The United States has sharply increased tariffs on goods imported from India, doubling rates from 25 percent to 50 percent across a wide range of categories. This decision represents the most aggressive trade action taken by Washington against New Delhi in decades, putting India on par with some of the most heavily taxed U.S. trading partners.

The measure builds on earlier tariff hikes introduced just weeks ago and underscores a rapid deterioration in economic relations between the two countries. Levies of this scale now cover a large share of Indian exports to the United States, which last year totaled nearly $87 billion.

Targeting Russian Oil Purchases

The White House has framed this tariff escalation as punishment for India’s continued imports of discounted crude oil from Russia. Washington argues that by buying Russian oil, India is indirectly helping Moscow finance its ongoing war in Ukraine. Despite repeated warnings, India has maintained that its oil imports are a matter of national energy security and has resisted pressure to scale back purchases.

Observers note that the United States has not imposed equivalent penalties on other major Russian oil buyers. China, for example, remains the largest customer for Russian energy but faces tariffs capped at around 30 percent, compared to the new 50 percent ceiling applied to India. This uneven approach has fueled frustration in New Delhi, where officials argue that the penalties are politically motivated and risk undermining trust between two countries that have deepened defense and strategic cooperation in recent years.

Trade Deficit and Growing Economic Ties

The U.S. and India have seen trade expand significantly over the past decade, with bilateral goods trade more than doubling. The trade balance, however, remains heavily in India’s favor. Last year, U.S. imports from India reached $87 billion, while American exports to India stood at roughly $42 billion, according to Commerce Department data.

India’s main exports to the U.S. include pharmaceuticals, apparel, gems, jewelry, textiles, communications equipment, and machinery. Many of these goods are now subject to the new 50 percent tariffs, which will sharply reduce competitiveness in the American market. Pharmaceuticals and smartphones are notable exceptions, exempt from the highest levies.

Meanwhile, top U.S. exports to India consist of petroleum products, chemicals, machinery, and aerospace components. These sectors could be vulnerable to retaliation if India decides to impose counter-tariffs on American imports.

Economic Impact on Businesses and Consumers

For India, the tariffs pose an immediate threat to exporters in sectors such as textiles, leather, jewelry, and seafood. These industries employ millions of workers, and higher costs for American buyers could lead to a sharp drop in orders. Analysts warn that a prolonged tariff standoff could slow India’s GDP growth, reduce export earnings, and put pressure on the rupee, which already touched record lows against the dollar after the announcement.

In the U.S., businesses and consumers are bracing for higher prices. Importers have warned that tariffs will push up costs for key goods such as clothing, home furnishings, and industrial components, many of which have been increasingly sourced from India as an alternative to China. The timing is difficult for American households, who are already facing broader inflationary pressures. The labor market, once resilient, is also showing signs of strain, and higher input costs could add to those challenges.

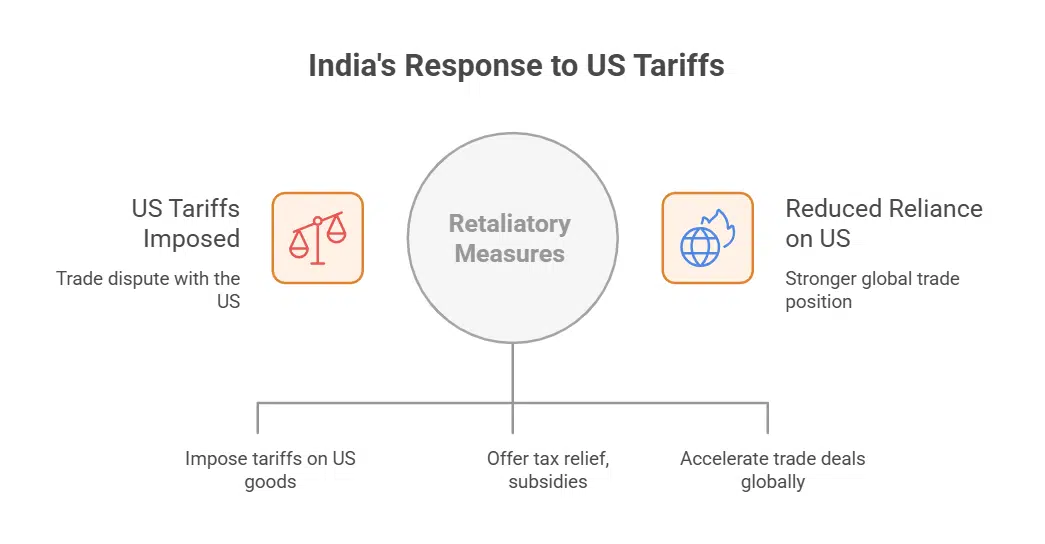

India’s Expected Response

New Delhi has already signaled that it will retaliate. Indian trade officials have discussed imposing counter-tariffs on American products such as liquefied natural gas, agricultural goods, and aircraft components. These measures could target politically sensitive sectors of the U.S. economy, amplifying the dispute.

At the same time, India is moving to shield its exporters by offering tax relief, subsidies, and incentives for diversification into new markets. Government agencies are working to accelerate trade deals with the European Union, Southeast Asia, Latin America, and Africa, reducing reliance on the U.S. market.

India’s policymakers view the U.S. decision as a breach of trust, particularly because the two countries have built a closer strategic partnership over the past 20 years through defense pacts, technology cooperation, and joint initiatives under the Quad alliance.

Diplomatic Fallout and Strategic Risks

The tariff escalation has broader implications beyond trade. The U.S. and India have worked closely on counterbalancing China’s influence in Asia, strengthening defense ties, and promoting democratic values in the Indo-Pacific. The imposition of punitive tariffs threatens to undermine this strategic cooperation.

Diplomatic analysts describe the current moment as one of the lowest points in U.S.–India relations in recent memory. While communication channels remain open, officials on both sides acknowledge that resolving the dispute will require high-level talks. A potential meeting between President Trump and Indian Prime Minister Narendra Modi at the United Nations later this year could provide an opportunity for de-escalation.

The Russia Factor

Ironically, the biggest beneficiary of this dispute may be Russia. By targeting India over Russian oil imports, Washington has effectively forced New Delhi to double down on its energy ties with Moscow. Russian crude remains cheaper than most alternatives, and India relies on these supplies to stabilize domestic fuel prices.

As a result, even though the U.S. tariffs hurt Indian exports, they are unlikely to immediately change India’s energy strategy. Instead, the measures could push India and Russia closer together, undermining Washington’s broader goal of isolating Moscow.

The decision to double tariffs on Indian imports represents not only a significant economic challenge but also a diplomatic setback for two countries that have invested heavily in strengthening ties. For India, the tariffs threaten vital export industries and employment. For the U.S., they risk higher prices for consumers and strained supply chains.

The geopolitical consequences are equally serious: while Washington aims to curb Russia’s war financing, the tariff dispute could instead push India closer to Moscow, weakening U.S. efforts in the Indo-Pacific. Unless resolved through high-level dialogue, the tariff escalation risks turning a trade dispute into a full-scale strategic rift between two of the world’s largest democracies.