Web3’s like a crypto frontier—blaze a trail through metaverses and dApps, and you’ll carve out riches. I got hooked after dropping $100 on a Decentraland plot for a 2x pop in 2024, but I’ve also wandered into dead-end trails that cost me. If you’re ready to pioneer profits in 2025, you should roll over to the-quantum-ai.org to connect with trailblazers who’ll keep your path clear. Here’s my dusty, pioneer-wagon guide to Web3 wins, patched from my gold-strike highs and some barren flops.

Why Web3 Is Crypto’s New Territory?

Web3 spans virtual worlds, decentralized apps, and tokenized identities on chains like Polkadot and Ethereum. I tossed $50 into The Sandbox last year when X buzzed about its game boom—up 35%, like staking a prime claim. CoinMarketCap shows Web3 tokens soaring as adoption spikes, with market caps under $10B signaling potential. But scams are thick; I lost $70 on a “metaverse gem” that was pure dirt. X is your scout—threads on user activity pointed me to Polkadot, up 30%. Check whitepapers and CoinGecko for volume; Sandbox’s tech is wild but legit. If a project’s got no community or smells like a con, it’s a dry gulch, not a profit vein.

Blazing Your Web3 Trail

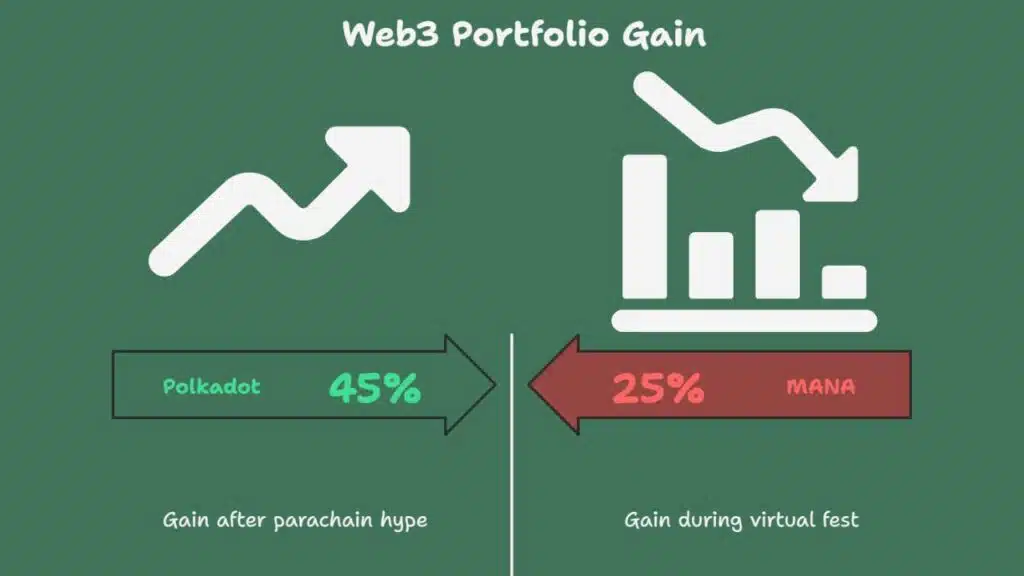

Web3’s volatile, so don’t stake your whole wagon train. I keep 15% of my portfolio in Web3, backed by Bitcoin and USDC. Last summer, I dropped $40 into Polkadot after X hyped its parachains—up 45%, my kinda pioneer haul. Start small on Binance or MetaMask, testing with $20 to avoid busts. Timing’s your compass: Web3 tokens pop during metaverse events or dApp launches. I grabbed MANA last fall when a virtual fest hit, banking a 25% gain. X vibes and CoinGecko’s charts spot these surges, but TradingView’s RSI keeps me from overpaying—dodged a hyped DOT spike. Cashing out’s where I’ve lost my way; I held a 2x token too long, missing $80. Now I sell 20% at a 50% gain, 50% at a double, using Kraken’s swaps. Holding for utility, like virtual land rentals, adds nuggets like a side claim.

Securing Your Frontier Stash

Web3 draws hackers like bandits to a gold rush—$1.9 billion got swiped in 2024. I store my coins in a Ledger Nano X; hot wallets like MetaMask are for small trades. 2FA with Authy’s my lock—SMS is a hacker’s open trail. I nearly lost $180 to a fake “metaverse drop” link last year; felt like my camp got raided. Now I skip “urgent” X DMs and check URLs like a sheriff. Scams love Web3 hype; I blew $50 on a “virtual asset” ‘cause I didn’t vet its contracts. Etherscan’s audits and X threads are my scam detectors—if a project’s shady or hype’s louder than a saloon piano, I’m out. Use a dedicated wallet for Web3; I keep my MetaMask separate from my main stash. Back up your seed phrase on paper, stash it in a safe; my cousin lost $400 in MANA ‘cause he didn’t. And watch 2025’s MiCA rules—shady projects could get run out of town. I skipped a bad one last month after CoinDesk flagged its legal gaps. Stay secured, or your stash is a thief’s loot.

Conclusion

Web3’s your frontier to pioneer, carving riches in new lands. Pick solid projects, time your moves, and hold for utility to maximize your haul. Keep your coins safer than a locked strongbox and dodge scams like you’re outrunning bandits. 2025’s Web3 scene is a gold rush—play it sharp, and you’ll be the one striking it rich while others are still breaking ground.