Taxes can be a headache for anyone, but they’re especially tough for doctors and high-income earners. If you feel like your tax bill eats up too much of your hard-earned money, you’re not alone.

Many professionals in higher tax brackets struggle to keep more of what they make.

One key fact: smart tax planning can lower your taxable income and help you save big. By using the right strategies, you may even grow your wealth while cutting down on taxes.

In this post, you’ll find seven practical tips to reduce taxes and keep more cash in your pocket. Keep reading—you’ll thank yourself later!

Maximize Contributions to Tax-Advantaged Accounts

Boosting savings in tax-friendly accounts can shrink your taxable income. These tools offer long-term tax perks that keep more money in your pocket.

Fully fund retirement accounts

Max out contributions to your retirement plans each year. For a 401(k), you can contribute up to $22,500 in 2023. If you’re 50 or older, add another $7,500 as a catch-up. This lowers taxable income now and grows tax-deferred over time.

Self-employed physicians should consider a SEP IRA or a defined benefit plan. These options allow higher contribution limits compared to standard accounts. Using these tools means more savings and fewer dollars going toward taxes.

“It’s like paying yourself instead of the IRS.”.

Utilize Health Savings Accounts (HSAs)

HSAs offer big tax benefits. Contributions go in pre-tax, which lowers taxable income. Growth in the account is tax-free, and withdrawals for qualified medical expenses are also untaxed.

This triple tax advantage makes an HSA a smart move for high-income earners.

Doctors can contribute up to $3,850 annually if single or $7,750 for families in 2024. People over 55 can add another $1,000 as a catch-up contribution. Funds roll over each year, so there’s no pressure to spend all at once.

It’s not just for medical bills now; save receipts and reimburse later while enjoying the compounding growth!

Consider a Roth IRA Conversion

Switching to a Roth IRA can lower taxes in retirement. Unlike a traditional IRA, Roth IRAs allow tax-free withdrawals if you follow the rules. Paying taxes now on contributions may save more later, especially if your income grows over time.

High-income earners might prefer a backdoor Roth conversion. This strategy lets you convert after-tax contributions from a traditional IRA into a Roth IRA, even when earning above IRS limits.

Consult with a financial advisor to decide if this fits your tax plan and long-term goals.

Optimize Charitable Giving

Giving to charity saves taxes and supports causes you love. Use smart strategies to stretch your impact while lowering taxable income.

Leverage donor-advised funds

A donor-advised fund (DAF) lets you give to charity while lowering your taxes. You put money or appreciated assets, like stocks, into the fund. These grow tax-free over time. Once added, you get an income tax deduction right away.

Doctors and high-income earners can use this tool to plan their giving. For example, donating $50,000 in a strong earning year may reduce taxable income significantly. The DAF also allows flexibility since you choose when and where to donate the funds down the line.

Donate appreciated assets

Giving appreciated assets, like stocks or mutual funds, can lower taxes. If the value has grown over time, donating them avoids capital gains tax. This saves money compared to selling first and giving cash.

Doctors and high-income earners benefit most since they’re often in higher tax brackets. Charitable contributions may also allow for an itemized deduction on your tax return, reducing taxable income further.

Add Money to a 529 College Savings Plan

A 529 plan helps pay for education while offering big tax advantages. Any earnings grow tax-free. Withdrawals stay tax-free if used for qualifying expenses like tuition or books. States may also give extra benefits, like state income tax deductions.

High-income earners can gift up to $17,000 per year without touching the federal gift tax limit. Married couples can double that amount to $34,000 annually. Want to front-load contributions? Use the five-year rule and add up to $85,000 in one go ($170,000 for couples).

This strategy gives your money more time to grow while reducing taxable income over time!

Use Tax-Loss Harvesting

Sell investments worth less than what you paid to offset gains. This lowers taxable income and reduces capital gains taxes. Replace the sold investment with a similar one to maintain your portfolio balance.

For example, sell stocks showing losses and buy ETFs in the same sector. Be careful of the IRS “wash-sale” rule—wait 30 days before rebuying a nearly identical asset. High-income earners can use this strategy each year to save thousands on federal income tax.

Plan for Family Gifting

Gift money to family members to lower your taxable income. The IRS allows up to $17,000 per year per person in tax-free gifts for 2023. Married couples can double that amount by giving jointly.

Use this strategy to help loved ones and reduce estate taxes. Consider funding a child’s 529 college savings plan as part of your gifting. It grows tax-deferred and supports education expenses later.

Always keep track of amounts given to stay within limits.

Defer Income and Accelerate Deductions

Push income to the next year if possible. For example, delay billing or bonuses until January. This reduces taxable income for the current year and may lower tax rates.

Speed up deductions instead. Pay business expenses, state taxes, or charitable donations before December 31. Doing so increases deductible amounts now while lowering this year’s adjusted gross income (AGI).

