The world of cryptocurrency offers exciting opportunities for investors, traders, and businesses. However, navigating the complex web of crypto laws and regulations can be daunting. Compliance is no longer optional — it’s a necessity.

With governments worldwide implementing stricter regulations, staying compliant ensures your operations remain legal and builds trust with clients, partners, and stakeholders.

Here are the top 10 tips for staying compliant with crypto laws to help you succeed in this dynamic landscape.

Why Crypto Compliance Is Crucial

Understanding the Need for Regulation in Crypto

Cryptocurrencies operate in a decentralized and largely unregulated environment. While this provides freedom and innovation, it also opens the door to fraud, money laundering, and other illicit activities.

Regulatory bodies aim to protect consumers, maintain market integrity, and prevent criminal misuse of crypto assets.

Risks of Non-Compliance

Failing to comply with crypto laws can have severe consequences. These include hefty financial penalties, legal action, loss of business licenses, and reputational damage.

Moreover, non-compliance can lead to frozen accounts and a loss of investor confidence, jeopardizing your business’s future.

Common Risks of Non-Compliance

| Risk Type | Description |

| Financial Penalties | Heavy fines for violating crypto regulations. |

| Legal Consequences | Lawsuits and potential imprisonment. |

| Reputational Damage | Loss of trust from clients and stakeholders. |

| Operational Disruptions | Frozen accounts or shutdown of operations. |

Top 10 Tips for Staying Compliant With Crypto Laws

Staying compliant with crypto laws has become an essential practice for anyone involved in the crypto space.

With regulations evolving rapidly across the globe, understanding the legal framework is vital for avoiding potential risks and penalties.

Whether you are a trader, investor, or business owner, staying informed and proactive ensures your operations remain lawful and your reputation stays intact.

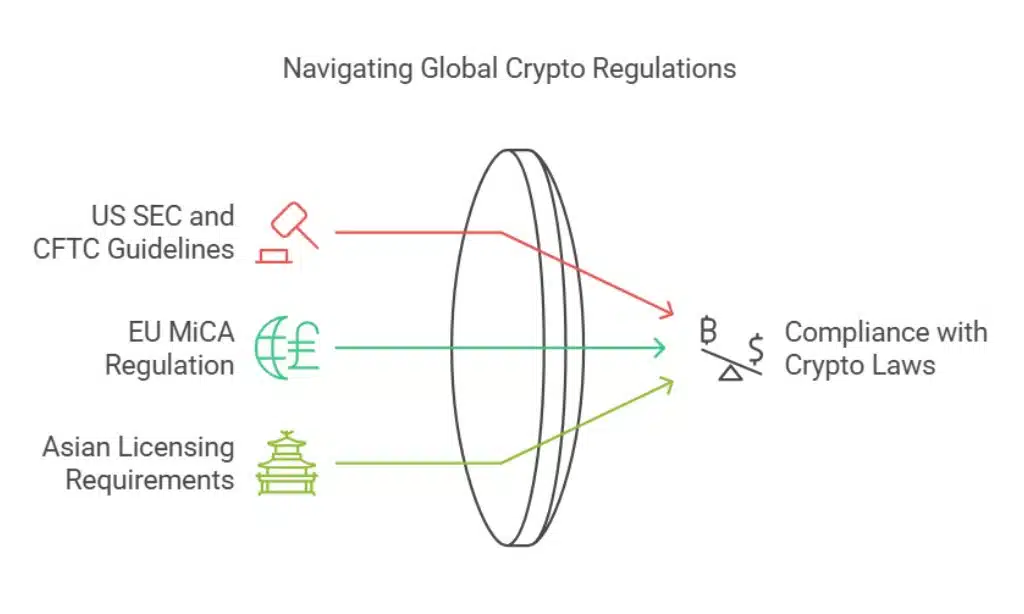

1. Stay Updated on Local and Global Crypto Laws

Crypto regulations vary significantly across countries and regions. Staying informed about these laws is one of the most essential tips for staying compliant with crypto laws. For example:

- In the United States, entities must adhere to SEC and CFTC guidelines.

