Taxation in Germany is a complex system that plays a critical role in maintaining the country’s robust economy and infrastructure. Yet, for many residents and expats, navigating this system can be daunting.

Making mistakes on your tax return can lead to significant financial losses or even penalties. This article highlights eight common tax mistakes in Germany and provides actionable advice to help you avoid them.

By staying informed and proactive, you can save thousands and ensure compliance with German tax laws.

Why Taxes Matter in Germany?

Germany has one of the most efficient tax systems in the world, funded by contributions from its citizens and businesses. Taxes are essential for maintaining public services, including healthcare, education, and transportation.

However, the system’s complexity often leads to errors that can cost taxpayers dearly. Whether you’re a resident or an expat, understanding how taxes work in Germany is crucial to avoid pitfalls and maximize your savings.

By avoiding common errors and leveraging professional tools or advice, you can navigate this intricate system more effectively.

Common Tax Mistakes in Germany

Let’s take a closer look

1. Overlooking Tax Deductions

One of the biggest tax mistakes in Germany is failing to claim all eligible deductions. Tax deductions (“Steuerabzüge”) can significantly reduce your taxable income, saving you money. However, many taxpayers either don’t know what they can claim or fail to keep adequate documentation for deductions.

Commonly Missed Deductions

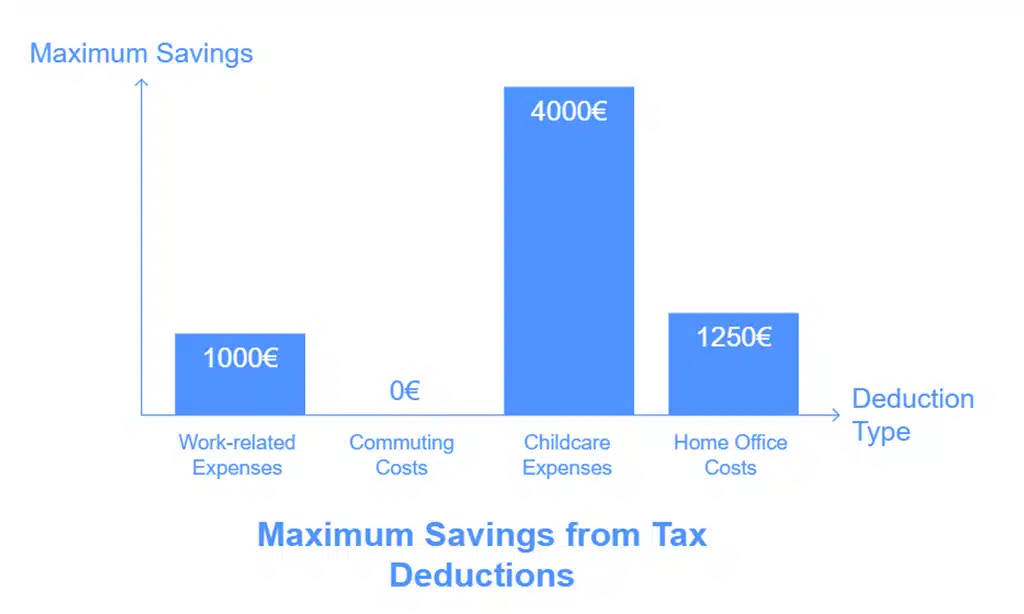

| Deduction Type | Description | Maximum Savings |

| Work-related Expenses | Tools, uniforms, and professional development. | Up to €1,000 annually. |

| Commuting Costs | Distance to work at €0.30/km for the first 20 km. | Depends on distance traveled. |

| Childcare Expenses | Kindergarten and daycare fees. | 2/3 of costs up to €4,000/year. |

| Home Office Costs | Rent and utilities for a dedicated workspace. | Up to €1,250 annually. |

Practical Example

For instance, if you commute 25 km to work daily, you can claim a deduction of €1,725 annually (€0.30 for the first 20 km and €0.38 for the remaining 5 km). Documenting these costs accurately can lead to substantial savings.

Actionable Tips for Claiming Deductions

- Keep Detailed Records: Maintain receipts, invoices, and mileage logs.

- Leverage Technology: Use apps like Taxfix or WISO Steuer for tracking and filing.

- Know Your Entitlements: Research deductions applicable to your job or life situation.

2. Filing Taxes Late or Not at All

Failing to meet tax deadlines in Germany can lead to severe penalties and fines. The annual tax filing deadline is July 31, but extensions may be available if you use a tax advisor or file electronically.

Consequences of Missing Deadlines

| Issue | Penalty |

| Late Filing Fee | 0.25% of unpaid taxes for each month late (min. €25). |

| Interest on Unpaid Tax | 6% annual interest rate. |

| Increased Audit Risk | Tax authorities may scrutinize delayed filings. |

Tips to Stay on Schedule

- Set Calendar Alerts: Mark tax deadlines on your phone or planner.

- Organize Documents Early: Begin compiling necessary forms and receipts months in advance.

- Seek Professional Help: Hire a tax consultant to ensure timely filing.

Real-life Insight

An expat who missed the filing deadline faced a late penalty of €150, along with additional interest charges. Filing on time or requesting extensions can easily avoid these unnecessary costs.

Additional Resources

| Resource | Purpose | Link |

| Elster Portal | Online tax filing system | Elster.de |

| Finanzamt Contact Directory | Locate your tax office | Finanzamt Locator |

3. Incorrect or Incomplete Tax Declarations

Errors in your tax declaration (“Steuererklärung”) can lead to rejected filings, additional charges, or audits. This mistake is particularly common for first-time filers and expats unfamiliar with German tax regulations.

