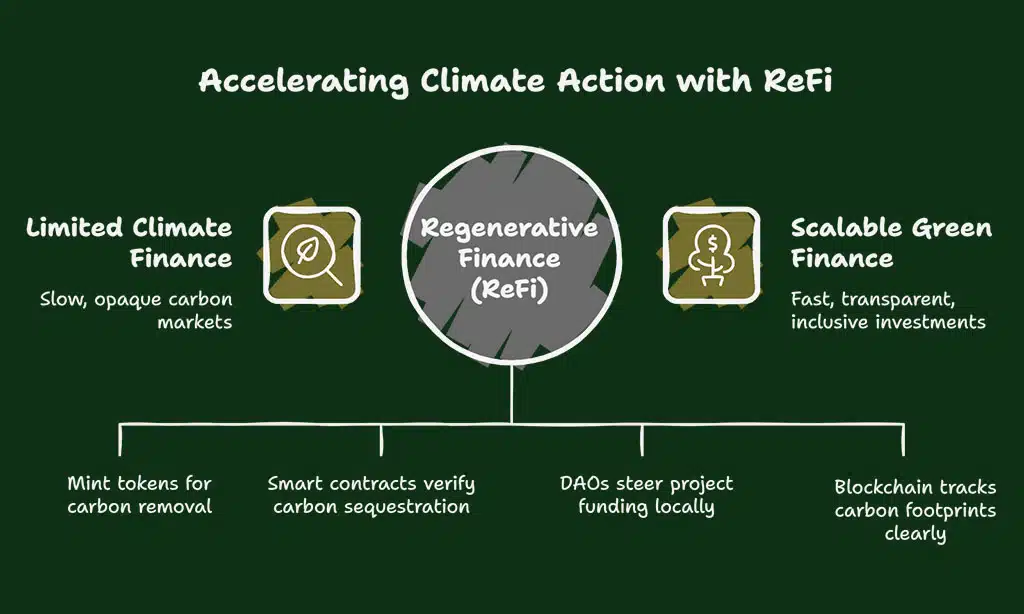

It feels like chasing rainbows when you look for real climate action. Banks still push extractive finance, while floods and wildfires wreck towns. A key fact: regenerative finance, or ReFi, uses blockchain networks to link money to green goals.

This change turns crypto into a tool for climate action.

We show seven Web3 projects that drive climate action with tokenization and proof of stake. We explore smart contracts, decentralized autonomous organizations, and carbon credit markets.

This guide will help you fund tree growth, clean energy, and carbon removal. Ready to join the ReFi wave?

Key Takeaways

- ReFi uses proof-of-stake blockchains, smart contracts and tokenized carbon credits (called base carbon tonnes or BCT) to fund tree planting, soil restoration and carbon removal.

- Seven leading Web3 projects fight climate change: Regen Network, Celo, Toucan Protocol (joined KlimaDAO in Oct 2021), Algorand, NEAR Protocol, KlimaDAO and Open Forest Protocol. They use decentralized autonomous organizations, satellite oracles and low-energy consensus to track impact.

- Ethereum’s 2022 switch to proof-of-stake cut its energy use by over 99%. Algorand, Celo and NEAR also run low-energy networks for cleaner finance, and global ESG assets hit $40 trillion by 2022 (up 25% since 2019).

- ReFi faces high gas fees (over $20 per transfer in 2021), regulatory uncertainty on carbon credits and token rules, and greenwashing risks highlighted by Shell Oil Canada’s fraud claims in May 2024; projects tackle these with on-chain audits, third-party verifiers and quadratic funding.

The Core Principles of ReFi

ReFi reshapes finance with blockchain networks, community governance, and smart contracts that fund clean power and forest projects. It weaves carbon credits, financial inclusion, and regenerative economics into a living engine that heals our world.

Regeneration Over Extraction

Regenerative economics rewards reforestation and carbon sequestration. It uses smart contracts on blockchain technology to track carbon credits in voluntary carbon market. Projects issue tokens for each base carbon tonne logged.

This shift fights climate change at the roots.

Programmable incentives drive ecosystem services like soil restoration. Participants earn crypto asset rewards when they plant trees or add soil organic matter. This model supports environmental, social, and governance goals and promotes sustainable agriculture.

Pilot programs can fuel universal basic income and decarbonize supply chains.

