DeFi is growing fast, but does it ever feel like a maze you just can’t navigate? You want your money to work smarter, but who has time to stare at price charts or manage complex trades all day? Mistakes happen, fees add up, and sometimes you just miss out on the best deals because you were sleeping.

AI Agents in DeFi are here to change that game for good. These smart tools use machine learning to handle trading, yield farming, and even spot risks in real time. They work like a tireless personal assistant for your crypto portfolio.

In this post, I will explain exactly what these AI agents are and how they make DeFi easier for everyone. I’ll walk you through the top projects, the real benefits, and the simple steps to get started. Curious? Let’s go through the answers that could save you both time and stress.

What is DeFAI? [DeFi + AI Agent Synergy]

DeFAI mixes artificial intelligence with decentralized finance to create something powerful. Smart agents now help people trade, lend, and grow money faster than ever before. Think of it as upgrading from a paper map to a GPS that drives the car for you.

Defining “Agentic” Workflow

An “agentic” workflow uses machine learning and automation to do the heavy lifting. AI agents watch the blockchain, study smart contracts, and react to events on their own. These agents can hunt for price gaps in trading algorithms or swiftly manage yield farming across different liquidity pools.

AI agents act like tireless financial assistants. They read data fast, make judgments without waiting for humans, and carry out complex tasks such as portfolio management or risk assessment with crisp precision. For instance, agents on the Olas (Autonolas) network are already executing a massive chunk of transactions on Gnosis Chain. They are proving that bots can be reliable power users.

The process stays decentralized because no one person controls all the keys. This keeps trust high while machines keep an eagle eye on cryptocurrency moves day and night.

Why Now? The 2026 Catalyst

2026 feels like a tipping point for Decentralized Finance. AI agents are about to shake things up significantly. More blockchains use smart contracts now, and the global value locked in DeFi has jumped past previous records.

New tech like zero-knowledge proofs and machine learning keeps getting better. This makes more automation possible by the day. This wave is also powered by stronger chips and cheaper cloud computing from networks like Gensyn and Render.

Regulators are stepping in worldwide, too. Projects must get smarter fast or risk being left behind. The EU’s MiCA rules set strict deadlines for crypto firms. This pushes every team to act before stricter laws kick in across major economies. Smart contract-based trading, automated prediction markets, and tokenization tools all need adaptable AI to win this race.

