You may worry when cryptocurrencies swing up and down. Crypto swings led major firms to drop digital assets. You will learn how central banks link blockchain tech, digital wallets and monetary policy.

Keep reading.

Key Takeaways

- Crypto’s wild price swings can wreck payment systems and dent trust in the U.S. dollar and global finance. Tesla accepted then dropped bitcoin in early 2021, and Amazon shelved crypto payments after just weeks.

- The U.S. still lacks unified crypto rules. A January 2021 OCC guidance won’t do until Congress acts. By September 2024, lawmakers left a patchwork of state and federal laws that let bad actors roam and risk bank runs.

- Crime on blockchains rose in 2023. Chainalysis reports ransomware, darknet trades, and banned-group deals topped the list. In 2020, over $50 billion moved from East-Asia Bitcoin wallets to foreign accounts. Mixers and tumblers hide stolen funds.

- Central banks need steady interest rates to hit a 2% inflation goal. Since 1991, the Bank of Canada and the Fed have used rate paths to guard stability. Sharp crypto booms or busts can trigger inflation or deflation beyond their reach.

- Private tokens challenge central bank digital currencies (CBDCs). In 2020–2021, major banks tested CBDCs for offline pay and compliance. Crypto’s proof-of-work or proof-of-stake schemes sidestep rules, pushing central banks to innovate.

Why is cryptocurrency volatility a risk to financial stability?

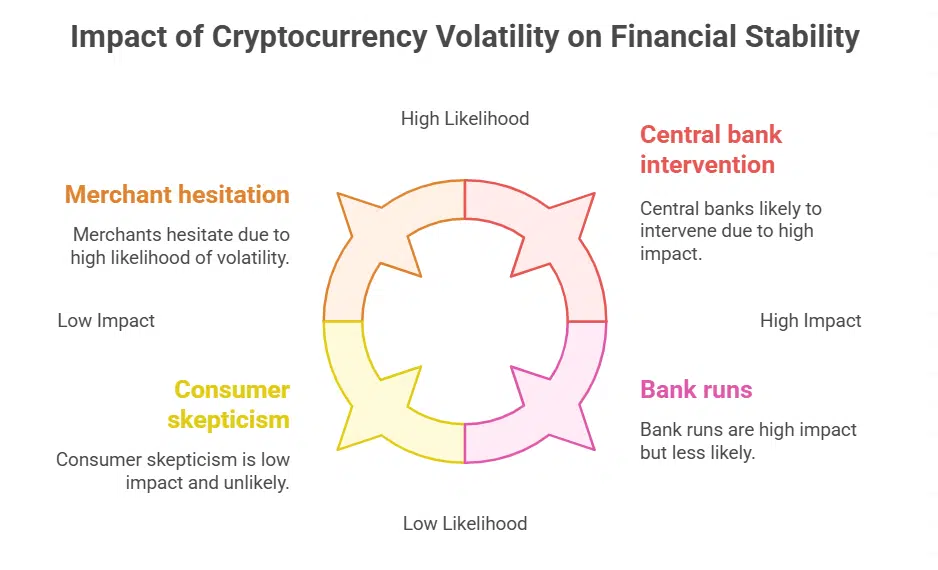

Wild swings in the leading crypto coin price can wreck payment systems, making merchants pause before they take digital currencies or use trading platforms. Tesla agreed to accept the coin then dropped it in early 2021, and Amazon shelved similar plans after just a few weeks, so shoppers doubt crypto’s payment power.

This jittery market can erode faith in the u.s. dollar and dent trust in the global financial system.

Central banks like the Fed track these swings closely, since sudden falls in crypto-assets can send credit cards and mortgage rates on a wild ride and even trigger panic. They need calm interest rate paths to steer inflation and guard economic stability.

A sharp collapse in the cryptocurrency market might spark runs on bank deposits, shaking faith in fiat currency.

Why is the lack of regulation a concern for central banks?

Central banks fear gaps in digital asset rules. They see no clear guardrails around crypto tokens. A recent Executive Order from the president highlights the need to standardize digital assets rules.

The U.S. Office of the Comptroller of the Currency issued guidance in January 2021 on blockchain use in banking. Lawmakers still have not passed new crypto regulation by September 2024, leaving a patchwork of state and federal rules.

This patchwork can let bad actors roam free. It can also sow instability in the cryptocurrency market. Banks could face runs if people panic and flow funds to tokens. Volatile shifts in token prices can spill over to fiat currencies and hurt economic stability.

Governments walk a tightrope between overregulation and lax rules. Some nations fear tight rules could dampen digital banking innovation. Others warn lax rules can fuel money laundering and theft.

Central banks need clear AML rules for all crypto exchanges. Congress failed to enact proposed bills by September 2024, so many crypto services dodge oversight. Bank of Canada and the Federal Reserve keep an eye on market runs and trader risks.

Stablecoin failures and sudden swings can upend central bank plans for interest rates and money supply. Clear rules could help the Federal Reserve anchor monetary policy. They could curb bank runs.

How can cryptocurrencies be used for illegal activities?

