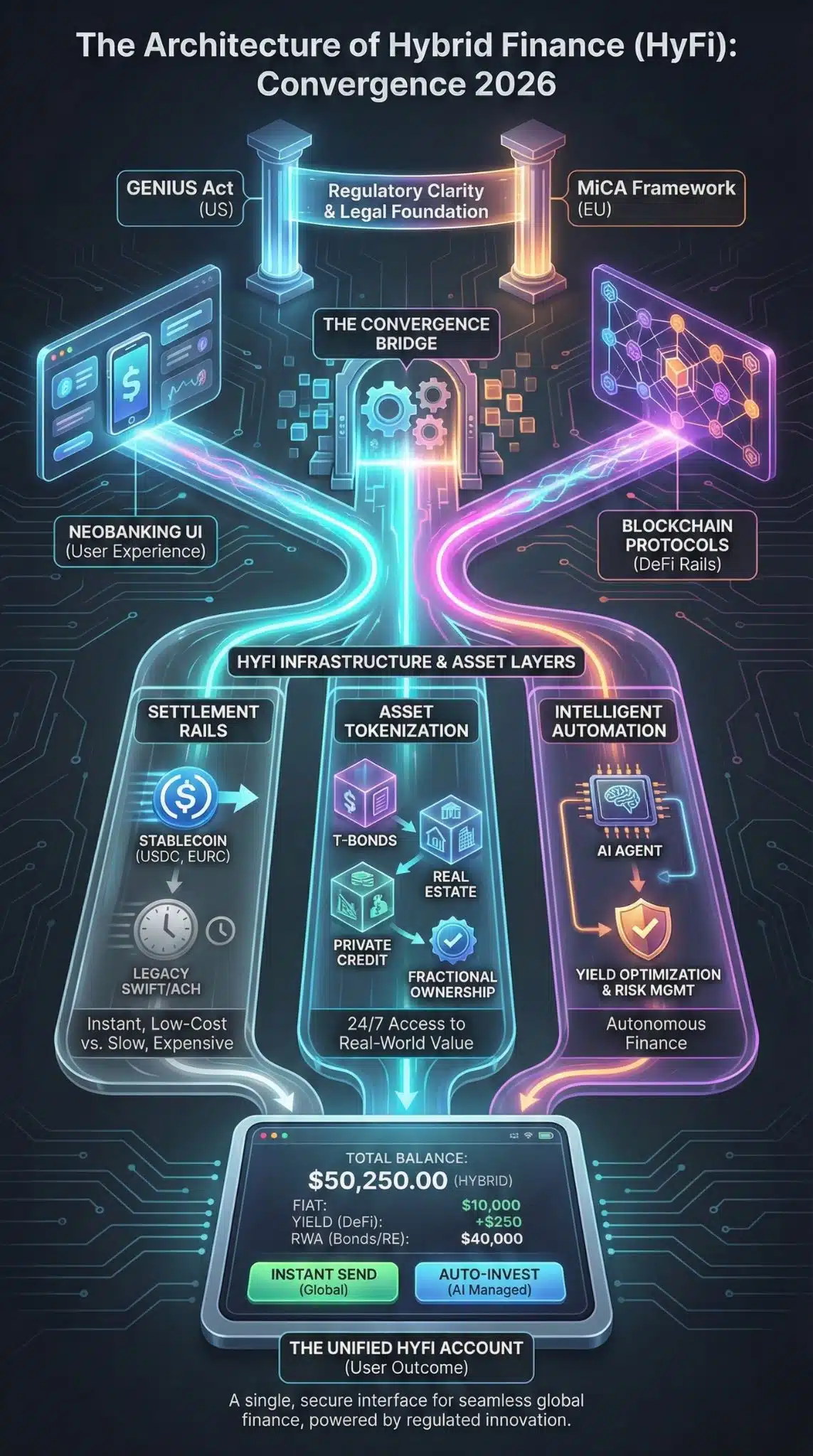

The wall between “crypto” and “real money” has officially crumbled. As of early 2026, the implementation of the US GENIUS Act and the full maturation of Europe’s MiCA framework have forced a historic convergence. Only Web 3 Neobanking convergence is now driving this transformation. We are no longer talking about “crypto-friendly” banks; we are witnessing the birth of “Hybrid Finance” (HyFi)—an era where your checking account holds tokenized treasuries, your savings yield comes from DeFi lending pools, and “money” moves on blockchain rails, invisible to the user.

