Tax planning is an essential aspect of personal finance, especially for millennials in the UK who are navigating their careers, businesses, and investments.

Effective tax planning can help you maximize savings, take advantage of available allowances, and secure long-term financial stability. In this guide, we will explore 12 tax planning strategies for millennials in UK that can significantly reduce your tax burden while optimizing financial growth.

Whether you’re a salaried professional, a self-employed individual, or an investor, implementing these strategies can ensure a more financially secure future.

Why Tax Planning Matters for Millennials in the UK

The UK tax system is structured with various income tax bands, personal allowances, and reliefs designed to help individuals manage their tax liabilities effectively. For the 2024/25 tax year, the tax bands are:

| Income Bracket | Tax Rate | Taxable Amount |

| Up to £12,570 | 0% (Personal Allowance) | Tax-free income |

| £12,571 – £50,270 | 20% (Basic Rate) | Tax applies on earnings in this range |

| £50,271 – £125,140 | 40% (Higher Rate) | Higher tax rate for higher earnings |

| Above £125,140 | 45% (Additional Rate) | Highest tax rate bracket |

How Smart Tax Planning Can Boost Your Savings

By strategically managing your income, investments, and expenses, you can legally reduce the amount of tax you pay each year. This means more money in your pocket to invest, save, or use for personal development. Without a solid tax plan, many millennials end up overpaying or missing out on key tax benefits.

Key Tax Planning Strategies for Millennials

Tax planning is an important financial strategy that helps millennials optimize their earnings, reduce tax burdens, and maximize savings. With various tax reliefs, allowances, and investment opportunities available, it is crucial to understand and apply these strategies effectively.

Below, we outline the most effective tax planning strategies for millennials in UK to help secure a financially stable future.

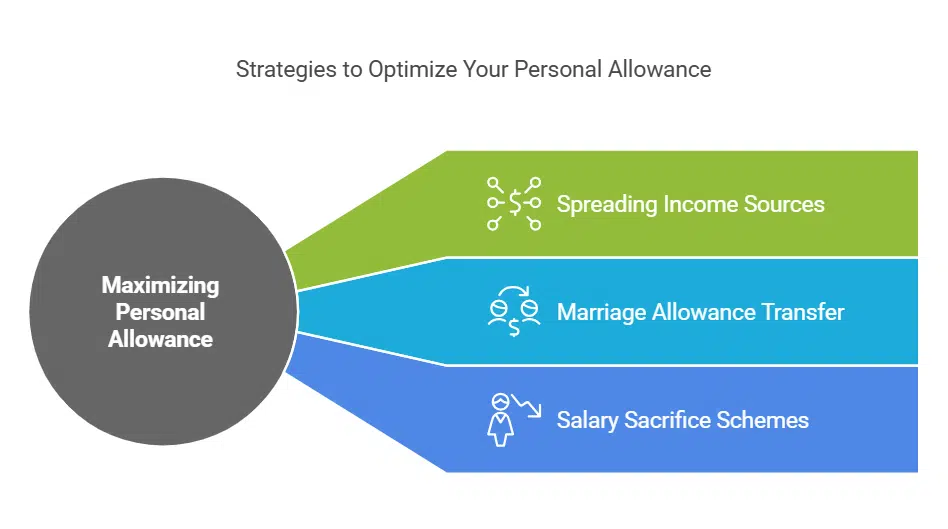

1. Maximize Your Personal Allowance

Your personal allowance (£12,570 for most taxpayers) is tax-free income. To make the most of this:

- Avoid exceeding tax bands unnecessarily by spreading your income sources.

- If married, transfer part of your allowance to your spouse through the Marriage Allowance (if they earn below ¥12,570).

- Consider salary sacrifice schemes to reduce taxable income.

| Tax Allowance Strategy | Benefit |

| Marriage Allowance | Saves up to £252 per year |

| Salary Sacrifice | Lowers taxable income and increases pension contributions |

| Spreading Income Sources | Helps avoid high tax brackets |

2. Take Advantage of ISA Accounts

ISAs (Individual Savings Accounts) offer tax-free interest, dividends, and capital gains. This makes them a great tool for long-term savings and investment growth.

| Type of ISA | Benefit |

| Cash ISA | Tax-free interest on savings |

| Stocks & Shares ISA | Tax-free capital gains and dividends |

| Lifetime ISA (LISA) | 25% government bonus for homebuyers & retirement |

| Innovative Finance ISA | Tax-free earnings on peer-to-peer lending |

3. Optimize Pension Contributions

Pension contributions offer significant tax relief. Contributions up to £60,000 per year receive tax relief at your highest income tax rate.