Transparency and Accountability

Blockchain logs can’t change. They record every carbon credit claim in public ledgers. Smart contracts link these entries to real world sensors and satellites. IoT devices feed data on tree growth, soil moisture, or solar output.

Projects in regenerative finance tap this system to power trust.

Satellite images add a bird’s eye view to tracking efforts. This proof stops greenwashing in global carbon markets. People can trace each token back to a real forest or wind farm.

That level of auditability drives trust in carbon offsetting.

Community Governance

Clear audit logs and public data pave the way for community governance. Decentralized autonomous organizations let local groups steer funding, set project priorities, and shape policy.

Open source smart contracts record each vote with digital identity checks. This setup boosts climate action, from funding carbon credits to backing renewable energy.

Governance modules like quadratic funding give small voices a louder reach. Transparent rules guard fair benefit distribution. Members can track each dollar in a public ledger. People feel more in control, and projects gain stronger buy-in.

Financial Inclusion

Small villages struggle to get bank loans. Decentralized systems supply mobile wallets, stablecoins, and smart contracts. They give underserved folks tools, and they enable community-led development.

People tap decentralized autonomous organizations and a decentralized exchange on a smartphone.

Web3 lowers barriers for smaller investors. It lets citizens join climate bonds, carbon trading, and tokenized forestry projects. A DAO handles governance and a crypto asset platform tracks carbon credits.

That model boosts financial inclusion and guides impact investing.

The Intersection of ReFi and Web3

ReFi projects link chain records and auto deals, mint coin tokens as carbon credits, and power open councils, so you see green wins in your wallet—keep reading.

Leveraging Blockchain for Transparency

Projects use digital ledgers to track ecological health and carbon credits in real time. They record each step on a public chain. Smart contracts move funds after each milestone clears.

This process cuts out middle steps, and it stops money from vanishing. Regulators see every ERC-20 token transfer and audit the carbon footprint data.

People call this method a game changer for climate action. It feels like shining a light on a dark trail. Investors track crypto assets tied to carbon credits. Developers build open code that anyone can test.

Communities shout out updates on shifts in environmental sustainability.

Tokenizing Environmental Assets

Platforms like Toucan Protocol, Moss.Earth, and Regen Network turn carbon credits, biodiversity offsets, and renewable energy certificates into tokens. These tokens run on a distributed ledger.

Self executing code tracks each base carbon tonne, or bct. Traders swap bcts on a voluntary carbon market, fueling climate action and sustainable development.

This approach drives regenerative finance, and boosts financial inclusion. Decentralized autonomous organizations steer token rules and fund green projects. Some folks quip that this method feels like turning trees into tokens, but it helps cut greenhouse gas emissions.

It links each token to a certified carbon removal or ecological restoration credit, so buyers see real impact.

Aligning Incentives with Climate Impact

ReFi links money to nature value. It issues tokens for each carbon storage unit. Buyers trade a base carbon tonne (bct) in a voluntary carbon market. Smart contracts run trades on a public blockchain.

Celo, Regen Network and Toucan Protocol use this setup.

DAOs let communities steer funds and boost financial inclusion. Quadratic grants reward top ideas and slash greenwashing risks. ReFi Spring events gather gov bodies and the World Economic Forum.

These moves set the stage for protocols that cut energy use and track carbon offsets.

How ReFi Addresses Climate Change

They ditch proof-of-work chains for proof-of-stake, cutting energy use across networks. They lock Base Carbon Tonnes (BCT) into smart contracts on Toucan Protocol’s marketplace, giving on-chain carbon accounting real teeth.

Energy-Efficient Blockchain Protocols

Many blockchains use proof of stake to slash energy use. Ethereum switched from proof of work in 2022, and cut power by over 99%. Algorand, Celo, NEAR Protocol and Chia tap renewable energy sources or low-carbon infrastructure.

These networks shrink their carbon footprint, and offer cleaner rails for decentralized finance. Consensus mechanisms on these chains need far less electricity.

Carbon Offsetting Mechanisms

Energy-efficient blockchains still leave some emissions, so projects add offset modules. Protocols buy carbon credits on the voluntary carbon market to balance their carbon footprint.

Platforms like Toucan Protocol and Moss.Earth create base carbon tonne tokens via smart contracts, they trade those tokens across DeFi apps.

