Building credit can feel tough, especially if you’re just starting out or trying to fix past mistakes. Many people don’t know where to begin. Without a credit history, getting approved for regular credit cards seems almost impossible.

Secured credit cards that report to all 3 bureaus can help solve this problem. These cards report your payments to the three major bureaus—Experian, Equifax, and TransUnion—which helps build your credit score over time.

In this blog post, you’ll discover eight great options and learn how they work.

Ready to start building better credit? Keep reading!

What to Look for in a Secured Credit Card

Picking the right secured card can change your credit game. Focus on what matters most to your needs before making a move.

Reports to all 3 credit bureaus

Secured credit cards share your payment history with Experian, Equifax, and TransUnion. This helps build credit faster because all three bureaus get updates. Late payments can hurt your score, so paying on time is key.

The Bank of America Travel Rewards Secured Card stands out as a top-choice due to its 3-bureau reporting. Other cards like Discover it Secured also offer this benefit while adding rewards like cashback.

Minimum deposit requirement

Most secured credit cards need a deposit to open. This is your guarantee for the lender. Some cards require as little as $200. Others may ask for more, like $500 or even higher, depending on the issuer.

For example, Capital One Platinum Secured Credit Card offers flexibility with deposits starting at just $49 based on creditworthiness.

Your deposit also sets your credit limit in many cases. If you put down $300, that’s usually your spending cap. Cards like Discover it® Secured let you build credit while keeping costs low by only needing a minimum upfront payment.

Before applying, make sure you can afford the amount required without stretching yourself too thin financially.

Annual fees and other charges

Annual fees can add up quickly. Some secured Credit Cards, like the Discover it® Secured Credit Card, have no annual fee. Others might charge yearly or monthly fees, so reading terms is key.

Hidden charges matter too. Late payment fees or high-interest rates on balances can cost you more in the long run. Choose a card with transparent costs and fair terms to avoid surprises.

Upgrade opportunities to unsecured cards

Some secured cards let you move to an unsecured card. This can happen after good payment history. For example, Discover it Secured Card may review your account monthly. If approved, they return your deposit and upgrade you.

These upgrades help build stronger credit.

Capital One Platinum Secured Card also offers this chance. With steady use and timely payments, many users report upgrading within six months. Switching unlocks more benefits like higher limits or better rewards without needing another deposit.

Discover it® Secured Credit Card

The Discover it® Secured Credit Card offers cash-back rewards and reports to all three major credit bureaus, making it a solid choice for building credit.

Features & Description (Discover it® Secured Credit Card)

This credit card reports to all three major bureaus. It helps build or rebuild your credit history. Users must pay a refundable deposit as low as $200 to open the account. You can earn 2% cashback at gas stations and restaurants for up to $1,000 in combined purchases each quarter.

All other purchases get you 1% cashback with no limits.

There is no annual fee, making it cost-friendly. Discover matches all cashback earned in the first year without added charges. Payments are reported monthly to help improve your credit score faster with good usage habits.

Cardholders also get free FICO score tracking through their accounts online or via mobile apps for easy monitoring of progress.

Pros & Cons (Discover it® Secured Credit Card)

The Discover it® Secured Credit Card is a solid choice for building credit. It offers cashback rewards and reports to all three major credit bureaus.

Pros:

- No annual fee is required, saving you money every year.

- Earn 2% cashback at gas stations and restaurants on up to $1,000 in combined purchases each quarter.

- Get 1% cashback on other purchases with no limit, making everyday spending rewarding.

- Discover matches all the cashback you earn in your first year, doubling your rewards automatically.

- Reports payment history to Experian, Equifax, and TransUnion regularly to help improve your credit score.

- Free FICO® Score access allows easy monitoring of your credit progress over time.

- Upgrade opportunities exist for transitioning to an unsecured card after responsible use.

Cons:

- Requires a minimum deposit of $200 as collateral, which might feel restrictive for some users.

- Cashback rewards are limited to specific categories like gas and dining; not ideal for varied spending.

- Some applicants may find approval difficult without meeting basic financial requirements.

- Does not carry many premium benefits often seen with other secured or unsecured cards.

- Low initial credit limit equals the security deposit amount, limiting purchasing ability initially.

Capital One Platinum Secured Credit Card

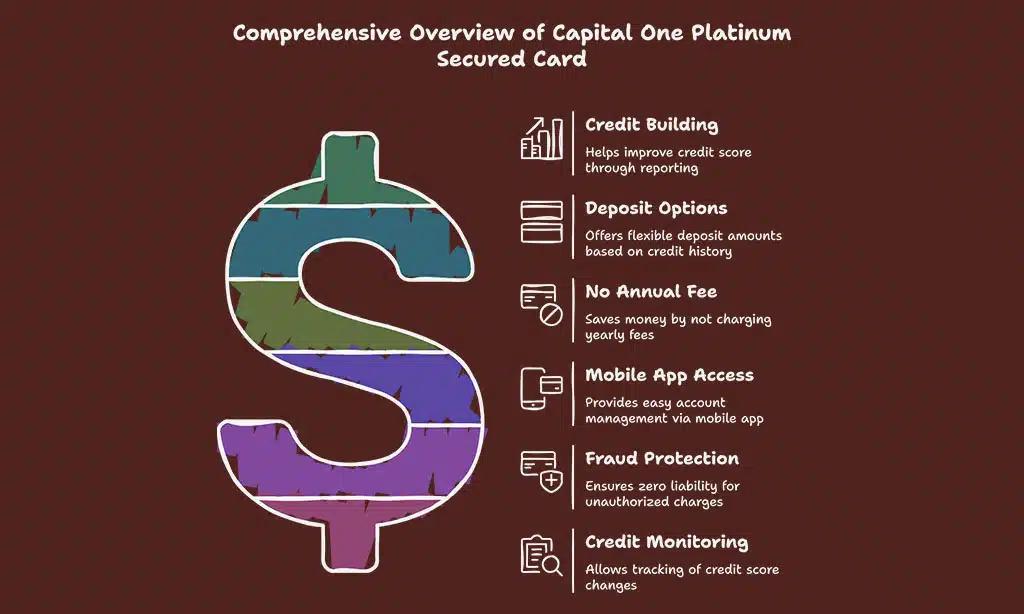

The Capital One Platinum Secured Credit Card keeps things simple, with flexible deposit options and monthly reporting to all three credit bureaus—take a closer look!

