Toyota’s Solid-State Battery 2027 claim matters because it targets the last EV objections: charging time, safety, and range. If Toyota scales it, the battery race shifts from incremental gains to a new industrial baseline, just as EV demand cools and governments subsidize batteries.

Toyota Solid-State Battery 2027 has become a kind of shorthand for a bigger question: is the next jump in EV adoption going to come from cheaper lithium-ion, more charging stations, or a genuine chemistry leap that makes EVs feel effortless?

Toyota’s messaging, and the way the story is being repeated across the global media cycle, sits at the intersection of three pressures that define the 2026 auto market.

First, consumers are more skeptical than the early-adopter era. Many like EVs, but still hesitate due to charging time, winter range losses, and resale uncertainty. Second, automakers are squeezed by price wars in some regions, high interest rates, and the expensive transition from combustion platforms to software-heavy electric architectures. Third, governments increasingly treat batteries as industrial policy, not just a consumer technology, because batteries determine jobs, supply security, and geopolitical leverage.

That is why the “1,200 km range” storyline resonates. It is not only a number. It is a promise that EVs can stop asking drivers to change habits. Whether Toyota can deliver that promise in 2027, or whether it arrives later and in smaller volumes, the attempt itself is reshaping how competitors plan, how suppliers invest, and how policymakers set targets.

How We Got Here: Toyota’s Long Game And The Solid-State Hype Cycle?

Toyota’s path to solid-state is not just a research narrative. It is a strategic posture shaped by Toyota’s unusual position in the EV era.

Toyota spent two decades proving that electrification could be mainstream without a charging network. Hybrids made Toyota the “quiet winner” of emissions tightening, especially in markets where EV infrastructure lagged. That success created both strength and risk. Strength, because Toyota could keep selling high-volume electrified vehicles while others burned cash racing into BEVs. Risk, because the market’s center of gravity is still moving toward full electrification, and the longer Toyota waits, the harder it becomes to define the next era.

Solid-state batteries offered a bridge between Toyota’s conservatism and the market’s hunger for breakthroughs. They are regularly described as a step change because, in principle, they can deliver:

- Higher energy density, which can translate into longer range or smaller packs.

- Faster charging potential, if the chemistry and interfaces allow high power without rapid damage.

- Improved safety, because removing flammable liquid electrolytes can reduce certain thermal runaway pathways.

But the reason solid-state has become a “hype cycle” is also simple. It has been “almost ready” for a long time. Academic prototypes, lab-scale demonstrations, and venture-backed announcements repeatedly ran into the same obstacles when scaling toward automotive-grade reliability.

Toyota learned from that history. It publicly positioned solid-state as part of a roadmap, not a miracle product. The company’s stated targets for commercial introduction clustered around 2027 to 2028, which was far enough out to be plausible for manufacturing readiness, but close enough to feel like a competitive deadline.

At the same time, Toyota’s approach has been shaped by Japan’s broader industrial ambitions. Japanese policymakers watched China build scale dominance across cathodes, anodes, cells, and refining. They watched South Korea become a packaging and high-nickel powerhouse. They saw Japan’s own battery champions under pressure. In response, Japan leaned harder into “next-generation” bets, including solid-state, with policy tools that are closer to national strategy than traditional subsidies.

That context matters because it suggests Toyota’s solid-state is not only about Toyota vehicles. It is also an attempt to anchor a domestic supply ecosystem around a chemistry where Japan can compete on intellectual property, materials specialization, and manufacturing discipline.

Here is a practical way to read Toyota’s solid-state timeline, not as a single reveal, but as a chain of commitments that must align at the same time.

| Year | What The Public Narrative Shifted Toward | What It Implied Strategically |

| 2010s | Patent leadership and long-term research focus | Toyota was building options, not products |

| Early 2020s | “Practical application” talk and pilot lines | Toyota began planning beyond the lab |

| 2023–2024 | Roadmaps and government-aligned plans | Solid-state moved into industrial-policy territory |

| 2025–2026 | Supplier investments for solid electrolytes and cathodes | Toyota started locking the upstream bottlenecks |

| 2027–2028 | Target window for early commercialization | The credibility moment becomes real-world performance and yields |

The key takeaway is that Toyota’s “2027” is better understood as a launch window for early commercialization, not a guarantee that every bold spec will appear immediately in high volumes. That still matters. In the battery world, the first credible industrial deployment often shapes the next decade, even if early units are limited.

