Hey there, are you feeling lost in the wild jungle of cryptocurrencies? With so many options popping up, picking the right altcoins for long-term growth can feel like finding a needle in a haystack.

Did you know that cryptos like Ethereum and Solana offer more than just digital cash, powering things like smart contracts and decentralized apps? That’s a game-changer! In this post, we’ll guide you through the top altcoins to watch, break down what makes them special, and share tips to grow your crypto wallet.

Stick around, it’s gonna be a quick ride!

Key Takeaways

- Ethereum (ETH) leads with a market cap of $315.30 billion and a price of $2,607.93 as of May 1, 2025, dominating smart contracts and DeFi.

- Solana (SOL) offers fast transactions at 65,000 per second with a market cap of $89.13 billion and a price of $171.20 as of May 1, 2025.

- Ripple (XRP) focuses on quick cross-border payments with a market cap of $141.33 billion and a price of $2.41 as of May 1, 2025.

- Cardano (ADA) shows strength with a 57% year-over-year return as of April 2025 and a market cap of $27.41 billion.

- Polkadot (DOT) connects blockchains with a market cap of $7.72 billion and a price of $4.88 as of May 1, 2025, boosting interoperability.

Factors to Consider When Choosing Altcoins for Long-Term Growth

Hey there, wanna know what makes an altcoin a solid pick for the long haul? Let’s chat about a couple of key things to keep an eye on before you toss your hard-earned cash into the crypto game.

Utility and real-world use cases

Folks, let’s chat about why altcoins matter in the real world. Their utility, or practical use, is a big deal when picking ones for long-term growth. Many altcoins power cool stuff like transactions, gaming, and even non-fungible tokens (NFTs).

Take Ripple (XRP), for instance, it’s all about speeding up banking payment solutions with fast international settlements. That’s a game-changer, right?

Think about how these crypto tokens solve everyday problems. Some fuel decentralized apps (dApps) or help with decentralized finance (DeFi). Others, like platforms for NFTs, open doors to digital art and collectibles.

If an altcoin tackles real needs, it’s got a shot at sticking around. So, keep your eyes on their purpose, it’s the heart of their value!

Development team and community support

Hey there, let’s chat about why the development team and community support matter so much when picking altcoins for long-term growth. A solid team behind a cryptocurrency, like the brains steering Ethereum (ETH) or Cardano (ADA), can make or break its future.

You want developers who are skilled and active, pushing updates and fixing bugs. Think of them as the builders keeping the blockchain house strong.

Now, a buzzing community is just as vital for crypto coins. It’s like having a loyal crew cheering for your favorite team. Strong community support drives projects forward, spreading the word and building trust around blockchain networks.

With insights from experts like Logan Jacoby, a financial journalist with 7 years of experience, and reviews by Michael Benninger, who has over 15 years in finance, plus Rae Hartley Beck as Deputy Editor, you can see why a passionate crowd matters for altcoin success.

Market capitalization and trading volume

Market cap reflects the total value of a cryptocurrency, determined by its price and the number of coins in circulation. For instance, Bitcoin (BTC) boasts an impressive market cap of $2.05 trillion at a price of $103,674.47.

Ethereum (ETH) stands at $315.30 billion with a price of $2,607.93, while Solana (SOL) and Binance Coin (BNB) each maintain a solid $89.13 billion, priced at $171.20 and $654.48. This figure, folks, offers a fast glimpse at a coin’s scale and influence in the crypto space.

Trading volume, on the other hand, reveals how much of a coin is exchanged daily on crypto platforms. A high volume indicates plenty of activity, like a lively marketplace full of buyers and sellers.

It’s a strong indicator of a coin’s demand and potential for sustained growth. So, when considering altcoins like ETH or SOL, look at these numbers to gauge if they’ve got the momentum to endure!

Upcoming catalysts or partnerships

Hey there, readers, let’s chat about something exciting with altcoins. Upcoming catalysts and partnerships can really boost a coin’s future in the blockchain technology space. Think of these as big events or team-ups that spark growth.

For instance, a project like Polkadot (DOT) stands out with its focus on blockchain interoperability. This means it helps different blockchains connect and work together as a Layer-0 protocol, which is a huge deal for the crypto world.

