If you are still paying $5 to swap a token on Ethereum, you are doing crypto wrong. By 2026, the blockchain landscape has changed completely. The days of “gas wars” costing hundreds of dollars are largely behind us, thanks to massive upgrades like EIP-4844 (Proto-Danksharding) and the widespread adoption of Layer-2 (L2) networks. Today, Ethereum is the settlement layer—the bedrock of security—while Layer-2s are the high-speed express lanes where actual business happens.

But not all express lanes are priced the same. Some are built for complex institutional trading, while others are optimized for cheap, instant NFT minting.

In this guide, we rank the top 5 Layer-2 blockchains for low fees, backed by 2026 data. Whether you are a DeFi yield farmer, a gamer, or just buying your first memecoin, this list will help you stop burning money on gas.

Cheapest L2 Blockchains Networks at a Glance

| Network | Best Use Case | Avg. Transfer Fee (Est.) | Avg. Swap Fee (Est.) | Key Tech |

| 1. Base | Retail, SocialFi, Memecoins | < $0.01 | $0.02 | Optimistic Rollup |

| 2. Arbitrum One | DeFi, Lending, Yield Farming | $0.01 | $0.03 | Optimistic (Nitro) |

| 3. ZKsync | Payments, UX (Gasless) | $0.02 | $0.05 | ZK-Rollup |

| 4. Polygon zkEVM | Enterprise, Real World Assets | $0.02 | $0.06 | ZK-Rollup (AggLayer) |

| 5. Starknet | Gaming, High-Speed Apps | $0.04 | $0.09 | ZK-STARKs |

Why Layer-2 Blockchains Fees Matter in 2026

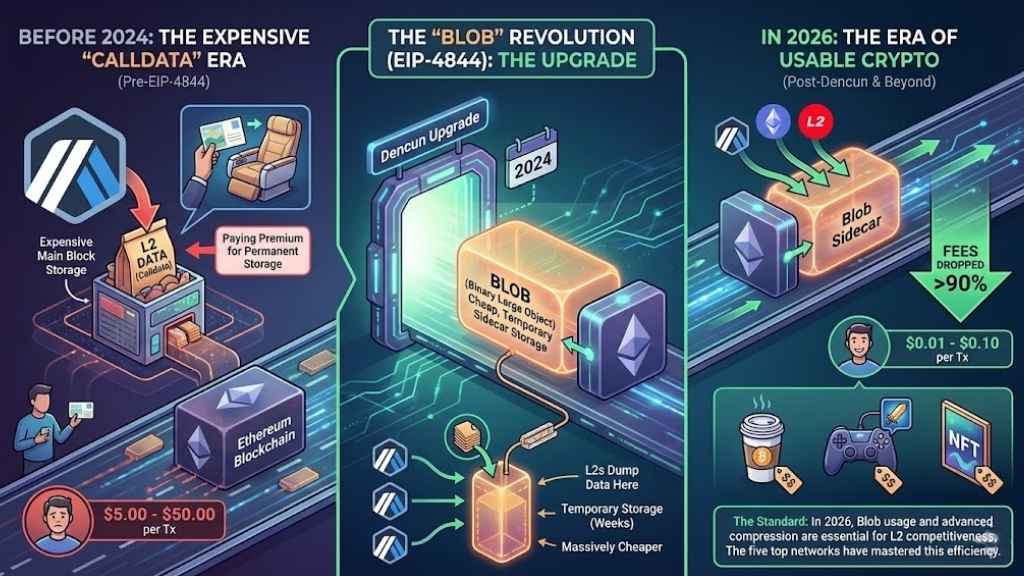

To understand why fees have dropped so much, we need to look at the “plumbing” of the internet of value.

Back in 2024, Ethereum underwent a major upgrade known as Dencun (EIP-4844). Before this, Layer-2 networks had to squeeze their transaction data into the expensive “calldata” section of an Ethereum block. It was like paying for a first-class seat just to send a postcard.

The “Blob” Revolution

EIP-4844 introduced “Blobs” (Binary Large Objects). Think of blobs as a sidecar attached to the Ethereum blockchain. They are temporary storage spaces that are incredibly cheap. L2 networks now dump their data into these blobs instead of the main block.

- The Result: Fees dropped by over 90% overnight.

- The Benefit: You can now mint an NFT or swap tokens for pennies, making crypto actually usable for buying coffee or in-game items.

In 2026, if an L2 isn’t using blobs or advanced compression, it simply cannot compete. The five networks below have mastered this efficiency.

1. Base (The Retail King)

Base has become the breakout star of the 2025-2026 cycle. Incubated by Coinbase, it was designed with one goal: to bring the next billion users on-chain. It has succeeded wildly by offering an experience that feels less like “crypto” and more like a standard fintech app.

Why It’s Cheap

Base is an Optimistic Rollup built on the OP Stack. It benefits from the “Superchain” architecture, allowing it to share costs with other chains in the Optimism ecosystem. Because it is centralized enough to be efficient but decentralized enough to be secure, it processes transactions with incredible speed and minimal cost.

