The financial technology (fintech) revolution transforms how small businesses manage their operations. From streamlining accounting to simplifying payroll, affordable fintech solutions for small business operations are making it easier than ever for small enterprises to compete in a digital-first world.

For small businesses operating on tight budgets, finding affordable fintech solutions for small business needs is essential to stay competitive and improve efficiency without overspending.

In this article, we explore ten affordable fintech solutions for small business success, diving into their features, pricing, and benefits.

Whether you’re an entrepreneur, a small business owner, or a finance manager, this guide will help you identify the tools that align with your needs and budget.

What Are Fintech Solutions?

Understanding Fintech for Small Businesses

Fintech solutions refer to software and digital tools designed to enhance financial processes and operations. For small businesses, including those selling Square Canvas Photo Prints for Wall Art, these tools help simplify complex tasks such as accounting, payroll, payment processing, and expense management.

Unlike traditional financial systems, affordable fintech solutions for small business needs are often more accessible, scalable, and tailored to modern business requirements.

Key Benefits of Fintech Solutions for Small Businesses:

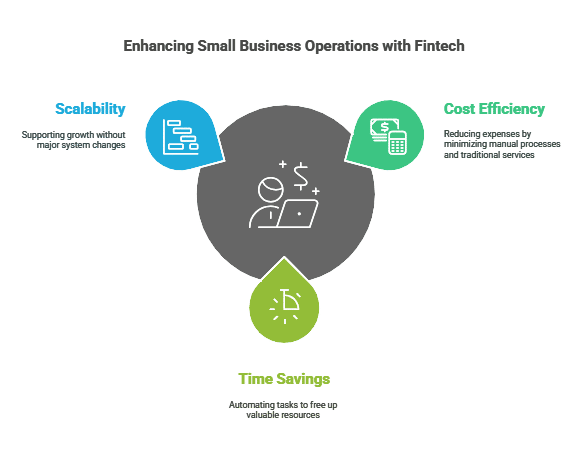

- Cost Efficiency: Reduce reliance on manual processes and expensive traditional services.

- Time Savings: Automate routine financial tasks, freeing up resources.

- Scalability: Support growth without needing a complete overhaul of systems.

Why Affordability Matters

Small businesses often operate with limited financial resources, making affordability a top priority. The best affordable fintech solutions for small business operations offer robust features at competitive prices, allowing small enterprises to optimize their operations without exceeding their budgets.

Key Considerations:

- Budget-Friendly Options: Focus on tools with tiered pricing or free plans.

- High ROI: Ensure the tool delivers measurable value for its cost.

- Scalability: Choose solutions that can grow with your business.

The Top 10 Affordable Fintech Solutions

Selection Criteria

When compiling this list, we focused on solutions that are:

- Cost-effective: Offering significant value for their price.

- User-friendly: Designed for small businesses without technical expertise.

- Feature-rich: Providing essential tools for financial management.

The Solutions You Should Explore

Here are the 10 budget friendly fintech solutions that you must check out.

1. QuickBooks Online

QuickBooks Online is a versatile accounting software that caters to businesses of all sizes. Its intuitive interface and powerful features make it a favorite among small business owners. With QuickBooks, you can seamlessly manage invoices, expenses, and taxes, saving time and reducing errors.

- Features:

- Invoicing and payment tracking.

- Automatic tax calculations and filing.

- Expense categorization and financial reporting.

- Pricing: Starts at $25/month with tiered plans for growing businesses.

- Use Case: Ideal for small businesses looking for a comprehensive accounting tool with scalability.

| Feature | Description |

| Invoicing | Create and send professional invoices |

| Expense Tracking | Automatically categorize expenses |

| Tax Preparation | Simplify tax filing with automation |

2. Wave Financial

Wave Financial provides free accounting and invoicing tools tailored for small businesses and freelancers. It’s particularly valuable for startups or solo entrepreneurs needing cost-effective solutions. Wave also supports real-time tracking and integration with bank accounts, enhancing transparency and control over finances.

- Features:

- Free invoicing and payment tracking.

- Payroll integration is available as a paid feature.

- Real-time transaction tracking and reporting.

- Pricing: Free for core tools, with paid add-ons like payroll starting at $20/month.

- Use Case: Perfect for small businesses with limited budgets.

| Metric | Insight |

| Core Features | Free invoicing and accounting |

| Add-ons | Payroll, credit card payments |

| Integration Tools | Bank accounts, payment platforms |

3. PayPal for Business

PayPal is a household name in online payment processing, offering businesses a simple and secure way to accept and manage payments. Its business platform allows multi-currency transactions, making it ideal for international e-commerce operations.

- Features:

- Multi-currency support for international transactions.

- Integration with e-commerce platforms like Shopify and WooCommerce.

- Instant payouts to linked accounts.

- Pricing: No monthly fee; transaction fees apply (2.9% + $0.30 per transaction).

- Use Case: Best for businesses engaged in e-commerce or international trade.

| Metric | Value |

| Transaction Fees | 2.9% + $0.30 per transaction |

| Supported Currencies | 25+ currencies worldwide |

| Integration Options | Shopify, WooCommerce |

4. Square

Square offers an all-in-one payment and point-of-sale (POS) solution that’s particularly popular among retail and food service businesses. Its user-friendly interface and robust analytics tools empower small businesses to manage sales effectively both online and offline.

- Features:

- POS systems with inventory tracking.

- Tools for managing online and offline sales.

- Free mobile card reader for payments.

- Pricing: Hardware costs vary; transaction fees start at 2.6% + $0.10 per swipe.