Keep an eye on news about fresh collaborations or upgrades with coins like Polkadot. These moves often signal stronger networks or new uses for decentralized apps (dapps). It’s like watching a small seed grow into a mighty tree with the right care.

So, stay tuned to crypto exchanges and updates, because a solid partnership can change the game for long-term gains!

Tokenomics and supply dynamics

Let’s chat about tokenomics and supply dynamics, folks. This is all about how a cryptocurrency’s supply works and why it matters to you as an investor. Think of it like a pie, okay? Some pies are huge with endless slices, while others are tiny and rare.

For instance, Bitcoin (BTC) has a strict cap at 21 million coins, with about 19 million already out there. That scarcity can drive value up over time, much like a limited-edition toy.

Now, compare that to something like Dogecoin (DOGE), which has an inflationary supply. New coins keep popping up, sorta like printing extra dollars, and that can dilute value. Supply dynamics, paired with mining rewards like Bitcoin’s current 6.25 BTC per block, halved every four years or so, shape a coin’s future.

So, when picking altcoins, peek at these details. They hint at whether your crypto wallet might grow or shrink down the road.

Ethereum (ETH) – The Leading Smart Contract Platform

Hey there, readers, let’s talk about Ethereum, or ETH, the major player in the crypto space. It’s the trailblazer of smart contracts, those clever digital agreements that operate automatically.

Plus, it’s the core of decentralized apps, known as dApps, influencing the future of tech. With a market cap of $315.30 billion and a price of $2,607.93 as of May 1, 2025, it’s a powerhouse in the industry.

Ethereum also dominates decentralized finance, or DeFi, with the strongest presence in the field. It operates on a Proof of Stake system, which is more energy-efficient than older approaches like Proof of Work.

But, take note, it deals with heavy network congestion and expensive transaction fees. Even with a year-over-year return of negative 42% as of April 2025, its influence on blockchain tech makes it a leading choice for many.

Cardano (ADA) – A Strong Competitor in Layer 1 Blockchains

Cardano (ADA) stands tall as a strong player among layer 1 blockchains, and it’s worth a look, folks. It operates on a decentralized blockchain using Proof of Stake, which ensures it is energy-efficient, scalable, and secure.

As of May 1, 2025, its market cap rests at an impressive $27.41 billion, with a price of $0.7761. Also, its year-over-year returns reached 57% as of April 2025, displaying significant strength in the crypto market.

Now, let’s talk about what positions Cardano, often referred to as ADA, as a competitor to giants like Ethereum (ETH). Its emphasis on sustainability and smart contracts attracts enthusiasts of decentralized apps (dapps) and decentralized finance (DeFi).

Yet, it encounters challenges with limited adoption and some murmurs about decentralization concerns. Stay tuned to this one, though, as it has the potential to make waves in the sphere of public blockchains with the right steps.

Solana (SOL) – High-Speed Blockchain for DeFi and NFTs

Solana (SOL) is a speedy blockchain making waves for DeFi and NFTs. It handles around 65,000 transactions per second using its Proof of History system. That’s lightning fast, folks! Plus, with fees as low as $0.00025, it’s a bargain compared to other networks.

As of May 1, 2025, its market cap sits at $89.13 billion, with a price of $171.20. Talk about a heavy hitter in the crypto game!

One snag, though, is its limited connection with Ethereum (ETH), which can be a hurdle. Also, Solana has faced some network outages in the past, causing headaches for users. Still, its year-over-year returns of 9% as of April 2025 show promise for growth.

If you’re into decentralized finance (DeFi) or non-fungible tokens (NFTs), keep this blockchain on your radar. It’s built for speed and innovation in the wild world of crypto assets!

Ripple (XRP) – Revolutionizing Cross-Border Payments

Hey there, let’s chat about Ripple, or XRP, a big player in the crypto game. It’s all about making cross-border payments faster and cheaper, especially for banks. With a market cap of $141.33 billion and a price of $2.41 as of May 1, 2025, XRP is focused on speedy international settlements.