This analysis dissects why this shift is happening now, who controls the new infrastructure, and why the banks that refused to adapt are already dying.

Key Takeaways

- Regulatory Clarity: The 2025 GENIUS Act (US) and MiCA (EU) eliminated the “gray zone,” allowing institutions to safely integrate DeFi protocols.

- Infrastructure Shift: Stablecoins have replaced SWIFT for a significant portion of cross-border neobank settlements, cutting costs by up to 80%.

- New Asset Class: “Tokenized Real-World Assets” (RWAs) like government bonds are now standard features in retail banking apps, democraticizing access to yield.

How We Got Here: From Experimentation to Integration

To understand the 2026 landscape, we must look back at the friction of the early 2020s. For years, “Neobanks” like Monzo, Revolut, and Chime were essentially pretty front-ends built on top of aging, clunky banking infrastructure. They offered better user experiences but were hamstrung by the same slow settlement times (ACH/SEPA) and limited asset access as traditional incumbents.

Simultaneously, the “DeFi summer” of 2020 and the subsequent crypto winters highlighted a powerful technology (programmable money) plagued by terrible user experience and regulatory hazards. The turning point arrived in late 2024 and 2025. Facing pressure from high interest rates and a demand for operational efficiency, regulators in major jurisdictions—specifically the EU with the full rollout of Markets in Crypto-Assets (MiCA) and the US with the passage of the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins)—finally provided the rulebook. This gave fintech giants the green light to stop experimenting and start re-architecting their core systems on blockchain rails.

The Great Convergence: Core Analysis

1. The Regulatory Unlock: Permission to Build

The single biggest driver of this convergence is legal certainty. In 2026, “compliance” is no longer a blocker to crypto-integration; it is the product. The GENIUS Act in the US effectively legitimized stablecoins as a form of payment, allowing neobanks to hold and settle in USDC or PYUSD without the existential fear of SEC enforcement.

This has led to a bifurcation in the market. “Regulated DeFi” pools—liquidity pools that require KYC (Know Your Customer) verification—have become the backend for high-yield savings accounts. Neobanks now act as the “trust layer,” verifying user identity and then granting them access to decentralized lending protocols. The user sees “5% APY”; the bank sees a smart contract interaction.

2. Stablecoins: The New Settlement Layer

The most invisible yet profound shift is the death of the correspondent banking model for fintechs. Neobanks like Revolut and N26 have largely bypassed legacy networks (like SWIFT) for internal cross-border transfers.

Instead, they use stablecoin rails. When a user sends Euros from Berlin to a recipient in Brazil, the bank converts the fiat to a stablecoin, moves it across a blockchain like Solana or Ethereum L2 in seconds for fractions of a cent, and converts it back to Real (BRL) at the destination. This “HyFi” model has compressed settlement times from days to seconds and collapsed fees, allowing neobanks to undercut traditional banks aggressively on international transfers.

3. The Tokenization of Real-World Assets (RWAs)

In 2023, buying a US Treasury bond was a bureaucratic nightmare for a retail user. In 2026, it is a one-click action. Neobanks have integrated tokenized assets—digital representations of bonds, real estate, or private credit—directly into user dashboards.

This “fractionalization” means a gig worker can invest $50 into a commercial real estate project or a government bond fund that was previously accessible only to institutional investors. This shift has turned neobanks from simple payment processors into full-service wealth management platforms, eroding the market share of traditional brokerages.

4. “Agentic AI” in Finance

The convergence isn’t just about blockchain; it’s about how AI interacts with it. 2026 is the year of “Agentic AI”—autonomous software agents that can execute tasks. Because blockchain transactions are programmable and operate 24/7, they are the native language of AI.

Modern neobanks are deploying AI agents that actively manage user finances. For example, an agent might monitor gas fees and yield rates across different protocols, automatically moving a user’s idle cash into the highest-yielding safe asset (verified by the bank’s risk engine) overnight, and moving it back for spending in the morning. This level of automation was impossible with the “9-to-5” limitations of traditional banking.

