Navigating the maze of tax regulations can be challenging, yet understanding the myriad tax deductions in Ireland can transform your financial strategy.

This authoritative guide provides a deep dive into the top 15 tax deductions for 2025 in Ireland, offering practical insights, actionable tips, and real-world examples to help you maximize your savings. In today’s dynamic financial environment, staying on top of these deductions not only reduces your taxable income but also empowers you to plan smarter for the future.

By embracing the strategies outlined below, you’ll gain clarity on how to leverage each deduction—from medical expenses to energy efficiency grants—and discover proven techniques that real taxpayers have used to lower their tax bills.

Our comprehensive guide is structured with clear headings, interactive tables, bullet points, and case studies to ensure every reader, whether an individual or business owner, can easily navigate and apply these tax deductions in Ireland to their unique situation.

Overview of the Top 15 Tax Deductions

Tax deductions in Ireland offer diverse opportunities for savings. Here’s a quick overview of the deductions we will cover, along with their key highlights:

- Medical Expenses Relief

Offset the costs of medical treatments, medications, and hospital services not covered by insurance. - Pension Contributions Relief

Encourage long-term financial security by reducing taxable income through approved pension schemes. - Home Renovation Relief

Benefit from deductions when making qualifying improvements to your primary residence. - Tuition Fees Relief

Support your educational ambitions or those of your dependents by deducting higher education expenses. - Employee Expenses Relief

Reclaim costs incurred as part of your employment, from travel to essential work tools. - Motor Vehicle Expenses

Claim the business portion of expenses for using your private vehicle for work purposes. - Rental Property Expenses

Offset the costs associated with managing and maintaining rental properties. - Business Expenses for the Self-Employed

Deduct ordinary and necessary expenses from your business income to reduce overall taxable profit. - Charitable Donations Relief

Receive tax credits for supporting approved charities, making your giving both generous and beneficial. - Interest on Investment Loans

Deduct interest on loans taken for investment purposes, reducing the cost of financing your ventures. - Capital Gains Tax Exemption

Enjoy exemptions or reductions when disposing of qualifying assets, easing the burden of capital gains tax. - Insurance Premium Relief

Lower your taxable income by claiming relief on premiums paid for qualifying insurance policies. - Energy Efficiency Grants

Support sustainable living by claiming deductions on certified energy-saving home improvements. - Student Loan Interest Deduction

Ease the burden of student debt by deducting the interest paid on approved student loans. - Voluntary Contributions Relief

Claim deductions for voluntary contributions to approved funds and charitable initiatives.

Understanding the Irish Tax System in 2025

Ireland’s tax framework is designed to be both progressive and incentivizing. For 2025, the system continues to evolve, reflecting recent economic shifts, environmental initiatives, and digital transformation trends.

The emphasis on digital tax filing and streamlined record-keeping is helping to simplify the process for both individuals and businesses. Recent policy changes aim to:

- Enhance transparency and fairness in tax collection.

- Promote investments in sustainable and green technologies.

- Encourage long-term savings through improved retirement and pension benefits.

Key Tax Environment Trends

| Trend | Description | Impact on Taxpayers |

| Digital Transformation | Increased use of online tax filing and digital records management | Faster processing and reduced errors |

| Green Initiatives | Incentives for energy-efficient investments and renovations | Greater benefits for eco-friendly projects |

| COVID-19 Recovery Measures | Temporary adjustments and additional deductions to support recovery efforts | Short-term relief measures |

| Progressive Tax Reforms | Adjustments to allowances and thresholds to better reflect income diversity | More equitable tax burden distribution |

These trends underline the importance of staying updated with tax deductions in Ireland, as each adjustment can open new opportunities for savings and strategic planning.

Key Tax Concepts and Definitions

To fully benefit from tax deductions in Ireland, it’s crucial to understand some core concepts:

- Taxable Income: The net income on which tax is calculated after all allowable deductions have been applied.

- Allowable Expenses: Specific costs that are legally deductible from your total income, thus lowering your taxable income.

- Tax Relief: A direct reduction in the amount of tax owed, resulting from qualifying expenditures.

- Legislative Reforms: Policy updates and regulatory changes that affect eligibility criteria and benefits for various tax deductions in Ireland.

