Car insurance for teen drivers can be notoriously expensive. As young, inexperienced drivers are statistically more likely to get into accidents, insurers consider them high-risk, leading to steep premiums.

However, saving money on car insurance for teens doesn’t have to be a daunting task. With the right strategies and informed decisions, both parents and teens can secure affordable policies without compromising on coverage.

In this guide, we’ll explore seven actionable ways to save money on car insurance for teens. From leveraging discounts to choosing the right vehicle, these tips will help reduce your costs while ensuring peace of mind on the road.

Each section is enriched with insights, practical tips, and examples to maximize value for readers.

7 Ways to Save Money on Car Insurance as a Teen Driver

1. Compare Multiple Insurance Providers

One of the simplest yet most effective ways to save money on car insurance for teens is by comparing multiple insurance providers.

Every insurer has its own method of calculating premiums, so rates can vary widely for the same level of coverage.

A well-researched comparison can help families identify significant cost-saving opportunities without sacrificing coverage quality.

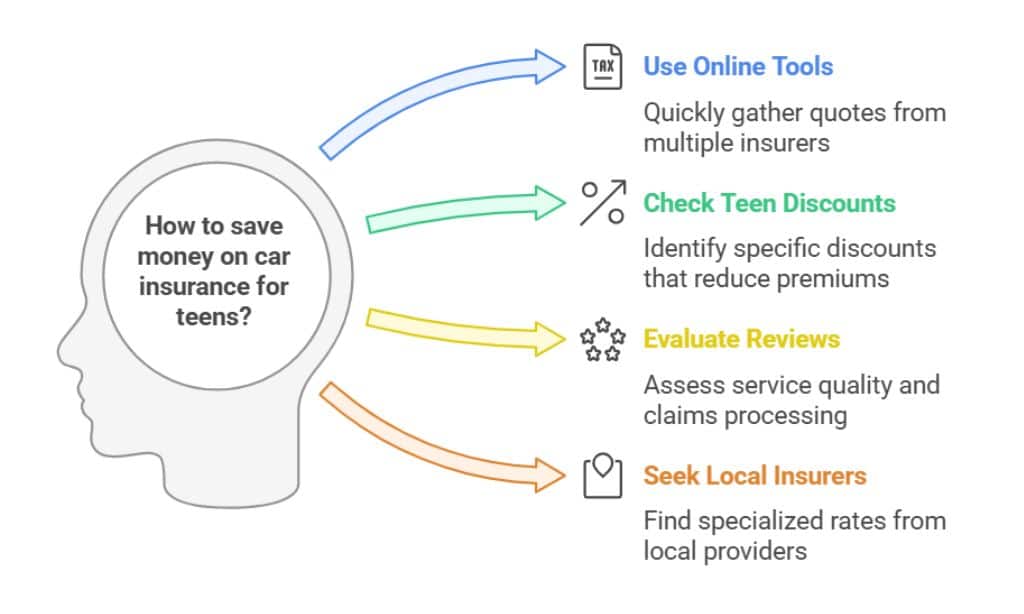

Steps to Compare Quotes:

- Use online comparison tools to get quotes from multiple insurers quickly.

- Check for teen-specific discounts offered by insurers.

- Evaluate customer reviews to gauge service quality and claims processing.

- Seek local insurers who may offer specialized rates for your area.

Key Tip: Look for providers specializing in affordable car insurance for teens, as they may offer better deals tailored to young drivers.

| Top Platforms for Comparing Insurance | Features | Average Savings |

| The Zebra | Real-time comparison | Up to 20% |

| Compare.com | Detailed policy analysis | 15-25% |

| Policygenius | Personalized recommendations | Up to 30% |

| Insurify | AI-driven suggestions | 20-35% |

What to Look For in a Policy

When comparing policies, focus on more than just the premium. Ensure that the policy provides adequate coverage for liability, collision, and uninsured motorists.

Ask about potential add-ons, such as roadside assistance, and whether they come at an extra cost.

Consider customer support quality, as it can make a significant difference in times of need.

Pro Tip: Check whether insurers offer accident forgiveness programs, which prevent premiums from skyrocketing after an initial accident.

2. Opt for a Higher Deductible

A deductible is the amount you pay out of pocket before your insurance kicks in.

Opting for a higher deductible can significantly lower your monthly premium, making it an effective strategy for families aiming to save money on car insurance for teens.

However, this approach requires careful financial planning.

Example:

- A $500 deductible might result in a premium of $200/month.

- Increasing the deductible to $1,000 can lower the premium to $150/month, saving $600 annually.

| Deductible Amount | Monthly Premium | Annual Savings |

| $500 | $200 | – |

| $1,000 | $150 | $600 |

| $1,500 | $125 | $900 |

Financial Preparedness for Higher Deductibles

- Start a savings fund specifically for your deductible.

- Use budgeting tools or apps to allocate monthly savings toward potential deductible costs.

- Combine this strategy with discounts, such as good student or bundling discounts, for cumulative savings.

Pro Tip: Ensure your emergency fund has at least the amount of your deductible to avoid financial strain in case of an accident.

3. Take Advantage of Good Student Discounts

Many insurance companies reward academic excellence with discounts. If your teen maintains a GPA of 3.0 or higher, they could qualify for savings of up to 25%.

This incentive not only reduces costs but also encourages teens to prioritize their studies.

Eligibility Requirements:

- Proof of enrollment in a full-time educational program.

- Report cards or transcripts as evidence of grades.