5. Identity and Privacy: The Rise of Zero-Knowledge Proofs

With financial crime a major concern, 2026 has seen the adoption of Zero-Knowledge Proofs (ZKPs) for identity. Neobanks are issuing “Soulbound Tokens” or Verifiable Credentials to users. These allow a user to prove they are over 18 and a resident of a compliant jurisdiction without revealing their name or address to every merchant or protocol they interact with. This solves the “privacy vs. compliance” paradox that plagued the early Web3 industry.

Data & Visualization: Winners vs. Losers

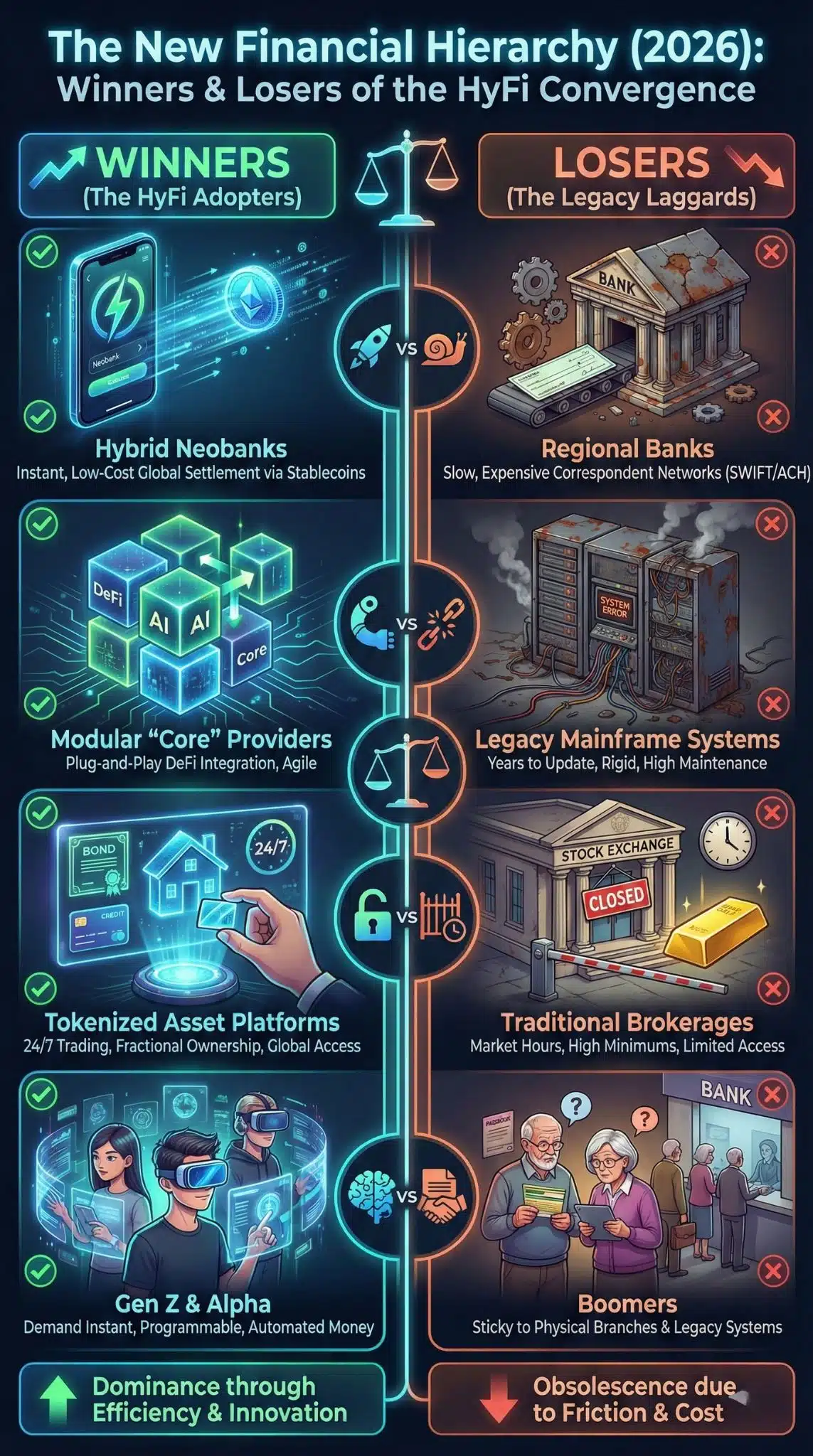

The market is not lifting all boats. The convergence heavily favors agile tech stacks over legacy COBOL cores.

