficiently.

- DeFi Integration: Enables USDC usage across DeFi platforms.

Key Details of Circle

| Feature | Description |

| Supported Currencies | USDC, BTC |

| Unique Offering | Stablecoin solutions and payments |

Example:

Circle partnered with Visa to enable businesses to make payments in USDC via Visa cards, showcasing its influence as a crypto-focused fintech platform for Web3 revolution.

Takeaways

Crypto-focused fintech platforms for Web3 revolution are at the forefront of a paradigm shift in global finance. By leveraging blockchain technology, these platforms are enabling secure, efficient, and transparent financial solutions that cater to both individual users and large enterprises.

From Coinbase’s user-friendly tools to Circle’s stablecoin innovations, these platforms demonstrate the transformative potential of Web3.

As adoption of decentralized technologies accelerates, these platforms will play an increasingly critical role in shaping the future of finance. They provide the infrastructure for more inclusive financial systems, open new avenues for innovation, and drive the transition from centralized systems to a decentralized economy.

To stay ahead, businesses and individuals should actively explore the opportunities offered by these platforms. Whether you’re looking to invest, innovate, or simply navigate the Web3 space, these fintech platforms offer the tools and resources needed to succeed in the decentralized era.

Have you used any of these crypto-focused fintech platforms for Web3 revolution? Share your experiences and insights in the comments below. Let’s keep the conversation going about the future of decentralized finance!