As the global economy emerges from the turbulence of recent years, 2025 presents a pivotal moment for investors. With shifting geopolitical dynamics, rapid technological advancements, and an increased focus on sustainability, the investment landscape is ripe with opportunities and challenges.

According to analysts, global GDP is expected to grow moderately, driven by recovery efforts and innovative sectors. However, inflationary pressures and interest rate fluctuations will continue to influence market sentiment.

This blog dives deep into 2025 investment trends and top suggestions, exploring the most promising sectors, emerging markets, alternative assets, and strategies to maximize returns in an ever-evolving economic environment.

The Economic Backdrop of 2025

As 2025 unfolds, the global economy is set to navigate a delicate balance between recovery and reinvention. This section delves into the major macroeconomic trends and emerging themes that will define the year, offering investors a clear understanding of the landscape ahead.

From GDP growth and inflation control to the rise of sustainability and digital transformation, 2025 presents both challenges and opportunities for strategic investment decisions.

Macroeconomic Trends

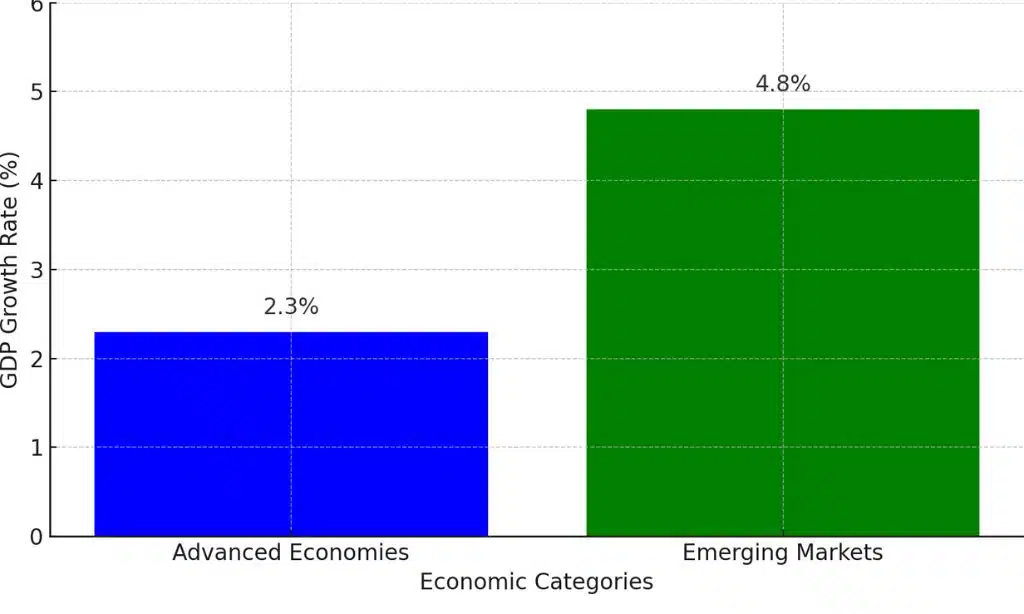

- Global GDP Growth Projections: According to the IMF, global GDP is projected to grow by 3.5% in 2025, reflecting a moderate recovery post-pandemic. Advanced economies are expected to stabilize, while emerging markets like India and Southeast Asia will drive substantial growth.

- Inflation and Interest Rates: Central banks worldwide continue to juggle inflation control with economic growth. While inflation rates in developed nations are predicted to decline to 2-3%, emerging markets might face persistent challenges due to currency volatility and supply chain disruptions.

| Region | Inflation Rate (2024) | Predicted Rate (2025) |

| United States | 3.7% | 2.8% |

| Eurozone | 5.4% | 3.1% |

| India | 6.6% | 5.2% |

- Geopolitical Dynamics: Conflicts in Eastern Europe and escalating US-China tensions could impact energy markets and trade flows. The shift toward regional trade agreements, such as the Indo-Pacific Economic Framework (IPEF), may alter global trade dynamics, with sectors like defense and energy experiencing higher demand.

Emerging Economic Themes

- Sustainability: Governments are prioritizing green energy projects and sustainable infrastructure, creating lucrative opportunities in renewable energy, electric vehicles, and eco-friendly technologies. For example, the EU’s Green Deal is set to allocate billions toward sustainability initiatives.