Quick Reference Table: Tax Concepts

| Concept | Definition | Importance |

| Taxable Income | Income after deductions | Determines tax liability |

| Allowable Expenses | Costs deducted from gross income | Lowers overall taxable income |

| Tax Relief | Direct reduction in tax payable | Reduces overall tax bill |

| Legislative Reforms | Updates in tax law | Can expand or modify available deductions |

Understanding these definitions is fundamental when planning your financial strategy around tax deductions in Ireland.

Impact of 2025 Tax Reforms

Legislative Changes

For 2025, legislative updates are designed to simplify processes and broaden the scope of tax deductions. These changes focus on:

- Enhanced Eligibility: More taxpayers now qualify for certain deductions due to relaxed criteria.

- Simplified Filing: Digital integration means easier tracking and submission of claims.

- Expanded Deductions: New areas, such as green energy investments, are now eligible for deductions.

Economic Implications

The economic benefits of these reforms are significant. By lowering taxable income, these measures:

- Increase disposable income for households.

- Encourage reinvestment in business and property.

- Stimulate overall economic growth, particularly in emerging sectors like renewable energy.

| Reform Focus | Description | Expected Economic Impact |

| Expanded Eligibility | Broader criteria for claiming deductions | More taxpayers benefit; higher overall savings |

| Digital Filing | Integration of digital tools in tax administration | Reduced processing time; lower error rates |

| Green Incentives | Deductions for eco-friendly investments and renovations | Promotes sustainable investments; potential long-term savings |

These reforms ensure that tax deductions in Ireland remain both relevant and beneficial in a rapidly evolving economic landscape.

Detailed Breakdown of the Top 15 Tax Deductions in Ireland For 2025

In this section, we present an expanded, detailed analysis of each deduction, complete with practical examples, case studies, and tables summarizing key details. These deductions represent a cornerstone of strategic financial planning and are designed to empower taxpayers to achieve significant savings.

1. Medical Expenses Relief

Medical expenses can rapidly add up, and this deduction in Ireland is a crucial lifeline for those facing high out-of-pocket costs for health services. Whether it’s prescription medications, diagnostic tests, or specialist consultations, you can claim relief on qualifying expenses.

Eligibility Criteria:

- Expenses must be incurred for approved medical services.

- Non-reimbursed costs qualify.

- Detailed receipts and medical documentation are required.

How to Claim:

- Maintain organized records of all medical-related expenses.

- Fill out the designated section in your tax return, attaching receipts and invoices.

- Submit supporting documentation by the deadline.

Practical Example:

Consider Mary, who incurred over €1,200 in medical costs last year. By claiming medical expenses relief, she reduced her taxable income by approximately 20% of her qualifying expenses, resulting in noticeable savings.

Medical Expenses Relief: Quick Reference Table

| Aspect | Details |

| Eligible Expenses | Hospital stays, prescriptions, specialist fees |

| Documentation Required | Receipts, invoices, medical reports |

| Estimated Deduction | Up to 20% of qualifying expenses |

| Example Benefit | Savings of around €240 on €1,200 in expenses |

2. Pension Contributions Relief

Investing in your future is paramount. Pension contributions relief encourages long-term saving by reducing your current taxable income while building your retirement fund.

Eligibility Criteria:

- Contributions must be made to an approved pension scheme.

- Contributions should fall within the annual limits.

- Annual pension statements must be provided.

How to Claim:

- Track all contributions made over the year.

- Report contributions accurately in your tax return.

- Keep pension statements from your provider as proof.

Case Study:

John, a 45-year-old professional, consistently contributed to his pension scheme throughout 2024. By claiming pension contributions relief, he significantly lowered his taxable income, ensuring both immediate tax savings and a more secure retirement.

Pension Contributions Relief: Quick Reference Table

| Aspect | Details |

| Eligible Contributions | Approved pension schemes, defined annual limits |

| Documentation Required | Pension provider statements |

| Estimated Impact | Significant reduction in taxable income |

| Case Study Highlight | John reduced his taxable income and secured retirement savings |

3. Home Renovation Relief

Home renovations not only enhance your living environment but also provide significant tax benefits. This deduction applies to improvements made to your primary residence that add value or improve functionality.

Eligibility Criteria:

- The property must be your primary residence.

- Renovation works should meet specific quality and value criteria.

- Comprehensive documentation, including contractor invoices and photographic evidence, is needed.

