Owning a home is a dream for many, but it comes with responsibilities and potential risks. One crucial question every homeowner must answer is: “Do I really need home insurance?” In 2025, with the world facing evolving challenges and uncertainties, the importance of home insurance cannot be overstated.

This article delves into five compelling reasons why you need home insurance for your home this year. Along the way, we’ll address common misconceptions, provide actionable advice, and explain why this decision could save you from financial disaster.

Why You Need Home Insurance for Your Home in 2025

The role of home insurance has expanded over the years, reflecting changes in our environment, economy, and society. In 2025, several factors make home insurance more relevant than ever.

The Evolving Role of Hohomeme Insurance

Natural disasters are becoming more frequent and severe. According to recent statistics, damages from extreme weather events have increased by over 40% in the past decade. Home insurance provides a financial safety net for such unforeseen events.

Modern Challenges Homeowners Face

From climate change to rising property values, homeowners are exposed to significant risks:

| Challenge | Potential Impact |

| Increasing natural disasters | Flooding, wildfires, and storms damage homes. |

| Rising cost of home repairs | Repairs can cost tens of thousands of dollars. |

| Burglary and vandalism risks | Property and valuables need protection. |

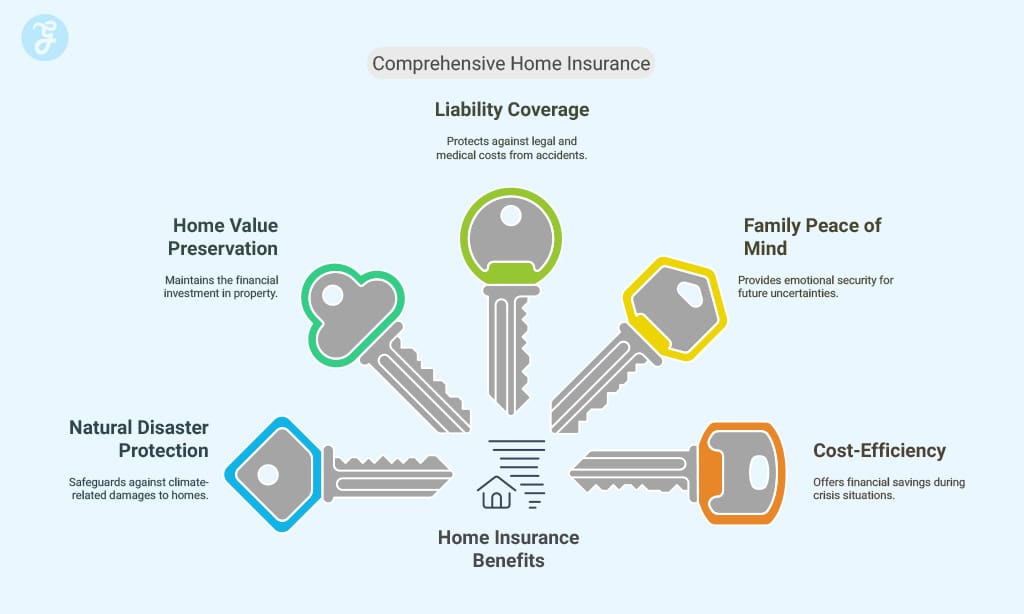

Graphics Credit: Editorialge.com

5 Reasons You Need Home Insurance

Let’s explore the top five reasons why investing in home insurance in 2025 is a smart decision.

1. Protection Against Natural Disasters

With climate change causing more intense storms, floods, and wildfires, the risk to your home is higher than ever. Home insurance policies often cover damages caused by these events, helping you rebuild without depleting your savings.

Key Facts:

- The average cost of repairing flood damage is $40,000.

- Wildfires in 2022 caused over $3 billion in damages across the U.S.

| Natural Disaster Type | Estimated Repair Costs (2025) |

| Flooding | $35,000 – $50,000 |

| Hurricanes | $10,000 – $75,000 |

| Wildfires | $15,000 – $100,000 |

Takeaway: A comprehensive insurance policy ensures that you’re covered for these unexpected disasters.

2. Safeguarding Your Home’s Value

Your home is one of your most valuable assets. Without insurance, you risk losing this investment in the event of significant damage. Home insurance policies help preserve your property’s value by covering repair and replacement costs.