What Toyota Solid-State Battery 2027 Could Change: Range, Charging, And Consumer Psychology?

The battery conversation often collapses into range, because range is easy to visualize. But if Toyota truly delivers a solid-state pack that charges in roughly ten minutes and supports long-distance driving without punishing degradation, the biggest impact may be psychological.

The average driver does not want to become a charging strategist. They want to stop thinking about it.

Why “1,200 km” Became The Headline?

A 1,200 km claim is powerful because it implies two things at once.

- You can drive farther than most people ever need on a single charge.

- You can “overspec” away real-world losses, like cold weather, high speeds, towing, and battery aging.

Even if real-world range is substantially lower than a lab headline, the perception of abundance changes purchasing decisions. It turns range from a constraint into a comfort feature, like having a large fuel tank.

But range claims are also slippery. They depend on:

- Test cycle assumptions that can be more optimistic than highway reality.

- Vehicle efficiency, which varies massively by size, tires, aerodynamics, and drivetrain tuning.

- Usable battery window, because manufacturers protect packs by not allowing full charge and full discharge.

- Temperature management strategies, which may limit performance to preserve longevity.

So the most analytical interpretation is not “Toyota will sell 1,200 km cars in 2027.” The more useful question is: what threshold would change mass-market behavior?

For many buyers, the threshold is not 1,200 km. It is the combination of “fast enough charging” plus “enough range that you stop worrying.” In practical terms, a vehicle that can add a large share of its usable range in a short stop, consistently, for years, does more to remove friction than a single extreme range number.

Charging Speed Is The Hidden Center Of The Story

Toyota’s solid-state narrative often emphasizes fast charging because that directly targets the pain point that still blocks mainstream adoption in apartment-heavy cities and in highway travel.

If charging time falls meaningfully, three second-order effects follow.

- Charging infrastructure gets more productive

A charger that serves more cars per hour reduces congestion and improves economics for station operators.

- Automakers can downsize packs without hurting usability

If you can add miles quickly, you can carry less battery weight. Less battery weight can improve efficiency, which further reduces needed pack size.

- Resale value and fleet economics improve

The fear that “fast charging kills batteries” is one reason used EV buyers hesitate. A chemistry designed for high power, if proven durable, can stabilize residual values.

To see how this could reshape product strategy, compare the current mainstream EV trade-offs with what solid-state is aiming to offer.

| What Buyers Experience Today | What A Credible Solid-State Leap Would Signal | Why It Matters For Adoption |

| Great daily driving, but planning needed for road trips | Road trips feel closer to gasoline norms | EVs become less of a “lifestyle choice” |

| Range varies strongly by weather and speed | Bigger buffer against real-world losses | Less anxiety, fewer returns, better reviews |

| Charging networks uneven across regions | Faster sessions reduce waiting pain | Infrastructure feels “good enough” sooner |

| Battery degradation worries affect resale | Longer-life reputation reduces resale discount | Faster mass-market uptake |

The Competitive Implication: The Baseline Moves

If Toyota proves that fast charging and long range can co-exist without rapid degradation, the competitive baseline shifts away from “who has the most range” toward “who has the most usable time.”

That is a subtle but profound change. In consumer tech, usability wins. Smartphones did not win on raw battery size alone. They won by making charging effortless, battery life predictable, and performance consistent. EVs are in the same phase. Toyota’s bet is that the winning product is the one that makes the battery invisible.

The Hard Part: Why Solid-State Is A Manufacturing Problem Disguised As Chemistry?

Solid-state batteries are often explained as “swap the liquid electrolyte for a solid one.” That is technically true and practically misleading.

Liquids naturally wet surfaces. They flow into microscopic gaps. They maintain contact even as materials expand and contract during charging. Solids do none of that by default. In solid-state, the interfaces are everything, and interfaces are where batteries fail.