Real-World Use Cases

- SocialFi: Apps like Farcaster run on Base. You can “tip” creators or mint posts for fractions of a cent.

- Memecoins: In 2026, the “degen” economy lives here. The low fees make it possible to trade tokens worth $10 without losing $5 to fees.

- Onboarding: Because it connects directly to Coinbase, moving fiat money (dollars) into Base is often free and instant.

Pro Tip: If you use the Coinbase Smart Wallet, you can often interact with Base dApps without even needing to own ETH for gas, as developers can subsidize the fees for you.

2. Arbitrum Nitro (The DeFi Heavyweight)

Arbitrum One (often just called Arbitrum) is the giant of the room. It holds the most Total Value Locked (TVL)—which means more money sits in Arbitrum smart contracts than any other L2.

Why It’s Cheap

Arbitrum uses a tech stack called Nitro. Nitro compiles the code to run fast and compresses data tightly before sending it to Ethereum. Even though it is the busiest network, its “economies of scale” keep fees low. When more people use Arbitrum, the cost to post a “batch” of transactions to Ethereum is split among more users, keeping individual costs down.

Real-World Use Cases

- Serious DeFi: If you are lending $10,000 on Aave or providing liquidity on Uniswap, Arbitrum is the safest bet. It has the deepest liquidity, meaning you get better trade prices.

- Perpetual Trading: Platforms like GMX allow you to trade crypto futures on-chain. This requires many fast transactions, which Arbitrum handles effortlessly.

Arbitrum vs. Base

- Arbitrum is more decentralized and battle-tested (better for large amounts of money).

- Base is slightly cheaper and easier for beginners (better for small trades and social apps).

3. ZKsync (The Privacy & UX Choice)

ZKsync (formerly zkSync Era) represents the “end game” of scaling technology: Zero-Knowledge (ZK) Rollups. While Optimistic rollups (like Base and Arbitrum) assume transactions are valid and wait 7 days for fraud checks, ZK rollups use math to prove transactions are valid instantly.

Why It’s Cheap & Unique

Historically, ZK tech was expensive to compute. But in 2026, ZKsync’s “Boojum” upgrade and hardware acceleration have crushed costs.

The killer feature here is Native Account Abstraction. On other chains, your wallet is just a dumb key. On ZKsync, your wallet is a smart contract.

- Paymasters: You can pay gas fees in USDC, DAI, or the token you are swapping, instead of ETH.

- Bundling: You can sign one transaction to approve, swap, and stake a token all at once.

Real-World Use Cases

- Payments: Ideal for merchants who want to accept crypto but don’t want to handle volatile ETH for gas fees.

- Gaming: ZKsync’s instant finality (security) is perfect for games where items need to be truly owned immediately.

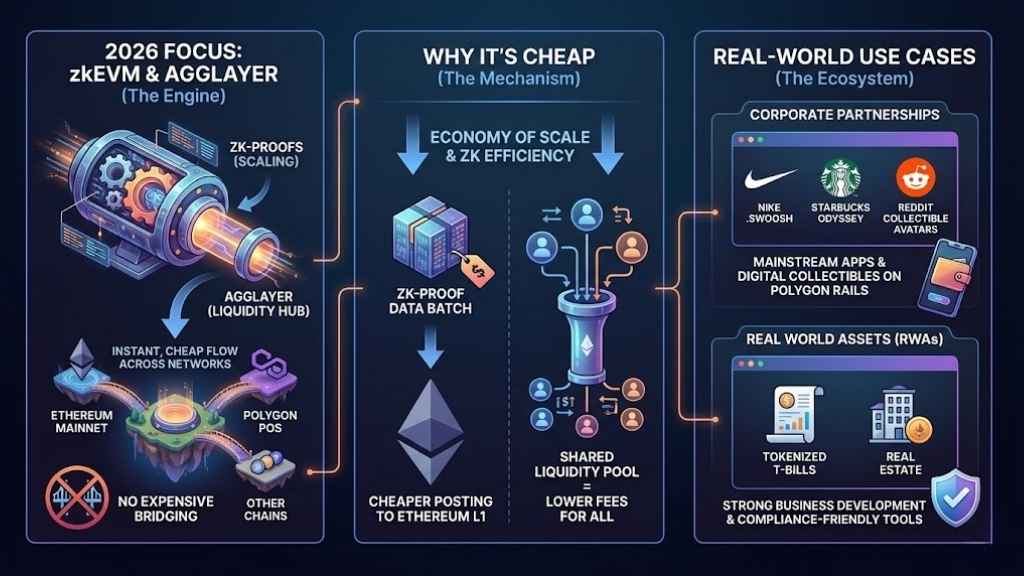

4. Polygon zkEVM (The Corporate Powerhouse)

You probably know Polygon (MATIC/POL) from the 2021 bull run. In 2026, their focus has shifted to the Polygon zkEVM and the AggLayer (Aggregation Layer).

Why It’s Cheap

Polygon zkEVM is fully compatible with Ethereum code but uses ZK proofs for scaling. The “AggLayer” allows liquidity to flow between different chains in the Polygon ecosystem instantly. This means you aren’t stuck on one isolated island; you can access apps across the entire network without expensive bridging.