- The EU enforces the MiCA (Markets in Crypto-Assets) regulation.

- Many Asian countries, like Japan, have specific licensing requirements for crypto businesses.

Practical Tip: Set up Google Alerts for keywords like “crypto regulations” or subscribe to newsletters from reputable crypto legal advisors to ensure you’re always up to date.

Examples of Key Crypto Regulatory Bodies

| Region | Regulatory Body | Key Focus |

| United States | SEC, CFTC, FinCEN | Securities, commodities, AML |

| European Union | ESMA, MiCA | Crypto asset classification, taxes |

| Japan | Financial Services Agency (FSA) | Licensing, consumer protection |

| Singapore | Monetary Authority of Singapore (MAS) | Licensing, AML/KYC |

2. Register Your Crypto Business With Regulatory Authorities

Most jurisdictions require crypto businesses to register with financial regulatory bodies. This registration often involves obtaining a license to operate legally.

Compliance starts with understanding what licenses apply to your business activities, whether it’s trading, wallet services, or providing DeFi platforms.

Examples:

- The Financial Conduct Authority (FCA) in the UK mandates registration for crypto asset firms.

- In the US, FinCEN requires crypto exchanges to register as Money Service Businesses (MSBs).

Key Insight: Registration demonstrates your commitment to transparency and adherence to local laws, building trust with users and regulators alike.

Key Steps for Crypto Business Registration

| Step | Description |

| Identify Applicable License | Determine the specific license you need. |

| Prepare Documentation | Compile business registration and compliance records. |

| Submit Application | File the application with the regulatory body. |

| Renewal and Monitoring | Keep track of renewal dates and compliance updates. |

3. Implement Strong Anti-Money Laundering (AML) Policies

Anti-Money Laundering (AML) policies help detect and prevent illegal financial activities. Governments worldwide enforce strict AML compliance requirements for crypto firms. A robust AML framework includes:

- Conducting risk-based assessments to identify vulnerable areas.

- Monitoring transactions for suspicious patterns.

- Filing Suspicious Activity Reports (SARs) with relevant authorities.

Example: The US Treasury’s Office of Foreign Assets Control (OFAC) requires crypto firms to block transactions with sanctioned individuals or entities.

Actionable Tips:

- Integrate AML software like CipherTrace for efficient compliance.

- Conduct regular audits to ensure all AML protocols are followed.

Core Components of AML Compliance

| Component | Description |

| Risk Assessment | Evaluating transaction and customer risks. |

| Transaction Monitoring | Real-time analysis for suspicious activities. |

| Reporting Requirements | Filing SARs and ensuring timely reporting. |

| Training and Education | Ensuring staff is aware of AML best practices. |

4. Conduct Regular Know Your Customer (KYC) Checks

Know Your Customer (KYC) is a cornerstone of compliance. It involves verifying the identity of customers to prevent fraud and illegal activity.

Key Details:

- Government-issued ID and proof of address are typically required.

- Advanced verification methods like biometrics can enhance security.

- Regular audits ensure KYC data stays up to date.

Example: Binance, a leading crypto exchange, requires all users to complete KYC verification before accessing trading features.

Documents Required for KYC Verification

| Document Type | Examples |

| Identification | Passport, Driver’s License |

| Proof of Address | Utility Bill, Bank Statement |

| Additional Verification | Selfie or Biometric Scan |

5. Use Secure and Transparent Blockchain Practices

Transparency and security are vital for compliance. Choose blockchain solutions that offer:

- Immutable and auditable transaction records.

- Privacy features that don’t compromise regulatory requirements.

Example: Ethereum’s public ledger allows transactions to be audited, while privacy-focused solutions like zk-SNARKs ensure user confidentiality within compliant boundaries.

Practical Advice: Use platforms like Chainalysis to integrate transparency and monitoring capabilities into your blockchain operations.

Benefits of Transparent Blockchain Practices

| Feature | Compliance Benefit |

| Auditability | Facilitates regulatory inspections. |

| Transparency | Builds trust with users and regulators. |

| Privacy Integration | Balances user confidentiality and compliance. |

6. Stay Informed About Taxation Laws

Taxation laws for cryptocurrencies can be complex and vary by jurisdiction. Ensure you understand how to:

- Report crypto gains and losses accurately.

