Money and politics often raise big questions. Voters want to know if candidates are honest about their earnings and business dealings. Tim Sheehy, a Republican candidate for the Montana Senate seat in 2024, has drawn attention for his wealth and financial choices.

Tim Sheehy net worth in 2025 is between $102million and $297 million, based on public records. His income comes from many sources, including Bridger Aerospace—a company he leads that focuses on aerial firefighting.

This blog digs into his finances, business troubles, and political money disclosures. Keep reading to see what we found!

Who is Tim Sheehy

Tim Sheehy is a Montana GOP Senate candidate for 2024. He served as a Navy SEAL and completed military service with distinction. After his time in the U.S. military, he started Bridger Aerospace, an aerial firefighting company based near Bozeman Yellowstone International Airport.

Sheehy has gained recognition as a Montana success story. As CEO of Bridger Aerospace, he focuses on wildfire suppression and securing government contracts. His work ties into efforts to combat climate change while building local jobs.

Tim Sheehy Net Worth in 2025

Tim Sheehy net worth in 2025 could range between $102 million and $297 million. This estimate comes from a June 2024 financial report. His earnings are around $7 million each year.

He also invested $1.5 million into his Senate campaign.

Much of his wealth ties to Bridger Aerospace and other investments like real estate, stocks, and bonds. Some reports compare his growing portfolio to figures like Ken Griffin or Stephen Schwarzman in private equity markets.

Sources of Tim Sheehy’s Wealth

Tim Sheehy net worth in 2025 ranges between $102 million and $297 million. His wealth comes from different areas, including business earnings and smart investments—keep reading to see how these shaped his financial story.

Income from Bridger Aerospace

Sheehy earned $5 million annually from Bridger Aerospace. His 2023 pay package included a $149,000 base salary and a $2.3 million bonus. These amounts highlight his key role in the company’s growth.

He stepped down as CEO on July 1, 2024, but still owns large shares. This ownership keeps him financially tied to Bridger Aerospace and its success on NASDAQ: BAER.

Investments and real estate assets

He owns a $2.5 million home in Bozeman, Montana. This property adds to his impressive real estate portfolio. He also has rental properties in Big Sky and cabins in Polson, Montana.

A 20,000-acre cattle ranch boosts his wealth further. Besides real estate, he invests in companies like Roblox Corp., Alibaba, and funds like Pzena Emerging Markets Value Fund.

Political Financial Disclosures

Tim Sheehy’s financial reports reveal key details about his assets and ties—sparking curiosity and debate.

Key highlights from disclosure documents

Disclosure documents reveal important details about finances. They shed light on income, assets, and possible concerns.