- Some insurers may require renewal of proof every six months or annually.

| Insurer | Average Discount | Eligibility GPA |

| State Farm | Up to 25% | 3.0+ |

| GEICO | 15% | 3.0+ |

| Allstate | 20% | 3.0+ |

| Progressive | 10-15% | 3.0+ |

Maximizing Academic Discounts

- Combine good student discounts with other offers, like multi-policy bundling.

- Encourage teens to enroll in advanced placement (AP) or honors courses, as some insurers consider these additional factors.

- Explore college-based programs that offer additional savings for enrolled students.

Case Study: Sarah, a high school junior with a GPA of 3.8, saved 20% on her car insurance by providing her transcripts to State Farm.

Her family combined this with a bundling discount, achieving total savings of $600 annually.

Pro Tip: Parents should also verify discounts if the teen studies away at college and doesn’t have regular access to the family vehicle.

4. Enroll in a Driver’s Education Program

Completing a driver’s education course can significantly lower insurance premiums. These courses teach teens essential road skills, helping them become safer drivers and reducing their risk profile for insurers.

Many states mandate driver’s education for young drivers, and insurers often provide discounts for completing approved programs.

Recognized Programs:

- State-certified driver’s education courses.

- Online programs like DriversEd.com or Aceable.

- High school or community center programs.

| Driver’s Ed Program | Cost | Average Savings |

| DriversEd.com | $50-$100 | 10-15% |

| Local State Programs | $100-$300 | 15-20% |

| Aceable | $40-$60 | 10-20% |

| IDriveSafely | $30-$80 | 15-25% |

Online and In-Person Options

Both online and in-person programs have their benefits:

- Online: Flexible, self-paced learning suitable for busy teens.

- In-Person: Hands-on driving experience with professional instructors.

Pro Tip: Some insurers partner with specific programs, offering additional discounts for completing these courses. Check with your provider for approved options.

5. Bundle Policies for Additional Savings

Many insurance providers offer discounts for bundling multiple policies, such as auto and homeowners insurance.

This is an excellent option for families with multiple drivers or insurance needs. Bundling simplifies policy management and can lead to significant cost savings.

How Bundling Works:

- Combine your teen’s auto insurance with a family policy.

- Bundle auto insurance with renters or homeowners coverage for additional discounts.

- Multi-car policies are another option for families with multiple vehicles.

| Policy Types Bundled | Average Savings |

| Auto + Homeowners | 10-25% |

| Auto + Renters | 5-15% |

| Multi-Car Policies | 15-30% |

| Auto + Life Insurance | 10-20% |

Steps to Bundle Policies

- Contact your current insurer to inquire about bundling discounts.

- Request quotes from new providers to compare savings.

- Ensure the bundled policy meets all coverage needs.

Case Study: The Johnson family saved 18% on their premiums by bundling their auto and homeowners insurance policies with Allstate.

By adding their teen driver to the plan, they reduced costs further with a multi-car discount.

Pro Tip: Always review the fine print to ensure bundling doesn’t inadvertently reduce necessary coverage.

6. Choose a Safe and Affordable Vehicle

The type of car your teen drives plays a significant role in determining insurance rates. Insurers typically favor vehicles with high safety ratings and low repair costs.

Older, reliable models often come with lower premiums compared to new, high-performance cars.

Best Vehicles for Teens:

- Honda Civic

- Toyota Corolla

- Subaru Impreza

- Mazda CX-5 (for families preferring SUVs)

| Vehicle Model | Insurance Cost (Annual) | Safety Rating |

| Honda Civic | $1,200 | 5/5 |

| Toyota Corolla | $1,100 | 5/5 |

| Subaru Impreza | $1,150 | 5/5 |

| Mazda CX-5 | $1,300 | 5/5 |

Safety Features That Drive Down Costs

Vehicles equipped with the following features often qualify for discounts:

- Anti-lock braking systems (ABS).

- Advanced airbag systems.

- Electronic stability control (ESC).

- Rearview cameras and parking sensors.

Checklist for Cost-Effective Cars:

- High safety ratings (e.g., IIHS Top Safety Picks).

- Low theft rates.

- Affordable repair costs.

7. Consider Usage-Based Insurance Programs

Usage-based insurance (UBI) programs allow policyholders to pay premiums based on their actual driving habits.

These are ideal for teens who don’t drive frequently. Insurers use telematics devices to monitor mileage and driving behavior, offering discounts for safe practices.

Examples of UBI Programs:

- Progressive’s Snapshot.

- Allstate’s Drivewise.

- Nationwide’s SmartRide.

- Liberty Mutual’s RightTrack.

| Program | Features | Average Discount |

| Progressive Snapshot | Tracks driving behavior | Up to 30% |

| Allstate Drivewise | Rewards safe driving | Up to 25% |

| Nationwide SmartRide | Discounts for low mileage | 15-40% |

| Liberty Mutual RightTrack | Monitors braking and acceleration | 5-30% |

Telematics Devices and Driver Behavior Monitoring

Telematics devices track driving behaviors, such as:

- Speeding.

- Hard braking.

- Mileage.

Safe driving habits can result in significant discounts, often up to 30% off premiums. However, it’s essential to understand the privacy implications and ensure transparency with the insurer.

Pro Tip: Review telematics data regularly to identify and improve risky driving habits.

Final Thoughts On Save Money On Car Insurance For Teens

Saving money on car insurance for teens is possible with the right approach. By comparing providers, leveraging discounts, and encouraging safe driving habits, families can significantly reduce costs while maintaining robust coverage.

The strategies outlined above not only help in immediate savings but also promote responsible driving habits that benefit teens for a lifetime.

Take action today by exploring these options and discussing them with your insurance provider.

Lower premiums are within reach with a proactive approach to securing the best deals.