Traveling in 2025 comes with its own set of uncertainties, and having robust travel insurance is essential for peace of mind. While many travelers invest in insurance, few truly understand how to maximize its benefits.

This comprehensive guide will provide actionable insights on how to make the most out of your travel insurance and ensure you’re protected from unexpected situations during your trips.

These tips to maximize your travel insurance benefits will save you time, money, and stress while traveling.

Understanding Travel Insurance Benefits

Why Travel Insurance is Essential

Travel insurance offers crucial protection for a variety of unforeseen circumstances that can disrupt your trip. Here are some key reasons why it is indispensable:

- Covers unforeseen events like cancellations, medical emergencies, and lost luggage.

- Provides financial security during travel mishaps.

- Offers peace of mind knowing you have a safety net while traveling.

Real-World Example:

A family’s dream vacation to Bali was cut short when one member fell ill and needed immediate hospitalization. Travel insurance covered the hefty medical bills, allowing them to focus on recovery without financial stress. This highlights the importance of understanding tips to maximize your travel insurance benefits.

Key Features of a Comprehensive Travel Insurance Plan

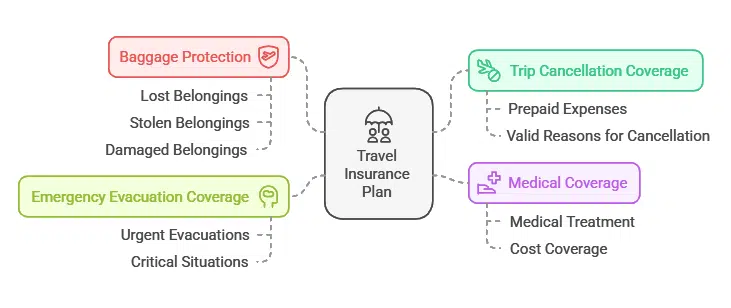

Understanding the features of a travel insurance plan is the first step to maximizing your benefits. A robust plan typically includes:

- Trip Cancellation Coverage: Protects prepaid expenses if you have to cancel due to valid reasons.

- Medical Coverage: Ensures you get treated without worrying about costs.

- Baggage Protection: Covers lost, stolen, or damaged belongings.

- Emergency Evacuation Coverage: Assists with urgent medical evacuations in critical situations.

| Feature | What It Covers | Why It’s Important |

| Trip Cancellation | Refund for canceled flights or bookings | Protects prepaid expenses |

| Medical Coverage | Costs for accidents or illnesses during travel | Avoids high medical bills |

| Baggage Protection | Lost, stolen, or damaged luggage | Covers valuable belongings |

| Emergency Evacuation | Transportation to nearest medical facility | Saves lives in critical emergencies |

7 Tips to Maximize Your Travel Insurance Benefits in 2025

In 2025, travel insurance can provide crucial protection, but it’s important to know how to maximize its value.

Here are seven tips to ensure you get the most out of your travel insurance coverage:

Tip 1: Compare Multiple Policies Before Purchase

Before purchasing travel insurance, explore multiple options to find a policy that best suits your needs.

Comparing plans ensures you get the right coverage at the best price and helps you implement tips to maximize your travel insurance benefits effectively.

Factors to Compare

To ensure you get the best policy, compare the following elements:

- Coverage limits.

- Premium costs.

- Exclusions and fine print.

- Customer reviews and claim success rates.

Tools to Use

Modern technology makes it easy to compare policies. Consider using:

- Online insurance comparison platforms.

- Mobile apps that evaluate policies in real-time and provide recommendations.

| Comparison Tool | Features | Benefits |

| Online Platforms | Policy reviews, side-by-side comparison | Saves time and ensures informed choice |

| Mobile Apps | Real-time updates, customization options | Easy access and user-friendly |

Additional Insight:

Many insurers offer free online calculators to estimate premium costs based on your specific needs. Use these tools to avoid overpaying and follow tips to maximize your travel insurance benefits.

Tip 2: Customize Your Coverage

Tailor Policies Based on Your Trip

Not all trips are the same, and your travel insurance should reflect that. Here’s how to customize your policy:

- Add adventure sports coverage if you’ll be skiing, scuba diving, or engaging in other high-risk activities.

- Opt for extended medical coverage for longer trips or destinations with high healthcare costs.

- Include rental car insurance if you plan to drive.