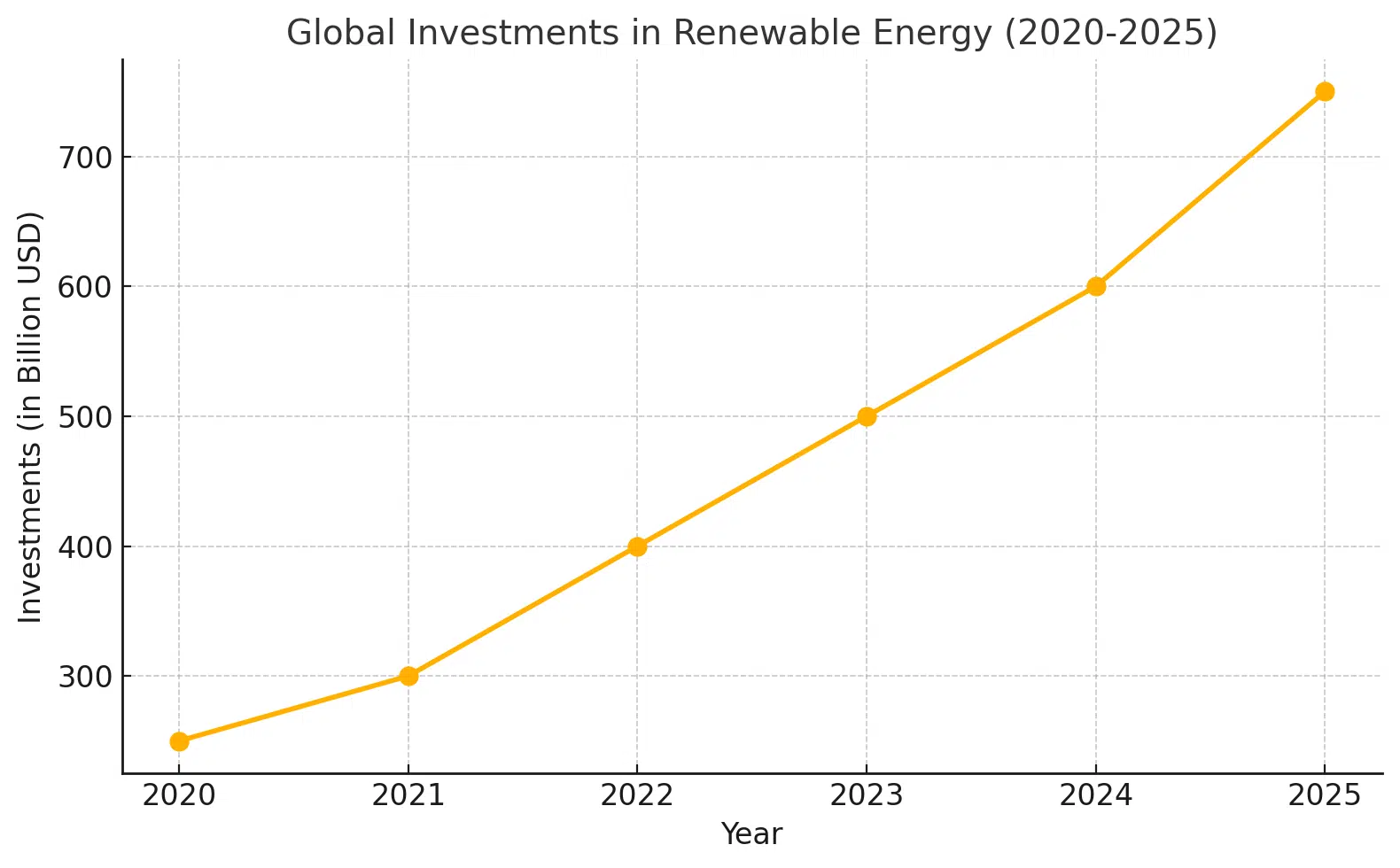

Graph: Global Investments in Renewable Energy (2020-2025) - Digital Transformation:

- The adoption of AI, IoT, and blockchain technologies is revolutionizing industries. By 2025, over 70% of companies in manufacturing and healthcare are expected to integrate IoT solutions, enhancing efficiency and data-driven decision-making.