How to Claim:

- Document every aspect of the renovation with detailed invoices and receipts.

- Provide evidence of the improvements (e.g., before-and-after photos).

- File your claim along with your annual tax return.

Real-Life Example:

Consider the case of Liam, who undertook extensive kitchen and bathroom renovations. By documenting every expense, Liam was able to claim a substantial deduction, lowering his taxable income and boosting his home’s value.

Home Renovation Relief: Quick Reference Table

| Aspect | Details |

| Eligible Renovations | Structural improvements, kitchen/bathroom upgrades |

| Documentation Required | Invoices, photographic evidence, contractor quotes |

| Estimated Benefit | Varies based on expenses; significant potential savings |

| Real-Life Example | Liam’s renovations led to a substantial tax reduction |

4. Tuition Fees Relief

Education is a long-term investment, and tuition fees relief helps alleviate the financial burden of higher education for both individuals and their dependents.

Eligibility Criteria:

- Fees must be paid to approved higher education institutions.

- Applies to both undergraduate and postgraduate courses.

- Receipts and proof of enrollment are mandatory.

How to Claim:

- Maintain records of all tuition fee payments.

- Complete the tuition fee section on your tax return, including necessary attachments.

- Verify your eligibility with the institution if required.

Case Study:

Emma, a recent graduate, was able to claim tuition fees relief after completing her master’s program. This deduction not only reduced her tax liability but also underscored the long-term financial benefits of investing in education.

Tuition Fees Relief: Quick Reference Table

| Aspect | Details |

| Eligible Institutions | Recognized universities and colleges |

| Documentation Required | Tuition receipts, enrollment confirmation |

| Estimated Deduction | Fixed percentage relief on tuition fees |

| Case Study Highlight | Emma lowered her taxable income significantly |

5. Employee Expenses Relief

Many employees incur work-related expenses that are not reimbursed by their employers. This deduction allows you to claim those necessary expenses as a tax benefit.

Eligibility Criteria:

- Expenses must be directly related to your job.

- Must be necessary for performing your duties.

- Detailed logs and receipts are required.

How to Claim:

- Maintain a comprehensive record of all work-related expenses.

- List expenses such as travel, tools, and supplies in your tax return.

- Use digital tools or apps to track these expenses consistently.

Example:

Consider Mark, who traveled frequently for work. By keeping a detailed mileage log and saving all travel receipts, he was able to claim a deduction that significantly lowered his overall taxable income.

Employee Expenses Relief: Quick Reference Table

| Aspect | Details |

| Eligible Expenses | Travel costs, tools, work supplies |

| Documentation Required | Receipts, mileage logs, expense diaries |

| Estimated Impact | Notable reduction in taxable income |

| Real-Life Example | Mark’s travel expenses led to significant savings |

6. Motor Vehicle Expenses

If you use your personal vehicle for business, you can claim a deduction for the proportionate cost associated with business travel. This deduction takes into account fuel, maintenance, and other related expenses.

Eligibility Criteria:

- Vehicle use must be primarily for business.

- Maintain detailed records of business mileage.

- Only the business-use proportion of expenses is deductible.

How to Claim:

- Keep an updated logbook noting business trips, distances, and dates.

- Gather all receipts for fuel, servicing, and repairs.

- Calculate the percentage of business use and apply this to your total expenses.

Practical Example:

Sarah, a freelance consultant, uses her car for client meetings and site visits. By documenting her mileage and expenses meticulously, she reduced her taxable income significantly through motor vehicle expense claims.

Motor Vehicle Expenses: Quick Reference Table

| Aspect | Details |

| Eligible Expenses | Fuel, maintenance, repairs |

| Documentation Required | Logbook, receipts, mileage records |

| Calculation Method | Business use percentage of total expenses |

| Example Benefit | Sarah’s detailed logbook maximized her claim |

7. Rental Property Expenses

Owning rental property involves various expenses, from maintenance to management fees. This deduction allows property owners to offset rental income with these costs.

Eligibility Criteria:

- Expenses must be directly related to managing and maintaining the rental property.

- Accurate records of maintenance, repairs, and management fees are necessary.

- Only allowable expenses can be deducted from rental income.

How to Claim:

- Maintain a detailed log of all expenses associated with the rental property.