Example

Scenario: Sarah plans a month-long trip to Europe, including skiing in the Alps. She customized her policy to include adventure sports and extended medical coverage, ensuring she’s fully protected. This personalization is a prime example of tips to maximize your travel insurance benefits.

| Customization Option | Ideal For | Benefit |

| Adventure Sports | High-risk activities (e.g., skiing, scuba diving) | Covers injuries and accidents |

| Extended Medical | Long-term trips or high-cost destinations | Avoids large out-of-pocket expenses |

| Rental Car Insurance | Trips with driving plans | Covers damage or theft of rental cars |

Tip 3: Understand Exclusions

Common Exclusions to Watch For

Being aware of what your policy doesn’t cover can save you from unpleasant surprises. Common exclusions include:

- Pre-existing medical conditions.

- High-risk activities without specific add-on coverage.

- Losses due to negligence or lack of proper documentation.

How to Avoid Surprises

- Carefully read the policy document before purchasing.

- Ask your insurer for clarification on unclear clauses or exclusions.

| Exclusion Type | Example | How to Mitigate |

| Pre-existing Conditions | Chronic illnesses | Declare upfront and get coverage add-on |

| High-risk Activities | Skydiving | Add specific coverage |

Real-Life Tip:

A traveler’s claim for lost baggage was denied because they couldn’t provide a purchase receipt for the items. Always retain proof of purchase for valuable belongings. Such insights emphasize tips to maximize your travel insurance benefits by being prepared.

Tip 4: Keep Documentation Handy

Essential Documents to Carry

Keeping necessary documents readily available ensures smooth claim processing. Always carry:

- Policy details and claim forms.

- Copies of receipts for prepaid expenses, medical treatments, or lost items.

- Emergency contact numbers for your insurer.

| Document Type | Why It’s Needed |

| Policy Details | Quick reference for claims and coverage |

| Receipts | Proof of expenses for reimbursement |

| Emergency Contacts | Immediate assistance in emergencies |

Pro Tip:

Digitize all your documents and store them securely in cloud storage for instant access during your trip. This is one of the practical tips to maximize your travel insurance benefits.

Tip 5: File Claims Promptly

Step-by-Step Guide to Filing Claims

Delaying your claim can lead to rejection. Follow these steps for a successful claim:

- Notify your insurer immediately after the incident.

- Gather and submit all required documentation, including receipts and photos if applicable.

- Maintain regular communication with your insurer to track the claim’s progress.

Example

Scenario: After losing his luggage on an international flight, John immediately contacted his insurer, submitted receipts for essential items he purchased, and received reimbursement within a week. Timely action aligns with tips to maximize your travel insurance benefits.

| Filing Step | Why It Matters |

| Immediate Notification | Prevents delays in claim processing |

| Complete Documentation | Ensures smooth and successful claims |

| Regular Follow-ups | Keeps the insurer accountable |

Tip 6: Leverage Technology for Easy Management

Benefits of Digital Insurance Platforms

Digital tools have revolutionized how we manage travel insurance. Some advantages include:

- Instant access to policy details and claim tracking.

- Automated reminders for premium payments.

- Easy uploading of documents for faster processing.

Recommended Apps

Explore these apps for better travel insurance management:

- Apps that provide live chat support.

- Platforms that allow real-time policy updates and digital claims filing.

| App Name | Features | Benefits |

| TravelProtect | Live chat, document uploads | Simplifies claims process |

| InsureMe | Real-time tracking, reminders | Streamlines policy management |

Data Insight:

According to a 2025 report, over 70% of travel insurance claims are processed faster when submitted via mobile apps. Utilizing these tools is key to tips to maximize your travel insurance benefits.

Tip 7: Review Your Policy Annually

Reasons to Review Regularly

Your travel habits may change over time, and so should your insurance coverage. Regular reviews help:

- Update coverage based on new travel plans or destinations.

- Take advantage of new offers or improved benefits from your insurer.

- Ensure continued compliance with the latest travel regulations.

| Review Aspect | Why It Matters |

| Coverage Limits | Ensures adequate protection |

| New Offers | Access to better benefits |

| Compliance | Avoids policy voidance due to outdated terms |

Takeaways

Travel insurance is a critical aspect of stress-free travel in 2025. By implementing these 7 tips to maximize your travel insurance benefits, you can ensure comprehensive protection, avoid unnecessary financial burdens, and make informed decisions for every journey.

Whether it’s customizing your coverage, understanding exclusions, or leveraging technology, each step helps you unlock the full potential of your policy. Don’t just buy travel insurance—take charge of it, adapt it to your unique travel needs, and experience the peace of mind that comes with being thoroughly prepared for any unforeseen circumstances.

Travel smart, stay secure, and enjoy your adventures knowing you’re fully protected.