Algorand targets carbon-negative status through forestry, blue carbon and renewable kits, it backs partners to pull CO2 from air. Developers use tokenizing environmental assets to fund carbon removal and ecosystem services.

Users track each offset on chain for clear, public audits.

Green Auditing and Certification

Auditors use blockchain oracles, such as Chainlink nodes, to feed real time emissions data. The system tracks each kilowatt burned and logs carbon footprints on public ledgers. Decentralized autonomous organizations fund these audits with sensor arrays and satellite feeds.

Auditors keep measurement separate from carbon trading, a move that guards ecological health.

Certification bodies, like Verra and Gold Standard, stamp carbon credits to match real carbon sequestration. Experts audit smart contracts and tokenized offsets with soil sample tests and satellite checks.

Clear proof of reforestation steps and avoided emissions acts like a truth serum for offset claims. This curb on greenwashing fuels trust in the voluntary carbon market and regenerative finance.

We can now explore top ReFi projects.

Top ReFi Projects Fighting Climate Change

A forest-conservation protocol tracks tree growth with satellite oracles on a public ledger. A carbon-credit marketplace uses smart contracts and tokenization to fund climate projects on a proof-of-stake network.

Regen Network: Tokenizing Ecosystem Services

Regen Network mints on chain ecological assets that back verified carbon sequestration and land stewardship. It tokenizes carbon credits and biodiversity offsets for trading on voluntary carbon markets.

The project uses smart contracts on blockchain technologies and decentralized finance tools. Farmers and land stewards earn tokens and shape decisions via community governance in a decentralized autonomous organization.

Buyers can track carbon removal in real time and report emissions with a clear audit trail. The model rewards ecological economics and supports climate action toward net zero. Open finance meets environmental, social and governance goals in a single system.

Celo: Mobile-First Climate Solutions

Celo brings climate action to mobile users. The platform offers green stablecoins to offset carbon footprints. Users can mint tokenized trees with a few taps. Builders test universal basic income pilots in remote areas.

Community developers build regenerative finance tools as decentralized finance modules.

Celo moved to an Ethereum layer-two via OP Stack to boost scale. This shift slashes energy use and cuts fees. Smart contracts lock in carbon credits on a public ledger. Next we will explore Toucan Protocol’s carbon credit infrastructure.

Toucan Protocol: Carbon Credit Infrastructure

Toucan Protocol turns carbon credits into digital tokens. It links off-chain registries like Verra and Gold Standard to decentralized finance markets. Users buy base carbon tonne tokens, or BCT, on Uniswap or SushiSwap.

In October 2021, Toucan joined KlimaDAO to inject carbon markets into DeFi. The system boosts transparency and cuts carbon footprint claims.

Developers build OP Stack tools and smart contracts on Toucan. They tap voluntary carbon market data for climate action. The protocol feeds tokenized environmental assets into decentralized autonomous organization projects.

This approach makes climate finance more inclusive; it opens doors for small investors. Next we explore Algorand and its sustainable blockchain technology.

Algorand: Sustainable Blockchain Technology

Following Toucan Protocol’s carbon credit infrastructure, Algorand drives zero carbon finance. Algorand holds carbon negative status. It offsets emissions through partnerships and eco projects.

Developers use a low energy Proof of Stake model to cut power needs. This eco friendly blockchain also fosters financial inclusion. Smart contracts on Algorand Standard Assets help climate mitigation and sustainable finance apps.

NEAR Protocol: Low-Energy Consensus Model

NEAR Protocol uses a low-energy consensus model that draws a tiny slice of the power other chains burn. The network cuts carbon footprints down to near zero-carbon levels. It proves blockchain and green finance can coexist.

Validators secure transactions using smart contracts without burning gas the way older systems do.

Community developers channel fees into regenerative finance and climate action grants. Projects can tokenize carbon credits or base carbon tonne (bct) assets on the chain. This approach boosts financial inclusion and community governance in a decentralized finance setting.

The protocol shows how decentralized autonomous organizations can drive regenerative economics.

KlimaDAO: Driving Carbon Neutrality

Low-energy consensus models set the stage for a market that fights carbon. KlimaDAO builds an on-chain carbon market with KLIMA tokens to boost demand for tokenized carbon credits.

A partnership with Toucan Protocol in October 2021 lifted ReFi’s profile. It uses smart contracts to retire voluntary carbon credits held as base carbon tonne units.

