Ever wonder which startups are raking in the most cash across the U.S.? If you’re curious about where the money’s flowing in 2024, you’re not alone. Many want to spot the next big thing before it blows up.

This year, AI, biotech, and clean energy startups are swimming in funding. Some states have surprise winners you might not expect. We’ve dug into the data to show you the top-funded startup in every state, plus the trends driving their success.

Ready to see who’s leading the pack? Let’s go.

Overview of Startup Funding Trends in 2024

Money keeps pouring into startups, with AI and clean energy leading the charge. Investors are betting big on innovation, but competition for funding is fiercer than ever.

Popular industries receiving funding

In 2024, artificial intelligence dominates startup funding, with companies like OpenAI and CoreWeave leading the charge. A whopping 49 U.S. AI startups raised over $100 million this year alone, proving tech investors are betting big on smart machines.

Biotech and healthcare also rake in cash, with Moderna and Nusano showing how medical innovation pulls dollars. Clean energy follows close behind as climate concerns drive up investments in firms like Venture Global LNG.

Not to be outdone, fintech players such as Robinhood keep attracting venture capital by reinventing how we handle money online. From enterprise software to gaming giants like Epic Games, these industries prove where the smart money’s flowing right now.

Key funding sources

Startups in 2024 are pulling cash from a mix of big players and fresh faces. Venture capital firms still lead the pack, with names like Sequoia and Andreessen Horowitz writing hefty checks.

Corporate investors, such as Google Ventures and Intel Capital, are also jumping in, especially for AI and biotech deals.

Crowdfunding platforms like Kickstarter help smaller startups test ideas early. Angel investors fill gaps for seed-stage companies, while private equity firms chase later-stage growth.

Some startups even lean on government grants, particularly in clean energy and healthcare.

Money talks, but it don’t sing and dance. — Neil Young

The Most Funded Startups by Industry

Some industries are raking in big bucks, with AI and biotech leading the charge. Fintech and clean energy aren’t far behind, proving innovation pays off.

Artificial Intelligence

Artificial intelligence leads as one of today’s hottest investment magnets among tech ventures nationwide—OpenAI tops California’s charts as its standout example after massive backing surged past rivals like CoreWeave elsewhere too! Across America alone forty-nine firms cracked over $100 million raises each just within AI sectors during early stages including niche players such fashion-tech disruptor Alta pocketing solid eleven mil seed money upfront despite stiffening competition everywhere else meanwhile…

This boom reflects broader hunger seen globally where smarter algorithms now power everything from chatbots handling customer queries seamlessly down robotic arms assembling cars faster than humans ever could before long-term bets keep pouring steadily inward without slowing anytime soon either way forward clearly favors bold innovators here first movers gain edge hands-down every single time period end story basically folks!

Biotechnology and Healthcare

Biotechnology healthcare saw massive investments surge through early-stage ventures during Q1-Q2 ’24 alone—Moderna led Massachusetts’ charge alongside firms like Nusano & MARAbio securing hefty seed rounds focused on oncology breakthroughs & radiotherapeutics innovations nationwide!

*Science may set limits knowledge must pass but imagination has none.* – Albert Einstein

Investors doubled down across gene-editing platforms tackling rare diseases faster thanks largely due rising demand precision medicine tools post-pandemic era reshaping patient outcomes dramatically within months rather years now possible at scale finally hitting mainstream clinics coast-to-coast today already changing lives daily basis quietly yet profoundly behind scenes without fanfare often overlooked outside industry circles still growing exponentially regardless economic headwinds elsewhere globally speaking truthfully here folks…

Fintech

While biotech continues to push healthcare forward, fintech is rewriting the rules of money. Startups like Robinhood and Calendly lead the charge, with AI-driven tools and digital payment solutions stealing the spotlight in 2024.

The sector saw massive funding rounds, including Alta’s $11M for fashion tech and CoreWeave’s AI-powered financial platforms shaking up traditional banking.

Investors poured cash into companies solving real-world money problems. Remote work tech, crypto wallets, and automated investing tools dominated the scene. Firms like Impulse Space grabbed attention with fresh takes on blockchain security.

Fintech startups now focus on speed, making loans faster and payments smoother than ever before. The race is on to replace clunky old systems with sleek digital alternatives that anyone can use from their phone.