The New Financial Hierarchy (Winners vs. Losers 2026)

| Category | Winners (The HyFi Adopters) | Losers ( The Legacy Laggards) | Why? |

| Settlement | Hybrid Neobanks (e.g., Revolut, Bleap) | Regional Banks | HyFi banks settle globally in seconds via stablecoins; Regional banks rely on slow, expensive correspondent networks. |

| Infrastructure | Modular “Core” Providers | Legacy Mainframe Systems | Modern cores allow “plug-and-play” DeFi integration; Legacy systems require years to update. |

| Assets | Tokenized Asset Platforms | Traditional Brokerages | Tokenization offers 24/7 trading and fractional ownership; Traditional brokers have market hours and high minimums. |

| Customer Base | Gen Z & Alpha | Boomers | Younger generations demand instant “programmable” money; Older generations remain sticky to physical branches. |

Traditional vs. Hybrid Banking Model

| Feature | Traditional Neobank (2020-2024) | Hybrid Finance (HyFi) Bank (2026) |

| Custody | Bank holds 100% of funds. | Hybrid: Bank holds cash; User self-custody options for crypto. |

| Yield Source | Central Bank Rates. | Diversified: Central Banks + Staking + RWA Yields. |

| Transfer Speed | Hours to Days (Cross-border). | Seconds (On-chain settlement). |

| Interoperability | Closed Garden (In-app only). | Open: Connect wallet to external dApps. |

Expert Perspectives

To ensure a balanced view, we must look at the risks accompanying this innovation.

The Optimist View: Dr. Aris K., Fintech Analyst at Juniper Research:

“The convergence is inevitable because it is efficient. We are seeing a 40% reduction in operational costs for banks that switch to blockchain rails for settlement. In a low-margin environment, that isn’t just an advantage; it’s survival.”

The Skeptic View: Sarah Jenkins, Senior Policy Advisor at The Financial Stability Board:

“While the GENIUS Act provided clarity, the systemic risk has effectively moved from the ‘shadow banking’ sector directly into consumer retail apps. If a major ‘regulated’ DeFi protocol is hacked, the contagion will no longer be contained to crypto natives—it will hit grandma’s savings account. The technology is faster, but the guardrails are still being stress-tested.”

Key Statistics (2026 Snapshot)

- $115 Billion: Projected size of the alternative financing market by 2035, driven largely by HyFi platforms.

- 38%: Percentage of Western financial institutions now supporting direct crypto-to-fiat services.

- $2 Trillion: Annual payment flows moving through blockchain-integrated banking channels.

- 80%: Cost reduction in cross-border remittances for institutions using stablecoin rails compared to legacy SWIFT transfers.

- 100 Million+: Users of hybrid neobanks in Latin America (led by players like Nubank and Bitso).

Future Outlook: What Happens Next?

As we look toward 2027 and 2030, the “convergence” will likely disappear—because it will just be “finance.”

- The “Invisible” Blockchain: Users will stop hearing about “wallets” and “keys.” Biometric authentication (Passkeys) combined with Account Abstraction will make using a blockchain application indistinguishable from using a standard banking app.

- Central Bank Digital Currencies (CBDCs) vs. Stablecoins: A major clash is looming. As private stablecoins (USDC, EURC) gain dominance in B2B settlement, Central Banks may push back with retail CBDCs, potentially forcing neobanks to choose sides in a “currency war.”

- Algorithmic Regulation: Regulation will move from “reactive” (audits) to “proactive” (code). We expect regulators to deploy their own smart contracts to monitor bank solvency in real-time, automatically halting withdrawals if liquidity ratios dip below safe levels.

Final Thoughts

The convergence of Web3 and neobanking in 2026 is not merely a technological upgrade; it is a fundamental restructuring of how value moves. For the consumer, it promises cheaper, faster, and more accessible financial tools. For the industry, it signals an extinction event for those who believe that “banking” still requires branches and mainframes. The future is hybrid, automated, and relentlessly efficient.