Tesla’s board of directors has reportedly begun exploring options to find a potential successor to CEO Elon Musk. According to a report published by The Wall Street Journal (WSJ) on April 30, 2025, board members contacted several top executive search firms about a month ago. The move comes as Musk’s increasing involvement in politics—particularly his prominent role in the Trump administration—raises alarm among Tesla stakeholders and investors.

People familiar with the matter told WSJ that the board’s decision was influenced by growing worries over Musk’s split focus between running Tesla and his role as head of the Trump administration’s “Department of Government Efficiency,” or DOGE. While no formal decision or timeline has been set, and the current status of the board’s efforts remains unclear, the outreach marks a notable shift in Tesla’s internal strategy.

Elon Musk Promises to Refocus on Tesla, But Questions Remain

Just last week, Musk publicly stated he would significantly reduce the time he devotes to government work and instead recommit to overseeing Tesla’s operations. The announcement was reportedly made following direct appeals from fellow board members who asked him to reaffirm his focus on Tesla.

However, it is not clear whether Musk was made aware of the board’s outreach to search firms or whether his renewed commitment to Tesla had any effect on the succession planning effort. Musk, who also sits on the board, has not publicly addressed the reported search for his potential replacement. Neither Tesla nor Musk responded to requests for comment by Reuters.

DOGE Role Draws Scrutiny and Controversy

Musk’s government role at DOGE has stirred considerable debate, both within and outside of Tesla. The DOGE department—created by former President Donald Trump during his second term—has been tasked with cutting federal workforce expenditures, eliminating bureaucracy, and slashing budgets across various federal agencies.

Musk, a vocal advocate for deregulation, has used the position to push for aggressive job cuts and streamlining in federal programs. However, critics argue these efforts have resulted in essential service disruptions and a rise in political unrest. Musk’s alignment with far-right policies in Europe and the U.S. has also sparked protests and even vandalism of Tesla showrooms and Supercharger stations in multiple cities.

These developments have added to investor anxiety, especially as Tesla faces headwinds in its core electric vehicle (EV) business.

Investor Concerns Mount as Tesla Struggles With Aging Lineup and Strategic Pivot

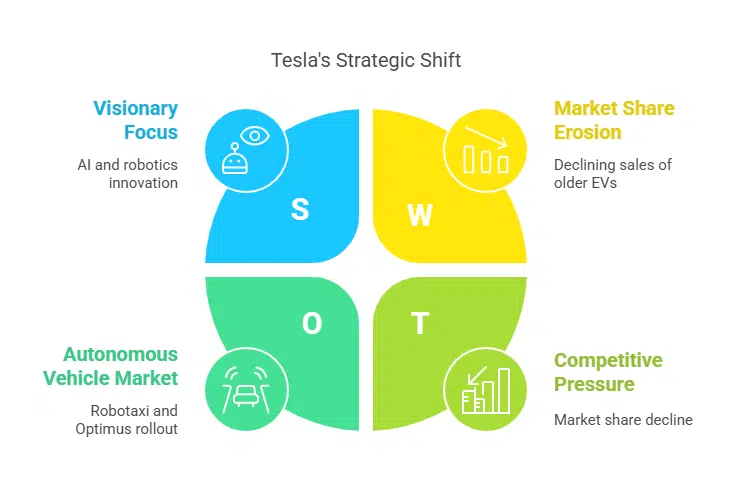

Tesla’s once-dominant position in the EV market is facing serious pressure. Sales of its older EV models have declined globally, with growing competition from Chinese EV makers like BYD and global brands like Hyundai and Ford making inroads into Tesla’s market share.

In response, Musk has recently shifted the company’s vision away from developing a new affordable electric vehicle platform—which many investors were counting on—to instead focusing on long-term ambitions in artificial intelligence and robotics. This includes ambitious plans to roll out fully autonomous “robotaxis” and the humanoid robot “Optimus,” both of which Musk describes as Tesla’s next frontier.

While this pivot excites some investors who see Tesla as more than just a carmaker, it has unsettled others who view the delay in launching affordable EVs as a missed opportunity, especially as competitors aggressively expand in that space.

Board Members Step Up Investor Reassurance Amid Succession Buzz

As news of succession discussions circulates, some Tesla directors have reportedly been meeting with major institutional investors to ease concerns and assure them of the company’s leadership stability. Among those involved is JB Straubel, Tesla co-founder and one of the few members seen as having strong technical and operational credibility.

These efforts suggest the board is taking investor sentiment seriously and is attempting to strike a balance between allowing Musk to pursue bold technological visions while ensuring Tesla’s operational leadership remains intact and accountable.

Governance Issues and Board Independence Under the Microscope

Tesla’s board structure has long been a target for criticism, particularly from activist investors and governance watchdogs who argue that it lacks independence and is too closely aligned with Musk’s interests. The board currently consists of eight members, including:

-

Robyn Denholm, Board Chair

-

Kimbal Musk, Elon Musk’s brother

-

James Murdoch, son of Rupert Murdoch

-

JB Straubel, Tesla co-founder

-

Four additional long-term members

Robyn Denholm, who was appointed chair following Musk’s 2018 settlement with the U.S. Securities and Exchange Commission, has herself been a source of controversy. Critics argue she has failed to effectively oversee Musk’s actions and point to her support for his controversial compensation package—valued at up to $56 billion—as evidence of compromised oversight.

Despite these claims, Denholm has publicly defended both the board’s independence and her compensation. A spokesperson previously stated her pay package was “aligned with Tesla’s performance and shareholder value.”

Now, with increased scrutiny, the board is said to be looking for an independent director to add fresh perspective and strengthen its governance practices.

Regulatory Tailwinds Offer Tesla a Short-Term Boost

Despite the internal drama, Tesla recently got some good news from federal regulators. The U.S. Department of Transportation announced a relaxation of certain rules around testing and deploying autonomous vehicles. This policy shift is seen as favorable to Tesla’s plans for expanding its Full Self-Driving (FSD) software and launching autonomous taxi services.

Following the announcement, Tesla’s stock saw a temporary boost. Analysts noted that while the regulatory win may help in the near term, longer-term challenges—including leadership uncertainty, slowing EV sales, and brand reputation—still loom large.

Tesla’s Future: Automaker or AI Giant?

With Musk pushing Tesla to redefine itself as a leader in artificial intelligence and robotics, rather than a pure-play electric vehicle company, the stakes are higher than ever. The company’s valuation—still significantly higher than traditional automakers—is largely predicated on Musk’s vision of a high-tech future powered by autonomous transport and humanoid robots.

Whether the board’s succession planning will yield any changes remains to be seen. But as Tesla stands at a strategic crossroads, both the market and the company’s most loyal investors are watching closely to see who will lead the next chapter of its journey.