- Blockchain technology is gaining traction beyond cryptocurrencies, particularly in supply chain management and decentralized finance (DeFi).

Top Sectors for Investment in 2025

In 2025, the global investment landscape continues to evolve, driven by advancements in technology, growing sustainability efforts, and the shifting dynamics of healthcare and real estate. This section highlights the sectors poised for significant growth and innovation, offering investors insights into where to allocate their capital for maximum returns.

a. Technology and Innovation

Technology remains a powerhouse for investment. Key areas include:

- Artificial Intelligence (AI): AI adoption is expanding across industries, with companies focusing on automation, data analytics, and customer personalization.

- Blockchain and IoT: Innovations in blockchain technology, particularly in supply chain and finance, are expected to grow.

| Subsector | Growth Rate (CAGR) | Key Players |

| AI and Automation | 23% | NVIDIA, OpenAI, Google |

| Blockchain Solutions | 20% | Ethereum, IBM, Chainlink |

| IoT Devices | 18% | Cisco, Bosch, Samsung |

b. Renewable Energy and Green Technology

The green energy revolution offers immense potential:

- Solar and Wind Energy: These will remain the backbone of the global transition to net-zero emissions. Investments in large-scale solar farms and offshore wind projects are expected to grow by 25% globally in 2025, driven by government subsidies and corporate ESG commitments.

- Battery Storage: With EV adoption on the rise, investments in lithium-ion and solid-state batteries are projected to surge. The global battery market is anticipated to grow at a CAGR of 20%.