- Submit these details as part of your rental income declaration.

- Ensure each expense is backed by proper invoices and receipts.

Case Study:

James, a landlord with multiple properties, kept detailed accounts of all repairs and maintenance costs. By deducting these expenses, he significantly lowered his taxable rental income, improving his cash flow.

Rental Property Expenses: Quick Reference Table

| Aspect | Details |

| Eligible Expenses | Repairs, maintenance, management fees |

| Documentation Required | Invoices, expense logs, receipts |

| Impact on Taxable Income | Offsets rental income, lowering tax liability |

| Case Study Highlight | James’s record-keeping maximized his deductions |

8. Business Expenses for the Self-Employed

For the self-employed, managing business expenses is crucial. This deduction allows you to subtract ordinary and necessary business costs from your income.

Eligibility Criteria:

- Expenses must be ordinary, necessary, and directly related to business operations.

- Detailed records and financial statements are required.

- Only costs directly associated with business activity are deductible.

How to Claim:

- Utilize accounting software or spreadsheets to track every business expense.

- Categorize expenses (e.g., supplies, software, travel) for easy reference.

- Include these details accurately in your annual tax return.

Real-Life Example:

Alex, a freelance graphic designer, tracked all his business expenses meticulously. From software subscriptions to travel costs, every expense was recorded and later deducted, significantly reducing his taxable profits.

Business Expenses (Self-Employed): Quick Reference Table

| Aspect | Details |

| Eligible Expenses | Office supplies, travel, digital tools |

| Documentation Required | Receipts, invoices, financial logs |

| Estimated Benefit | Substantial reduction in net business income |

| Case Study Highlight | Alex’s diligent record-keeping maximized his deductions |

9. Charitable Donations Relief

Supporting charitable organizations can yield both social and tax benefits. Donations made to approved charities are eligible for tax relief, converting generosity into savings.

Eligibility Criteria:

- Donations must be made to approved and registered charities.

- There is typically a minimum donation amount to qualify.

- Proof of donation, such as receipts, is mandatory.

How to Claim:

- Collect donation receipts throughout the year.

- Report these contributions in the designated section of your tax return.

- Verify that the charity is recognized by the relevant authorities.

Example:

Olivia, an avid supporter of local charities, donated regularly throughout the year. By claiming charitable donations relief, she not only supported her community but also enjoyed a significant tax credit.

Charitable Donations Relief: Quick Reference Table

| Aspect | Details |

| Eligible Donations | Contributions to approved charities |

| Documentation Required | Donation receipts, bank statements |

| Impact on Tax Liability | Direct tax credits applied to donation amounts |

| Real-Life Example | Olivia’s contributions resulted in noticeable tax savings |

10. Interest on Investment Loans

For many, financing investments with loans is a strategic move. Interest on these loans can be deducted, reducing the overall cost of investment.

Eligibility Criteria:

- Loans must be used exclusively for investment purposes.

- Only the interest portion of the loan is deductible.

- Detailed loan agreements and bank statements are required.

How to Claim:

- Document all interest payments with clear bank statements.

- Report the interest amounts in the investment section of your tax return.

- Ensure that the loan purpose is clearly stated in supporting documents.

Case Study:

David, an investor, took out a loan to expand his portfolio. By accurately documenting interest payments, he reduced his overall financing costs through tax deductions.

Interest on Investment Loans: Quick Reference Table

| Aspect | Details |

| Eligible Interest | Interest paid on investment-specific loans |

| Documentation Required | Loan agreements, bank statements, interest records |

| Estimated Benefit | Reduction in overall cost of financing investments |

| Case Study Highlight | David’s documentation led to lower financing costs |

11. Capital Gains Tax Exemption

While not a traditional deduction, capital gains tax (CGT) exemptions play a critical role in managing taxable profits from asset disposals. Qualifying assets may be partially or fully exempt from CGT.

Eligibility Criteria:

- Assets must meet the criteria set by Irish tax authorities.

- Exemptions often apply to primary residences or qualifying business assets.

- Detailed records of the asset’s purchase, improvements, and sale are necessary.

How to Claim:

- Complete the appropriate sections of your tax return dedicated to capital gains.

- Provide detailed records of acquisition and disposal.

- Consult a tax advisor to ensure accurate application of exemptions.

