Many Indians struggle with term insurance choices as premiums rise and coverage gaps widen. The insurance sector faces new challenges from digital transformation, changing lifestyles, and evolving family structures. This analysis covers policy features, premium factors, and digital tools to help you navigate the right coverage path.

Key Takeaways

- Premium costs jumped 15-20% in 2024 due to higher medical expenses and lifestyle diseases, pushing many to reassess coverage amounts and policy terms.

- Digital platforms now process 70% of term insurance applications, cutting approval times from weeks to days through automated underwriting and AI-powered risk assessment.

- Coverage gaps affect 65% of working Indians, with most policies covering only 5-8 times annual income instead of the recommended 10-15 times for adequate protection.

- Younger buyers (25-35) drive 60% of new policies, seeking higher coverage at lower premiums before health issues impact insurability.

- Riders and add-ons like critical illness and accidental death benefits now feature in 80% of new policies, reflecting growing awareness of comprehensive protection needs.

Rising Premium Challenges

Insurance companies face mounting pressure from increased claim ratios and medical inflation. Term insurance premiums climbed sharply in 2024, with some insurers hiking rates by 20% across age groups. Urban pollution, sedentary lifestyles, and stress-related disorders push claim frequencies higher.

Younger applicants still enjoy lower rates, but even they feel the pinch. A 30-year-old non-smoker paying ₹12,000 annually for ₹1 crore coverage now faces ₹14,400 for the same policy. The window for affordable coverage narrows with each passing year.

Medical tests became stricter, with insurers requiring detailed health screenings for coverage above ₹50 lakh. Pre-existing conditions like diabetes and hypertension, once manageable, now trigger higher premiums or exclusions. The underwriting process resembles a medical examination more than a simple form submission.

Digital Transformation Impact

Technology reshapes how Indians buy and manage term insurance. Online platforms streamline applications, cutting paperwork and processing delays. AI algorithms assess risk profiles instantly, flagging high-risk cases for manual review while fast-tracking standard applications.

Digital tools help compare policies across insurers, revealing price differences that span thousands of rupees annually. Mobile apps track policy status, premium due dates, and claim processes. This transparency forces insurers to compete on features and pricing rather than sales tactics.

Telemedicine partnerships enable remote medical consultations for policy approvals. Video calls replace physical visits to insurance offices, saving time for busy professionals. Digital documentation reduces paperwork errors that previously delayed policy issuance.

As more Indians shift to online platforms for guidance, understanding term insurance fundamentals becomes crucial in navigating the digital insurance journey confidently.

Coverage Gap Analysis

Most Indians underestimate their insurance needs, creating dangerous coverage gaps. Financial advisors recommend coverage worth 10-15 times annual income, but average policies provide only 5-8 times. A software engineer earning ₹10 lakh annually needs ₹1-1.5 crore coverage, yet often settles for ₹50 lakh due to premium concerns.

Family structures complicate coverage calculations. Joint families with multiple dependents need higher coverage than nuclear families. Working spouses reduce individual coverage needs, while single earners bear full family responsibility. Children’s education costs, aging parents’ medical expenses, and outstanding loans add to coverage requirements.

Urban living costs outpace rural expenses, demanding higher coverage for city dwellers. Mumbai and Delhi residents need 30-40% more coverage than tier-2 city counterparts for equivalent lifestyle protection. Housing loans, school fees, and healthcare costs drain family budgets when primary earners face unexpected events.

Changing Demographics and Preferences

Millennials and Gen Z buyers reshape term insurance markets with distinct preferences. They research online, compare options extensively, and prefer digital interactions over agent meetings. These younger buyers seek transparent pricing, quick processing, and minimal paperwork.

Career mobility influences policy choices. Frequent job changes make group insurance inadequate for long-term protection. Young professionals buy individual policies early, locking in lower premiums before health issues emerge. Remote work trends reduce employer-provided coverage, pushing individuals toward personal policies.

Women’s workforce participation drives demand for dual-income family coverage. Working couples need individual policies rather than depending on single earner protection. Financial independence goals motivate women to buy separate term insurance, ensuring protection regardless of marital status changes.

Regulatory Environment Shifts

IRDAI regulations impact policy features and pricing structures. New guidelines mandate simplified product designs, reducing complexity for average buyers. Standardized policy wordings improve transparency, helping consumers understand coverage terms better.

Claim settlement ratios receive greater scrutiny, with insurers required to publish detailed settlement statistics. This transparency helps buyers choose reliable insurers with strong claim payment records. Companies with poor settlement ratios face reputational damage and customer exodus.

Regulatory changes also affect premium calculations and risk assessment methods. Stricter capital requirements force insurers to maintain higher reserves, potentially impacting pricing. Consumer protection measures strengthen, but compliance costs may translate to higher premiums.