Bitcoin hides user names behind codes. Criminals move cash on blockchain networks, so banks can’t see who pays. Chainalysis found that in 2023, the top crypto crimes were ransomware, darknet trades, and deals with banned groups.

More than $50 billion shifted from East-Asia Bitcoin wallets to foreign accounts in 2020, showing big capital flight. Money launderers use mixing services on cryptocurrency exchanges to hide illegal gains.

Mixers split cryptocurrency transactions into many tiny parts to wash stolen funds. Hackers rent tumblers on cryptocurrency exchanges to break coin trails. Anti-money laundering teams track flows with analysis software and blockchain explorers.

Some criminals shift funds into stablecoins or private digital currencies to dodge bank rules.

How does cryptocurrency threaten monetary policy control?

Central banks shape interest rates to guide growth. They tap rates to hit a 2% inflation goal, as the Bank of Canada has done since 1991 with federal oversight. Digital assets in the cryptocurrency market, like private digital currencies or decentralized finance tokens, ignore those shifts.

Traders use blockchains and digital wallets to swap coins from any country. External actors can flood cryptocurrency exchanges and spark wild price swings. This chaos can trigger rapid inflation or sudden deflation, well outside the Federal Reserve in the United States or ECB’s reach.

Some nations fix exchange rates, peg their fiat currency to U.S. dollars or euros to tame inflation. Central banks drop the reins when digital currency adoption surges. Monetary policy can’t cool a token boom or cushion a sudden crash.

Value drifts around interest rate decisions, so central bankers feel like they chase shadows. Many push central bank digital currencies (cbdcs) to grab back control in modern finance.

Competition with Central Bank Digital Currencies (CBDCs)

Digital assets lure cash into blockchain networks, and they clash with a Fed digital coin in wallets. They spark tough talks at the Federal Reserve on policy power.

How do cryptocurrencies compete with CBDCs?

Crypto tokens run on blockchain technology and sidestep strict central bank rules. They promise peer to peer payments and remove the need for a middleman. Some rely on proof of work, while others use proof of stake to secure the network.

People compare these private digital currencies to a wild horse in a rodeo. Central banks want their own stable versions, so they test CBDCs in proof of concept trials. The Federal Reserve works with big banks on CBDC research and development.

Enthusiasts shop on cryptocurrency exchanges and link their digital wallet for quick trades. They face taxes on gains, yet they dodge some banking fees. Instant settlement attracts tech savvy users and low income folks who seek financial inclusion.

Central bank digital currencies aim to match this speed, maintain monetary policy control, and boost economic stability. Several national banks ran pilots in 2020 and 2021 to test features like offline payments and compliance tools.

Competition fuels faster innovation in each money market, pushing both camps to up their game.

What challenges do CBDCs face from cryptocurrencies?

Private tokens draw cash from central bank digital currencies (CBDCs). Traders swap them on cryptocurrency exchanges. They rely on blockchain technology and digital wallets. Bitcoin began in a 2008 whitepaper.

It has no formal legal recognition. It links to crime. That link shakes the cryptocurrency market. Thousands of cryptocurrencies face uncertain futures.

Central banks need strict oversight. They tie a central bank digital currency to a fiat currency to keep the same stability. They fear unchecked code could weaken monetary policy control.

The Federal Reserve worries about bank runs in digital banking. Poor rules might rock economic stability.

Takeaways

Central banks fret over wild price swings in bitcoin and other tokens. They flag dark web trades and suspect fund crimes in digital wallets. Many now back central bank digital currencies as safer payment methods.

Officials guard interest rates and inflation from outside shocks. Governments push tighter rules on exchanges to shield financial stability.

FAQs on Why Central Banks Fear Cryptocurrency

1. What shakes up central banks about digital assets like bitcoin?

Central banks worry digital assets, like bitcoin, can slip past their control. They fear bitcoin mining and wild swings can rock financial stability like a bull in a china shop.

2. How can cryptocurrency adoption mess with monetary policy?

Crypto adoption can push interest rates up or down in strange ways. It can erode the value of fiat currency and change the rate of exchange. This can throw a wrench into monetary policy.

3. Why is blockchain technology a hot button for national currency control?

Blockchain technology runs on algorithmic trust. It makes private digital currencies and virtual currency hard to peg to a national currency. This can chip away at central banks tools.

4. Do cryptocurrency exchanges stir up trouble for the financial system?

Yes. Crypto exchanges handle many cryptocurrency transactions. They can fuel bank runs and strain the financial system.

5. How do crypto assets affect economic stability and the financial market?

Crypto assets can swing wildly and spook investors in the cryptocurrency market. They can drain funds from money market mutual funds, exchange traded funds, and even hit stock markets. This can hurt economic growth and economic stability.

6. What steps do central banks take to curb crypto risks and boost financial inclusion?

They study central bank digital currencies CBDCs and test private digital currencies. They look at digital banking tools, digital wallets, digital cash, and payment methods with credit card companies and debit cards firms. They lean on countering the financing of terrorism rules to guard the financial system. They aim to help low-income users.