Clean Energy and Sustainability

Clean energy startups are gaining serious traction in 2024, with big funding rounds fueling innovation. Companies like Venture Global LNG and CoreWeave lead the charge, focusing on scalable solutions for renewable energy and sustainable tech.

Investors are pouring cash into projects that cut carbon footprints while turning a profit.

The push for green tech isn’t slowing down. Startups in solar, wind, and battery storage dominate funding trends, proving sustainability sells. Even smaller players like GlacierGrid attract attention by tackling waste reduction and smart grids head-on.

The message is clear: clean energy isn’t just good for the planet—it’s smart business too.

Enterprise Software and SaaS

Moving from clean energy to tech, enterprise software and SaaS startups are raking in big funding. Companies like CoreWeave, a cloud computing firm, landed major investments in 2024.

These tools help businesses run smoother, from managing data to automating tasks.

AI-driven platforms dominate the space, with startups like Datadog in New York leading the pack. Investors love scalable solutions that cut costs and boost efficiency. The rise of remote work has also fueled demand for collaboration and security software.

Expect more growth as companies keep digitizing operations.

Regional Patterns in Startup Funding

The U.S. startup scene isn’t one-size-fits-all—coasts dominate, but rising stars in the Midwest are shaking things up. From Silicon Valley’s tech giants to Atlanta’s fintech boom, each region brings its own flavor to the funding game.

Most funded startups on the East Coast

The East Coast remains a powerhouse for startup funding in 2024, with New York and Massachusetts leading the charge. Moderna, based in Massachusetts, continues to dominate biotech funding, while Datadog in New York stands out as a top enterprise software player.

Other notable names include Gopuff in Pennsylvania and Magic Leap in Florida, both securing massive investments to scale operations. These companies highlight the region’s strength across AI, healthcare, and consumer tech sectors.

Venture capital flows heavily into East Coast hubs like Boston and NYC, where industries like fintech and clean energy thrive. Startups such as AbbVie show big bets on biotechnology innovation.

The region’s dense talent pool keeps drawing investors eager to back high-growth ventures from seed funding to later stages. With strong ties to global financial markets, these startups often race ahead fast for business development success stories nationwide too!

Most funded startups on the West Coast

The West Coast remains a powerhouse for startup funding in 2024. California leads the pack with OpenAI topping the list, while Washington’s Convoy and Colorado’s Guild Education show strong growth.

Tech and AI dominate here, with companies like CoreWeave and Cruise pulling in massive investments.

Venture capital flows freely in this region, especially into AI and clean energy. Startups like Impulse Space and Nusano highlight the focus on cutting-edge tech. The West Coast’s mix of established giants and fresh innovators keeps it at the heart of the entrepreneurial ecosystem.

Emerging startup hubs in the Midwest

The Midwest is heating up as a hotspot for startups in 2024. Cities like Chicago, Detroit, and Minneapolis are drawing big investments. For example, Illinois-based Cameo connects fans with celebrities through videos and has landed major funding.

Michigan’s Rivian stands out too, making electric trucks and SUVs that compete with Tesla.

Clean energy and tech are driving growth here. Corvus Robotics from the Midwest focuses on automation solutions, while MARAbio works on cutting-edge biotech innovations. Venture capital is flowing into these new hubs, proving you don’t need Silicon Valley to build something big anymore.

The region offers lower costs, strong talent pools, and hungry investors ready to back fresh ideas.

Funding trends in the South

The South saw strong startup funding in 2024, with companies like Magic Leap in Florida and Carvana in Arizona leading the pack. Clean energy and biotech startups gained traction, drawing venture capital interest.

Georgia’s Calendly and North Carolina’s Epic Games stood out, proving the region isn’t just about traditional industries. Investors backed Southern startups for their lower costs and growing talent pools, fueling economic development.

The Most Funded Startups in Every U. S. State

From OpenAI in California to Robinhood in Nevada, these startups struck gold in 2024—find out who else made the list.

California: OpenAI

OpenAI leads as California’s top-funded startup in 2024. Known for AI breakthroughs, it has raised billions to push the limits of machine learning and language models. The company stands out among tech giants, drawing massive venture capital interest.

Other heavyweights like Cruise and CoreWeave also shine in the state’s thriving startup scene. Investors continue betting big on AI-driven innovation, fueling rapid growth here. Up next, Texas makes waves with a different kind of frontier—space.