Features & Description (Capital One Platinum Secured Credit Card)

This card helps people build credit. It reports to all three major credit bureaus monthly. A refundable deposit is required, starting at $49, $99, or $200, based on your credit history.

The initial credit line starts at $200 but can increase with more deposits or good usage. There’s no annual fee.

Cardholders gain access to an easy-to-use mobile app for managing their account. Payments are reported quickly each month to boost scores faster. Fraud liability is zero if the card gets lost or stolen.

Credit monitoring tools are included for tracking progress and staying informed about changes in your score.

Pros & Cons (Capital One Platinum Secured Credit Card)

The Capital One Platinum Secured Credit Card is good for building credit. It offers flexible options but also has some drawbacks.

Pros:

- Reports to all three major credit bureaus, boosting your credit-building efforts.

- Low minimum deposit starting at $49, depending on your creditworthiness.

- No annual fee, saving you money every year.

- Offers opportunities to upgrade to an unsecured credit card with responsible use.

- Provides access to an easy-to-use mobile app for managing your account and payments.

Cons:

- Does not offer rewards like cashback or points on purchases.

- High variable APR can lead to expensive interest charges if you carry a balance.

- Requires a refundable security deposit upfront, which may be hard for those with tight budgets.

- Limited benefits compared to other secured cards in the same category.

OpenSky® Secured Visa® Credit Card

The OpenSky® Secured Visa® Credit Card skips credit checks, making it a solid pick for building credit.

Features & Description (OpenSky® Secured Visa® Credit Card)

No credit check is required to apply for the OpenSky® Secured Visa® Credit Card. It’s perfect for people with no credit or bad credit. A minimum deposit of $200 secures your line of credit, and you can deposit up to $3,000.

This card reports monthly to all three major bureaus, helping build your credit history. There’s a $35 annual fee but no checking account is needed for payments. You control how much you spend based on your deposit, making it simple to manage.

Pros & Cons (OpenSky® Secured Visa® Credit Card)

The OpenSky® Secured Visa® Credit Card is good for people building credit. It reports to all three major credit bureaus.

Pros:

- No credit check needed to apply, which helps those with poor or no credit history.

- Reports to Experian, Equifax, and TransUnion for better credit-building opportunities.

- Low minimum deposit of $200 makes it accessible to many users.

- Monthly payments are reported, so timely payments can boost your score quickly.

- Offers flexible payment methods, including online and mobile options.

Cons:

- Has an annual fee of $35 that some may find inconvenient.

- Does not offer any rewards like cashback or points on spending.

- No option to upgrade to an unsecured card, which limits growth opportunities with this lender.

- Requires a security deposit that cannot be waived, tying up funds until account closure.

- Higher Annual Percentage Rate (APR) at 21.89% Variable compared to other secured cards might result in costly interest charges if balances are not paid in full monthly.

Citi® Secured Mastercard®

The Citi® Secured Mastercard® helps you build credit with minimal fuss and offers simple terms—learn more about how it works!

Features & Description (Citi® Secured Mastercard®)

This card helps you build or rebuild credit. It reports to all three major credit bureaus, which can improve your credit score over time. You need a security deposit of at least $200 to open an account.

Your deposit amount becomes your credit limit.

There is no annual fee, so you won’t pay extra just for having the card. Citi offers tools like account alerts and free access to your FICO score online. Plus, it’s accepted anywhere Mastercard is used globally, adding convenience while growing financial flexibility!

Pros & Cons (Citi® Secured Mastercard®)

The Citi® Secured Mastercard® is a good choice for building credit. It reports to all three major credit bureaus and has simple terms.

Pros:

- Reports to Experian, Equifax, and TransUnion every month, which helps build credit quickly.

- Requires a minimum deposit of $200, making it accessible for many people.

- Charges no annual fee, saving money compared to other cards.

- Offers tools like online account access and mobile app for easy card management.

- Allows you to monitor your credit score regularly with FICO score access.

- Has fraud protection features for added financial security.

- Provides upgrade opportunities to unsecured Citi cards after showing responsible use.

Cons:

- Requires a deposit equal to the credit limit, which can be hard for some individuals to afford upfront.

- Does not offer cashback or rewards unlike other secured cards like Discover it®.

- The approval process may take time since Citi reviews individual credit history thoroughly.

- Lacks clear upgrade timelines compared to competitors offering faster transitions to unsecured cards.

- International usage might incur fees, making it less ideal for travelers outside the U.S.

Takeaways

Secured credit cards can change the way you build your credit. They report to all three major bureaus, helping boost your score over time. Many options, like Discover and Capital One, offer low fees or cashback benefits.

Picking the right card is easy if you focus on deposits, fees, and rewards. A good secured card opens doors to better financial opportunities later. Start small today; your future self will thank you!