Many new traders struggle to pick the right trading platform, and they worry about hidden trading fees or a clunky mobile trading app. One top broker from Denmark offers low trading fees, clear research, and fast order tools.

This guide will sort out the top ten platforms, show key trading features like stock trading, forex trading, copy trading, and app performance. Read on.

Key Takeaways

- Saxo Bank leads with a 5.0-star rating, covers stocks, ETFs, CFDs, and forex, scores 4.8 for research, and runs under BaFin oversight.

- Interactive Brokers serves 255,673 active users, earns 4.6/5, charges no account or inactivity fees, and offers API access and advanced charting tools.

- eToro drew 44,715 new traders, scored 4.5/5, cuts stock and ETF fees to near zero, adds a $5 withdrawal fee, and shines with social copy trading.

- DEGIRO (10,270 users, 4.1/5), Comdirect (1,207 users, 4.3/5), and Plus500 (2,861 users, 4.3/5) offer demo accounts, low spreads, and FCA/BaFin regulation.

- Trade Republic (€1 per order), Scalable Capital (€0.99 per trade), and flatex (zero maintenance fees) set new standards for low-cost, mobile-first trading.

Saxo Bank

Saxo Bank stands out as a top trading platform in Germany, with a total rating of 5.0 stars. It earns high marks for its broad product portfolio that spans stocks, ETFs, CFDs, and forex.

Every mobile and web interface receives a perfect 5 stars from users. Traders engage in stock trading, forex trading, ETFs and CFDs with ease, thanks to a sleek user-friendly interface.

The platform features a research score of 4.8 to help people track financial markets. BaFin, Germany’s federal financial supervisory authority, oversees Saxo Bank to keep every trade safe.

Interactive Brokers

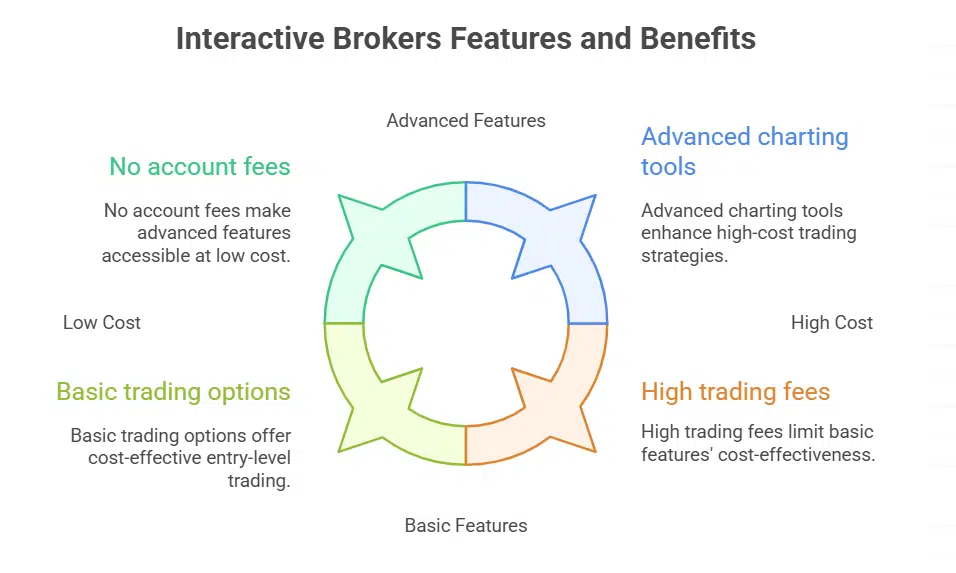

Interactive Brokers scored 4.6 out of 5 in a recent review. It charges no account fee or inactivity fee. Traders perform stock trading, forex trading, ETFs, and futures. Cheap trading fees help day traders and retail cfd accounts.

This CFD broker also serves equities and options specialists. The platform saw 255,673 active users in the last six months. Investors transfer funds via bank transfer or debit cards at no extra cost.