| Technology | Projected Growth (2025) | Key Players |

| Solar Farms | 30% | First Solar, SunPower |

| Wind Power | 25% | Vestas, Siemens Gamesa |

| Battery Storage | 20% | Tesla, Panasonic, CATL |

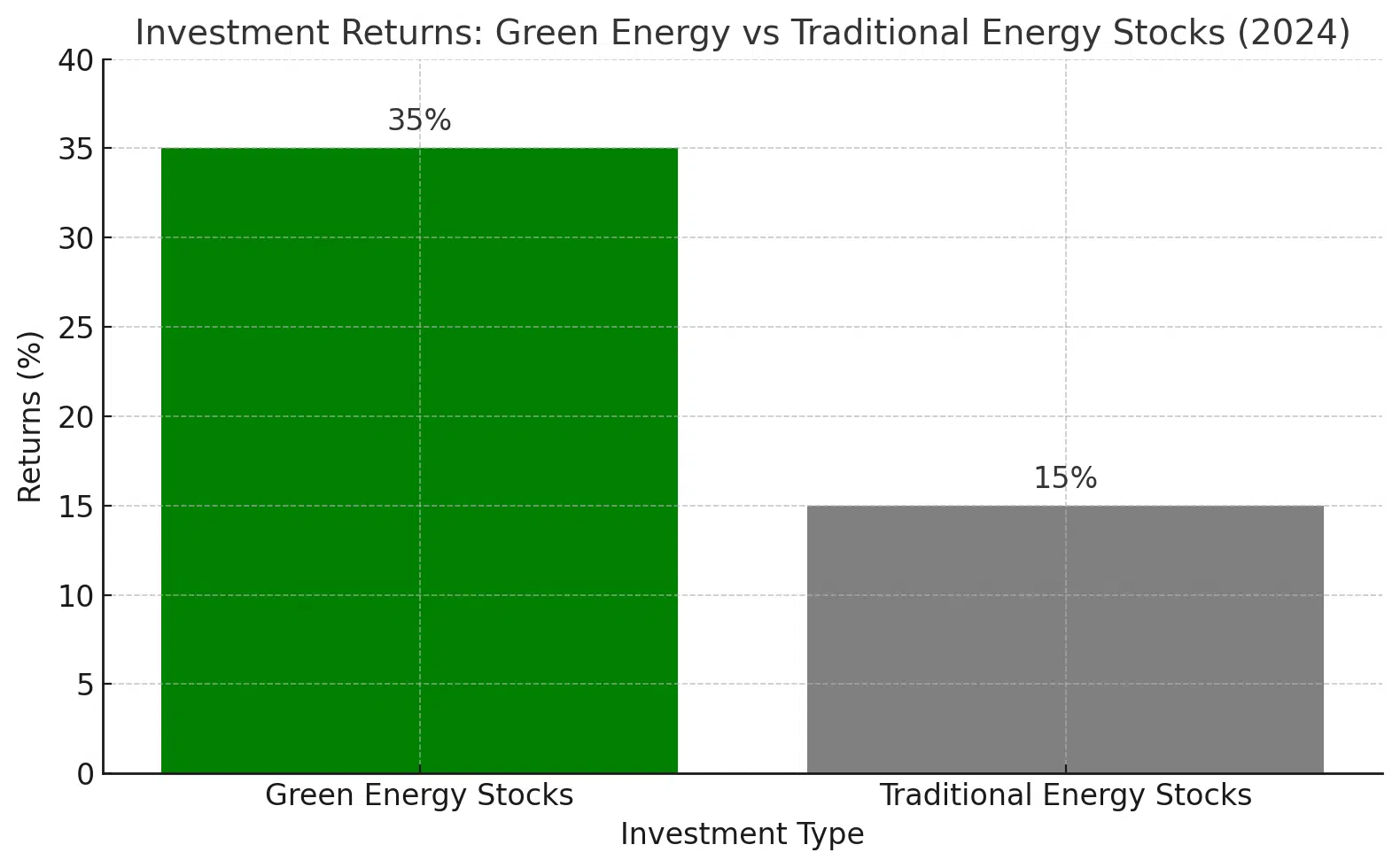

Market Analysis: A comparative analysis shows that investments in renewable energy outperformed fossil fuel investments in 2024, a trend expected to continue in 2025. Here is a graphical representation of sectoral investment growth:

Investors looking for long-term gains should consider renewable energy as a core component of their portfolios, particularly in countries with aggressive climate policies like the EU, the US, and China.

c. Healthcare and Biotechnology

- Gene Editing: CRISPR technologies are advancing rapidly, creating opportunities for groundbreaking treatments.

- Telemedicine: The convenience of remote healthcare services continues to drive this sector’s growth.

d. Real Estate

The real estate sector in 2025 is poised for growth as it adapts to shifting demographics, technological innovations, and the rising demand for sustainable development. Below is a comparison of key trends:

| Segment | Growth Projection (2025) | Drivers |

| Urban Development | 12% | Smart cities, infrastructure spending |

| Commercial Real Estate | 8% | Post-pandemic recovery, co-working |

| Sustainable Housing | 15% | Green certifications, eco-friendly materials |

Market Analysis:

- Urban development is expected to see double-digit growth as governments globally invest in smart city projects and infrastructure upgrades.

- Sustainable housing is gaining traction, with green-certified buildings attracting premium valuations and higher rental yields.

- Commercial real estate is recovering steadily, with hybrid workspaces and co-working spaces driving demand.

Investors can leverage these opportunities by focusing on REITs (Real Estate Investment Trusts) or directly investing in markets showing high urbanization rates and green housing demand.

Emerging Markets to Watch

Emerging markets are positioned to play a transformative role in the global economy in 2025, driving innovation, consumption, and manufacturing capabilities. These economies often exhibit higher growth rates than their developed counterparts, fueled by favorable demographics, technological adoption, and increasing urbanization.

With rising disposable incomes and expanding middle classes, these markets are becoming lucrative destinations for investors seeking high returns.

Countries Poised for Growth

Southeast Asia:

- Southeast Asia continues to attract global attention as manufacturing hubs like Vietnam and Indonesia thrive due to the ongoing shift of supply chains from China.

- Vietnam’s export-oriented economy has seen annual growth exceeding 6%, with sectors like electronics and textiles leading the way. Indonesia, as the largest ASEAN economy, is leveraging its rich natural resources and digital transformation.

- Regional free trade agreements like the RCEP (Regional Comprehensive Economic Partnership) are expected to bolster trade and investment.

Africa:

- Africa’s youthful population, abundant natural resources, and burgeoning tech ecosystems make it a hotspot for investment.

- Countries like Nigeria and Kenya are leading in fintech adoption, with mobile payment platforms like M-Pesa transforming financial accessibility.

- Infrastructure projects under the African Union’s Agenda 2063 are driving growth in sectors like energy and transport.

Latin America:

- Brazil and Mexico continue to stand out as investment destinations due to their renewable energy potential and proximity to major markets like the US.