Imagine sending money across the world in seconds, not days, that’s the magic Ripple brings through the XRP Ledger.

Now, here’s the flip side, folks. Ripple isn’t fully decentralized like some other coins, and it’s got an ongoing legal tussle with the SEC. Still, with a year-over-year return of 7.61% as of April 2025, it’s catching eyes.

If you’re into cryptocurrency volatility or looking at fiat currencies, keep XRP on your radar for its banking solutions. Stick it in your crypto wallet and watch how it plays out!

Polkadot (DOT) – The Future of Blockchain Interoperability

Polkadot (DOT) stands out as a game-changer in the crypto space. It’s a layer-0 protocol that focuses on blockchain interoperability, letting different blockchains talk to each other.

Imagine it as a big bridge, connecting isolated islands of decentralized apps (dApps) and networks. With a market cap of $7.72 billion and a price of $4.88 as of May 1, 2025, it shows solid investor interest.

This setup makes it super developer-friendly, opening doors for new ideas in decentralized finance (DeFi) and beyond.

Still, Polkadot faces some hurdles worth noting. It’s up against tough competition from other platforms vying for the same spot. Plus, the blockchain slots on its network can cost a pretty penny, which might slow down smaller projects.

Despite that, its focus on linking blockchains could shape the future of how non-fungible tokens (NFTs) and smart contracts work across systems. Keep an eye on DOT if you’re curious about the next big leap in crypto connections!

Avalanche (AVAX) – A Scalable and Energy-Efficient Network

Hey folks, let’s chat about Avalanche, or AVAX, a blockchain that’s making waves with its speed and eco-friendly vibe. It’s built to handle thousands of transactions per second, which is pretty darn fast.

Plus, as of May 1, 2025, its market cap sits at a cool $9.90 billion with a price of $23.68. That’s a solid spot in the crypto world, showing it’s got real potential for growth.

Now, what makes AVAX stand out is how developer-friendly it is, perfect for creating decentralized apps, or dApps, in areas like decentralized finance, known as DeFi, and non-fungible tokens, or NFTs.

The downside? It faces stiff competition from other networks, and the staking requirements can be a bit high for some users. Still, if you’re eyeing a scalable platform with a green edge, AVAX might just catch your interest in this wild crypto ride.

Chainlink (LINK) – Essential Oracle Solution for Smart Contracts

Chainlink (LINK) stands out as a key player in the crypto space. It acts as a bridge, connecting smart contracts on platforms like Ethereum (ETH) to real-world data. Think of it as a trusty messenger, fetching info like prices or weather for decentralized apps (DApps).

Without it, these apps would be stuck guessing. Pretty neat, right?

This project solves a big problem for decentralized finance (DeFi) and beyond. With over 9,000 cryptocurrency projects out there as of March 2024, Chainlink’s role in linking blockchains to outside data keeps it vital.

Its focus on security and real-world use cases, from transactions to NFTs, makes it a solid pick for long-term growth. Wanna know more about its impact? Stick around!

Stellar (XLM) – Facilitating Global Financial Inclusion

Stellar, known as XLM, is a cryptocurrency built to make money transfers easy across the globe. It focuses on financial inclusion, helping people in underserved areas access banking services.

Imagine sending cash as fast as a text message, even to far-off places. That’s the magic Stellar brings with low fees and quick transactions.

Think of it like a bridge connecting different currencies, from U.S. dollars to euros. With over 9,000 crypto projects out there as of March 2024, Stellar stands out for its real-world use.

It powers transactions and partnerships that aim to lift communities. Plus, its network supports various platforms, making it a key player in the crypto wallet and decentralized finance (DeFi) space.

Toncoin (TON) – Innovative Blockchain for Gaming and Web3

Hey there, let’s talk about Toncoin, or TON, an impressive contender in the crypto space. It’s designed to support gaming and Web3 projects with incredible speed. Envision a blockchain that processes transactions instantly, ideal for in-game purchases or decentralized apps, also known as dapps.

With over 9,000 cryptocurrency projects out there as of March 2024, TON shines for these practical applications.

Now, imagine you’re gaming or exploring Web3 platforms, and TON ensures everything runs seamlessly. Its emphasis on non-fungible tokens, known as NFTs, brings added value for creators and players.