Real-Life Example:

Fiona sold a property that had been her primary residence for several years. Due to qualifying for the capital gains tax exemption, she significantly reduced the tax payable on the sale.

Capital Gains Tax Exemption: Quick Reference Table

| Aspect | Details |

| Eligible Assets | Primary residences, qualifying business assets |

| Documentation Required | Purchase/sale records, improvement receipts |

| Impact on Tax Liability | Reduced or exempt capital gains tax |

| Real-Life Example | Fiona’s property sale benefited from the exemption |

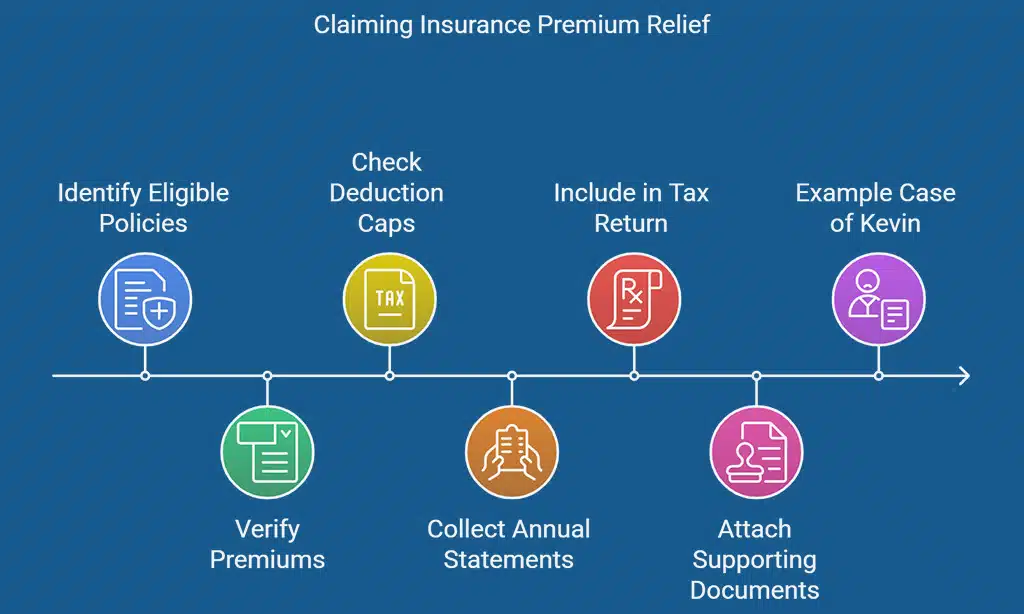

12. Insurance Premium Relief

Insurance is a key component of financial planning, and this deduction in Ireland offers relief on premiums paid for certain qualifying insurance policies, such as life and health coverage.

Eligibility Criteria:

- Policies must be approved under relevant tax guidelines.

- Premiums should be verifiable with official statements.

- There may be caps on the deductible amounts.

How to Claim:

- Collect annual insurance statements from your provider.

- Include the premium amounts in the appropriate section of your tax return.

- Attach supporting documents if required.

Example:

Kevin, who holds both life and health insurance policies, used his annual statements to claim insurance premium relief, reducing his taxable income by the deductible portion of his premiums.

Insurance Premium Relief: Quick Reference Table

| Aspect | Details |

| Eligible Policies | Approved life and health insurance |

| Documentation Required | Annual insurance statements, policy documents |

| Estimated Benefit | Partial reduction in taxable income |

| Example Benefit | Kevin’s deductions led to significant tax savings |

13. Energy Efficiency Grants

As sustainability becomes a priority, energy efficiency grants have emerged as a significant benefit. This deduction supports investments in eco-friendly home improvements.

Eligibility Criteria:

- Improvements must be certified as energy-efficient.

- Contractors must be accredited.

- Detailed invoices and certification documents are needed.

How to Claim:

- Gather all relevant invoices and contractor certifications.

- File your claim along with the tax return, ensuring compliance with guidelines.

- Consider combining the deduction with government-sponsored green incentives.

Case Study:

Niamh invested in upgrading her home’s insulation and solar panels. By claiming energy efficiency grants, she not only reduced her carbon footprint but also secured valuable tax credits.