The platform offers demo accounts and advanced charting tools. A mobile trading app runs smoothly on iOS and Android. Traders get margin, risk management tools, and API access to automate trades.

Social trading fans link to copy trading networks. Research features include market scanners and live news feeds. Withdrawal fees stay low. Users praise portfolio management features and real-time data.

eToro

eToro, a trading platform, scored 4.5 out of 5 in our tests. It drew 44,715 new traders in the last six months. The platform cuts stock and ETF trading fees to almost zero. Users open a trading account in minutes.

They link a credit card or bank wire and pass ID checks fast. Social trading shines with copy trading tools.

The site adds a $5 withdrawal fee, but eToro Money clients avoid that cost. Inactivity fees run $10 monthly after one year. Mobile trading apps perform well on iOS and Android. The broker offers CFD accounts, ETF trading and stock trades.

Regulators like BaFin and the FCA watch your funds. The interface stays clear for new users.

DEGIRO

DEGIRO charges very low fees. It earned an aggregate score of 4.1 out of 5. Investors log in to trade stocks, ETFs, CFDs, and currency pairs. Regulators grant it a BaFin license in Germany.

Ten thousand two hundred seventy users joined in the past six months. While the mobile app ranks 4.5 stars, the web platform scores 4.0 stars.

Traders link a bank account or credit card in minutes. The app displays live prices and charts. One user called the interface a pocket trading desk. It handles portfolio management and risk tools.

Folks find screen layouts simple. Zero inactivity fees keep costs down.

Trade Republic

This mobile-first broker opened in 2019 with a certified banking license. It aims to be the best all-mobile trading platform. The app feels like carrying a trading floor in your pocket, with a user-friendly interface that even a newbie can love.

Trade Republic charges zero annual fee, and it tacks on one euro per order. Commission-free trades apply to over 2,600 ETF savings plans and more than 3,000 stock savings plans. Investors earn two percent credit interest on cash balances up to fifty thousand euros.

Lang & Schwarz handles all orders on a single trading venue. You can trade stocks, exchange-traded funds, derivatives, and major cryptocurrencies. Account maintenance fees and inactivity fees stay at zero.

BaFin regulates the service, so deposit protection kicks in right away. Casual traders praise its clean layout and mobile trading apps for quick stock moves. Advanced investors may seek extra tools for long-term strategies though.

One user joked, My crypto stash feels snug in a neat little toolbox.

Scalable Capital

Scalable Capital charges just €0.99 per order. It has zero annual account fee. The broker grants up to €2,500 for new users as a switching bonus. Its Prime trading account unlocks 600 more ETFs on top of 1,300 free funds.

Traders can buy stocks on Xetra or Gettex. The service runs under BaFin rules. Investors pick from free, €2.99, or €4.99 monthly plans. The mobile app works well, yet it speaks only German.

Active traders enjoy low fees, they pay €0.99 per trade and face no annual or inactivity costs. Traders buy stocks or use ETF trading tools on the same platform. A single securities account holds all open positions on a mobile trading app.

Clients link credit cards or debit cards for fast deposits. Three plans let investors match fees to their goals. EU rules and BaFin regulation protect every trade.

flatex

Ranked among Germany’s top five brokers, Flatex handles over a million investment pools, equities, exchange-traded funds, and notes. The account opening feels like a joyride, no paperwork piles, no securities account fees since 2023.

It nails clear trading fees, drops maintenance costs to zero, and keeps trade charges tiny. Seasoned traders smile at this shortcut to low costs, even on big stock trading.

Cryptocurrency trading sits outside Flatex’s playbook, and the service speaks only German. ETF savings plans cost €2.50 each month, matched to a 0.25 percent fee on every order.

Experts often note its tight fee model, user-friendly interface, and solid portfolio management tools. This broker shines for those chasing simple, secure trading platforms without hidden costs.

Comdirect

Comdirect ranks among top trading platforms in Germany. Users give it a 4.3 out of 5 score. 1,207 traders joined it in the last six months. It lists stocks, ETFs, forex pairs and CFDs on over 30 venues.