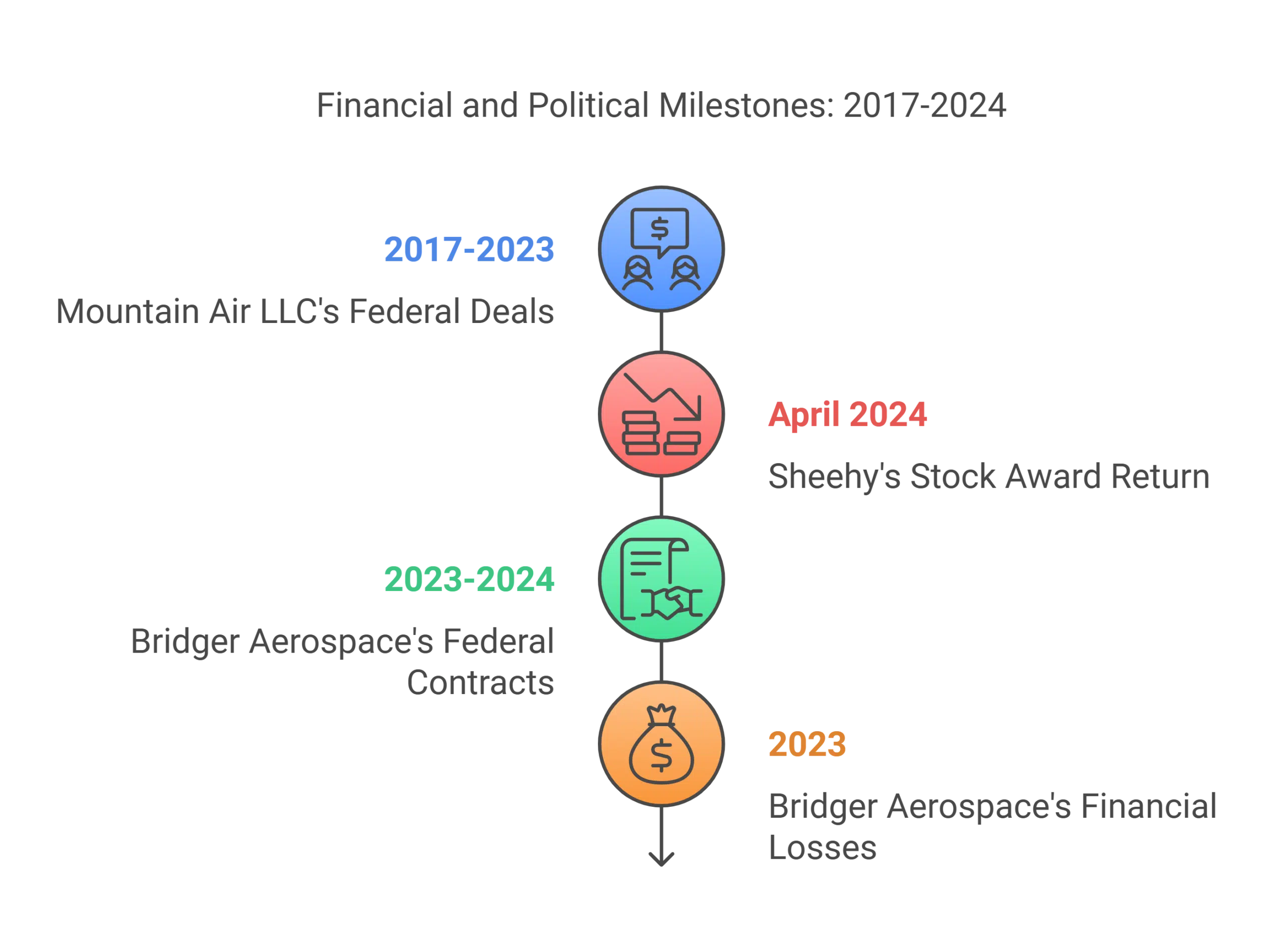

- Sheehy returned $30 million in stock awards in April 2024. The value dropped to $15 million after stock depreciation.

- Bridger Aerospace secured $16.1 million in federal contracts over 2023 and 2024.

- Mountain Air LLC, co-owned by Sheehy, got $21.3 million in federal deals from 2017 to 2023.

- Campaign funds included $5 million each from Ken Griffin at Citadel LLC and Stephen Schwarzman of Blackstone.

- Some disclosures point toward conflicts of interest tied to federal contracts and campaign donors.

- Bridger Aerospace reported losses impacting the company’s financial health, raising “going concern” issues.

- Investments include real estate holdings and stakes in various companies linked to securities and hedge funds.

- Disclosure highlights the influence of backers like Steve Daines and Greg Gianforte within political circles.

- Critics argue overlaps between business ties and policy decisions could harm transparency for u.s lawmakers.

- Lobbying efforts by associated firms also hint at potential conflicts with the board of directors’ roles in investments or bond issues.

Potential controversies and conflicts of interest

Lobbyists spent $450,000 on Bridger Aerospace since 2021. This raised questions about fairness and influence. Critics point to federal contracts making up 69% of its revenue in 2023, sparking debates over government favoritism.

Sheehy criticized Sen. Jon Tester for taking lobbyist funds but faces his own scrutiny for lobbying ties. Accusations also include financial mismanagement at Bridger and firearm-related incidents in the past.

These claims fuel concerns over transparency and trustworthiness toward voters.

Business Ventures and Financial Performance

Tim Sheehy’s businesses, like Bridger Aerospace, have faced financial hurdles—sparking questions about their impact on his net worth.

Bridger Aerospace’s reported losses

Bridger Aerospace faced tough times in 2023. The company reported losses of over $77 million for the year. Since going public in January 2023, total net losses have gone past $150 million.

Its debt stands at a staggering $211 million. A $160 million bond deal from 2022, with an 11.5% interest rate, adds more pressure. Stock prices fell sharply by about 70% over the past year—dropping to just $3.15 per share now—leaving investors and bondholders worried about liquidity challenges ahead.

Other business investments

Tim Sheehy co-founded the Little Belt Cattle Company in 2020. The ranch operates near Martinsdale, Montana, focusing on raising cattle. It shows his interest in agriculture and rural business.

His other ventures include raising $9.2 million by selling Bridger Aerospace stock to executives in April 2023. This move highlighted confidence from key stakeholders within the company’s leadership circle.

Public and Political Reactions

Tim Sheehy’s financial dealings drew cheers from allies and sharp words from critics—sparking debates among voters. Tim Sheehy net worth ranged between $102 million and $297 million.

Support from Republican allies

The National Republican Senatorial Committee, led by Steve Daines, backs Sheehy’s campaign. Their support shows strong trust in his ability to win.

A super PAC called “More Jobs, Less Government” has spent nearly $11 million for him. These big investments highlight Republican allies’ confidence in his political journey.

Criticisms from opponents

Opponents pointed to Bridger Aerospace’s struggles. Federal filings showed financial losses despite praise from Wall Street Journal editorials. Critics questioned if Tim Sheehy’s business background fits a public role.

Some voiced concerns about conflicts of interest. His political disclosures and ties to investment banking raised eyebrows. Opponents linked his work with Tencent to possible foreign influence in U.S. politics.

Takeaways

Tim Sheehy net worth draws attention from all sides. His wealth and business losses spark debates about his leadership. Critics question his lobbying, while supporters highlight his investments in Montana.

The truth lies in the numbers and the choices he makes moving forward. His political journey will keep eyes watching closely.