As the tax deadline in Germany approaches, many individuals and businesses might find themselves scrambling to complete their filings. However, last-minute tax planning doesn’t have to mean missing opportunities.

With the right strategies, you can still take advantage of numerous tax-saving tips before the deadline in Germany. Whether you’re a freelancer, a business owner, or an employee, there are several opportunities to reduce your taxable income and maximize deductions.

In this article, we present 10 last-minute tax-saving tips before the deadline in Germany that can help you keep more money in your pocket.

Why Act Now? The Importance of Last-Minute Tax Planning

The tax filing season can be stressful, especially when the deadline is looming. In Germany, the official tax return deadline is typically on May 31st of the year following the tax year. However, many individuals wait until the last minute to file their taxes due to procrastination, uncertainty, or simply forgetting the importance of timely submission.

Failing to act before the deadline can result in missed opportunities to reduce your tax liability, leaving money on the table. Moreover, filing late without an extension can result in penalties and interest charges. For example, if you owe taxes and don’t file on time, the German tax office (Finanzamt) may impose late fees that can quickly add up, creating unnecessary financial stress.

That’s why it’s crucial to act now and explore tax-saving tips before the deadline in Germany. From maximizing deductions to utilizing investment strategies, there are numerous ways to reduce your taxable income and avoid unnecessary taxes.

Tip #1: Maximize Your Deductions Before the Deadline

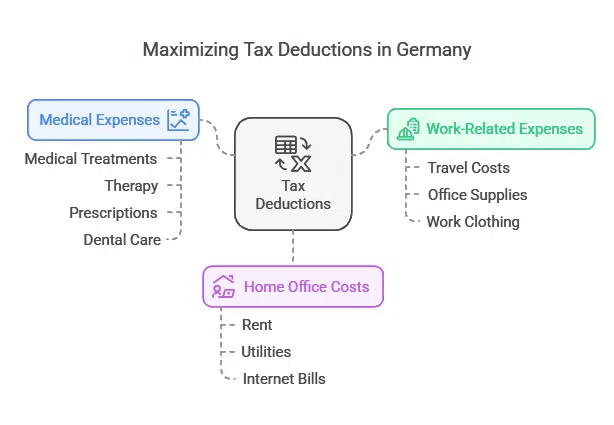

Germany’s tax system offers a variety of deductions that can help lower your taxable income. These deductions, if utilized correctly, can save you a significant amount of money. Whether it’s work-related expenses, medical costs, or home office deductions, it’s essential to take advantage of these opportunities before the deadline.

- Work-Related Expenses: If you incur any expenses related to your job, such as travel costs, office supplies, or even work clothing, you can potentially deduct them from your taxable income. However, to qualify, these expenses must be directly linked to your employment.

- Home Office Costs: Due to the rise in remote work, many individuals now qualify for home office deductions. This includes expenses for your home office, such as rent, utilities, office furniture, and internet bills. To claim this deduction, you must use the space exclusively for work.

- medical Expenses: Health-related costs such as medical treatments, therapy, prescriptions, and even dental care can be deducted if they exceed a certain threshold. This threshold depends on your income and the number of people in your household.

How to Ensure You Claim All Available Deductions

To ensure you claim every possible deduction, gather all the necessary documents ahead of time. This includes receipts, invoices, and records of any relevant expenses. Use an online tax tool or consult with a tax professional to ensure all deductions are claimed appropriately.

Here’s a checklist of common deductions you should consider:

| Deduction Category | What You Can Deduct | Documentation Needed |

| Work-Related Expenses | Travel costs, office supplies, training, business lunches | Receipts, travel logs, training certificates |

| Home Office Costs | Rent, utilities, office supplies, internet, phone bills | Rent contract, utility bills, invoices |

| Medical Expenses | Doctor’s bills, medical treatments, prescriptions | Medical receipts, prescriptions |

| Charitable Donations | Donations to registered charities | Bank statements, donation receipts |

Tip #2: Use Your Investment Losses to Offset Gains

Investment income is subject to taxes in Germany, but there is a strategy called tax-loss harvesting that allows you to offset investment losses against gains, thereby reducing your overall taxable income. If you have realized capital gains, selling investments that have depreciated can lower the amount of taxable income generated by your portfolio.

How to Apply Investment Losses for Tax Reduction

By selling investments that have lost value, you can offset any capital gains you’ve realized, reducing your overall tax liability. For example, if you sold some stocks at a profit but also have other stocks in your portfolio that have declined in value, you can sell those depreciated stocks to realize a loss, which can be used to offset the gains.

Let’s take an example:

- You sold some shares of company A for a €5,000 profit.

- However, you also have shares in company B that have lost €2,000 in value.

By selling those company B shares, you realize a €2,000 loss, which can offset your €5,000 gain, meaning you only pay taxes on €3,000 instead of €5,000.

Tip #3: Maximize Contributions to Retirement Accounts

Germany offers attractive tax-saving opportunities for retirement planning. Both the Riester pension and Rürup pension plans allow you to contribute pre-tax income, lowering your taxable income in the process. This is particularly beneficial for individuals who want to save for retirement while simultaneously reducing their current tax liability.

How to Boost Contributions and Reduce Taxable Income

If you haven’t fully funded your retirement accounts yet, consider making additional contributions before the deadline. Contributing more to your Riester or Rürup pension can provide significant tax savings.

