Buying your first home in Canada is an exciting milestone, but it can also feel overwhelming. The Canadian real estate market is diverse and competitive, with varying trends across provinces, fluctuating property prices, and an array of financing options.

For first-time buyers, navigating these complexities requires careful planning and informed decision-making.

This guide on “Tips for First-Time Property Buyers in Canada” will provide you with actionable advice to make your home-buying journey smoother and more rewarding.

From understanding mortgage options to saving for a down payment and avoiding common pitfalls, this comprehensive article covers everything you need to know to confidently step into the Canadian property market.

Understanding the Canadian Real Estate Market

The Canadian real estate market is influenced by several factors, including economic conditions, population growth, and government policies.

Urban centers like Toronto and Vancouver often have higher property prices, while rural areas offer more affordable options.

In 2025, we’re seeing increased interest in smaller cities due to remote work opportunities and the rising cost of living in metropolitan areas.

Moreover, government programs aimed at first-time buyers are reshaping demand patterns.

Regional Variations to Consider

Each province in Canada has unique characteristics and pricing structures.

For instance, homes in Atlantic Canada are generally more affordable than those in Ontario or British Columbia.

Consider factors like climate, job opportunities, and future growth prospects when choosing a location.

Average Home Prices by Province (2025)

| Province | Average Home Price (CAD) | Key Highlights |

| Ontario | $940,000 | High demand in Toronto and suburbs. |

| British Columbia | $1,020,000 | Expensive due to Vancouver’s popularity. |

| Alberta | $430,000 | Affordable with growing urban hubs. |

| Quebec | $480,000 | Mix of urban and rural affordability. |

| Nova Scotia | $380,000 | Rising interest in coastal properties. |

| Saskatchewan | $330,000 | Stable and affordable options. |

10 Tips for First-Time Property Buyers in Canada

1. Set a Realistic Budge

Your budget is the foundation of your home-buying journey. As a rule of thumb, your housing costs should not exceed 30% of your gross monthly income.

Beyond the purchase price, account for additional expenses such as property taxes, insurance, and ongoing maintenance.

Preparing a detailed financial plan will save you from potential financial stress down the line.

These essential “Tips for First-Time Property Buyers in Canada” will ensure you remain financially stable while achieving your dream.

Practical Advice: Begin by listing your current income and monthly expenses. Identify areas where you can cut costs and redirect funds towards your housing budget. Consider future expenses, such as furnishing and utility bills, in your calculations.

Key Budgeting Components

| Expense Type | Estimated Cost (CAD) | Notes |

| Mortgage Payments | Varies (based on rate) | Ensure it aligns with your income. |

| Property Taxes | 0.5% – 2.5% of home value | Depends on the province. |

| Insurance | $800 – $1,500 annually | Coverage for home and belongings. |

| Maintenance | $1,000+ annually | For repairs and upkeep. |

2. Understand Mortgage Options

Mortgages in Canada come in various types, and understanding them is crucial for first-time buyers.

The right choice depends on your financial stability and risk tolerance. Following “Tips for First-Time Property Buyers in Canada” like exploring mortgage options will help you make a confident decision.