- Brazil’s robust agricultural sector and Mexico’s manufacturing boom, particularly in automotive and electronics, underscore their economic resilience.

Key Investment Opportunities

| Region | Sectors with High Growth Potential | Risk Factors to Monitor |

| Southeast Asia | Electronics, E-commerce, Manufacturing | Political stability, export dependency |

| Africa | Fintech, Renewable Energy, Infrastructure | Currency volatility, governance issues |

| Latin America | Agriculture, Renewable Energy, Manufacturing | Inflation, trade policy changes |

Risks and Rewards

While emerging markets offer promising opportunities, they are not without challenges. Political instability, regulatory uncertainty, and currency fluctuations are key risks to consider. However, the potential for high returns often outweighs these risks, particularly in diversified portfolios.

Investors are advised to focus on sectors with structural growth, such as technology and renewable energy, and adopt region-specific strategies to mitigate challenges effectively.

As global economic growth shifts toward dynamic and fast-evolving regions, emerging markets in 2025 are set to play a significant role. These economies, often characterized by youthful populations, technological adoption, and growing consumer bases, offer exciting opportunities for investors. Understanding their unique risks and rewards is essential for navigating this high-growth landscape effectively.

The Role of Alternative Investments

As traditional investment avenues face heightened competition and market volatility, alternative investments are gaining traction among savvy investors. These assets offer the potential for higher returns and portfolio diversification, making them an integral part of a well-rounded strategy in 2025.

From digital currencies to private equity, alternative investments are reshaping the financial landscape and opening up new opportunities for growth.

a. Digital Assets

- Cryptocurrencies: Despite volatility, Bitcoin and Ethereum remain strongholds, while stablecoins are gaining popularity for transaction stability.

- Blockchain-Based Products: NFTs and decentralized finance (DeFi) platforms are opening new avenues for investors.

b. Private Equity and Venture Capital

- Startup Investments: Fintech, healthtech, and greentech startups offer substantial ROI potential.

- Disruptive Industries: Early-stage investments in robotics and space technology are attracting attention.

c. Commodities

- Gold and Silver: Reliable hedges against inflation.

- Energy Commodities: Natural gas and oil remain critical, especially in geopolitically tense regions.

Investment Strategies for 2025

The fast-evolving global economy in 2025 demands a strategic approach to investments, balancing the opportunities of emerging trends with the uncertainties of shifting markets. Investors need to align their strategies with both short-term market dynamics and long-term growth prospects to maximize returns.

Diversification

Diversification remains one of the most effective ways to mitigate risk in volatile markets. By allocating assets across:

- Asset Classes: Equities, fixed income, commodities, and alternative investments.

- Sectors: High-growth areas like renewable energy, AI, and healthcare alongside stable traditional sectors.

- Geographies: Balancing exposure to advanced economies with emerging markets poised for rapid expansion.

Diversified portfolios have shown resilience in uncertain economic periods, reducing dependency on any single asset’s performance.

Risk Management

- Hedging Strategies: Using derivatives, such as options and futures, to protect against adverse market movements.

- Inflation Protection: Incorporating inflation-linked bonds or commodities like gold to safeguard purchasing power.

- Portfolio Rebalancing: Regularly adjusting allocations based on market conditions ensures portfolios align with changing economic landscapes.

