Car insurance laws in the United States vary significantly from one state to another, creating a complex landscape for drivers to navigate. Understanding these differences is essential to ensure compliance and make informed decisions about your coverage.

From mandatory insurance requirements to unique regulations like no-fault systems, this article delves into the “car insurance laws differences in U.S. states,” offering clarity and actionable insights for every driver.

Whether you’re a new driver, relocating, or simply curious about how your state compares, this guide will help you make sense of the complexities and choose coverage that fits your needs.

The “car insurance laws differences in U.S. states” can impact costs, coverage options, and penalties, making it vital to stay informed.

The Basics of Car Insurance Laws

Mandatory Insurance Requirements

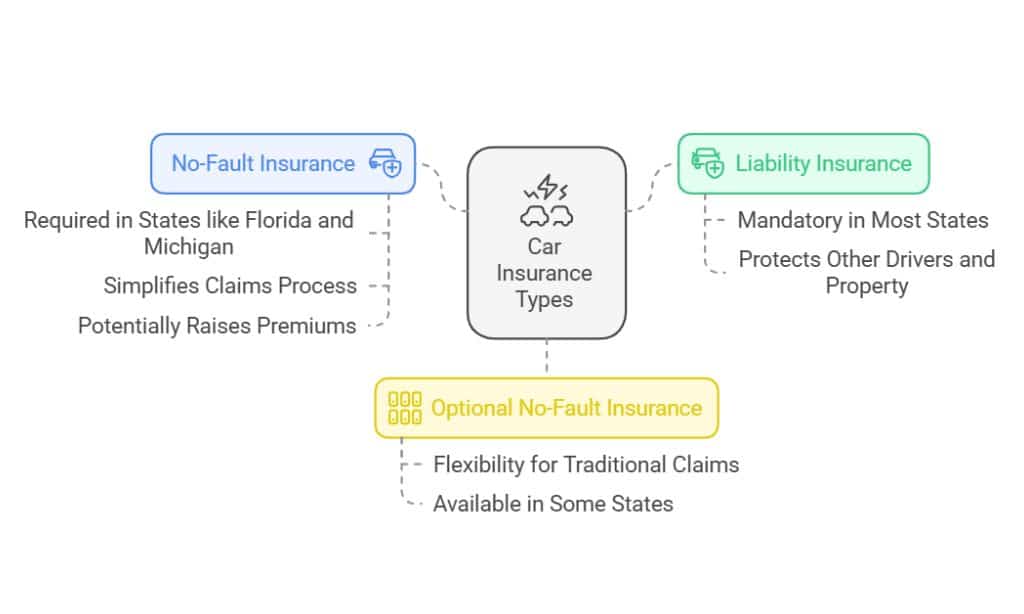

Each state has its own rules regarding mandatory car insurance. While liability insurance is universally required, the specifics can differ:

- Liability Insurance: Covers damages to others in an accident you cause. Most states mandate this as a minimum to protect other drivers and property.

- No-Fault Insurance: Required in states like Florida and Michigan, no-fault insurance covers your own damages regardless of who is at fault, simplifying the claims process but potentially raising premiums.

- Optional No-Fault Insurance: Some states allow drivers to choose between fault-based and no-fault systems, offering flexibility for those who prefer traditional claims processes.

These “car insurance laws differences in U.S. states” reflect diverse approaches to managing risk and ensuring fair coverage for drivers.

Overview Table of Mandatory Insurance Types

| State | Liability Insurance | No-Fault Insurance | Optional No-Fault |

| California | Yes | No | No |

| Florida | Yes | Yes | No |

| New Jersey | Yes | Yes | Yes |

Minimum Coverage Limits

Minimum coverage limits specify the least amount of liability coverage a driver must carry. For example:

- California: Minimum liability coverage is $15,000 for injury/death of one person, $30,000 for multiple persons, and $5,000 for property damage.

- Florida: Requires $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

Key Insights:

- States with higher minimums, like Alaska, provide more robust baseline protection but can lead to higher premiums.