Clients open a BaFin regulated securities account fast. Trading fees show clearly on each ticket. Withdrawal fees cost zero on SEPA transfers. Inactivity fees stand at zero. A demo account lets newcomers test strategies.

Mobile trading apps shine with a 4.7 star rating on Google Play and App Store. The desktop version scores 4.4 stars in user reviews. Traders place orders in seconds. Funding works via credit or debit cards.

Push alerts pop up for price moves. Live quotes stream from the Frankfurt stock exchange. Two factor login locks each session. BaFin rules guide all processes, data stays encrypted.

Tax forms cover capital gains and solidarity surcharge. Phone and chat help comes in both German and English. Practice trades replay real market action in demo mode.

Plus500

Plus500 ranks among top trading platforms for German users. It shows a 4.3/5 overall score, with 2,861 users in six months. Its mobile trading app scores 5.0 stars; its web trader earns 4.5 stars.

Investors trade CFDs (contracts for difference) on stocks, forex, options, futures, and S&P 500 indexes. Licenses from FCA and BaFin back the platform, so regulation feels solid.

Retail CFD accounts come with no commissions, just spreads. Traders pay a $10 monthly inactivity fee after three months. New users submit ID and proof of address to open a securities account.

Demo accounts let day traders hone skills without risking real cash. The clean interface makes stock trading, intraday trading, and risk management tools feel like child’s play.

Swissquote

Swissquote wins praise for its reliable trading platform. It ranks 4.4 out of 5 among German investors. Over 14,943 users joined in the last six months. A CHF 10 inactivity fee kicks in after half a year, so don’t let your account gather dust.

Traders rate its mobile trading apps at 4.7 stars. The web platform earns 4.3 stars for stability. Stock traders get access to Swiss and global markets. Clients tap into forex trading, retail CFD accounts, and crypto trading.

Fees stay low on stock trading, ETF trading, and withdrawal fees.

Comparison of Trading Fees Across Platforms

Here is a quick look at trading fees across top German trading sites.

| Trading Site | Commission | Spread | Inactivity Fee | Withdrawal Fee |

|---|---|---|---|---|

| Saxo Bank | Check fee grid | Check fee grid | Check site | Check site |

| Interactive Brokers | Check fee grid | Check fee grid | Check site | Check site |

| eToro | No commission | From 1 pip | $10 / mo after 12 mo | $5 per withdrawal |

| DEGIRO | Check fee grid | Check fee grid | Check site | Check site |

| Trade Republic | Check fee grid | Check fee grid | Check site | Check site |

| Scalable Capital | Check fee grid | Check fee grid | Check site | Check site |

| flatex | Check fee grid | Check fee grid | Check site | Check site |

| Comdirect | Check fee grid | Check fee grid | Check site | Check site |

| Plus500 | No commission | Fixed spread | $10 / mo after 3 mo | Free |

| Swissquote | Check fee grid | Check fee grid | CHF 10 after 6 mo | Check site |

Key Features of Popular Platforms

You get a quick look at key features here.

| Feature | Saxo Bank | Interactive Brokers | eToro | DEGIRO |

|---|---|---|---|---|

| Research & Analysis | Daily reports, deep market data from Saxo Bank. | Advanced screeners and research tools at Interactive Brokers. | Basic news feed, market updates on eToro. | Limited research, simple insights via DEGIRO. |

| Fees | Mid-range fees for stocks, ETFs at Saxo Bank. | Very low charges across global markets at Interactive Brokers. | Low stock and ETF fees on eToro. | Ultra low trading fees through DEGIRO. |

| Trading Tools | Powerful charting tools, watchlists at Saxo Bank. | API access, advanced order types at Interactive Brokers. | Copy trading feature, social feed on eToro. | Simple order types, basic chart views at DEGIRO. |

| Social & Copy Trading | Community insights in Saxo’s portal. | Trader forum, peer chats at Interactive Brokers. | Full social network, live copy trades on eToro. | No social features in DEGIRO platform. |