The Core Engineering Obstacles

A commercially viable automotive battery must do three things at once: store energy, deliver power, and survive thousands of cycles in harsh conditions. Solid-state struggles because:

- Interface stability is difficult

The boundary between the electrolyte and electrodes can develop resistive layers that reduce performance over time.

- Physical contact is fragile

Charging and discharging causes swelling, stress, and microcracks. Even tiny gaps can raise resistance and create hotspots.

- Dendrite control is not optional

Metallic lithium systems can form needle-like structures that pierce the electrolyte and short the cell. Preventing that across millions of cells is a scale challenge.

- Manufacturing tolerances become tighter

Small defects can cause catastrophic failures. That pushes up quality costs, inspection complexity, and scrap rates.

This is why the “breakthrough” is not only materials science. It is the ability to manufacture consistent interfaces at scale.

Why Toyota’s Supplier Moves Matter More Than Prototype Claims?

The most important signal in the Toyota solid-state story is not a prototype headline. It is the industrial ecosystem Toyota is building around it.

Solid electrolytes, especially sulfide-based candidates, require specialized production, strict moisture control, and careful handling. Scaling that supply is not like ordering more lithium carbonate. It resembles building a new chemical-processing backbone.

If Toyota’s supply partners can deliver solid electrolyte in meaningful volumes by the late 2020s, it suggests Toyota believes it can overcome yield challenges well enough to justify upstream investment. That is the difference between a lab story and a manufacturing story.

What “Success” Would Look Like Technically?

To interpret Toyota Solid-State Battery 2027 realistically, it helps to define what counts as success in the first commercial wave.

Success is not necessarily the highest energy density on paper. Success is:

- Stable fast charging without severe degradation penalties.

- Strong performance across temperature ranges.

- Predictable longevity, supported by warranty confidence.

- Manufacturable yields high enough to avoid luxury-only economics.

Here is a practical map of how solid-state problems translate into commercial constraints.

| Engineering Challenge | What It Can Break In The Real World | What A Commercial Solution Typically Requires |

| Interface resistance growth | Slower charging, lower range over time | Coatings, material tuning, pressure management |

| Microcracks and contact loss | Sudden performance drops, safety risks | Mechanical design that maintains contact |

| Dendrite formation | Short circuits and recalls | Robust electrolyte, current control, defect screening |

| Moisture sensitivity (for some electrolytes) | Higher costs and factory complexity | Dry-room scaling, robust packaging |

| Yield variability | High cost per pack | Process discipline, quality automation |

Toyota’s advantage, if any, will come from operational excellence. The Toyota Production System is famous for removing variability. Solid-state is a variability nightmare. If any automaker culture is built to attack that, it is Toyota’s.