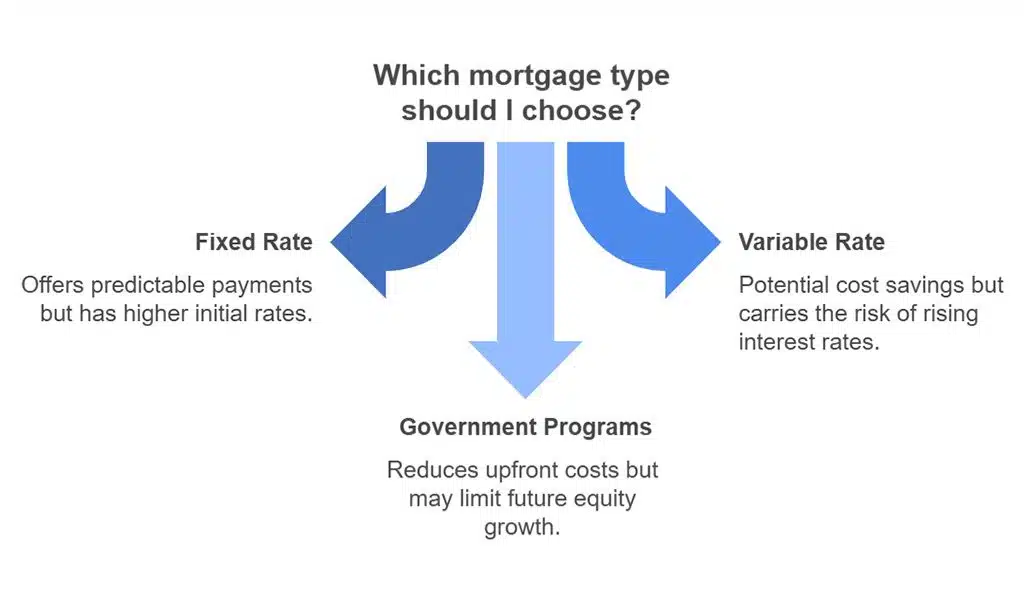

Fixed vs. Variable Rate Mortgages

- Fixed Rate: Offers predictable payments, ideal for buyers who prefer stability and long-term planning.

- Variable Rate: Payments fluctuate with market interest rates, which can be advantageous if rates drop.

Government-Backed Programs

- The First-Time Home Buyer Incentive (FTHBI) provides shared equity with the government to lower monthly mortgage costs.

- The Home Buyers’ Plan (HBP) allows you to withdraw up to $35,000 from your RRSP to use as a down payment.

Example: Sarah, a Toronto-based graphic designer, chose a fixed-rate mortgage to lock in stable monthly payments, while leveraging the FTHBI to reduce her overall borrowing.

Mortgage Comparison

| Mortgage Type | Pros | Cons |

| Fixed Rate | Predictable payments | Higher initial rates. |

| Variable Rate | Potential cost savings | Risk of rising interest rates. |

| Government Programs | Reduces upfront costs | May limit future equity growth. |

3. Prioritize Location

Location significantly impacts property value and quality of life. Assess factors like proximity to work, schools, public transport, and local amenities.

Neighborhood features like walkability and safety are also crucial. Among the “Tips for First-Time Property Buyers in Canada,” prioritizing the right location is often a game-changer for long-term satisfaction.

Checklist for Evaluating a Neighborhood:

- Walkability to shops and services.

- Crime rates and community safety.

- Future development plans that could enhance or hinder the area.

- Access to healthcare, schools, and recreational facilities.

Example: A young couple in Montreal prioritized areas near public transit and green spaces, ensuring convenience and a higher resale value.

4. Save for a Down Payment

Saving for a down payment is one of the biggest challenges for first-time property buyers in Canada.

A larger down payment can reduce your monthly mortgage costs and make you a more attractive buyer.

This is one of the crucial “Tips for First-Time Property Buyers in Canada” to help you prepare financially.

Tips to Save Faster:

- Automate monthly savings into a high-interest account.

- Cut unnecessary expenses, like dining out, to allocate funds towards your goal.

- Explore provincial grants and incentives for first-time buyers.

Savings Timeline

| Monthly Savings (CAD) | Time Needed for $25,000 Down Payment |

| $500 | 50 months (4 years, 2 months) |

| $1,000 | 25 months (2 years, 1 month) |

5. Get Pre-Approved for a Mortgage

Pre-approval not only clarifies your budget but also demonstrates to sellers that you are a serious buyer.

It also helps lock in an interest rate for a certain period. Following “Tips for First-Time Property Buyers in Canada,” getting pre-approved ensures you’re prepared for a competitive market.

Steps to Get Pre-Approved:

- Gather financial documents, including proof of income and credit history.

- Compare lenders to find the best rates and terms.

- Submit your application and await approval.

Example: John, a Calgary-based engineer, found his dream home but faced competition from other buyers. His mortgage pre-approval gave him an edge by proving his financial readiness.

6. Hire the Right Professionals

Navigating the home-buying process is much easier with the right team. Among the “Tips for First-Time Property Buyers in Canada,” building a team of experts ensures your interests are protected.

Real Estate Agent: Choose someone with local market knowledge and strong negotiation skills. Lawyer: Ensure the legalities of your purchase are handled correctly, including title searches and contract reviews.

Example: Emma, a Vancouver resident, avoided a costly legal oversight thanks to her lawyer’s thorough review of her property contract.