Maximize Practice-Related Tax Deductions

Claiming deductions linked to your practice can cut down taxes. Self-employed physicians should review expenses like malpractice insurance, payroll costs, or office supplies. These items often qualify for business tax deductions and reduce taxable income.

Doctors with home offices may deduct a portion of rent or utilities if used solely for work. Keep detailed records of all costs tied to your practice. Expenses such as software subscriptions or professional memberships might also count as deductions, offering more savings come tax season.

Explore Alternative Investments for Tax Benefits

Consider municipal bonds to reduce taxes. They provide income exempt from federal taxes and occasionally from state taxes as well. High-income professionals can take advantage of this consistent income stream without raising taxable income.

Real estate investments also offer tax benefits. Depreciation deductions can balance out rental income, reducing your total tax liability. Investing in specific opportunity zones may also delay or decrease capital gains taxes.

These avenues help build wealth while focusing on savings.

Work with a Tax Professional for an Integrated Strategy

A tax professional can help lower your taxable income. High-income earners, like doctors, often face complex tax rules. A qualified advisor knows how to navigate these. They ensure you use every available deduction and credit.

For example, they might suggest maxing out employer-sponsored retirement plans or using a Health Savings Account (HSA). These steps can lead to more tax savings now and in the future.

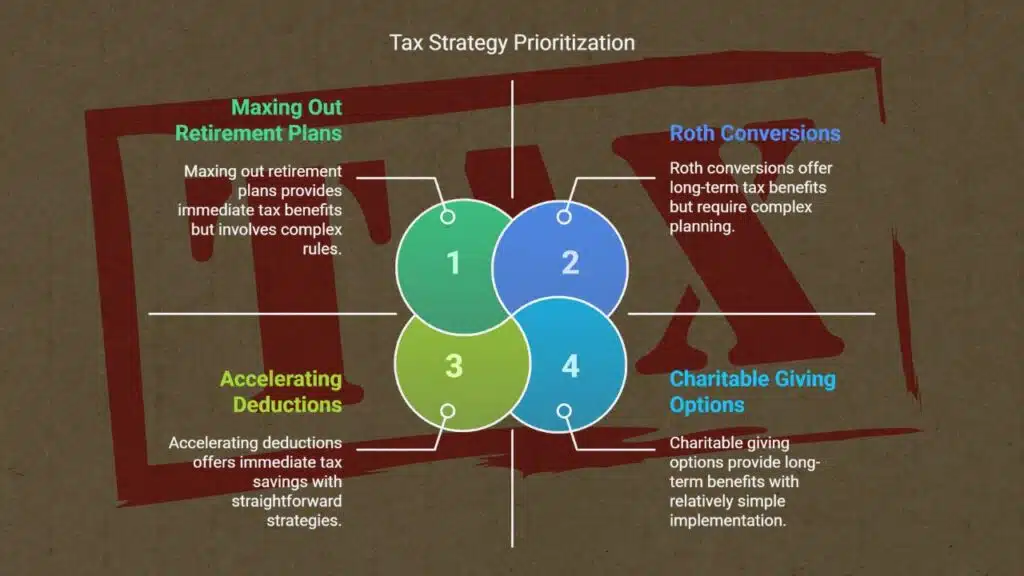

They also provide strategies for long-term planning. Roth conversions, charitable giving options, and family gifting are just some examples they address. They may advise on accelerating deductions before year-end or deferring income when it makes sense for your specific needs.

This puts money back in your pocket while still meeting legal requirements. Embrace their expertise—it saves time, stress, and often thousands of dollars during both simple and tricky financial years!

Takeaways

Planning your taxes as a doctor or high-income earner can save you big money. Max out retirement accounts, use an HSA, and consider a Roth IRA conversion. Smart giving and college savings plans make a difference too.

These steps are simple yet powerful for cutting tax bills quickly. Start today—your future self will thank you!

FAQs

1. What are some tax planning tips for doctors and high-income professionals?

Doctors and high earners can use strategies like contributing to a Roth IRA or backdoor Roth IRA, using health savings accounts (HSAs), lowering taxable income through tax deductions, and taking advantage of employer-sponsored retirement plans.

2. How does a backdoor Roth IRA work?

A backdoor Roth IRA allows you to convert funds from a traditional IRA into a Roth IRA, letting you benefit from tax-free growth on your investments.

3. Can I reduce taxes by using an HSA?

Yes, contributions to an HSA offer triple benefits: they lower your adjusted gross income (AGI), grow tax-deferred, and allow for tax-free withdrawals when used for qualified medical expenses.

4. Should I consider refinancing my student loans as part of financial planning?

Refinancing student loans can help reduce debt faster by securing lower interest rates, freeing up more money for retirement savings or other investments.

5. How do charitable donations affect my taxes?

Charitable giving may provide valuable tax deductions if itemized on your return, especially through options like donating appreciated securities or making qualified charitable distributions.

6. Why is it important to know about required minimum distributions (RMDs)?

RMDs must be taken from certain retirement accounts after age 73 to avoid penalties; failing to plan could increase taxable income significantly in later years.