- Pay taxes on earnings from trading, staking, or mining.

Example: In the US, crypto is taxed as property, requiring capital gains reporting for every transaction.

Practical Tip: Keep detailed records of all trades and use tools like TokenTax to simplify tax filing.

Common Crypto Taxation Scenarios

| Activity | Tax Treatment |

| Trading | Capital gains or losses on profits. |

| Mining Rewards | Taxed as ordinary income. |

| Staking Rewards | Treated as income and taxed accordingly. |

7. Partner With a Crypto Compliance Expert

Navigating crypto laws can be overwhelming. Hiring a compliance expert or legal advisor ensures your business meets all regulatory requirements. Look for specialists with experience in:

- International crypto regulations.

- AML/KYC implementation.

- Tax compliance.

Case Study: Kraken, a prominent crypto exchange, partnered with legal experts to navigate international regulations, ensuring smooth operations across multiple jurisdictions.

Actionable Tip: When hiring a compliance expert, ensure they have certifications like CAMS (Certified Anti-Money Laundering Specialist).

8. Maintain Accurate and Up-to-Date Records

Accurate recordkeeping is essential for audits and reporting. Maintain detailed logs of:

- Transactions and wallet addresses.

- Customer identities and verification data.

- Tax-related documents.

Practical Tip: Use crypto accounting software like QuickBooks or CoinLedger for streamlined record management.

Record Types to Maintain

| Record Type | Purpose |

| Transaction Logs | Audit trail and tax reporting. |

| KYC Records | Compliance with identity verification laws. |

| Financial Statements | Tax filing and operational transparency. |

9. Monitor and Report Suspicious Transactions

Reporting unusual or suspicious activity is a legal obligation in many jurisdictions. Red flags may include:

- Large, unexplained transactions.

- Transfers involving high-risk regions.

Example: Coinbase’s automated systems flag high-risk transactions for further review.

Practical Tip: Automate transaction monitoring with tools like Elliptic or Chainalysis.

Red Flags in Crypto Transactions

| Red Flag | Description |

| Large Transactions | Significant amounts with no clear source. |

| High-Risk Regions | Transactions involving sanctioned countries. |

| Repeated Small Transfers | Possible structuring to avoid detection. |

10. Educate Your Team and Stakeholders

Ongoing education is vital for maintaining compliance. Regularly train your team on:

- New regulatory developments.

- Best practices for AML/KYC.

- Proper use of compliance tools.

Example: Regular workshops at Binance ensure employees are updated on the latest compliance practices.

Actionable Tip: Leverage online courses from platforms like Coursera or specialized certifications to keep your team informed.

How to Adapt to Changing Crypto Regulations

Staying Agile in a Dynamic Regulatory Environment

Crypto laws evolve rapidly. To stay ahead:

- Monitor regulatory updates through trusted sources.

- Attend industry conferences and webinars.

- Join crypto industry associations.

Practical Tip: Dedicate a compliance officer or team to track changes and update internal policies accordingly.

Leveraging Technology for Compliance

Compliance technology can significantly ease the burden of meeting regulatory requirements. Tools like TRM Labs and ComplyAdvantage offer comprehensive solutions for transaction monitoring, KYC/AML, and fraud detection.

Top Compliance Tools for Crypto Firms

| Tool | Functionality |

| TRM Labs | Risk management and transaction monitoring. |

| ComplyAdvantage | Real-time AML screening and risk assessment. |

| Chainalysis | Blockchain analysis and transaction tracking. |

Takeaways

Remaining compliant with crypto laws is not just about avoiding penalties. It’s a way to build trust, ensure long-term success, and contribute to the legitimacy of the crypto industry.

By implementing these top 10 tips for staying compliant with crypto laws, you can navigate the complex regulatory landscape with confidence and focus on growing your crypto business.

Compliance is an ongoing process, and staying proactive in adapting to changes ensures your business thrives in the evolving world of cryptocurrency.