Texas: SpaceX

Moving from California’s AI giant OpenAI, Texas boasts SpaceX as its top-funded startup in 2024. Founded by Elon Musk, SpaceX continues to dominate aerospace innovation, securing massive funding rounds for projects like Starship and satellite internet through Starlink.

The company stands out in the venture capital landscape, drawing investors eager to back its ambitious space exploration goals. With a strong track record and cutting-edge tech, SpaceX remains a key player in Texas’ thriving startup ecosystem.

Its growth fuels job creation and cements the state’s role in the tech and aerospace industries.

New York: Datadog

New York’s Datadog remains a standout in the startup funding landscape. The company specializes in cloud monitoring and analytics, helping businesses track performance across digital systems.

In 2024, it continues to attract major venture capital due to its strong growth in enterprise software solutions.

Datadog’s tools are vital for companies scaling their tech infrastructure, making it a leader in SaaS innovation. With demand rising for remote work technologies, its platform has become indispensable.

Investors see long-term potential as more businesses rely on data-driven operations.

Florida: Magic Leap

Florida’s Magic Leap is a standout in the 2024 startup funding scene. Known for its augmented reality tech, the company continues to attract major investment. Magic Leap focuses on blending digital content with the real world, making waves in industries from gaming to healthcare.

Investors see big potential in its immersive experiences, keeping it at the top of Florida’s most funded startups list.

The company stands out among fast-growing U.S. startups, joining names like OpenAI and SpaceX. Funding trends show strong interest in cutting-edge tech, and Magic Leap fits right in.

With venture capital pouring into innovation hubs nationwide, Florida’s startup ecosystem gets a boost from this AR pioneer. Its growth reflects broader trends favoring high-tech solutions and bold ideas.

Pennsylvania: Gopuff

Pennsylvania’s standout startup Gopuff has made waves as one of America’s most-funded companies this year (Important Fact #1). This instant delivery service grabbed attention by scaling fast across multiple cities while keeping its headquarters rooted firmly within Philadelphia’s entrepreneurial landscape (Keyword *Startup Ecosystem*).

With backing pouring into logistics-heavy ventures lately (Important Fact #2), their model thrives off quick grocery drops paired seamlessly alongside late-night snack cravings—no extra stops required! Investors clearly saw potential here too since recent reports highlight them among firms securing major venture capital injections nationwide (*Keywords* Venture Capital, Growth).

Massachusetts: Moderna

Moving from Pennsylvania’s fast-delivery star Gopuff, Massachusetts shines with Moderna, a biotech leader. The company has secured huge funding for its mRNA tech and vaccines, making waves in healthcare.

Moderna stands tall among the most funded U.S. startups, with AbbVie also noted in key funding lists. Its innovations push biotechnology forward, proving why investors bet big on life-saving science.

Clean energy rivals may rise, but few match Moderna’s impact right now.

Washington: Convoy

Washington’s standout startup Convoy leads freight logistics innovation through digital solutions backed by major venture capital investments since its launch.The company simplifies trucking services using smart technology,matching shippers efficiently while cutting costs.Convoy secured massive funds during multiple investment rounds,fueling rapid expansion across supply chain networks.With rising demand,America’s reliance on efficient transport boosts firms like Convoy,pushing them ahead among tech-driven logistics disruptors.Their success highlights Seattle’s thriving entrepreneurial ecosystem alongside giants such as Amazon.This growth reflects broader national interest,injecting fresh energy into transportation modernization efforts nationwide.Fundraising milestones keep propelling their mission forward without slowing down anytime soon!

Colorado: Guild Education

Moving to Colorado, Guild Education stands out as the state’s most funded startup in 2024. This Denver-based company focuses on upskilling workers through education benefits, partnering with big employers like Walmart and Disney.

It offers online degree programs and certificates through universities, helping employees boost their careers without drowning in student debt.

Guild Education has raised significant venture capital, hitting headlines for its growth-stage funding rounds. Its model taps into the rising demand for remote learning and workforce development.

The startup’s success reflects broader trends in edtech and corporate training, making it a key player in Colorado’s thriving entrepreneurial ecosystem. With strong investor backing, Guild is expanding its market reach while tackling America’s skills gap head-on.

Illinois: Cameo

Illinois shines in the startup world with Cameo leading its funding race. The personalized video platform lets fans connect with celebrities, turning heads in the venture capital scene.

Founded in Chicago, it’s one of the state’s standout success stories, proving even Midwest hubs can compete for big investments.