Stakeholders lock KLIMA to earn rewards and shrink their carbon footprint. Community governance drives protocol decisions, and clear tokenomics keep trust high. KlimaDAO places carbon in the hot seat, turning credits into a tool for real climate action.

Open Forest Protocol: Forest Conservation via Blockchain

Open Forest Protocol tracks reforestation and afforestation areas with blockchain and Sentinel-2 imagery. This system mints ERC-20 tokens for each verified hectare of new forest. It logs growth data on the Ethereum network to support carbon credits and back carbon sequestration.

Communities vote on fund use through Solidity scripts. The model boosts transparency and accountability in forest conservation.

Such a project ties into regenerative finance and regenerative economics. It aligns incentives for climate action by linking tokens to real data from satellite imaging. Organizations can back more climate change projects with clear proof of impact.

You will see how these tools accelerate climate action, enhance collaboration, and promote sustainable investments.

Benefits of ReFi Projects for the Environment

ReFi projects flip finance on its head, letting forest buyers bid with climate credits on a transparent ledger. They link smart contracts to decentralized autonomous organizations, paying stewards for carbon sequestration and lighting up green finance.

Accelerating Climate Action

Regenerative finance projects mint carbon credits as tokens to fund tree planting and soil regeneration. Blockchains track carbon footprints with clear ledgers to boost transparency, cutting out shady deals like a spotlight in a dark room.

Smart contracts automate payments once sensors confirm carbon removal in forests. Toucan Protocol issues BCT tokens for each ton of sequestered carbon. Communities earn crypto rewards for monitoring wetlands, and they trade high-fives in chat rooms.

Fast funding flows from quadratic grants and voluntary carbon markets in hours. A green audit can run in minutes, not months, thanks to decentralized platforms. Now we shift toward how diverse partners build global collaboration.

Enhancing Global Collaboration

Decentralized autonomous organizations let local groups steer project funding. Teams across five continents link up with no banks or big firms. They vote on carbon credit plans and carbon sequestration targets.

Smart contracts handle payments in base carbon tonne tokens. This setup boosts financial inclusion by cutting fees for small investors.

Open forums on Web3 let policymakers and activists share research on climate action. Quadratic funding rounds match small grants with bigger ones to spur new reforestation. Community governance rules give every voice equal weight in decisions on energy infrastructure.

Users tap Op Stack features for real-time carbon credit tracking. The network drives global climate change efforts at scale.

Promoting Sustainable Investments

Investors pour cash into ESG funds, they see climate value as profit. Global ESG assets hit $40 trillion by 2022, a 25 percent jump from 2019. ReFi links money to nature like a green handshake.

It brings financial inclusion to rural stewards, it adds community governance to every step. Projects like Toucan Protocol and Celo wrap carbon credits in tokens, they trade on smart contracts.

Major firms eye low carbon crypto for long term portfolios. They treat carbon sequestration like a new commodity. Regen Network tracks soil health on blockchain, it pays land stewards for sequestered carbon.

KlimaDAO pools tokens to fund carbon removal, it issues base carbon tonne tokens for traders. This mix of regenerative finance and DeFi channels more capital into nature. Let us explore the barriers that lie ahead.

Challenges Facing ReFi and Web3 in Climate Solutions

Projects sprint to scale decentralized exchanges and DAO protocols, but high fees and power hunger clog the lanes. They juggle quadratic funding and smart contracts to mint sequestration tokens, while city halls and banks eye these carbon deals like hot potatoes.

Scalability and Adoption Barriers

High blockchain fees and slow speeds block growth. Gas fees topped $20 per transfer in 2021, that hurts climate pilots. Carbon credits cost jumped above $50 per token. Users sweat over each base carbon tonne (bct) move.

Wallet screens form a maze of menus. That maze kills interest. Many drop off mid sign up.

Celo and green ledger cut fees to pennies. They run proof of stake chains. Wallet screens still spook new users. They join decentralized finance hubs, but links confuse people. They face tough choices on op stack and smart contracts.

They need clear paths to track carbon footprint. Toucan protocol bridges add more steps. ReFi must unclog these bottlenecks. Better tools spark broader financial inclusion and community governance.

Regulatory Uncertainty

Regulatory red tape can slow funding. Governments may change rules on carbon credits or token sales. This uncertainty drives away investors. Small projects may struggle to scale. The lack of clear rules on the voluntary carbon market like base carbon tonne can stall growth.

