Tesla Inc. is facing one of its most turbulent financial quarters in recent years, as its earnings for the first quarter of 2025 reveal a steep drop in profit and vehicle sales. The company, led by Elon Musk, reported a 71% year-over-year decline in net profit, falling to $409 million, a sharp contrast to the $1.4 billion reported during the same period in 2024. The earnings fell far short of Wall Street expectations and sent further ripples through investor confidence, already shaken by Musk’s controversial dual roles in business and government.

Revenue Drops as Automotive Sales Weaken

Tesla’s total revenue declined 9% to $19.3 billion for the first three months of 2025, compared to $21.3 billion during Q1 2024. A particularly concerning metric is the 20% decline in revenue from vehicle sales, which makes up the lion’s share of Tesla’s business.

Vehicle deliveries stood at 336,681 units, a 13% drop year-over-year, reflecting both production disruptions and weakening consumer demand. Tesla cited a “changeover of Model Y production lines” across all four of its Gigafactories as a major reason for the slowdown, which caused several weeks of production loss in Q1. Despite that, Tesla emphasized that the ramp-up of the new Model Y version is “going well.”

Musk Defends Government Role but Pledges Return to Tesla

Elon Musk’s continued involvement with the Department of Government Efficiency (DOGE), a cost-cutting advisory body under the Trump administration, has come under increasing scrutiny from investors. Many stakeholders argue his government role has distracted him from his responsibilities at Tesla during a critical time.

During the Q1 earnings call on Tuesday, Musk attempted to reassure investors by stating that the “heavy lifting” with DOGE is nearly complete and he expects to significantly reduce his time there starting in May 2025.

He added that he plans to contribute only one to two days a week to DOGE for the remainder of Donald Trump’s presidency, simply to “ensure that waste and fraud do not come roaring back.” He did not provide evidence of the alleged fraud, which remains unsubstantiated by any official watchdog agency.

Public Protests and Brand Damage

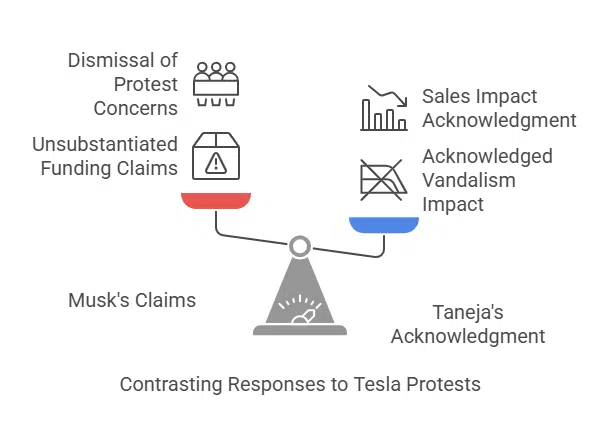

Musk also addressed ongoing protests against Tesla, asserting—again, without providing evidence—that demonstrators were being funded through “fraudulent money.” The comment has drawn criticism, especially as some protests have focused on Tesla’s labor practices and environmental concerns.

Tesla’s Chief Financial Officer, Vaibhav Taneja, acknowledged during the call that “vandalism and unwarranted hostility” in certain markets had negatively affected the brand and, subsequently, sales.

Tariffs and Global Trade Pressure Add More Strain

Tesla warned of further economic headwinds linked to shifting trade policies, particularly under the Trump administration. The company said the current “tariff landscape” is impacting costs, logistics, and long-term planning.

Musk has long been a proponent of lower tariffs, and reiterated his position:

“I believe lower tariffs are generally a good idea,” he said during the earnings call. “But this decision is fundamentally up to the elected representatives of the people.”

Tesla emphasized that the localization of supply chains has helped mitigate some of the negative effects, but global uncertainty continues to make operations more challenging.

“Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure,” Tesla noted in its shareholder update.

Analyst Response: A “Fork in the Road” Moment

Dan Ives, Managing Director of Equity Research at Wedbush Securities and a well-known Tesla supporter, described the situation as a “code red moment.” In a memo sent before the earnings call, Ives emphasized that Tesla’s board must confront the strategic crisis facing the company.

Market Competition Intensifies, Especially from China

While Tesla remains a global leader in the EV market, the company is under increasing pressure from Chinese automakers like BYD, which recently unveiled advancements in self-driving technology for vehicles priced as low as $9,600.

In contrast, Tesla’s own robotaxi program, announced in January 2025, is still in the early stages. A test rollout is scheduled to begin in Austin, Texas, in June 2025, but progress has been slow amid internal restructuring and development delays.

Focus on Cost, Resilience, and New Models

Despite this rough quarter, Tesla is taking strategic steps to stabilize its business. The company is working on launching a more affordable EV model, reportedly a stripped-down version of the Model Y, with production expected to begin in the U.S. by 2026.

Tesla also said it will not provide forward-looking financial guidance at this time, citing the uncertain macroeconomic environment and trade tensions as reasons for withholding projections.

Tesla’s Stock Performance and Market Reaction

Tesla shares have lost about 50% of their value since hitting an all-time high in December. The bulk of that decline has occurred since Donald Trump resumed the presidency and Elon Musk took on his government role.

As of this week, investors are growing more vocal about the need for stable leadership and product focus, particularly as Tesla navigates what could be a defining year for the company’s future direction.

Tesla’s Crossroads Moment

Tesla’s Q1 2025 results underscore the mounting challenges facing the EV giant—from internal leadership tensions and brand perception issues to stiffening global competition and a volatile economic climate.

With profits dropping, deliveries slowing, and confidence rattled, the pressure is now on Elon Musk to return his full attention to Tesla and steer it back on course. The next few quarters could be pivotal in determining whether Tesla retains its leadership in the electric vehicle market—or falls further behind in the fast-evolving global race.