| Usability | Complex interface, rich functions at Saxo Bank. | Steep learning curve for newcomers at Interactive Brokers. | Intuitive, friendly design on eToro. | Clean layout, very user-friendly at DEGIRO. |

| Product Range | Bonds, CFDs, forex and more via Saxo Bank. | Access to global equities, options at Interactive Brokers. | Stocks, ETFs, crypto assets on eToro. | Major stocks and ETF coverage via DEGIRO. |

| Support & Education | Live seminars, webinars from Saxo Bank. | Wide webinar library, tutorials at Interactive Brokers. | Video tutorials, help center on eToro. | Basic guides, FAQ section at DEGIRO. |

| Risk Controls | Built-in risk management tools at Saxo Bank. | Margin alerts, risk reports at Interactive Brokers. | Social risk scores, portfolio limits on eToro. | Basic filters, stop orders at DEGIRO. |

User Experience and Interface Insights

Saxo Bank ranks high in mobile trading apps with 5.0 stars on both mobile and web dashboards. Interactive Brokers sports a user-friendly interface that suits stock trading, forex trading, and etf trading.

eToro wins praise for easy account opening and social trading tools like stock list and price charts. Comdirect offers a solid mobile platform and a 4.4 star web portal, with portfolio management and live quotes.

A clean dashboard helps traders place orders fast, check balance, and view trend lines. Clear screens cut clutter and avoid hidden inactivity fees, withdrawal fees, or account maintenance fees.

All platforms meet BAFIN and FCA standards, backing financial security for every securities account.

Mobile App Availability and Performance

Many online brokers now offer apps for trading stocks, ETFs, forex and CFDs. App stability, ease of use, speed and features can make a big difference.

- Saxo Bank delivers a top mobile trading app, rated 5.0 stars on Google Play. It sports a user-friendly interface with real time quotes from global exchanges.

- Plus500 rolls out a fast app, also at 5.0 stars. It supports stock markets, CFDs and demo accounts.

- Swissquote packs a solid app, scoring 4.7 stars. It offers forex trading, risk management tools and order alerts.

- Trading 212 powers a slick app with a 4.9 star rating. It has spread free stock trading and simple ETF trading.

- eToro’s is an engaging social trading app. It lets you copy trading, view a peer portfolio, and trade crypto.

- Interactive Brokers unveils a pro mobile interface. It supports futures contracts, margin trading and low withdrawal fees.

- Trade Republic serves a German audience with a neat app. It charges low fees, it uses credit and debit cards and shows tax tools.

- DEGIRO’s smartphone app gives a minimalist look. It cuts account maintenance fees and follows BaFin rules.

Security and Regulation of Platforms

German trading platforms run under BaFin. They hold licenses from the Federal Financial Supervisory Authority. Strict checks cover capital reserves, risk controls and customer funds.

Regulators cap inactivity fees and withdrawal fees to protect savers. Saxo Bank and IG warn that 67% of retail CFD accounts lose money. Plus500 shows 82% of retail CFD clients face losses.

Rules also simplify securities trading and capital gains tax reporting.

Platforms ask new clients for proof of address and identity verification. They force strong passwords and two-factor authentication. Encryption covers mobile trading apps and web portals.

Trade Republic, Scalable Capital and flatex let users test demo accounts. This step guards user-friendly interfaces and blocks cyber threats with firewalls.

Availability of Educational Resources

Platforms offer varied educational resources. They range from on-demand video guides to trial accounts.

- Saxo Bank hosts a market research portal, on-demand webinars, and risk management tools.

- Interactive Brokers provides free webinars, paper trading accounts, and portfolio management guides.

- eToro hosts a social trading academy, video guides, copy-trading tutorials, and portfolio tips.

- DEGIRO issues step-by-step articles, etf trading tutorials, and blog posts on securities account setup.

- Trade Republic adds quick start manuals, in-app hints, and identity verification walkthroughs.

- Scalable Capital runs live seminars, portfolio management sessions, and crypto trading primers.

- flatex offers knowledge base articles, risk management modules, and platform walkthrough videos.