Real-World Use Cases

- Corporate Partnerships: Big brands like Nike (.Swoosh), Starbucks, and Reddit have historically built on Polygon tech. If you are using a mainstream app with “digital collectibles,” it’s likely running on Polygon rails.

- Real World Assets (RWAs): Tokenized treasury bills and real estate often live here due to Polygon’s strong business development and compliance-friendly tools.

5. Starknet (The Scalability Frontier)

Starknet is the playground for the future. It doesn’t just copy Ethereum; it uses a different coding language (Cairo) to achieve things that are impossible on other chains.

Why It’s Cheap

Starknet uses STARKs (Scalable Transparent Arguments of Knowledge). These are a specific type of ZK proof that gets more efficient the more transactions you process. As network usage grows in 2026, Starknet’s fees have actually trended downward.

Real-World Use Cases

- Fully On-Chain Games: We aren’t just talking about trading sword NFTs. Entire game worlds, physics, and logic run on Starknet because it can process massive amounts of computation cheaply.

- Complex DeFi: Apps that require heavy math (like options pricing models) run better here than on standard Ethereum L2s.

Note: Because Starknet uses a different wallet structure (Argent or Braavos), it feels different from MetaMask. It is a steep learning curve but offers powerful features like “session keys” (play games without signing every move).

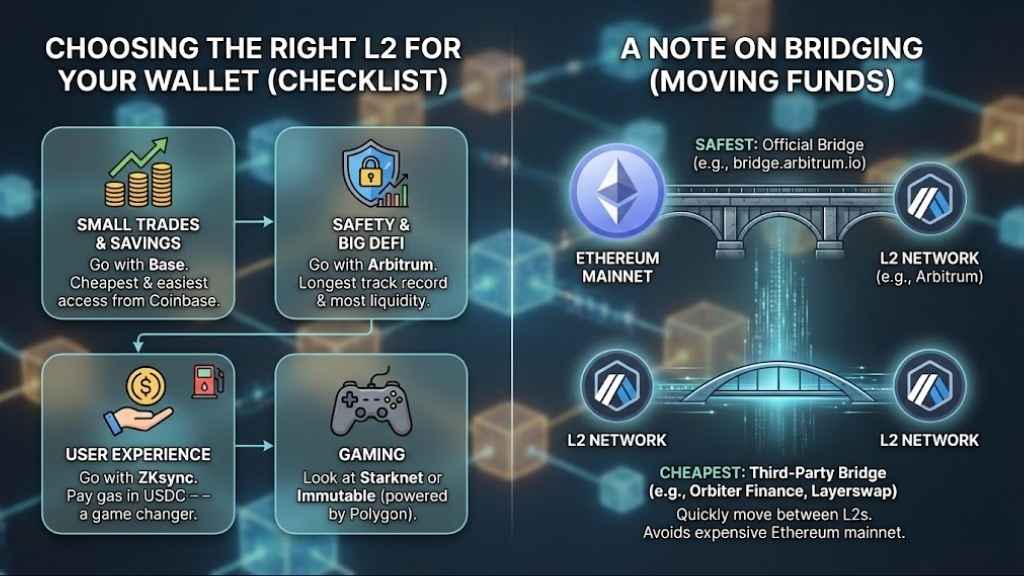

How to Choose the Right L2 Blockchains for Your Wallet

Struggling to pick one? Use this checklist:

- For Saving Money on Small Trades: Go with Base. It’s the cheapest and easiest to access from Coinbase.

- For Safety & Big DeFi: Go with Arbitrum. It has the longest track record and most liquidity.

- For User Experience: Go with ZKsync. Paying gas in USDC is a game-changer.

- For Gaming: Look at Starknet or Immutable (powered by Polygon).

A Note on Bridging

To get your money from Ethereum Mainnet to these L2s, you need a “Bridge.”

- Safest: Use the official bridge of the network (e.g., bridge.arbitrum.io).

- Cheapest: Use a “third-party” bridge like Orbiter Finance or Layerswap to move funds quickly between L2s without touching the expensive Ethereum mainnet.

Final Thoughts

By 2026, paying high transaction fees is no longer a necessity—it is a choice. The “Layer-2 Wars” didn’t end with a single victor; instead, they evolved into a specialized economy where utility dictates the winner. Just as you wouldn’t use a tank to pick up groceries, you should no longer use Ethereum Mainnet to buy a coffee or swap a small amount of tokens.

The landscape has matured beautifully. Base has democratized access for retail users, Arbitrum remains the fortress for institutional-grade DeFi, and ZK-rollups like ZKsync are finally delivering on the promise of instant, private, and cheap payments. The implementation of EIP-4844 changed the game, turning what was once a bottleneck into a global superhighway.

Your next move is simple: align your network with your goals. If you want a seamless social experience, head to Base. If you are moving serious capital, stick to Arbitrum. The technology is no longer a barrier; it is an enabler. Stop burning your portfolio on gas. Bridge your assets, explore these ecosystems, and experience the speed of the new internet.