Take a look at its market capitalization and security as well, since those are key for any crypto choice. Stay with me to discover how TON could elevate your crypto experience!

Strategies for Maximizing Long-Term Gains with Altcoins

Hey there, want to grow your crypto stash over the long haul? Stick with me, and let’s chat about some smart moves to boost those gains!

Staking and earning passive income

Staking your altcoins can be a smart move to grow your crypto stash without much effort. Think of it as putting your money in a savings account, but instead, you’re locking up coins like Ethereum (ETH) or Cardano (ADA) in a crypto wallet to support the network.

In return, you earn rewards, often more coins, just for helping out. It’s a neat way to make your holdings work for you.

Want in on this? Many altcoins tied to decentralized finance (DeFi) or smart contracts let you stake and grab those extra gains. Since cryptocurrencies are taxed as capital assets, keep track of your earnings for tax time.

With Bitcoin capped at 21 million coins and about 19 million already out there, altcoins offer a fresh path to build wealth. Jump into staking, and watch your portfolio grow!

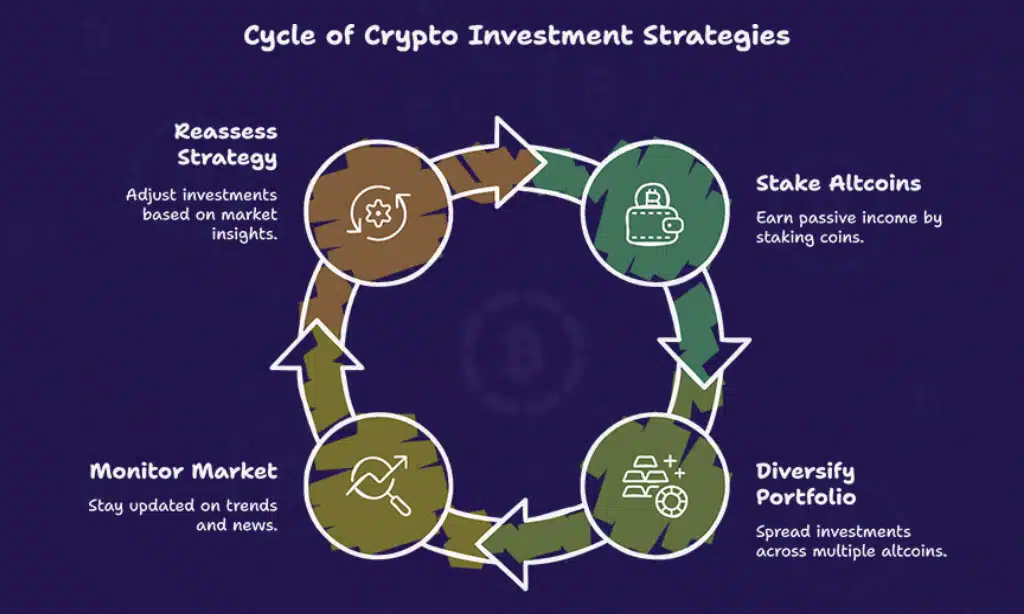

Diversifying across multiple altcoins

Hey there, let’s chat about spreading your bets in the crypto game. Diversifying across multiple altcoins, like Ethereum (ETH), Cardano (ADA), and Solana (SOL), can cut down your risks.

With over 9,000 cryptocurrency projects out there as of March 2024, you’ve got plenty of picks. Don’t put all your eggs in one basket, right?

Mixing it up helps balance out the wild swings of cryptocurrency volatility. Grab a few coins with solid market capitalization and real use cases, such as smart contracts or decentralized finance (DeFi).

Check their liquidity and security too. This way, if one coin stumbles, others might hold strong, keeping your crypto wallet safer.

Monitoring market trends and news updates

Keeping an eye on market trends and news is a must for any crypto investor. You’ve got to stay in the loop, folks, because the crypto world moves fast, like a roller coaster on steroids.

Check platforms like CoinMarketCap or CoinGecko daily for price shifts in coins like Bitcoin (BTC), which saw a solid 52% year-over-year return as of April 2025, while Ethereum (ETH) dropped a hefty 42%.