ReFi projects need strong oversight to fight greenwashing. DAOs can set standards and use outside audits. Projects like Toucan Protocol fit this model. They rely on distributed ledger and automated agreements.

These tools boost transparency and build trust in climate action.

Addressing Greenwashing Risks

Unclear rules left gaps that bad actors exploited, so ReFi teams must tackle greenwashing head on. Projects in decentralized finance use smart contracts and decentralized autonomous organization votes to lock data on a public ledger.

Teams track carbon credits and voluntary carbon market trades with on chain registries. They lean on environmental finance norms to slow fraud, boost trust in carbon removal, and show real climate change impact.

Shell Oil Canada’s offset program faced fraud allegations in May 2024. This case highlights why teams bring in third party verifiers, standard audits, and transparent registries.

Boards tie project funds to proof of carbon sequestration and soil health. A tight loop stops bogus claims that dodge accountability.

The Future of ReFi in Climate Action

Smart contracts and carbon tokens on a public ledger will speed carbon removal, spark fresh green ideas and shape our next steps—keep reading to learn more.

Opportunities for Long-Term Impact

Investors see long term gains as blockchain speeds up and rules clear, boosting regenerative finance in climate change fights. Regenerative finance using community governance lets people fund forest work and carbon sequestration.

Some platforms tap voluntary carbon market tools and quadratic funding to spark new projects.

Portfolio diversification grows with tokenized environmental assets and decentralized renewable energy projects. Decentralized autonomous organizations manage funds with smart contracts.

They reward local stewards with carbon credits and universal basic income grants. This approach blends regenerative economics and financial inclusion.

Driving Innovation in Green Technologies

Web3 powers fresh ideas in green tech. It uses smart contracts, decentralized autonomous organizations, and tokenized carbon credits to speed up new tools. Riding a green wave, platforms link code to climate action.

Developers build apps that track carbon sequestration or fund solar power through a voluntary carbon market.

A distributed ledger acts as decentralized infrastructure, giving clear data for audits and building trust. Teams across continents share funds and data in real time. Regenerative finance fuels startups that test wind turbines and biochar for carbon removal.

Regen Network and Toucan Protocol show how a base carbon tonne, or BCT, can trade on-chain. Quadratic funding pools small donations into big grants. We now move to the conclusion.

Takeaways

These seven projects act like climate heroes. Regen Network, Celo, and Toucan Protocol turn carbon removal into tradeable tokens. Algorand and NEAR use low-energy consensus to shrink carbon footprints.

KlimaDAO and Open Forest Protocol fund forest care with tokenized credits. They link smart contracts, DAOs, and carbon markets. They put money where Earth needs it most. This new finance model shows how DeFi can heal our world.

FAQs on Web3 Projects Fighting Climate Change

1. What is ReFi and how does it help with climate change?

ReFi, or regenerative finance, links decentralized finance with climate action. It backs carbon removal, carbon credits, and carbon sequestration. It fights climate change and drives economic growth.

2. How do projects use smart contracts and decentralized autonomous organizations?

They run smart contracts, also called automated agreements, on the blockchain. They form decentralized autonomous organizations for community governance and fund fights with quadratic funding. They move money fast, with full transparency.

3. What is the Toucan Protocol op stack and how does Base Carbon Tonne work?

The Toucan Protocol is a carbon protocol that mints Base Carbon Tonne, or BCT, tokens. It locks real carbon credits on chain. You trade BCT on a decentralised exchange to cut your carbon footprint.

4. Can ReFi boost financial inclusion and universal basic income?

Yes, ReFi can fund pilots for universal basic income by pooling votes in DAOs. It drives financial inclusion beyond central bank schemes. It blends regenerative economics with a kinder form of capitalism.

5. How do these projects tap the voluntary carbon market and ESG goals?

They plug into the voluntary carbon market to fund real climate action. They lean on environmental, social and governance standards and attract socially responsible investment. They swap the old commodification of nature for true value in carbon sinks.

6. Who backs ReFi and how does it fit with climate policies?

Groups like the crypto sustainability coalition and the World Economic Forum support it. They echo voices such as John Fullerton, who calls for real wealth beyond growth. They link decentralised finance, defi, to policies for addressing and tackling climate change, and even help us adapt to climate change with smart natural gas capture.