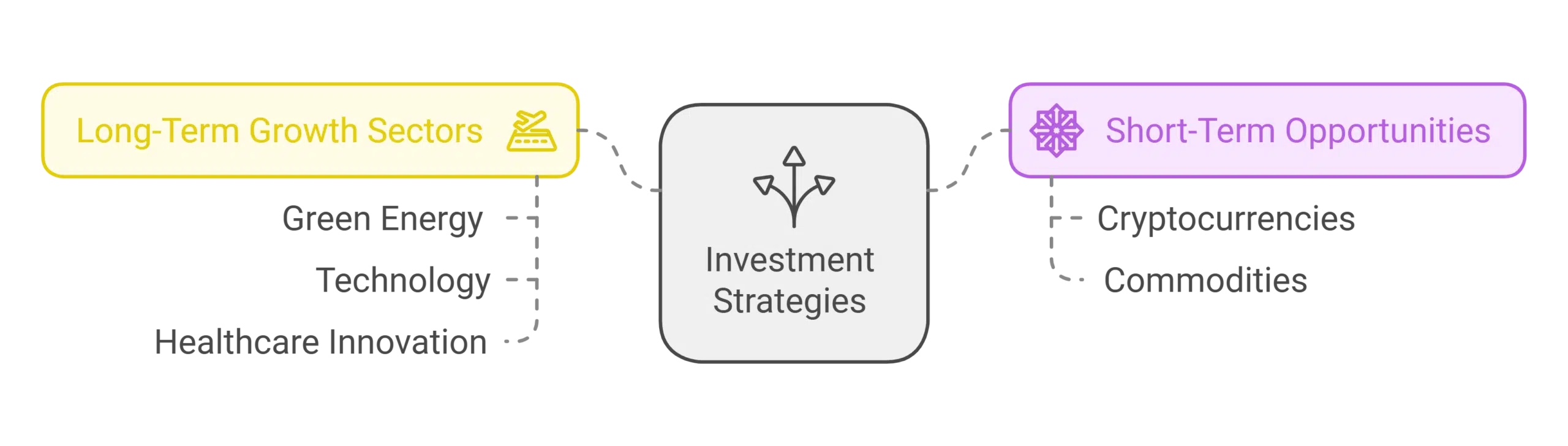

Long-Term vs. Short-Term Approaches

- Long-Term Growth Sectors:

- Green Energy: Countries worldwide are accelerating renewable energy initiatives, offering stable growth for decades.

- Technology: Investments in AI, IoT, and quantum computing continue to shape the future of industries globally.

- Healthcare Innovation: Gene editing, personalized medicine, and telehealth are emerging as transformative growth sectors.

- Short-Term Opportunities:

- Cryptocurrencies: While volatile, crypto assets offer high potential returns for risk-tolerant investors.

- Commodities: Energy commodities like oil and natural gas remain sensitive to geopolitical events, providing opportunities for active traders.

Behavioral Strategies

- Staying Informed: Monitoring economic trends, industry developments, and policy changes is critical.

- Flexibility: Adapting quickly to market signals ensures alignment with evolving opportunities.

- Expert Guidance: Leveraging insights from financial advisors and industry experts enhances decision-making accuracy.

Key Takeaways

The investment strategies of 2025 highlight the importance of adaptability and informed decision-making. By balancing diversification, managing risks effectively, and capitalizing on both long-term trends and short-term opportunities, investors can navigate the complexities of the modern financial landscape with confidence and precision.

Crafting a successful investment strategy in 2025 requires adapting to evolving market dynamics and emerging global trends. As the economic backdrop shifts, investors must balance risk and opportunity across diverse asset classes and geographic regions. This section outlines key approaches to help navigate the complexities of the current financial landscape and optimize portfolio performance.

2025 Investment Trends: Expert Predictions and Insights

As 2025 unfolds, expert forecasts shed light on the economic sectors and trends likely to dominate the investment landscape. From advancements in renewable energy to transformative technologies like AI and blockchain, these predictions provide critical insights for shaping successful investment strategies in a rapidly evolving market.

What Experts Are Saying

- Goldman Sachs: Predicts a surge in renewable energy stocks, driven by governmental green initiatives and technological advancements in solar and wind power.

- Morgan Stanley: Foresees strong growth in emerging markets, particularly in Southeast Asia, where manufacturing and digital innovation are thriving.

- JP Morgan: Highlights blockchain and decentralized finance (DeFi) as key disruptors in the financial sector, recommending a diversified portfolio with exposure to digital assets.

- BlackRock: Emphasizes sustainable investments, noting that ESG-focused funds are outperforming traditional indices and attracting significant institutional inflows.

- UBS: Suggests focusing on healthcare and biotechnology, driven by advancements in gene editing and personalized medicine, as long-term growth sectors.

Trends to Monitor

- Technological advancements in AI and blockchain.

- Evolving trade policies and international collaborations.

Final Thoughts

As 2025 approaches, the global investment landscape is brimming with opportunities across diverse sectors and markets. From technological breakthroughs to green initiatives and emerging economies, investors have a plethora of avenues to explore.

By staying informed, diversifying portfolios, and employing sound risk management strategies, investors can navigate the complexities of 2025 and beyond with confidence. Remember, the key to successful investing lies in aligning your strategy with your financial goals and market insights.