The Stakes Beyond Toyota: Economics, Supply Chains, And Battery Geopolitics

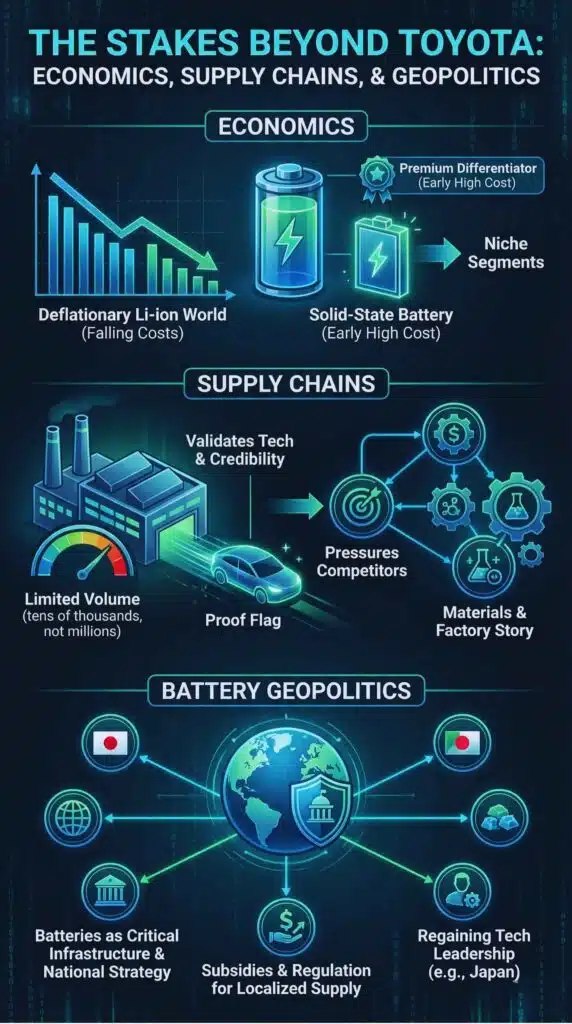

Even if Toyota’s first solid-state rollout is limited, the ripple effects can be large. Batteries set the rules for the auto industry’s profit pools and national industrial power.

The Cost Reality: Solid-State Enters A Deflationary Lithium-Ion World

In 2026, lithium-ion is not standing still. LFP chemistry keeps expanding, pack engineering is improving, and global manufacturing capacity has grown faster than demand in some segments. That pushes prices down and forces automakers to fight on affordability.

That environment makes solid-state’s value proposition sharper and harder at the same time.

- Sharper, because a clear performance leap can justify premium pricing.

- Harder, because incremental lithium-ion improvements may satisfy “good enough” for most buyers, limiting solid-state to niche segments unless costs fall.

Toyota’s likely commercial play, at least early, is to treat solid-state as a premium differentiator, then scale down cost over time if manufacturing yields improve.

The Supply Chain Constraint: Early Volume Will Probably Be Limited

Supplier investment announcements, especially around solid electrolytes and cathodes, imply that early volumes are likely measured in tens of thousands of vehicles, not millions. That is normal for a first-generation technology.

The strategic implication is that Toyota’s first solid-state vehicles may act like “proof flags.” They will:

- Validate the technology and build brand credibility.

- Create learning curves for manufacturing.

- Pressure competitors to accelerate their own timelines.

- Attract policy support and supplier investment.

Even a limited rollout can reset investment decisions across the supply chain.

Industrial Policy: Batteries As National Strategy

Governments increasingly treat batteries as critical infrastructure. That is visible in:

- Subsidy programs for domestic cell production and materials refining.

- Regulatory pressure to localize supply chains.

- Competition to secure raw materials like lithium, nickel, and graphite.

- Strategic concern about dependence on a small number of countries for key steps in the value chain.

Japan’s support for next-generation batteries reflects a desire to regain technological leadership and reduce strategic vulnerability. Toyota’s solid-state push aligns with that national objective.

Winners, Losers, And The “Second Order” Shifts

The most revealing way to understand Toyota Solid-State Battery 2027 is to ask who benefits even before the first car ships.

| Who Could Benefit First | Why They Gain Early | Who Feels Pressure |

| Japanese specialty materials firms | New demand for solid electrolytes and advanced cathodes | Commodity suppliers tied only to incumbent chemistries |

| Toyota’s premium brands | A credible leap supports pricing power | Mid-tier automakers competing mainly on price |

| Charging operators (in the long run) | Faster sessions improve charger utilization | Regions that delay infrastructure investment |

| Battery equipment makers | New tooling and inspection needs | Legacy tooling optimized only for liquid-electrolyte lines |

| Regulators and insurers | Potential safety improvements reduce risk | Manufacturers with recent battery fire headlines |

Now add a second layer. If solid-state enables smaller packs for the same usability, demand for some raw materials could shift. If it reduces reliance on certain liquid electrolyte components, chemical supply chains adjust. If it increases reliance on lithium metal or specialized sulfides, new bottlenecks appear.

In other words, the technology is not only an auto story. It is a materials story, a factory story, and a geopolitics story.

Key Statistics That Anchor The Discussion

- Toyota’s stated commercial window for solid-state is commonly framed around 2027–2028.

- Early solid electrolyte supply investments discussed publicly imply initial production on the order of tens of thousands of EVs, not mass-market millions.

- Industry battery pack pricing has been trending downward, making “cost versus performance” the central battle line for any next-gen chemistry.

- EV adoption in many markets is increasingly shaped by affordability, charging convenience, and policy stability, not only by technology headlines.