Most Common Errors to Watch For

| Error | Impact |

| Typos in personal details | Delayed processing or rejection. |

| Misreporting income | Leads to underpayment or overpayment. |

| Omitting foreign income | Triggers fines and legal complications. |

How to Double-Check Your Tax Return

- Use tax software with error detection, such as Taxfix or WISO Steuer.

- Consult a tax advisor to verify your entries.

- Cross-check your forms against income statements (“Lohnsteuerbescheinigung”).

Practical Example

A freelancer in Germany underreported their income from an international client. This led to a fine of €800 and an audit request. Using a professional tax advisor or digital tools could have prevented this oversight.

4. Failing to Understand the Tax Class (Steuerklasse) System

Your tax class in Germany determines the amount of income tax deducted from your salary. Choosing the wrong class can lead to overpayments or underpayments. Many taxpayers lose significant amounts simply because they’re in the incorrect category.

Overview of Germany’s Tax Classes

| Class | Who It Applies To | Key Characteristics |

| Class 1 | Single individuals. | Standard deductions for singles. |

| Class 2 | Single parents. | Includes additional child allowance. |

| Class 3 | Married, higher-income partner. | Favorable for high-earning spouses. |

| Class 4 | Married couples with similar income. | Balances income tax equally. |

| Class 5 | Married, lower-income partner. | Higher deductions, paired with Class 3. |

| Class 6 | Individuals with multiple jobs. | Highest tax rate applies. |

Choosing the Right Tax Class

Married couples can save significantly by selecting the appropriate combination of Classes 3 and 5. For example, if one spouse earns significantly more than the other, opting for Class 3 for the higher earner and Class 5 for the lower earner maximizes take-home pay.

Example Scenario

- Incorrect Tax Class: A married couple both in Class 4 end up overpaying taxes by €1,200 annually.

- Correct Tax Class: Switching to Class 3 and Class 5 reduces their tax burden significantly.

Action Steps

- Check your tax class annually or after significant life changes, such as marriage or job changes.

- Consult with a tax advisor to evaluate the best class for your situation.

5. Ignoring International Tax Obligations

Expats often make the mistake of not understanding their international tax responsibilities. Income earned abroad can still be taxable in Germany, depending on your residency status.

Double Taxation Treaties

Germany has agreements with over 90 countries to prevent double taxation. These treaties determine how income from foreign sources is taxed.

| Country | Tax Treatment |

| USA | Credits foreign taxes paid. |

| UK | Exempts certain income types. |

| India | Offers deductions for foreign taxes. |

Reporting Foreign Income Properly

- Fill out the “Anlage AUS” form to declare foreign income.

- Retain documents proving taxes paid abroad.

Case Study

A US-based freelancer living in Germany failed to report earnings from their American clients. The resulting audit led to additional taxes and a penalty of €2,000. Using double taxation treaties and accurate reporting could have avoided this issue.

6. Not Keeping Proper Records

Good record-keeping is essential for accurate tax filing in Germany. Missing documentation can result in rejected claims or audits.

Importance of Documentation

- Retain all receipts, invoices, and financial statements for at least 10 years.

- Ensure records are legible and translated if necessary.

Digital Tools to Organize Your Records

| Tool | Functionality |

| Taxfix | Scans and categorizes receipts. |

| WISO Steuer | Tracks expenses and prepares returns. |

| DATEV | Professional accounting for businesses. |

Practical Advice

- Use cloud storage to back up important financial documents.

- Schedule monthly reviews to ensure all expenses are accounted for.

7. Misusing Tax-Free Allowances (Freibeträge)

Tax-free allowances are designed to reduce your taxable income, but improper use can lead to penalties.

Overview of Freibeträge in Germany

| Allowance | Amount (2023) | Who Benefits |

| Personal Allowance | €10,908 | All taxpayers. |

| Child Allowance | €8,952/child | Parents with dependent children. |

| Savings Allowance | €801 | Individuals with investment income. |

Ensuring Correct Use of Allowances

Adjust Freibeträge annually to reflect life changes, such as having children or changing jobs. For instance, failing to update your child allowance could lead to an underclaim of €4,476 per year for two children.

8. Neglecting Professional Tax Advice

While Germany offers many resources for taxpayers, professional advice is invaluable for navigating complex situations.

When to Consult a Tax Professional

- If you have multiple income sources.

- If you’re self-employed or an expat.

- If you’ve received notices from the tax office (“Finanzamt”).

Benefits of Hiring an Advisor

| Benefit | Description |

| Maximized Deductions | Identifies deductions you may overlook. |

| Error-Free Filing | Ensures compliance and accuracy. |

| Peace of Mind | Handles complex tax issues for you. |

How to Avoid These Tax Mistakes?

- Proactive Tax Planning: Start early to organize your financial records.

- Use Technology: Tax software can simplify calculations and reduce errors.

- Seek Expertise: Hire a certified tax advisor for complex filings.

Final Thoughts

Understanding and avoiding these common tax mistakes in Germany can save you significant time, money, and stress. By staying organized, seeking professional advice, and using technology, you can navigate Germany’s tax system efficiently.

Take action today to ensure you’re maximizing your savings and staying compliant with tax laws.

Don’t let preventable errors cost you thousands—invest in knowledge and professional support to secure your financial future.