Those numbers can signal big changes, so don’t sleep on them.

Also, news about partnerships or updates can shake things up. Think of Ripple (XRP) and its focus on banking payment solutions for fast international settlements. A single headline about a new bank deal could spike its value overnight.

Follow crypto news on X or subscribe to newsletters to catch these tidbits. Staying sharp with trends in decentralized finance (DeFi) or non-fungible tokens (NFTs) helps you spot the next big wave before it crashes.

Crypto FAQs for Long-Term Investors

Hey there, got questions about holding altcoins for the long haul? Let’s chat about the key stuff, and dig deeper into what matters for your crypto journey!

How do altcoins differ from Bitcoin?

Bitcoin stands as the original cryptocurrency, with a fixed supply of 21 million coins, and about 19 million already in circulation. Altcoins, on the other hand, are every other digital coin besides Bitcoin, like Ethereum (ETH), Cardano (ADA), and Solana (SOL).

They often aim to do more than just be digital cash, exploring areas like smart contracts and decentralized apps (dapps).

Think of Bitcoin as the pioneer of crypto, focusing on being a store of value. Altcoins, though, pursue varied objectives, addressing concepts like decentralized finance (DeFi) or non-fungible tokens (NFTs).

Ethereum, the leading altcoin, excels with its platform for building apps, demonstrating how these coins expand beyond Bitcoin’s fundamental structure.

What are the risks of investing in altcoins?

Investing in altcoins can be a wild ride, folks. The biggest headache? Price volatility. These coins, unlike Bitcoin (BTC) or Ethereum (ETH), often swing hard in value, and you might see your funds shrink fast.

Scams also lurk around every corner. Fake projects pop up, promising big gains, only to vanish with your cash. It’s like chasing a ghost in a foggy field.

Then, there’s the issue of regulations, which can hit hard. Governments might crack down on crypto, messing with your plans. Plus, energy consumption for some altcoins, tied to proof-of-work systems, is sky-high, raising eco concerns.

Market trends reflect this chaos too, dragging prices down in a bear market. So, tread carefully with your crypto wallet, and watch for red flags in decentralized finance (DeFi) or non-fungible tokens (NFTs).

Takeaways

Hey there, we’ve just explored some exciting altcoins with big potential for long-term growth. Think of this as planting seeds in a garden of digital cash, hoping for a hefty harvest.

Got your eye on Ethereum or maybe Solana? Keep watching these coins, and stay curious about market shifts. Let’s chat more about crypto in the comments, alright!

FAQs on Top Altcoins to Watch for Long-Term Growth

1. What are the top altcoins to watch for long-term growth, buddy?

Well, keep an eye on Ethereum (ETH), Solana (SOL), Cardano (ADA), and Binance Coin (BNB). They’re tied to cool stuff like smart contracts and decentralized apps (dApps), which could mean big capital gains down the road.

2. Why should I care about Cardano (ADA) in this crypto jungle?

Because Cardano runs on a solid decentralized blockchain, it’s got a knack for supporting decentralized finance (DeFi). It’s like a sturdy ship in the stormy sea of cryptocurrency volatility. Plus, its consensus mechanism is built for lasting value, so it’s worth a peek.

3. How does Ethereum (ETH) stand out among altcoins, my friend?

Ethereum isn’t just a coin, it’s the backbone of decentralized applications and non-fungible tokens (NFTs). It’s like the Swiss Army knife of crypto, always handy for something new.

4. Is Dogecoin (DOGE) or Shiba Inu (SHIB) a serious bet, or just a laugh?

Hey, these meme coins like Dogecoin and Shiba Inu can spike faster than a jackrabbit, but watch out for the drop. They’re fun, tied to wild market moves, not solid stuff like smart contracts or DeFi. So, toss a few bucks in a crypto wallet, but don’t bet the farm.

5. What’s the deal with Solana (SOL), and why’s it buzzing?

Solana’s a speed demon for decentralized finance (DeFi) and dApps, rivaling even Ethereum. It’s like a racecar in the crypto world, zooming past slower coins.