- Failing to meet these minimums can result in fines, suspension of your license, or even vehicle impoundment.

- Actionable Tip: Always confirm coverage requirements when moving or updating policies to avoid penalties.

10 Key Differences in Car Insurance Laws Across U.S. States

1. No-Fault vs. At-Fault Systems

The distinction between no-fault and at-fault systems is one of the most notable “car insurance laws differences in U.S. states.”

- No-Fault States: Require drivers to file claims with their own insurance regardless of fault. Examples include New York and Hawaii. This simplifies the claims process but may result in higher premiums.

- At-Fault States: The at-fault driver’s insurance covers damages. States like Texas and Nevada follow this model, which can lead to disputes but lower premiums for safe drivers.

Comparative Table

| State | System Type | Key Feature |

| Florida | No-Fault | Own insurer covers damages |

| Texas | At-Fault | Fault-based claims process |

| Michigan | No-Fault | High PIP coverage required |

Example:

A driver in Texas rear-ends another car. Under the at-fault system, the driver’s liability insurance covers the damages. In Florida, the no-fault system would require both drivers to file claims with their own insurers.

2. Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage protects you if you’re hit by a driver without insurance.

- States Requiring Coverage: Connecticut and Illinois mandate this type of insurance.

- Optional Coverage: In states like California, it’s optional but recommended for additional protection.

Practical Example:

Imagine you’re involved in an accident where the at-fault driver has no insurance. Without uninsured motorist coverage, you’d have to pay out-of-pocket for repairs and medical expenses, which can be financially devastating. This aspect of “car insurance laws differences in U.S. states” highlights the importance of understanding local requirements.

Key Insights Table:

| Coverage Type | Benefits | State Requirement |

| Uninsured Motorist (UM) | Covers damages caused by uninsured drivers | Mandatory in CT, IL |

| Underinsured Motorist (UIM) | Covers shortfalls when the other driver’s policy limits are insufficient | Optional in CA |

3. Personal Injury Protection (PIP) Requirements

PIP covers medical expenses and lost wages after an accident.

- Mandatory in No-Fault States: Massachusetts requires a minimum of $8,000 in PIP coverage.

- Optional in Fault-Based States: Drivers in Texas can add PIP for enhanced protection.

Additional Insight:

PIP often includes coverage for rehabilitation expenses, childcare costs, and funeral expenses. It’s a crucial safety net for families. This requirement underscores how “car insurance laws differences in U.S. states” directly impact financial security in emergencies.

4. Penalties for Driving Without Insurance

Penalties for driving uninsured vary widely across the U.S.:

- California: Fines starting at $100 and potential vehicle impoundment.

- Michigan: Fines up to $500, potential jail time, and mandatory SR-22 filings.

Table of Penalties:

| State | Fine (First Offense) | Additional Penalties |

| California | $100 | Vehicle impoundment |

| Michigan | $500 | Jail time, SR-22 requirement |

| Texas | $175 | License suspension |

5. Use of Credit Scores in Premium Calculation

Some states, like California and Massachusetts, prohibit the use of credit scores in determining premiums. Other states argue that credit history correlates with risk.

Debate Insight:

Consumer advocacy groups often challenge this practice, arguing that it disproportionately impacts low-income drivers. However, insurers defend it as a predictive tool for risk assessment.

Quick Facts:

- Prohibited States: California, Massachusetts, Hawaii.

- Permitted States: Majority of U.S. states, with varying guidelines.

6. Rate Differences Based on ZIP Codes

Insurance premiums often vary by location:

- Urban Areas: Typically higher due to increased traffic and theft risks.

- Regulated States: Michigan imposes restrictions on ZIP code-based pricing to reduce disparities.

Data Snapshot

| State | ZIP Code Influence | Regulations |

| California | Moderate | No |

| Michigan | High | Yes |

7. Requirements for SR-22 Insurance

SR-22 insurance is often misunderstood, but it plays a crucial role for high-risk drivers.