Technology Integration Benefits

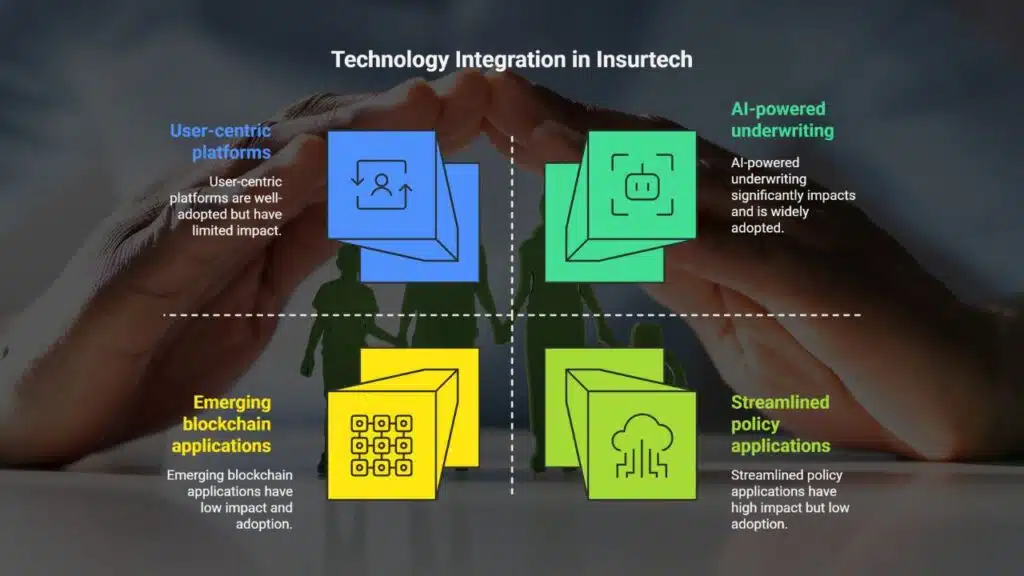

Insurtech startups disrupt traditional insurance distribution through innovative platforms and customer-centric approaches. These companies leverage technology to simplify policy comparison, streamline applications, and provide transparent pricing. Their focus on user experience raises industry standards across established players.

AI-powered underwriting reduces human bias in risk assessment while speeding up policy approval. Machine learning algorithms analyze vast datasets to predict claim probabilities more accurately than traditional methods. This precision helps insurers price policies fairly while maintaining profitability.

Blockchain technology promises enhanced security for policy records and claims processing. Smart contracts could automate claim settlements, reducing processing times and administrative costs. Though still emerging, these technologies will reshape insurance operations significantly.

Strategic Coverage Planning

Effective term insurance planning requires understanding life stage needs and financial goals. Young professionals should prioritize high coverage at low premiums, leveraging their insurability advantages. Mid-career individuals need balanced coverage considering family responsibilities and wealth accumulation goals.

Policy terms should align with major financial obligations. Home loan tenures, children’s education timelines, and retirement planning influence optimal coverage periods. Laddering strategies using multiple policies with staggered maturity dates provide flexible protection as needs evolve.

Riders enhance basic coverage but increase premiums. Critical illness, accidental death, and disability riders address specific risks but require careful evaluation. Understanding term insurance fundamentals helps buyers make informed decisions about essential versus optional coverage features.

Takeaways

Term insurance markets evolve rapidly, driven by technology, changing demographics, and regulatory reforms. Premium increases challenge affordability, but digital platforms improve accessibility and transparency. Coverage gaps remain widespread, requiring better financial planning and awareness.

Smart buyers leverage technology for research and comparison while understanding their specific protection needs. Early purchase decisions pay long-term dividends through lower premiums and guaranteed insurability. The landscape favors informed consumers who approach term insurance strategically rather than reactively.

FAQs

Why have term insurance premiums increased so much recently?

Medical inflation, higher claim ratios, and lifestyle diseases push costs up. Insurers also face stricter capital requirements and need to maintain higher reserves, which impacts pricing across all age groups.

How do I calculate the right coverage amount for my family?

Multiply your annual income by 10-15 times, then add outstanding loans and future expenses like children’s education. Consider your family’s lifestyle, location, and financial goals when determining coverage needs.

Are online term insurance policies as reliable as traditional ones?

Yes, online policies offer the same legal protection and are often more transparent. Digital platforms provide easy comparison tools and faster processing, while regulatory oversight ensures consumer protection regardless of purchase channel.

What happens if I miss premium payments?

Most policies offer a grace period of 30 days for premium payments. After this, the policy lapses, but you can usually revive it within a specified period by paying outstanding premiums and potentially undergoing medical tests.

Should I buy term insurance through an agent or online?

Online platforms offer transparency and competitive pricing, while agents provide personalized advice and ongoing support. Choose based on your comfort level with technology and need for guidance in policy selection and claims processes.