- Comdirect includes a demo account, beginner courses for stock trading, and BaFin regulation guides.

- Plus500 supports a practice mode, responsive customer support, and cfd trading primers.

- Swissquote scores 4.8 stars for its research center, video tutorials, and advanced trading strategy guides.

- IG delivers interactive courses, webcast sessions, and trading simulator tools.

Platforms Offering Cryptocurrency Trading

German investors can buy and trade crypto with online brokers in Germany. Each option mixes trading fees, tools, and safety under BaFin rules.

- Saxo Bank scores 5.0 on its crypto product portfolio and research. It covers Bitcoin and Ether, has no inactivity fees, and boasts a friendly interface.

- Interactive Brokers uses low trading fees for crypto, forex trading, and stocks. It offers demo accounts for global markets and mobile trading apps.

- eToro uses CopyTrader, a social trading tool that lets you mirror top traders. It lists more than 20 tokens, from Bitcoin to Cardano, and offers risk management tools.

- Trade Republic lets newbies trade crypto and stocks commission-free. It runs on a mobile app and follows BaFin rules.

- Plus500 offers retail CFD accounts on crypto and stocks. Its user-friendly interface accepts credit and debit cards, with low withdrawal fees.

- Swissquote links to the Frankfurt Stock Exchange for spot crypto and CFD trading. It asks for proof of address, handles identity verification, and gives tax statements for the 25% capital gains rate.

- Scalable Capital adds digital assets, with ETF trading and portfolio management. It waives account maintenance fees on crypto.

Platforms Suitable for Beginners

New traders need easy tools to start stock trading. Good platforms cut costs and offer trial accounts, plus a smooth user experience.

- eToro lets traders open accounts fast, with a social trading feed and copy trading features on its mobile trading app. Traders can test ideas with trial accounts and mirror top investors.

- Trading 212 offers a zero deposit path, no inactivity fees, and a clean design for stock trading and forex. Users face a smooth mobile trading app and clear trading fees.

- IG delivers an easy-to-use web platform that covers CFDs, forex, stocks, and ETFs. Newbies gain trial accounts, risk management tools, and live charting.

- Trade Republic runs on a mobile trading app, with low trading fees and no account maintenance fees. It holds a BaFin license and a clear securities account setup.

- Plus500 provides a user-friendly interface and retail CFD accounts. Beginners get trial accounts, fast credit or debit card deposits, and transparent trading costs.

- Saxo Bank powers a strong trading platform for multiple markets and financial instruments. Investors see a robust mobile app, advanced tools, and tight security under FCA and BaFin rules.

Advanced Tools for Experienced Traders

Trading pros need swift, reliable tools to beat tight markets. They pick advanced features from trading platforms like Saxo Bank, Interactive Brokers, Swissquote, and DEGIRO.

- API Hooks for Code Trades

Pros tap Interactive Brokers API to run auto orders in real time. This link cuts manual steps and lowers trading fees on stock trading, forex trading, CFDs, and ETFs. - Algorithm Builder Interface

Saxo Bank lets you drag and drop rules to craft signals. You backtest on equities, forex, and options contracts. - Advanced Charting Module

Swissquote supports dozens of indicators, heat maps, and market depth views. You spot patterns on the Frankfurt Stock Exchange and NASDAQ. - Risk Management Toolkit

DEGIRO shows VaR, margin calls, and liquidation levels. It meets BaFin and FCA rules for regulatory compliance. - Smart Order Routing System

Platforms scan venues across EU and US stock exchanges. You seize best bid offers, cut slippage, and lower trading costs. - Direct Market Access Portal

Interactive Brokers opens DMA to global stocks, options, and retail CFD accounts. You skip middlemen for faster fills. - Backtesting Laboratory

Traders use demo accounts to test ideas on historical data. Saxo Bank and Interactive Brokers share detailed metrics and charts. - Screener Engine Suite

Swissquote filters by price, volume, risk score, or corporate event. It lets you hunt stocks, ETFs, mutual funds, and CFDs in seconds. - Option Chain Analyzer

This tool breaks down Greeks, volatility skew, and implied moves. You size trades precisely for day-trader goals. - Integrated Newsfeed and Research Hub

Saxo Bank feeds expert analysis, charts, and Reuters stories. You stay on top of central bank decisions and tax laws.