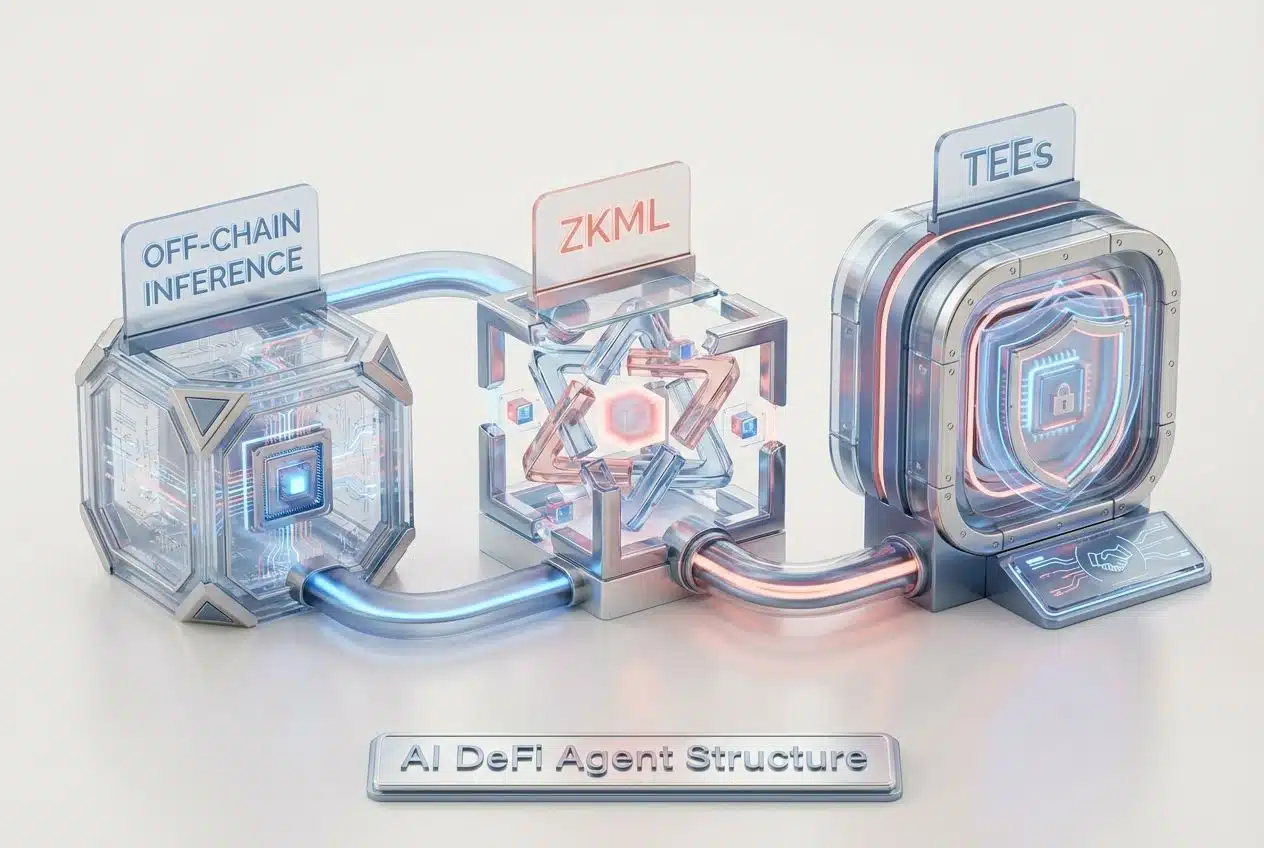

The Architecture of an AI DeFi Agent [Under the Hood]

AI DeFi agents use smart design. Each part does a key job. Their setup helps them act fast, solve problems on the fly, and keep your data safe as a squirrel hiding its nuts.

The Brain: Off-Chain Inference

AI agents use off-chain inference as their brain. This means they process data outside the blockchain before taking action on it. The agent collects real-world info, like market prices or news, and makes quick decisions without waiting for slow blockchain updates.

For example, an AI can spot yield farming opportunities across pools in seconds. Then it acts fast to grab them. Using machine learning models off-chain saves time and money by skipping high network fees. Projects like Ritual call this an “AI Coprocessor” because it handles the heavy thinking separately from the blockchain.

Off-chain inference also helps agents learn from new trends in cryptocurrency markets that are not recorded directly on the blockchain. Think of it as checking weather forecasts before planting seeds. You make smarter choices when using both on-chain and off-chain data sources. Machine learning lets these agents manage risks better, spot scams faster, and keep your portfolio safer than with traditional methods alone.

The Trust Layer: ZKML (Zero-Knowledge Machine Learning)

ZKML lets AI agents prove their work without giving away secrets. Think of it as showing your math homework to the teacher while hiding the answers from everyone else. This keeps user data safe, builds trust, and supports compliance in automated trading and smart contracts.

Innovators like Modulus Labs are leading this charge. They build systems that allow on-chain trading bots, like their “RockyBot,” to prove they executed a strategy correctly without revealing the proprietary code. These proofs run fast but stay private. They make sure information stays secure, even if used on blockchain technology.

“ZKML helps keep things fair by letting you show results, not details.”

Now let’s see how Trusted Execution Environments give these agents a body to act in the real world.

The Body: Trusted Execution Environments (TEEs)

Trusted Execution Environments, or TEEs, keep secrets safe. They build a secure area inside the computer’s hardware. This space locks away keys, personal data, and even trading algorithms from hackers and snoops.

TEEs are like vaults for financial technology in DeFi projects. Flashbots SUAVE is a prime example here. It uses TEEs to create a “privacy-aware” marketplace where transactions can be built securely. Only approved smart contracts or AI agents can see what happens inside these digital vaults.

Private trades and portfolios stay hidden from prying eyes with TEEs running the show. Traders get peace of mind because their machine learning models do not leak tricks to rivals in yield farming or arbitrage games. Mistakes by one app cannot hurt others since each TEE runs alone. Think of it as putting each agent’s toolkit in its own lockbox on blockchain networks like Ethereum or Solana.