Cameo’s growth reflects broader trends in tech and entertainment startups. With strong backing, it scales fast while dodging pitfalls like cash flow crunches or stiff competition.

Next up, Georgia’s Calendly shows how productivity tools rake in funds too.

Georgia: Calendly

Georgia made waves in 2024 with Calendly leading its startup scene. The scheduling software giant secured major funding, proving its spot as a key player in enterprise SaaS. With remote work still booming, Calendly’s tools help teams streamline meetings effortlessly.

Investors bet big on the Atlanta-based company, fueling growth and new features. Its success highlights Georgia’s rising role in the tech startup ecosystem. Next up is North Carolina’s gaming powerhouse, Epic Games.

North Carolina: Epic Games

North Carolina’s top-funded startup is Epic Games, the company behind Fortnite and Unreal Engine. In 2024, it remains a giant in gaming and virtual experiences, drawing major venture capital for its cutting-edge tech.

The firm continues to push boundaries in interactive entertainment, blending AI with immersive worlds.

Epic Games fuels growth by reinvesting funds into R&D and expanding its metaverse vision. With fierce competition in gaming, it stays ahead through constant innovation. The startup ecosystem in North Carolina thrives thanks to heavyweights like this leading the charge.

Their success highlights the state’s role as a rising tech hub beyond Silicon Valley.

Utah: Podium

Podium, based in Utah, stands out as one of the most funded startups in the state. It helps businesses manage customer interactions with tools for payments, reviews, and messaging.

Founded in 2014, Podium has raised over $460 million to expand its platform.

The company focuses on local businesses, making it easier for them to connect with customers online. Investors see potential in its simple yet powerful approach to communication and payments.

With a strong presence in Utah’s thriving tech scene, Podium continues to grow fast while keeping innovation at the core.

Michigan: Rivian

Michigan’s standout startup, Rivian, has made waves in 2024. The electric vehicle company continues to attract major funding, competing with giants like Tesla. Rivian focuses on rugged, eco-friendly trucks and SUVs, appealing to adventure seekers and green tech fans alike.

Backed by heavy investments, Rivian scales production and expands its market reach. The startup’s success highlights Michigan’s growing role in clean energy innovation. With strong venture capital support, Rivian proves the Midwest is more than just traditional auto manufacturing.

Arizona: Carvana

Moving from Michigan’s electric vehicle leader Rivian, Arizona shines with Carvana. This online used car retailer has grabbed major funding, making waves in the auto industry. Carvana’s tech-driven approach lets buyers shop, finance, and even get cars delivered in a vending machine-style tower.

The startup stands out in Arizona’s growing tech scene. Investors love its hassle-free model, pushing it into the top-funded ranks. Carvana proves innovation isn’t just about flashy tech—it’s about fixing everyday problems.

With strong funding backing its growth, it’s a key player in the state’s startup ecosystem.

Nevada: Robinhood

Shifting south from Arizona’s Carvana, Nevada boasts Robinhood as its top-funded startup in 2024. The fintech giant made headlines this year by securing massive investments and reshaping how everyday people trade stocks and crypto.

Robinhood stands out in Nevada’s growing startup ecosystem, proving that even states known for tourism can foster cutting-edge tech ventures. With user-friendly tools and a focus on democratizing finance, the company continues to attract venture capital while expanding its market reach.

How Startups Are Using Their Funds

Startups pour cash into research and development to stay ahead of the competition. They also expand teams, upgrade tech, and chase new markets with fresh funding.

Research and development

Startups pour big money into research and development to stay ahead. Companies like OpenAI and Moderna invest heavily in R&D to push tech and healthcare forward. In 2024, AI startups alone raised over $100M each, with Alta securing $11M for fashion tech.

R&D fuels breakthroughs, from self-driving cars at Cruise to clean energy at Venture Global LNG. It’s the backbone of scaling operations and staying competitive. Next, let’s see how startups expand their market reach.

Scaling operations

Scaling operations means growing a startup fast without losing control. Companies like OpenAI and SpaceX use funding to hire talent, open new offices, and boost production. For example, Rivian expanded its electric vehicle factories, while Gopuff scaled its delivery network nationwide.

Cash flow stays tight during rapid growth, so smart startups focus on efficiency. Firms like Epic Games and Magic Leap invest in tech and logistics to handle demand. The goal is to keep customers happy while growing.

Next, let’s see how startups expand their market reach.