7. Research the Local Market

Understanding market trends helps you make informed decisions about when and where to buy.

Use real estate websites, consult local agents, and stay updated with market reports to identify the best opportunities.

“Tips for First-Time Property Buyers in Canada” emphasize market research as an essential step.

Example: Maria, a teacher in Halifax, used online tools to track property prices for six months, helping her find a home during a buyer-friendly market dip.

Tools for Market Research

| Tool | Purpose | Examples |

| Real Estate Websites | Track listings and pricing trends | Realtor.ca, Zillow |

| Market Reports | Analyze trends and forecasts | CMHC Market Reports |

| Local Experts | Gain area-specific insights | Real estate agents, brokers |

8. Consider Resale Value

When purchasing a property, think long-term about its resale potential. Features such as a good location, modern design, and energy efficiency can significantly impact your home’s value over time.

Incorporating “Tips for First-Time Property Buyers in Canada,” always evaluate resale potential before purchasing.

Tips to Boost Resale Value:

- Prioritize properties in growing neighborhoods.

- Look for homes with timeless designs and versatile layouts.

- Invest in upgrades like energy-efficient appliances.

Example: Liam bought a small home in Winnipeg with solar panels and an open floor plan, later selling it for 20% more than comparable properties in the area.

Key Features Enhancing Resale Value

| Feature | Impact on Resale Price |

| Location | High (proximity to amenities) |

| Energy Efficiency | Moderate to High |

| Modern Upgrades | High (kitchens, bathrooms) |

9. Inspect the Property Thoroughly

A thorough property inspection ensures there are no hidden issues that could cost you later.

Engage a licensed inspector to evaluate structural integrity, plumbing, and electrical systems. Following “Tips for First-Time Property Buyers in Canada,” never skip a detailed inspection.

Checklist for Home Inspection:

- Foundation and roofing.

- HVAC and plumbing systems.

- Signs of pests or water damage.

- Electrical wiring and appliances.

Example: A couple in Edmonton avoided buying a home with hidden mold damage thanks to their inspector’s diligence.

Common Issues Found During Inspections

| Issue | Potential Cost to Fix (CAD) |

| Foundation Cracks | $5,000 – $15,000 |

| Roof Replacement | $4,000 – $10,000 |

| Mold Remediation | $500 – $6,000 |

10. Plan for Closing Costs

Closing costs in Canada typically range from 1.5% to 4% of the property’s purchase price. These costs cover legal fees, land transfer taxes, and home insurance.

Budgeting for them ensures you aren’t caught off guard on closing day. “Tips for First-Time Property Buyers in Canada” highlight the importance of being prepared for these additional expenses.

Breakdown of Common Closing Costs:

- Legal Fees: $1,000 – $2,500

- Land Transfer Tax: Varies by province.

- Title Insurance: $250 – $500

Example: Raj, a first-time buyer in Ontario, prepared for an additional 3% of his home’s cost to cover these fees, avoiding last-minute financial strain.

Estimated Closing Costs by Province

| Province | Average Closing Costs (% of Price) |

| Ontario | 1.5% – 4% |

| British Columbia | 1.5% – 3% |

| Alberta | 1% – 2.5% |

| Quebec | 1.5% – 3% |

Final Tips and Resources for Success

Before finalizing your purchase, take advantage of resources designed to assist first-time buyers.

Educate yourself on additional programs, attend local workshops, and leverage online tools to make informed decisions.

Always compare properties, consider future needs, and consult experts to ensure your investment aligns with your goals.

Key Resources:

- Canada Mortgage and Housing Corporation (CMHC): Comprehensive market insights and buyer resources.

- Realtor.ca: A trusted platform for property searches and market comparisons.

- Provincial Grants: Research incentives specific to your region.

Takeaway

Buying a home is one of the most significant investments you will make. By following these tips for First-Time Property Buyers in Canada, you can navigate the process with confidence and clarity.

From setting a realistic budget to planning for closing costs, each step brings you closer to finding a home that meets your needs and dreams.

Remember, preparation is key. Research the market, consult professionals, and utilize the tools and programs available to first-time buyers.

With informed decisions, your journey into homeownership in Canada can be a fulfilling and rewarding experience.

Start your search today, and take the first steps toward securing your future in a home that’s truly yours.