FAQs about pet insurance in India are becoming more relevant as pet ownership rises. Pet insurance is a game-changer for Indian pet owners, offering financial protection against unexpected veterinary expenses.

This guide dives into the top 10 FAQs about pet insurance in India to help you make informed decisions.

From understanding what it covers to choosing the best policy, we’ve got you covered with insights, actionable advice, and real-life examples.

1. What is Pet Insurance?

FAQs about pet insurance in India often start with this fundamental question: Pet insurance is a policy designed to cover veterinary expenses related to accidents, illnesses, or other health issues your pet might face.

By paying a monthly or annual premium, you can ensure that unexpected medical costs won’t strain your budget.

For pet owners in India, this offers peace of mind and financial security.

Key Details of Pet Insurance

| Feature | Details |

| Purpose | Covers medical expenses for pets. |

| Premium Types | Monthly or annual plans available. |

| Typical Coverage | Accidents, illnesses, surgeries. |

| Benefits | Reduces financial stress, improves pet care quality. |

| Popular Providers | Bajaj Allianz, Future Generali, New India Assurance |

Practical Tip:

To get started, compare at least three insurance providers to identify the best premium rates and coverage that suit your pet’s needs.

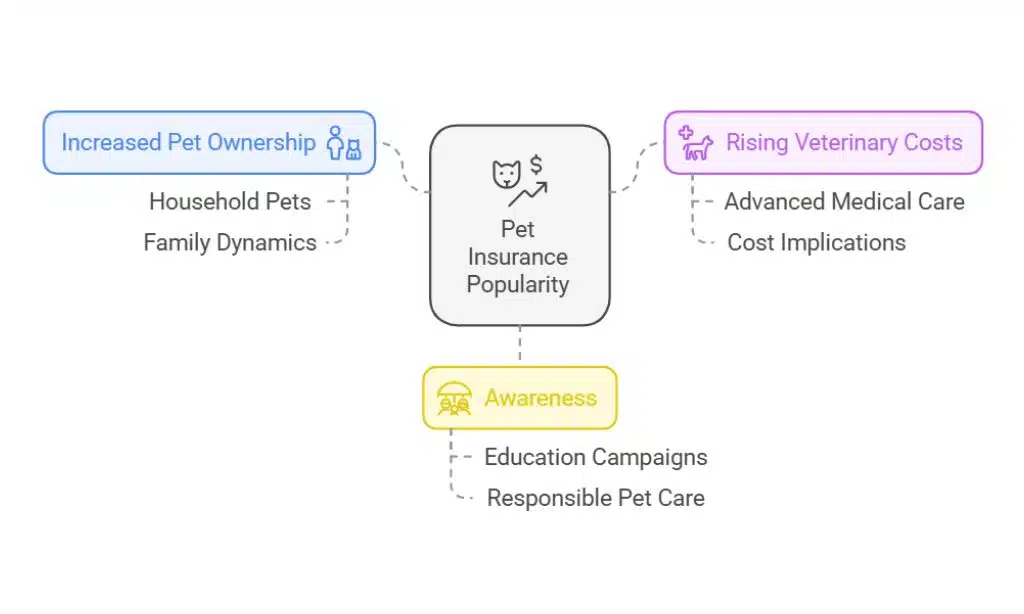

2. Why is Pet Insurance Gaining Popularity in India?

FAQs about pet insurance in India also explore why it’s becoming more popular. Here’s why:

- Increased pet ownership: The number of pet owners has surged over the past decade, with more families considering pets as part of their household.

- Rising veterinary costs: Advanced medical care for pets is becoming more accessible but can also be expensive.

- Awareness: More pet owners are learning about the benefits of pet insurance, making it a practical choice for responsible pet care.

Example Trend: Rise in Pet Ownership

A 2024 survey revealed a 50% increase in pet ownership in India over five years, with urban areas like Bengaluru and Mumbai leading the trend.

This growth underscores the need for financial planning to manage pet-related expenses.

Additional Insight:

Pet owners in India spend an average of ₹15,000 annually on routine check-ups and vaccinations. Comprehensive pet insurance can significantly offset these costs.

3. What Types of Pets are Covered Under Pet Insurance?

Another common question in FAQs about pet insurance in India is the range of pets covered. Pet insurance typically includes:

- Common pets: Dogs, cats, and birds are the most insured animals.

- Exotic pets: Some policies extend to rabbits, turtles, or reptiles, though these are less common.

- Breed restrictions: High-risk breeds may require specialized plans or incur higher premiums due to their predisposition to certain health issues.

Are Certain Breeds More Expensive to Insure?

Yes, certain breeds are costlier to insure due to genetic predispositions to health issues. For example:

- High-risk breeds: German Shepherds and Bulldogs often have higher premiums.

- Factors influencing costs: Size, health history, and breed-specific risks, such as hip dysplasia in larger breeds.

Breed Comparison Table

| Breed | Common Health Risks | Average Premiums |

| German Shepherd | Hip dysplasia, arthritis | ₹12,000/year |

| Labrador Retriever | Obesity, joint issues | ₹10,000/year |

| Persian Cat | Respiratory problems | ₹8,000/year |

| Parakeet | Respiratory issues | ₹5,000/year |

Pro Tip:

If you own a high-risk breed, consider policies with higher coverage limits for surgeries and chronic conditions.

4. What Does Pet Insurance Typically Cover?

When discussing FAQs about pet insurance in India, coverage details are essential. Pet insurance usually includes:

- Medical expenses: Covers illnesses, accidents, and surgeries.

- Add-ons: Optional coverage for vaccinations, routine check-ups, and dental care.