Customer Support and Responsiveness

Good help feels like a pit crew in a stock race. Plus500 fields quick answers on live chat and email. Saxo sends timely updates on account queries with a smile. IG offers chat bots and human agents who guide new traders through demo accounts.

Investors on Trading 212 find clear guidance on order types in the mobile trading app.

Platforms that answer fast cut stress when you face trading fees, withdrawal fees or bafin questions. Quick service eases worries over regulatory compliance or proof of address needs.

Fast chat and call lines feel like hotlines in a high stakes trade. A friendly voice can steer you past inactivity fees or help you fund your securities account on the frankfurt stock exchange.

Online brokers in germany earn praise when they solve problems in minutes, not hours.

Tax Considerations for German Traders

German traders pay 25% capital gains tax, plus a 5.5% solidarity surcharge on profits. They claim a tax-free allowance of €1,000 if single, or €2,000 when married. Most online brokers in Germany handle tax deductions automatically, and Bafin-regulated platforms link your securities account to tax reporting.

Traders using foreign brokers file returns by themselves. They send proof of address, identity verification, and trade records to the Finanzamt. Missing deadlines can trigger fines or extra trading fees.

How to Open a Trading Account

Opening a trading account takes just days. You get live access in one or up to three days.

- Pick a broker such as Trade Republic or Scalable Capital that fits your investment goals and has low trading fees, minimal account maintenance fees, and no inactivity fees.

- Gather proof of address, like a utility bill or bank statement, to meet regulatory compliance and Bafin rules for a securities account.

- Upload a government ID photo for identity verification so the platform can finish checks fast, often in one day.

- Await confirmation from the financial conduct authority or Bafin before your account moves to active status.

- Add funds via bank transfer, credit or debit cards, or e-wallets to meet any minimum deposit requirement.

- Set a deposit level that matches your portfolio management plan, whether you target etf trading, cfd deals, or crypto trading.

- Compare trading costs across platforms, check withdrawal fees, review demo accounts, and probe social trading tools before you fund.

- Activate two-factor authentication on your mobile trading app to boost financial security and block unauthorized logins.

- Test risk management tools and explore educational resources, like webinars and tutorials, to build confidence in stock, etf, or forex trading.

- Launch live trading on the Frankfurt Stock Exchange or global markets, monitor orders, and tweak your strategy as you learn.

Tips for Choosing the Right Platform

Pick a platform that fits your trading goals. Use fees, tools, and ease to guide your decision.

- Compare trading fees, withdrawal fees, inactivity fees, and account maintenance fees across brokers like the full service broker and the online bank broker. Lower costs boost your return.

- Test platform usability on desktop, web, and mobile trading apps. Seek a user-friendly interface with high platform scores for fast stock trading or forex trades.

- Check research tools that supply real-time news, advanced charting, and fundamental data. Good insights help your ETF trading and CFD plans.

- Use demo accounts to practice stock trading or forex trading without risk. Demo accounts build skill before you fund a securities account.

- Consider social trading features like copy trading and portfolio management. These tools can spark ideas for your strategy.

- Explore product range from exchange traded funds, contracts for difference, to cryptocurrency trading. A wide set of financial instruments helps meet varied investment goals.

- Ensure regulatory compliance under BaFin or the FCA. A broker with strong financial security meets German law and global standards.

- Factor in minimum deposit rules and proof of address steps for identity verification. Smooth account setup speeds you into the market.

- Seek educational resources and risk management tools. Good training lowers your finance trading risks.

- Assess customer support and responsiveness. Live chat or phone help cuts downtime when markets move fast.

- Match trading products to your needs. If you favor ETF trading or stock trading on the Frankfurt Stock Exchange, pick a broker with those options.

- Verify market access to the Frankfurt Stock Exchange and global financial markets. Broad access can open new investment paths.