These trusted spaces set the stage for new ways users interact with intents instead of just plain transactions. Next up is how that user experience takes shape!

“Intents” vs. “Transactions”: The User Experience Revolution

Swapping tokens used to mean sending a direct transaction. It felt like manual work. Every step was on you. Now users can send “intents” instead. An intent is just saying what you want, a goal, like getting the best ETH price or earning more yield in liquidity pools.

Here’s where agents called “solvers” change the game for decentralized finance. These AI-powered solvers read your intent and figure out how to achieve it. They use trading algorithms, scan smart contracts, compare liquidity pools, and even hunt for lower fees all at once.

This flips things around. Users set goals instead of pushing buttons over and over again. It feels smoother than before. You have less stress and fewer steps. More people can access financial technology without learning each blockchain trick themselves.

What is an Intent?

An intent is a wish or goal you make on the blockchain. It tells smart contracts and agents what you want to do. You might want to swap crypto, join liquidity pools, or earn yield. Instead of signing every tiny step, you just say your aim.

For example, you might say, “I want to sell my crypto if the price hits $50.” The AI agent finds the best way for this to happen. Intents make DeFi smoother for users. You set your plan once. Agents handle all steps and risks using machine learning and financial algorithms in real-time. This means fewer mistakes and less time spent clicking buttons.

Intents are changing how people use decentralized finance by letting agents carry out complex trades or manage portfolios automatically.

The Role of “Solvers” (The Agents)

After a user sets an intent, someone has to make it happen. That is where solvers step in. Solvers are smart agents powered by machine learning and blockchain technology. They study your goals, scan the market, and select the best possible path for you.

CoW Swap is currently the leader in this space. Their network of solvers competes to find you the best price, often beating standard exchanges by batching trades together. Let’s say you want high yield from liquidity pools or want to jump on an arbitrage trade quickly. Solvers can act fast.

These agents automate tasks like trading algorithms, portfolio management, or even real-time risk assessment. They talk directly with smart contracts and other decentralized apps to complete your transaction smoothly and safely. By working 24/7 without breaks or bias, solvers bring automation and speed that no person can match in decentralized finance. Their work flips DeFi from slow manual steps into a seamless experience that focuses on results instead of busywork.

Top Use Cases for AI Agents in DeFi [2026 Edition]

AI agents in DeFi are shaking things up. They make financial tasks smarter and faster than ever. Stick around to see how they’re changing the game!

1. Autonomous Yield Farming & Liquidity Management

AI agents can scan thousands of liquidity pools faster than a person. They spot high-yield chances and move funds without waiting for orders. Some agents switch assets between pools in seconds using real-time blockchain data and smart contracts.

This quick action helps avoid missed rewards or sudden losses. Specific agents like Giza’s ARMA on the Base network are designed to optimize yield strategies automatically. They monitor interest rates across protocols like Aave and Morpho to ensure your money is always in the most profitable spot.

These bots make split-second choices that most users cannot match by hand. They keep portfolios balanced while chasing top returns through careful algorithms and machine learning models.

2. AI-Driven Prediction Markets

AI agents forecast crypto prices, sports scores, or election outcomes using machine learning. They scan thousands of data points every second. This includes social media buzz, economic news, and trading signals from blockchain networks.

Trades happen automatically with smart contracts. No middleman is needed. On networks like Gnosis Chain, agents from the Olas ecosystem are already responsible for a huge portion of prediction market activity. They crunch data to place bets on platforms like Polymarket or Gnosis far more accurately than an emotional human trader.

In 2026, these automated prediction tools handle billions of bets daily. People worldwide join the action without banks or bookies clipping a share.

3. Smart Contract Security (Real-Time Defense)

Mistakes in smart contracts can lead to big losses. In past years, hackers stole over $1 billion from DeFi by finding flaws in code. New machine learning models spot attacks before they happen. The Forta Network is a standout example here.

Their “Firewall” product scans every blockchain transaction around the clock. It looks for strange patterns, wallet activity, or sudden price jumps. A 2025 report from Messari noted that chains using this type of firewall saw a 92% drop in successful phishing attempts.