Expanding market reach

Startups are pouring funds into growing their customer base. Companies like OpenAI and SpaceX use cash to enter new regions and industries. Magic Leap, for example, focuses on augmented reality expansion, while Robinhood targets financial markets nationwide.

Funding helps startups boost sales teams and marketing efforts. Firms like Epic Games and Carvana invest heavily in ads and partnerships. Others, like Guild Education, expand online learning access.

The goal is simple: reach more people, fast.

Key Trends Observed in Funded Startups

AI startups are stealing the spotlight, with investors eager to back the next big breakthrough. Meanwhile, green tech and remote work tools are also raking in cash as demand soars.

Rise of AI-focused startups

AI-focused startups are booming in 2024, with many raking in big funding rounds. Companies like OpenAI and Alta lead the pack, showing how investors bet heavy on artificial intelligence.

A list of 49 U.S. AI startups raised $100M or more this year alone, proving demand is sky-high for smart tech that changes industries fast.

The startup ecosystem leans hard into AI now, from fashion tech to robotics. Impulse Space and Corvus Robotics show fresh ideas get serious cash if they solve tough problems. With venture capital pouring in, these firms push research and development first before scaling up fast to meet market needs without missing a beat.

Sustainability-driven innovation

Startups in 2024 are racing to tackle climate challenges with fresh ideas. Companies like Venture Global LNG and CoreWeave focus on clean energy and efficient tech, pulling in massive funding.

The push for green solutions isn’t slowing down, with investors betting big on sustainability as a key driver of growth.

From AI-driven efficiency tools to breakthroughs in renewable energy, these startups prove eco-friendly innovation pays off. Take Rivian from Michigan or Podium in Utah—both show how blending tech and sustainability opens doors for funding.

The next wave of startup success stories will likely hinge on solving real-world environmental problems without breaking the bank. Let’s check out how remote work tech is reshaping industries next.

Growth in remote work technologies

Remote work technologies are booming as companies adapt to hybrid and fully remote setups. Startups like Calendly, which simplifies scheduling, and AI-powered tools, such as those developed by OpenAI, are reshaping how teams collaborate.

Nearly 49 U.S. AI startups raised over $100M in 2024, many focusing on productivity and communication solutions.

The demand for seamless virtual workflows has fueled investments in platforms like those from Guild Education and Podium. These tools help businesses manage remote teams, automate tasks, and bridge gaps in digital communication.

With more employees working from anywhere, the push for smarter, faster tech shows no signs of slowing.

Challenges Faced by Funded Startups

Scaling fast can burn cash quickly—many hot startups struggle with balancing rapid growth against staying profitable; curious how others handle these hurdles? Keep reading!

Maintaining cash flow

Cash flow keeps startups alive, but many struggle to balance spending and income. Companies like WeWork and JUUL faced cash crunches despite heavy funding.

Smart startups use funds wisely, focusing on growth without burning through reserves. Firms like OpenAI and CoreWeave invest in R&D while keeping operations lean. Stretching every dollar helps avoid sudden financial gaps.

Scaling infrastructure

Scaling infrastructure is a major hurdle for funded startups in 2024, especially as they grow. Companies like Vantage Data Centers and CoreWeave face the challenge of expanding their tech stacks while keeping costs low.

Startups must balance speed with reliability to avoid downtime or system crashes when demand spikes.

AI-driven firms, such as OpenAI and Impulse Space, invest heavily in cloud computing and data centers to handle rapid user growth. Logistics startups like Convoy need strong backend systems to manage nationwide operations smoothly.

Without solid infrastructure, even well-funded companies risk falling behind competitors in crowded markets like fintech or SaaS.

Competition in saturated markets

Standing out gets tough when everyone’s fighting over slices from one pie—just ask crowded fields like fintech or enterprise software where giants like Datadog dominate their turf already! Even fresh faces such as AI-driven Alta face pressure after bagging millions yet still needing room among peers chasing similar goals across states including California’s OpenAI hub spots too…

Cash helps but isn’t everything if rivals copy ideas faster than you scale them up—look at WeWork struggling despite heavy backing earlier years before newer players stepped onto shared workspace battlegrounds nationwide now packed tighter each quarter passing through seed stages toward growth phases alike other sectors seeing similar squeezes lately per recent stats tracking these exact patterns closely since January updates dropped mid-year reports showing spikes everywhere folks thought was safe bets once upon time ago…