Advantages of Using Online Trading Platforms

Online trading platforms cut costs. Interactive Brokers and DEGIRO offer low trading fees and no account maintenance fees. eToro lets you start stock trading fast with a simple identity verification process and no minimum deposit.

Saxo and Swissquote serve huge portfolios in forex trading, ETFs, crypto trading, and bonds. Real-time charting tools and demo accounts boost learning.

User-friendly interfaces and mobile trading apps help you trade on the go. Bafin oversight and FCA regulation protect your funds. You can place exit orders, set target price, or use margin.

Educational resources guide new traders and seasoned pros. Platforms show inactivity fees and withdrawal fees upfront to clear all costs.

Common Challenges When Using Trading Platforms

Many traders face high-risk warnings, 67% to 82% of retail investors lose money on contracts-for-difference. Newcomers trip over learning curves for advanced charting tools, margin trading or portfolio management.

Inactivity fees bite accounts at Plus500.com and eToro. Complex fee sheets on Interactive Brokers and Trade Republic hurt transparency. Tax forms pile up with foreign brokers, and proof of address can slow securities account set-up.

Mobile trading apps on Android and iOS sometimes freeze at market open, costing quick stock trades. A clean, user-friendly interface can still hide withdrawal fees or account maintenance fees.

Social trading on eToro tempts newbies to copy big names, but that can backfire fast. Demo accounts help, yet they fail to mimic real emotion under risk. Contracts-for-difference accounts test patience too.

The Future of Trading Platforms in Germany

Online brokers in Germany update mobile trading apps fast, they roll out new tools each month. It feels like holding the Frankfurt Stock Exchange in one hand. Regulators like Bafin impose tougher rules to boost security and regulation.

Traders enjoy low trading fees and zero inactivity fees on certain accounts. They click through sleek screens with a user-friendly interface and smart charting.

Investors spot AI alerts, portfolio management options, and demo accounts in new updates. They trade forex, CFDs, crypto, and ETFs on one platform without high withdrawal fees. They use research tools, video courses, and educational resources.

Trends show safer, smarter, cheaper trading platforms in Germany.

Takeaways

German investors got a tour of ten top trading platforms. Features vary from low fees to practice accounts and mirror trading. Every app connects you to BaFin oversight or German stock market listings.

Traders grab tools like investment tracking and risk alerts. Choose a platform that fits your goals and budget. Open an account, verify your identity, and start trading today.

FAQs on Trading Platforms for German Investors

1. What are some top trading platforms for stock trading in Germany?

You can dip your toes into the German stock market with online brokers in Germany. Try RepublicTrade, InteractiveTrade, ScalableCap or PlatformPlus. They let you trade stocks on the Frankfurt Stock Exchange, ETFs, CFDs, forex trading or crypto trading. Each offers a user-friendly interface, mobile trading apps and demo accounts to learn the ropes.

2. How do fees like trading fees, inactivity fees and withdrawal fees work?

Each broker sets its own trading fees, account maintenance fees, inactivity fees and withdrawal fees. Some charge a flat fee per trade, others charge by the month. Compare trading costs to keep more of your profits.

3. What do I need for identity verification and proof of address?

You upload a scan or photo of your ID, like a passport, plus proof of address. This step meets Bafin and FCA rules for regulatory compliance. It locks in financial security and unlocks your securities account.

4. Can I practice trading before risking real money?

Yes, most platforms offer demo accounts with virtual cash. You can use educational resources, test social trading or try copy trading. You get hands-on practice with risk management tools and portfolio management features.

5. Can I trade other financial instruments like forex, CFDs or crypto?

Absolutely. Many platforms offer retail CFD accounts, forex trading, cryptocurrency trading and ETF trading. You can tap into global financial markets, track price swings and build a diverse portfolio.

6. How do I pick the best online broker in Germany for my investment goals?

First, define clear investment goals. Then check minimum deposit, trading fees, and product range of financial products. Look for a user-friendly interface, mobile trading apps and solid portfolio management tools. Pick a provider that grows with you.