If trouble is found, alerts fire instantly. Agents even freeze fake trades or block risky actions right away. This helps guard funds in liquidity pools and keeps yield farming safe for everyone using automated trading and financial technology platforms.

4. Reputation and Identity Scoring

AI agents study your transaction history, wallet age, and smart contract activity. This data helps them guess how likely you are to pay back loans in a decentralized finance setup. They check your blockchain actions instead of using credit bureaus or social security numbers.

Projects like Delysium are pioneering this with their “Agent ID” layer. Smart algorithms weigh each move you make with cryptocurrency. Lending apps set interest rates based on this digital reputation score. A person who has used liquidity pools safely for months may get lower fees or bigger loans than someone new to DeFi.

AI makes these decisions faster and with fewer mistakes than human staff ever could manage by hand.

Top AI Agent Projects & Protocols to Watch in 2026

Some projects grab the spotlight. They mix smart algorithms with DeFi tools in fresh ways. Keep your eyes peeled. Each protocol is racing to change how money moves online.

Infrastructure & Marketplaces

AI agents need strong rails to operate in decentralized finance. Infrastructure projects like EigenLayer and Ritual let these agents access secure data, run smart contracts, and settle trades across many blockchains. Marketplaces pop up so agents can buy, sell, or swap useful tools or raw compute power fast. Think of this as a digital farmer’s market for code.

Platforms such as Gensyn supply cloud-like computing just for crypto tasks. These tools help AI-driven trading bots crunch numbers at lightning speed while keeping user data private with zero-knowledge proofs. Developers race to build simple plug-and-play services that anyone can use without deep tech skills. This new backbone makes automation smooth in DeFi activities like yield farming, portfolio management, and prediction markets.

Compute & Privacy Layers

Blockchains are public. It is like a city square where everyone can see what happens. DeFi needs smart ways to protect personal data and speed up math tasks. Compute layers use powerful computers outside the blockchain to handle tough machine learning jobs fast.

Privacy layers act as shields for your secrets using zero-knowledge proofs or ZKML. This way, users can prove things without spilling private details. Trusted Environments like those used by Flashbots help by giving safe spaces for trading algorithms to work quietly and safely. These tools mix with financial technology to guard portfolios from hackers or spies who want quick trades or inside scoops.

Every part works together. Fast computer power helps AI agents make decisions. Strong privacy keeps user information safe during prediction markets, peer-to-peer lending, and credit scoring on crypto networks.

Application Layer (The Agents Themselves)

AI agents act as the hands and feet of DeFi. They move crypto assets, manage portfolios, hunt for arbitrage chances, and pick yield farming pools in real time. These digital helpers talk with smart contracts without needing a person to press any buttons.

Imagine a bot that watches hundreds of liquidity pools at once or shifts funds between apps like Uniswap or Aave faster than any human. The Virtuals Protocol is making waves here by acting like a “Shopify for AI agents.” It allows anyone to launch and monetize agents on chains like Base and Solana.

Some agents handle simple trades. Others run full strategies using machine learning. In 2026, thousands of these “DeFAI” bots will execute billions in financial moves each day. No sleep needed. Each one follows rules set by users but adapts as markets shift. Now comes something that really changes how people interact: intents versus transactions.

The “Machine-to-Machine” (M2M) Economy

Machines pay and talk to each other. They run deals and trades on autopilot. Curious how? Keep reading!

Agents Paying Agents

AI agents can pay other AI agents directly on the blockchain. This is like robots buying coffee from each other, but with digital currency and smart contracts instead of cash or credit card swipes.

One agent might spot a change in liquidity pools and hire another to perform automated trading or risk assessment. These payments happen fast. Almost no human touch is needed. The ASI Alliance, formed by the merger of Fetch.ai, SingularityNET, and Ocean Protocol, is building the standard for this.

DeFi protocols set rules so that each payment is safe and fair. Agents use tokens to trade services. Think of one offering extra data for portfolio management, while another provides security checks on a smart contract. This machine-to-machine economy keeps costs down, boosts automation, and lets financial technology run at lightning speed any hour of the day.

Tokenization of Agent Output

Smart contracts can take the work done by agents and turn it into digital tokens. For example, suppose an agent manages your yield farming. The profit or results become a token you can hold, trade, or use as proof of performance.