- Theft or loss: Compensation if your pet is stolen or goes missing.

What is Excluded in Most Policies?

It’s important to know what your policy won’t cover:

- Pre-existing conditions: Any illnesses or conditions your pet had before purchasing the policy.

- Age-related exclusions: Policies often exclude pets over 10 years old.

- Specific activities: Racing or breeding-related injuries are typically not covered.

Coverage Comparison Table

| Type of Coverage | Included | Excluded |

| Illnesses | Yes | Pre-existing conditions |

| Surgeries | Yes | Cosmetic procedures |

| Theft or Loss | Yes | Intentional neglect |

| Vaccinations | Optional | Not included in basic plans |

Practical Tip:

Always review the policy exclusions section carefully to avoid surprises during a claim.

5. How Much Does Pet Insurance Cost in India?

One of the most asked FAQs about pet insurance in India revolves around cost. Here’s what you need to know:

- Average premiums: ₹2,000 to ₹20,000 annually, depending on the pet and the level of coverage.

- Factors influencing cost: Pet’s age, breed, health history, and coverage level.

Example: Budget-Friendly Plan

A policy covering basic medical expenses for a Labrador Retriever costs approximately ₹9,000 per year, while a comprehensive plan with add-ons may reach ₹15,000 annually.

Cost Comparison Table

| Coverage Level | Average Premiums (₹) |

| Basic (Accidents Only) | 2,000 – 5,000 |

| Standard (Accidents + Illnesses) | 6,000 – 12,000 |

| Comprehensive (Add-ons Included) | 15,000 – 20,000 |

Tips for Budget-Friendly Plans:

- Compare multiple policies before choosing.

- Opt for essential coverage and add-ons based on your pet’s needs.

- Check for discounts on multi-pet insurance.

6. How to Choose the Best Pet Insurance Policy?

FAQs about pet insurance in India often emphasize selecting the right policy. Here are key considerations:

- Coverage limits: Ensure it covers major medical expenses, including surgeries and treatments.

- Claim settlement ratio: High ratios indicate reliable insurers who process claims efficiently.

- Customer reviews: Check experiences of other pet owners for insights into service quality.

Should You Opt for Add-Ons?

Add-ons can be helpful but are not always necessary. Common add-ons include:

- Vaccination coverage: Useful for younger pets.

- Travel-related protection: Ideal for pets frequently traveling with owners.

- Third-party liability: Covers damages caused by your pet to third parties.

Comparison Table: Features to Consider

| Feature | Importance |

| Coverage Limit | Essential |

| Add-Ons | Optional |

| Claim Settlement Ratio | High priority |

| Customer Support | Critical |

7. Which Insurance Providers Offer Pet Insurance in India?

Several companies provide pet insurance in India. FAQs about pet insurance in India often include information on top providers:

| Provider | Key Features | Average Premiums |

| Bajaj Allianz | Covers surgeries and illnesses | ₹10,000/year |

| Future Generali | Includes vaccinations and theft | ₹7,000/year |

| New India Assurance | Offers add-on dental coverage | ₹12,000/year |

Are International Insurance Providers Available in India?

While most policies are domestic, some international providers cater to expats or those traveling with pets. These policies often include global coverage for accidents and illnesses but may be costlier than domestic options.

Practical Insight:

If you’re an expat or travel frequently with your pet, consider international providers for extended benefits.

8. How to File a Pet Insurance Claim?

Filing a claim is one of the most practical FAQs about pet insurance in India. Follow these steps:

- Notify your insurer immediately after an incident.

- Submit required documents:

- Veterinary bills and receipts.

- Claim form and policy details.

- Follow up with your insurer for updates.

Common Challenges:

- Delayed claims due to incomplete documentation.

- Rejections based on policy exclusions.

Claims Checklist Table

| Step | Required Action |

| Step 1 | Notify the insurer immediately. |

| Step 2 | Submit all required documents. |

| Step 3 | Follow up for status updates. |

| Step 4 | Resolve any queries from the insurer. |

Actionable Tip:

Keep digital copies of all receipts and medical records to ensure smooth claim processing.

9. What are the Tax Benefits of Pet Insurance in India?

Currently, pet insurance premiums do not qualify for direct tax benefits in India. However:

- Business deductions: Some business owners can claim deductions if pets are used for professional purposes, such as guard dogs.

- Future opportunities: Keep updated with potential policy changes that could introduce tax benefits for personal pet insurance.

Did You Know?

In countries like the US and UK, pet insurance premiums are sometimes deductible as part of medical expenses for service animals. Advocacy for similar measures is growing in India.

10. Is Pet Insurance Worth It for Indian Pet Owners?

FAQs about pet insurance in India often conclude with this vital question. Absolutely! Here’s why:

- Financial security: Covers unexpected costs, ensuring your pet gets quality healthcare without burdening your finances.

- Peace of mind: Knowing you have a safety net for emergencies.

- Real-life example: A pet owner in Mumbai saved ₹1.5 lakh on surgery costs through insurance.

Cost-Benefit Analysis Table

| Scenario | Cost Without Insurance (₹) | Cost With Insurance (₹) |

| Emergency Surgery | 1,50,000 | 10,000 (annual premium) |

| Routine Vaccinations | 5,000 | Covered (Add-on) |

Takeaways

FAQs about pet insurance in India provide essential knowledge for making informed decisions. Pet insurance is no longer a luxury but a necessity for responsible pet ownership in India.

By understanding these FAQs about pet insurance in India, you’re better equipped to safeguard your pet’s health and your finances.

Don’t wait until it’s too late—explore plans today and give your pet the care they deserve.