- Definition: It’s a certificate proving that you carry at least the state’s minimum required insurance coverage. Contrary to common belief, SR-22 is not a type of insurance policy but a filing submitted by your insurer to the state.

- When Required: Typically mandated after serious violations such as DUIs, reckless driving, or driving without insurance. It’s often required for a set period, such as 3 years, depending on state laws.

- States with Mandates: Florida and Texas frequently require SR-22 filings for drivers reinstating their licenses after violations.

- Costs: The filing fee is usually between $15-$50, but the real cost comes from increased insurance premiums due to the high-risk designation.

State-by-State SR-22 Requirements

| State | When Required | Duration |

| Florida | DUI, Driving Uninsured | 3 Years |

| Texas | DUI, Major Violations | 2-3 Years |

| California | Driving Without Insurance | 3 Years |

8. Grace Periods for Policy Renewal

Grace periods can be a lifesaver for drivers who face delays in renewing their policies:

- Definition: A grace period allows you to renew your policy without facing penalties or a lapse in coverage, but not all states provide this flexibility.

- Illinois: Offers a short grace period ranging from 7-10 days to ensure drivers avoid penalties while renewing their policies.

- Strict States: New York enforces immediate consequences for lapsed policies, including fines and possible license suspension.

Why Grace Periods Matter:

- Financial Implications: A lapse in coverage could result in higher premiums in the future.

- Legal Consequences: Driving without active insurance during a lapse can lead to fines and legal issues.

- Practical Tip: Mark your renewal date on a calendar and set reminders to avoid lapses.

9. Insurance for High-Risk Drivers

High-risk drivers face unique challenges in obtaining affordable coverage.

- Definition: High-risk drivers include individuals with a history of traffic violations, accidents, or DUIs. These drivers may not qualify for standard insurance policies.

- Assigned Risk Plans: States like New York provide assigned risk plans to ensure that even high-risk drivers have access to coverage. These plans distribute high-risk drivers among insurers, ensuring everyone contributes to the pool.

- Cost Implications: Insurance through assigned risk plans is generally more expensive due to the higher likelihood of claims.

- Example: New York’s Assigned Risk Plan ensures all drivers, regardless of history, can maintain the state-required coverage to legally drive.

Key Tips for High-Risk Drivers:

- Take a defensive driving course to potentially lower premiums.

- Avoid further violations to reduce your risk designation over time.

- Compare quotes from multiple providers specializing in high-risk coverage.

10. Additional State-Specific Requirements

Unique laws in each state reflect local priorities and challenges:

- Hawaii: Prohibits insurers from using gender as a factor in determining premiums, promoting fairness in pricing.

- Alaska: Offers lower minimum coverage requirements for drivers in rural areas, acknowledging the reduced risk of accidents in less populated regions.

- Michigan: Includes unique provisions for unlimited medical benefits under its no-fault insurance system, which significantly impacts premium costs.

Examples of State-Specific Regulations

| State | Unique Regulation | Impact |

| Hawaii | No Gender-Based Rates | Promotes equity in insurance pricing |

| Alaska | Reduced Minimums in Rural Areas | Adjusted costs for low-risk areas |

| Michigan | Unlimited Medical Benefits in No-Fault | Higher premiums but extensive coverage |

Tips for Navigating Car Insurance Laws

Understanding Your State’s Requirements

- Check your state’s Department of Insurance website.

- Use online tools to compare policies tailored to your location.

- Research “car insurance laws differences in U.S. states” to understand how your state’s regulations compare to others.

Choosing the Right Policy

- Consider exceeding minimum requirements for better protection.

- Evaluate optional coverages like uninsured motorist or PIP.

Avoiding Common Pitfalls

- Maintain continuous coverage to avoid penalties.

- Research state-specific laws before moving to a new state.

Takeaways

Navigating “car insurance laws differences in U.S. states” can be daunting, but staying informed is key to avoiding penalties and ensuring adequate coverage.

Review your state’s regulations regularly and consult insurance professionals to make the best decisions for your needs.

By understanding the “car insurance laws differences in U.S. states,” drivers can protect themselves financially and legally.