These points lead to a sober conclusion: Toyota’s solid-state will not “replace lithium-ion” overnight. It will compete with lithium-ion the same way hybrids once competed with gasoline, by making a specific pain point disappear for a certain buyer segment first, then scaling.

What Comes Next: The Milestones That Will Prove The Story And Three Plausible Futures

Toyota Solid-State Battery 2027 is now a countdown narrative. But the next stage is not marketing. It is evidence.

Here are the milestones that matter more than a single prototype range claim.

The Five Proof Points To Watch

- Pilot-line yields and defect rates

If manufacturing yields are low, costs stay high and volumes stay limited. Expect indirect signals like supplier expansion speed, factory tooling announcements, and hiring intensity.

- Charging durability claims backed by warranty posture

The market should watch what Toyota is willing to warranty under fast-charge-heavy usage. Warranty confidence is often the most honest signal of real-world durability.

- Thermal and cold-weather performance

High energy density is less meaningful if winter performance is unstable. A mass-market chemistry must be robust across climates.

- Vehicle segment choice

If Toyota launches in a premium model first, that signals early costs are still high, which is normal. If it launches in a mainstream model quickly, that would be a stronger disruption signal.

- Supplier scale alignment

Electrolyte and cathode supply must grow with vehicle plans. If upstream plants hit delays, vehicle rollouts will be constrained no matter how good the cells are.

Three Plausible Futures, With Clear Labels

Scenario 1: Premium Halo First, Then Gradual Scale (Most Likely)

Toyota launches solid-state in a high-end vehicle line where it can price in early costs. Volumes are limited for the first years. The technology becomes a brand differentiator more than an industry replacement. Over time, yields improve, costs fall, and solid-state expands into broader segments late in the 2020s or early 2030s.

Why this scenario fits the evidence: it matches typical new-chemistry rollouts and aligns with early upstream capacity constraints.

Scenario 2: Fast-Charge Breakthrough Forces A Competitive Reset (High Impact, Harder)

Toyota proves a repeatable, near-gasoline charging experience without severe degradation. Competitors respond aggressively, not by waiting for solid-state, but by pushing lithium-ion to its limits and accelerating alternative approaches. Charging operators and governments treat high-power charging as essential infrastructure. EV adoption re-accelerates because the “time cost” barrier falls.

What would make this scenario real: Toyota demonstrates not just performance, but consistency, including in cold conditions, and backs it with strong warranties.

Scenario 3: Technical Or Economic Friction Delays Broad Adoption (Still Meaningful)

Toyota introduces solid-state later than the headline suggests, or introduces it but keeps it niche because costs remain high. Lithium-ion continues improving and becomes “good enough” for most buyers. Solid-state becomes a premium technology used selectively, similar to how some advanced materials appear first in aerospace and luxury segments.

What would confirm this scenario: muted supplier expansions, cautious warranty language, or rapid improvements in lithium-ion fast charging that narrow solid-state’s advantage.

The Bigger Meaning: The Battery Race Moves From Cells To Systems

Regardless of which scenario plays out, Toyota’s solid-state push highlights a broader industry transition. The winner is increasingly determined by system-level integration, not only cell chemistry.

That includes:

- How efficiently the vehicle uses energy.

- How predictably the battery performs across temperatures.

- How seamlessly charging fits into daily life.

- How the supply chain scales without shocks.

- How the automaker manages software, thermal control, and warranty risk.

Toyota’s story matters because it forces the market to think about batteries the way aviation thinks about engines. Not as a part you buy, but as a platform you industrialize.

Toyota Solid-State Battery 2027 is best interpreted as a stress test for the entire EV transition. If Toyota proves that fast charging and high usable range can be delivered with durable, manufacturable solid-state packs, it raises the baseline for what consumers expect and pushes competitors to re-plan product cycles.

If Toyota’s first deployments are limited, the effort still matters. It pulls suppliers into next-generation materials, gives policymakers a new justification for battery industrial policy, and pressures lithium-ion incumbents to accelerate improvements. In either outcome, the shift is not just technological. It is strategic. The battery is becoming the new engine, and whoever controls its roadmap controls the next era of the auto industry.