These tokens may show how much value the agent added or what tasks it finished. People could pool these agent outputs just like they do with liquidity pools in DeFi now. If one person’s trading algorithm finds price gaps and earns crypto, that output becomes a token others may want to buy or sell.

This process helps everyone track which machine learning models perform best without needing trust between parties. Now, anyone can quickly see the value created by automation in clear numbers on the blockchain. No magic tricks needed, just math and code at work!

Key Challenges & Risks [The Bear Case]

Even clever machines can make mistakes. You might want to keep an eye out for both surprises and pitfalls. Stay curious for what’s next.

Adversarial Machine Learning

Bad actors can trick machine learning models in DeFi. They feed fake data or special inputs to make AI agents act against users’ best interests. For example, hackers might teach an automated trading algorithm to buy tokens at high prices or drain liquidity pools.

As more money flows through smart contracts each year, attacks will likely get smarter too. AI agents face real threats like market manipulation and data poisoning. A single attack on a decentralized finance protocol could cost millions of dollars overnight. Protocols battle these risks by using extra checks or diverse data sources, but the arms race never ends in financial technology. Trust stays fragile when machines fight machines in the cryptocurrency world.

The “Black Box” & Model Collapse

AI agents often make choices that even their creators cannot fully explain. This is called the “black box” problem. You may feed a machine learning model lots of data, ask it to manage yield farming, or scout for arbitrage chances in liquidity pools. Still, you might never know how it picked its moves on-chain.

Sometimes these models get stuck or fail all at once. This is called model collapse. In DeFi systems with smart contracts and automated trading algorithms, this can trigger big losses fast. If an agent’s training data becomes polluted with AI-generated garbage, its logic can fail before anyone notices.

Model collapse spreads across decentralized applications as one mistake leads to another. This makes risk assessment tricky for both portfolio management and tokenization strategies built using blockchain technology.

Regulatory Hurdles (EU AI Act & MiCA)

EU lawmakers passed the AI Act. This law sets new rules for machine learning systems in DeFi and other fields. Projects must show how their algorithms work, keep users safe, and stop bias.

MiCA (Markets in Crypto-Assets) is another big rulebook from Europe. It covers crypto assets like stablecoins and requires full reports to protect people who use digital coins. DeFi teams will need better record-keeping and audits for both smart contracts and machine learning models.

These laws ask projects to explain every step an automated agent takes. Anyone running financial technology with AI inside the EU faces higher costs, slower launches, and lots of paperwork. Many smaller teams might head elsewhere or skip European markets altogether if things do not get simpler.

How to Get Started with DeFAI Today: Steps

Start by choosing a trusted DeFi platform that uses AI agents. CoW Swap is a great place to begin to see “intents” in action without needing technical skills. For a more advanced experience, check out Olas Pearl to find autonomous agents you can run.

Create an account using your digital wallet, such as MetaMask. Fund the wallet with cryptocurrency, like ETH or USDC. Explore simple tools first. Try automated yield farming or AI-powered portfolio management to see how smart contracts and algorithms work together.

Check for active communities on Discord or Telegram for tips and updates. Read easy guides from leading DeFAI projects to learn safe steps for trading algorithms and liquidity pools. Stay cautious. Use only small amounts at first while you get used to how automated systems handle arbitrage, lending, or tokenization of assets in decentralized finance platforms.

Wrapping Up: The Agentic Future

AI agents are changing how people use Decentralized Finance. Tasks like yield farming, risk checks, and automated trading grow faster through smart contracts and machine learning. Imagine a trader in 2026 using an AI agent to handle liquidity pools or predict the next big price swing before breakfast.

Developers race to make smarter agents every year. Blockchain technology grows safer with ZKML and trusted execution environments. Agents now talk to each other, sending crypto back and forth in seconds while handling tokenization of countless assets without blinking.

As this wave builds speed, regular users get powerful tools once only dreamed of by Wall Street giants. Now, anyone can have help with portfolio management or peer-to-peer lending at their fingertips.

![What is DeFAI [DeFi + AI Agent Synergy] AI Agents In DeFi](https://cdn1.editorialge.com/wp-content/uploads/2026/02/What-is-DeFAI-DeFi-AI-Agent-Synergy.jpg.webp)