Tips for Aspiring Entrepreneurs

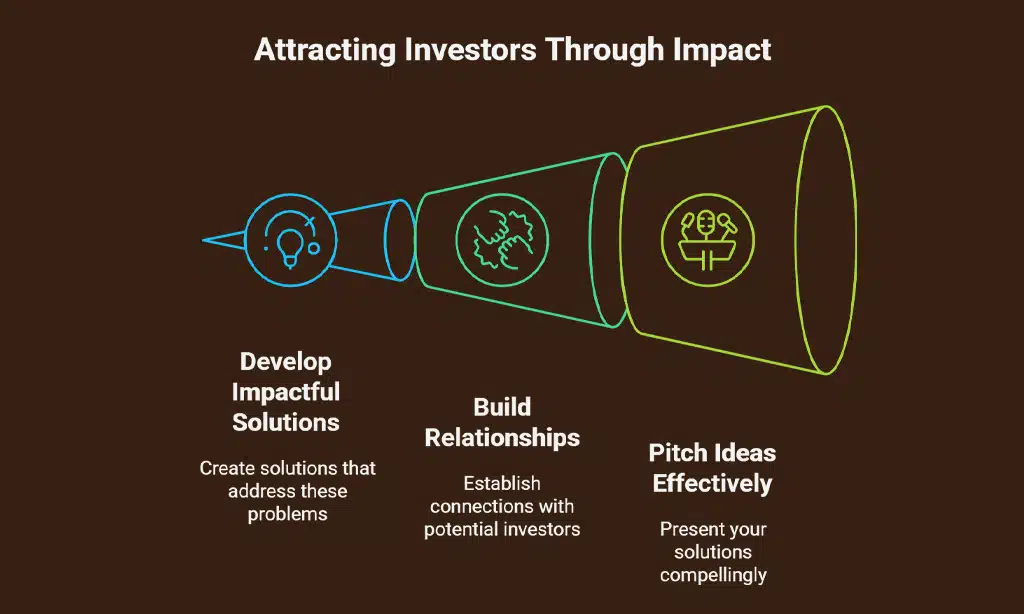

Want investors lining up at your door? Focus on solving real problems people care about—money follows impact like bees to honey.

Don’t just pitch your idea; build relationships early—investors bet on people as much as they bet on ideas!

Understanding funding opportunities

Funding opportunities for startups in 2024 are booming, with venture capital pouring into AI, biotech, and clean energy. Companies like OpenAI and CoreWeave lead the pack, raising millions to fuel innovation.

Investors are eager to back fast-growing startups, like Impulse Space and Nusano, showing strong potential.

Knowing where to look is key. Seed funding, growth-stage rounds, and venture capital dominate the startup ecosystem. Platforms list thousands of U.S. startups, making it easier to track trends.

Focus on industries like fintech or SaaS, where funding is hot. Build strong investor relationships early to stand out in a competitive market.

Building investor relationships

Strong investor relationships start with trust and clear communication. Show them real growth, like OpenAI’s funding success or Rivian’s rise in Michigan. Investors want proof, not just promises.

Keep them updated with wins, like Epic Games hitting milestones or Magic Leap’s progress in Florida. Be honest about challenges, too. Investors back founders who deliver results, not just ideas.

Preparing for funding rounds

Getting ready for funding rounds means doing your homework. Research shows that startups like OpenAI and Rivian raised big by focusing on strong pitches and clear growth plans. Know your numbers inside out before meeting investors, whether seeking seed funding or Series A.

Firms like Impulse Space and Nusano landed major deals by showing solid traction in AI and biotech, two hot industries right now.

Keep your financials tight and your vision tighter. Venture capitalists in 2024 backed companies with scalable models, like Guild Education and Magic Leap. Practice pitching until it feels natural, not rehearsed.

Highlight real wins, such as user growth or revenue spikes, to stand out in crowded markets like fintech or SaaS. Data from top-funded startups proves that preparation pays off when checks get signed.

Takeaways

Startups across the U.S. are booming, with AI, biotech, and clean energy leading the charge. Funding trends show strong growth on both coasts, while new hubs rise in the Midwest and South.

Companies like OpenAI and SpaceX prove big ideas attract big investments. Smart funding helps startups scale fast, but challenges like cash flow remain. For founders, building strong investor ties is key to success.

The future looks bright for those ready to innovate and push forward.