Ways to optimize:

- Workplace Pension Schemes: Employers match your contributions, doubling savings.

- Self-Invested Personal Pension (SIPP): Ideal for freelancers/self-employed millennials.

4. Claim Work-Related Tax Reliefs

Many millennials miss out on tax reliefs they are eligible for. Some examples include:

| Tax Relief Type | Who Qualifies? |

| Uniform Tax Refund | Employees required to wear and maintain a uniform |

| Remote Work Tax Relief | Employees paying for home office expenses |

| Professional Subscriptions | Workers needing memberships for their profession |

5. Use the Marriage Allowance Benefit

If one spouse earns below £12,570 and the other is in the basic tax rate, they can transfer £1,260 of their allowance to their partner.

This results in a tax saving of up to £252 per year, which can be particularly beneficial for families looking to optimize their household income. This process, known as the Marriage Allowance, is simple to apply for through HMRC and can provide long-term savings for couples where one partner has lower earnings or is not working.

6. Invest in Tax-Efficient Investments

Investment strategies to reduce tax liability include various tax-efficient schemes and structured investment options that can significantly minimize taxable income and optimize financial growth.

By leveraging government-backed initiatives, individuals can take advantage of tax reliefs while ensuring long-term wealth accumulation. These strategies include investing in tax-advantaged accounts, capitalizing on tax reliefs, and optimizing portfolio structures to align with tax efficiency.

| Investment Type | Tax Benefits |

| Enterprise Investment Scheme (EIS) | 30% income tax relief |

| Seed Enterprise Investment Scheme (SEIS) | 50% tax relief |

| Venture Capital Trusts (VCTs) | 30% tax relief and tax-free dividends |

7. Reduce Your Capital Gains Tax (CGT) Liability

Capital Gains Tax applies when selling assets like stocks or property for profit.

Salary sacrifice reduces taxable income by redirecting earnings into benefits like:

By opting for a salary sacrifice scheme, employees agree to receive a lower gross salary in exchange for specific non-cash benefits. This reduces their taxable income and National Insurance contributions while allowing them to enjoy valuable perks. Employers also benefit, as they pay lower National Insurance contributions, making it a win-win for both parties.

| Scheme | Tax Savings | Additional Benefits |

| Pension Contributions | Tax-free employer contributions | Boosts retirement savings with added employer support |

| Cycle to Work Scheme | Tax-free bicycle purchases | Promotes eco-friendly commuting and fitness |

| Childcare Vouchers | Pre-tax savings on childcare costs | Helps reduce childcare expenses for working parents |

| Electric Car Salary Sacrifice | Lower tax on electric vehicles | Supports environmental sustainability while cutting commuting costs |

| Additional Annual Leave | Tax-efficient way to buy extra leave | Enhances work-life balance and employee well-being |

These schemes are particularly beneficial for millennials looking to optimize their financial well-being while taking advantage of tax-efficient workplace perks.

8. Utilize Tax-Free Childcare Schemes

Parents can benefit from various tax-free childcare schemes that help reduce the financial burden of raising children while optimizing their tax position. These schemes are designed to support working parents by offering tax-efficient ways to cover childcare expenses. Proper utilization of these benefits can lead to significant savings each year.

| Scheme | Benefit |

| Tax-Free Childcare Account | Government adds 20% to contributions, up to £2,000 per child annually, and £4,000 for disabled children. |

| Child Benefit Adjustments | Parents earning above £50,000 can manage taxable income to avoid or reduce the High-Income Child Benefit Charge. |

| Workplace Nursery Schemes | Some employers offer tax-free nursery benefits as part of salary packages. |

| Universal Credit for Childcare | Low-income families may receive up to 85% reimbursement on childcare costs. |

By planning ahead and using these schemes effectively, parents can significantly reduce their tax liability while ensuring quality childcare support for their children.