- Use Case: Ideal for brick-and-mortar businesses seeking integrated payment solutions.

| Feature | Description |

| POS System | Track inventory and sales |

| Mobile Payments | Process payments via card reader |

| Analytics Tools | Gain insights into sales trends |

5. Zoho Books

Zoho Books is an affordable and robust accounting solution tailored for small businesses. Its automation capabilities reduce manual work, and its comprehensive integrations make it compatible with other business tools.

- Features:

- GST compliance for international users.

- Collaborative tools for team-based financial management.

- Automated workflows for recurring tasks.

- Pricing: Starts at $15/month with scalable plans.

- Use Case: Great for businesses seeking an all-in-one accounting tool.

| Feature | Description |

| Automation | Schedule and automate workflows |

| Collaboration | Team-friendly features |

| Compliance | GST and tax compliance for global users |

6. Expensify

Expensify simplifies expense reporting and reimbursement processes, making it an excellent choice for businesses with frequent travel or employee expense claims. Its receipt scanning and approval workflows reduce administrative overhead.

- Features:

- Receipt scanning via mobile app.

- Integration with popular accounting software like QuickBooks.

- Automated reimbursement management.

- Pricing: Starts at $5/month per user.

- Use Case: Ideal for businesses with expense-heavy operations.

| Feature | Description |

| Mobile App | Scan and submit receipts on the go |

| Approval Workflow | Streamline expense approvals |

| Integration | Connect with major accounting tools |

7. Gusto

Gusto provides payroll, benefits, and HR tools tailored for small businesses. Its easy-to-use interface ensures compliance with tax regulations while managing employee benefits and onboarding processes.

- Features:

- Automated payroll and tax filings.

- Employee benefits management, including health insurance.

- Onboarding tools for new hires.

- Pricing: Starts at $40/month plus $6 per employee.

- Use Case: Suitable for small businesses looking to streamline HR and payroll functions.

| Feature | Description |

| Payroll Automation | Automatically process employee pay |

| Tax Filing | Handle federal, state, and local taxes |

| Employee Benefits | Manage health insurance and perks |

8. FreshBooks

FreshBooks is a cloud-based accounting software designed for service-based businesses. It simplifies billing, project management, and client communication, making it a great option for freelancers and agencies.

- Features:

- Customizable invoices for professional branding.

- Time tracking to monitor billable hours.

- Expense categorization for accurate reporting.

- Pricing: Starts at $17/month.

- Use Case: Ideal for freelancers and service-oriented businesses.

| Feature | Description |

| Invoice Customization | Tailor invoices to match branding |

| Time Tracking | Monitor and bill for hours worked |

| Reporting Tools | Generate detailed financial reports |

9. Venmo for Business

Venmo for Business simplifies mobile payments and is particularly popular for small transactions. Its social integration allows businesses to engage with customers in a unique way.

- Features:

- Easy payment requests via mobile app.

- Social integration for added visibility.

- Transaction summaries for record-keeping.

- Pricing: Low transaction fees of 1.9% + $0.10 per payment.

- Use Case: Great for small businesses handling frequent, low-value transactions.

| Feature | Description |

| Mobile Payments | Convenient app-based transactions |

| Social Visibility | Showcase business activity socially |

| Fee Structure | Transparent, low-cost transactions |

10. Xero

Xero is a scalable cloud-based accounting solution with strong reporting and collaboration features. It supports international businesses with multi-currency capabilities and robust integration options.

- Features:

- Bank reconciliation for real-time updates.

- Multi-currency support for international businesses.

- Financial reporting tools for insights.

- Pricing: Starts at $13/month.

- Use Case: Best for small businesses with growing international operations.

| Feature | Description |

| Reporting | In-depth financial insights |

| Reconciliation | Automated matching of transactions |

| Global Support | Multi-currency and compliance tools |

Comparison of Solutions

| Solution | Key Features | Pricing |

| QuickBooks | Accounting, invoicing | Starts at $25/month |

| Wave Financial | Free accounting tools | Free |

| PayPal | Secure transactions | Transaction fees apply |

| Square | POS and payments | Transaction fees |

| Zoho Books | Automation, GST compliance | Starts at $15/month |

| Expensify | Expense management | Starts at $5/month per user |

| Gusto | Payroll, HR | Starts at $40/month |

| FreshBooks | Invoicing, time tracking | Starts at $17/month |

| Venmo | Mobile payments | Low transaction fees |

| Xero | Scalable accounting | Starts at $13/month |

Tips for Choosing the Right Fintech Solution

Evaluating Your Business Needs

- Identify core functionalities that align with your operations.

- Consider scalability and future growth.

- Assess compatibility with existing tools.

Making the Most of Fintech Tools

- Utilize free trials to test features.

- Train employees for efficient tool usage.

- Regularly review analytics to optimize performance.

Future Trends in Fintech for SMEs

Emerging Innovations

- AI and Machine Learning: Predictive analytics for smarter financial decisions.

- Blockchain Technology: Transparent and secure transactions.

- Cybersecurity Enhancements: Protection against data breaches.

Evolving Needs of Small Businesses

- Demand for customizable solutions to meet unique requirements.

- Enhanced mobile accessibility for on-the-go management.

- Integration with evolving payment systems like crypto wallets.

Takeaways

Affordable fintech solutions for small business operations are game-changers, providing cost-effective ways to manage finances and drive growth.

By exploring the options outlined in this guide, small business owners can harness the power of technology to enhance efficiency, reduce costs, and scale operations. Selecting the right fintech tools can make the difference between surviving and thriving in today’s competitive landscape.