Example: Imagine a burst pipe floods your kitchen. Without insurance, you might spend $20,000 or more to repair it. A good policy covers such damages, saving you money.

| Coverage Type | What It Protects |

| Structural coverage | Roof, walls, floors, and plumbing |

| Personal property | Furniture, electronics, clothing |

Takeaway: Home insurance protects not just the structure but also everything inside your home.

3. Liability Coverage for Unexpected Events

Accidents happen. What if a visitor slips on your icy driveway and decides to sue you? Liability coverage, included in most home insurance policies, protects you in such scenarios.

Key Features of Liability Coverage:

- Pays for medical expenses of injured parties.

- Covers legal fees if you’re sued.

- Provides coverage for damages caused by you, your family, or even pets.

| Liability Scenario | Potential Costs Without Insurance |

| Slip-and-fall accidents | $10,000 – $50,000 |

| Dog bites | $30,000 – $50,000 |

| Property damage to neighbors | $5,000 – $20,000 |

Takeaway: Liability insurance shields you from financial ruin caused by lawsuits or medical claims.

4. Peace of Mind for Your Family’s Future

Home insurance provides emotional security. Knowing your family’s home is protected against unforeseen events offers peace of mind.

Consider This: If your home is destroyed by a fire, rebuilding can take months. Insurance ensures that you have temporary housing and can recover without financial stress.

| Benefit | How It Helps |

| Temporary living costs | Covers rent or hotel stays during repairs |

| Rebuilding assistance | Covers construction and materials |

Takeaway: Protecting your home is a way of safeguarding your family’s future.

5. Cost-Efficiency in Crisis Situations

While home insurance may seem like an added expense, it’s a cost-effective solution in the long run. Without it, you’d need to pay out of pocket for major repairs or replacements.

Real-Life Example: In 2023, a severe storm caused $25,000 in damages to a homeowner’s roof. With insurance, they only paid a $1,000 deductible.

| Scenario | Cost With Insurance | Cost Without Insurance |

| Roof damage from storms | $1,000 deductible | $25,000 |

| Fire damage to kitchen | $2,500 deductible | $50,000 |

Takeaway: Insurance minimizes your financial burden during crises, making it a smart investment.

Addressing Common Myths About Home Insurance

Myth 1: “Home insurance is too expensive.”

Reality: Policies can be tailored to fit your budget, with basic plans starting as low as $50 per month.

Myth 2: “I’m renting, so I don’t need it.”

Reality: Renters insurance is an affordable option to protect your belongings.

Myth 3: “I’ll never need it.”

Reality: Unforeseen events like theft or weather-related damage can happen to anyone.

How to Choose the Right Home Insurance Policy?

- Assess Your Coverage Needs:

- Evaluate your home’s location and risk factors.

- Consider the value of your belongings.

- Compare Policies:

- Use online tools to compare premiums and coverage.

- Read the Fine Print:

- Understand deductibles, exclusions, and claim limits.

- Seek Expert Advice:

- Consult an insurance agent to identify the best policy for your needs.

| Factor to Consider | Why It’s Important |

| Location | Risk of natural disasters |

| Home value | Ensures adequate coverage |

| Policy limits | Avoids underinsurance |

Frequently Asked Questions (FAQs)

Q: Is home insurance mandatory in 2025?

A: While not always legally required, most mortgage lenders mandate it.

Q: How much does home insurance cost per month?

A: Premiums vary but typically range from $50 to $150, depending on coverage.

Q: What are the biggest risks to homes in 2025?

A: Natural disasters, rising repair costs, and theft remain top concerns.

Q: Can I bundle home and auto insurance?

A: Yes, many providers offer discounts for bundled policies.

Wrap Up

Understanding why you need home insurance for your home is crucial in 2025. Home insurance is more than a financial safety net; it’s an investment in your peace of mind, family’s future, and property’s value. With risks evolving in 2025, having the right coverage is essential.

Whether protecting against natural disasters, liability claims, or unforeseen crises, home insurance offers invaluable support. Evaluate your needs, compare policies, and choose a plan that’s right for you. Protect your home, secure your future—because it’s always better to be safe than sorry.