- Riester Pension: This plan is ideal for employees and low-income earners, offering government subsidies in addition to tax deductions.

- Rürup Pension: This is a great option for self-employed individuals, allowing higher contribution limits than the Riester plan.

For example, if you contribute €5,000 to a Riester pension, your taxable income will decrease by the same amount, reducing the taxes owed for that year. Plus, you may qualify for additional subsidies.

Tip #4: Take Advantage of Special Allowances

In addition to the standard deductions, Germany offers special tax allowances that can help reduce your taxable income. These allowances are typically available for individuals with specific circumstances, such as having children or providing care to a family member.

- Family Allowances: Parents can claim allowances for each child, which can significantly reduce their overall tax liability.

- Childcare Costs: You can deduct expenses for childcare, such as daycare or after-school programs, up to a certain amount.

- Other Exemptions: If you care for a family member who is disabled or in need of assistance, you may qualify for additional exemptions.

How to Claim Special Allowances Before the Tax Deadline

Ensure you gather the necessary documentation for your family allowances, including birth certificates, receipts for childcare, and any records of family care. These documents will help ensure you’re receiving the maximum allowances for which you qualify.

Tip #5: Review Your Tax Class to Maximize Savings

Your tax class in Germany determines how much tax is withheld from your paycheck and can have a significant impact on your final tax bill. By reviewing your tax class before the deadline, you can ensure that you are in the most beneficial category.

When and How to Adjust Your Tax Class

In Germany, tax classes are divided into six categories based on your marital status, number of dependents, and whether you’re employed or self-employed. For married couples, there’s an option to select between Tax Class III (which benefits the higher-earning spouse) and Tax Class V (for the lower-earning spouse). By making the right adjustment, couples can reduce their overall tax liability.

For example, if one spouse earns significantly more than the other, the higher earner should opt for Tax Class III, which can lower the total tax burden.

Tip #6: Leverage Charitable Donations for Tax Savings

Charitable donations are a great way to support causes you care about while also reducing your taxable income. In Germany, donations to registered charities can be fully deducted from your taxable income, which can significantly reduce your overall tax liability.

What Counts as a Valid Charitable Donation in Germany?

To qualify for tax deductions, donations must be made to registered non-profit organizations (called gemeinnützige Organisationen in Germany). You’ll need to provide proof of your donation, such as a Spendenbescheinigung (donation receipt), which you can obtain from the charity.

Example of How Donations Work

Let’s say you donated €500 to a registered charity. If you are in the 30% tax bracket, this donation could potentially save you €150 in taxes. By donating more, you can further reduce your taxable income.

Tip #7: Consider Tax-Advantaged Investment Products

In addition to retirement accounts, Germany offers several tax-advantaged investment products that help reduce your current tax liability. These include specific savings plans, insurance policies, and investment funds that are structured to provide tax benefits.

- ETFs (Exchange-Traded Funds): These are low-cost investments that often benefit from tax advantages, especially if held for the long term.

- Life Insurance: Certain life insurance policies provide tax deductions for contributions, as well as tax-free growth.

By investing in these products before the deadline, you can lower your current taxable income and benefit from long-term growth. Additionally, many of these products come with capital gains tax exemptions for the money you withdraw after holding the investment for a certain period.

Tip #8: Take Advantage of Home Office Tax Breaks

With more people working remotely, the home office tax break has become an increasingly popular way to reduce taxable income. If you are working from home and using a designated space for your job, you may be able to claim a portion of your rent, utilities, and other home expenses.

Common Mistakes to Avoid When Claiming Home Office Deductions

Be mindful of the requirements for claiming home office expenses. The space you claim must be used exclusively for work, and you cannot claim a portion of your home unless it is a designated office. Additionally, make sure you have proper documentation, including rent agreements and utility bills.

Tip #9: Don’t Forget About the “Sparer-Pauschbetrag”

The Sparer-Pauschbetrag, or savings lump-sum allowance, is an important benefit for German taxpayers who earn income from savings or investments. This allowance allows you to reduce the tax burden on your investment income.

Steps to Claim the Sparer-Pauschbetrag

To claim this allowance, submit a Freistellungsauftrag (exemption order) to your bank or financial institution. This will ensure that your investment income, up to the allowance limit of €1,000 for singles or €2,000 for couples, is exempt from tax.

Tip #10: Consult a Tax Professional for Last-Minute Advice

If you’re feeling overwhelmed or unsure about your filing, consulting a tax professional is a smart move. They can help you navigate complex tax laws, uncover additional deductions, and ensure you’re filing correctly.

When to Seek Professional Help

If you have significant assets, investments, or business income, or if your tax situation is complicated, a tax professional can provide personalized guidance and ensure you don’t miss out on any tax-saving tips before the deadline in Germany.

Final Thoughts: Act Now to Maximize Your Savings

As the deadline approaches, now is the time to act. By taking advantage of these 10 last-minute tax-saving tips before the deadline in Germany, you can minimize your tax liability and make the most of available deductions and allowances.

Whether you’re adjusting your tax class, making additional pension contributions, or leveraging investment losses, these strategies can help you save significant amounts.

Remember, tax planning doesn’t just end on the filing deadline—being proactive and strategic each year can set you up for long-term financial success. Stay ahead of the game and ensure you’re always prepared to take advantage of the best tax-saving tips before the deadline in Germany.