9. Benefit from Salary Sacrifice Schemes

Giving to charity can reduce tax bills in multiple ways, making it a beneficial strategy for both donors and the receiving organizations. Not only do charitable donations help reduce taxable income, but they also support causes that align with personal values. There are several tax-efficient ways to donate, each with specific benefits:

- Gift Aid: Allows charities to reclaim 25% in tax relief from HMRC, boosting the value of the donation without additional cost to the donor. Higher rate taxpayers can claim additional tax relief on their Self-Assessment tax return.

- Payroll Giving: Enables donations to be deducted before tax, providing an immediate tax benefit and reducing overall taxable income.

- Donating Assets: Shares, land, and properties given to charities avoid Capital Gains Tax (CGT) and qualify for full income tax relief, making it an efficient way to support a cause while optimizing tax liabilities.

- Leaving a Legacy in a Will: Gifts left to charities in a will are exempt from Inheritance Tax (IHT) and can reduce the overall tax burden on the estate.

By structuring charitable giving effectively, individuals can maximize their contributions while enjoying significant tax reliefs.

10. Claim Tax Relief for Self-Employed Individuals

Self-employed individuals and freelancers often have higher tax burdens due to irregular income streams and business expenses. However, various tax reliefs are available to reduce liabilities. Here are some key strategies to maximize savings:

- Deductible Expenses: Business-related expenses, such as office rent, travel costs, equipment, internet, and professional services, can be deducted from taxable income.

- Simplified Expenses: This allows self-employed individuals to claim a flat rate for expenses such as working from home or using a personal vehicle for business purposes instead of calculating actual costs.

- Annual Investment Allowance (AIA): Enables businesses to deduct the full value of qualifying plant and machinery purchases (up to £1 million) from taxable profits, reducing overall tax liability.

- National Insurance Contributions (NICs) Optimization: Ensure the correct NICs classification is used to avoid overpayment while maintaining eligibility for state benefits.

- Use of Pension Contributions: Contributions to a personal pension scheme offer tax relief at the highest rate of income tax paid, reducing taxable income while securing retirement funds.

By keeping accurate records and claiming all eligible expenses, self-employed individuals can significantly reduce their tax bills while maintaining compliance with HMRC regulations.

11. Reduce Tax Liabilities Through Charitable Donations

Charitable giving is not only a way to support good causes but also an effective method of reducing tax liabilities. Donations to registered UK charities can qualify for tax relief through various schemes:

- Gift Aid: Charities can reclaim an extra 25p for every £1 donated, and higher-rate taxpayers can claim the difference between their tax rate and the basic rate on their tax return.

- Payroll Giving: Donations made through payroll giving are deducted before income tax is applied, providing immediate tax benefits.

- Donating Assets: Contributions of shares, land, or property to a charity are exempt from Capital Gains Tax (CGT) and qualify for full income tax relief.

- Leaving a Legacy in a Will: Charitable bequests reduce the value of an estate subject to Inheritance Tax (IHT) and can lower the tax rate from 40% to 36% if 10% or more of the estate is left to charity.

Taking advantage of these charitable tax reliefs can lead to substantial savings while ensuring contributions make a greater impact.

12. Plan Ahead for Inheritance Tax (IHT)

Inheritance Tax (IHT) is a 40% tax applied to estates valued above £325,000. Proper planning can help minimize the burden and maximize the legacy left for heirs.

| Strategy | Benefit |

| Gifting Allowance | Give up to £3,000 per year tax-free, with an additional exemption for wedding gifts and small gifts. |

| Potentially Exempt Transfers (PETs) | Gifts made more than seven years before death are IHT-free. |

| Setting Up Trusts | Assets placed in a trust are removed from the estate, reducing IHT liability. |

| Using Business Relief | Investments in qualifying businesses can receive up to 100% IHT exemption. |

| Charitable Bequests | Leaving at least 10% of the estate to charity can reduce the IHT rate to 36%. |

By strategically gifting assets, setting up trusts, and utilizing available reliefs, individuals can ensure that more of their wealth is passed on to their loved ones rather than being lost to taxation.

Takeaways

Effective tax planning ensures you keep more of your hard-earned money while complying with tax laws. Stay informed about tax law changes and seek professional tax advice when needed to maximize your savings and financial security.