Energy Efficiency Grants: Quick Reference Table

| Aspect | Details |

| Eligible Improvements | Insulation, solar panels, energy-efficient appliances |

| Documentation Required | Invoices, contractor certifications, energy audit reports |

| Estimated Benefit | Combination of grants and tax credits |

| Case Study Highlight | Niamh’s eco-upgrades resulted in both savings and sustainable benefits |

14. Student Loan Interest Deduction

For many, the cost of higher education is compounded by student loans. The student loan interest deduction helps ease this burden by allowing borrowers to deduct the interest portion from their taxable income.

Eligibility Criteria:

- Loans must be from approved financial institutions.

- Only the interest component is eligible.

- Detailed loan statements are required.

How to Claim:

- Keep a record of all interest payments throughout the year.

- Report the interest amounts in the designated section of your tax return.

- Ensure all supporting documents are updated and accurate.

Example:

Liam, burdened by student debt, benefited from claiming the student loan interest deduction, which eased his repayment process and lowered his tax liability.

Student Loan Interest Deduction: Quick Reference Table

| Aspect | Details |

| Eligible Loans | Loans from approved financial institutions |

| Documentation Required | Loan statements, interest payment records |

| Impact on Tax Liability | Lower taxable income through interest deduction |

| Real-Life Example | Liam’s claim significantly reduced his overall tax bill |

15. Voluntary Contributions Relief

Supporting charitable causes not only enhances community welfare but also provides a tax benefit. This relief encourages you to contribute to approved funds and charitable initiatives.

Eligibility Criteria:

- Contributions must be made to recognized organizations.

- The donation should meet minimum threshold requirements if applicable.

- Receipts and acknowledgments must be maintained.

How to Claim:

- Document each voluntary contribution with receipts.

- Include these contributions in your tax return.

- Confirm that the organizations are approved for tax relief.

Case Study:

Clara, a dedicated volunteer, made consistent contributions to various causes. By claiming voluntary contributions relief, she enjoyed tax savings while supporting her community.

Voluntary Contributions Relief: Quick Reference Table

| Aspect | Details |

| Eligible Contributions | Donations to approved charitable organizations |

| Documentation Required | Donation receipts, bank records |

| Estimated Benefit | Varies based on contribution amount |

| Case Study Highlight | Clara’s ongoing contributions led to a substantial tax credit |

How to Claim Your Tax Deductions in 2025 in Ireland?

Claiming tax deductions in Ireland requires organization and a systematic approach. The following step-by-step guide breaks down the process into manageable actions, ensuring you capture every eligible expense.

Step-by-Step Filing Guide

| Step | Action Items | Tools/Resources |

| 1. Gather Documentation | – Collect all receipts, invoices, and bank statements. | Digital scanners, receipt apps |

| – Organize documents by category (medical, education, etc.). | Folders, spreadsheets, cloud storage | |

| 2. Maintain Detailed Records | – Use accounting software or spreadsheets to track expenses. | Software like QuickBooks, Excel |

| – Create logs for vehicle mileage and business-related costs. | Mileage tracking apps, digital logs | |

| 3. Complete Your Tax Return | – Fill out the designated sections accurately. | Online tax filing platforms, Irish Revenue site |

| – Attach supporting documentation as required. | Digital document attachments | |

| 4. Use Interactive Checklists | – Employ online tools and downloadable checklists to verify claims. | Irish Revenue tools, tax advisor checklists |

| 5. Seek Professional Guidance | – Consult a tax advisor if needed, especially for complex cases. | Local tax advisory services, professional networks |

Common Pitfalls to Avoid

- Poor Record-Keeping: Inadequate documentation can lead to disallowed claims.

- Misclassification: Ensure expenses are correctly categorized as eligible for tax deductions in Ireland.

- Overlooking Minor Expenses: Even small expenses can add up—maintain detailed records.

By following these steps, you can confidently claim your deductions and reduce your taxable income, ensuring you maximize the benefits of tax deductions in Ireland in 2025.

Expert Tips and Best Practices

To truly benefit from the extensive range of tax deductions in Ireland, consider these expert strategies:

- Plan and Prepare Early:

Start gathering documents and tracking expenses from the beginning of the year. Early preparation prevents last-minute stress and ensures no eligible expense is overlooked. - Regularly Update Records:

Monthly or quarterly reviews of your expense logs can keep your documentation organized and accurate. - Stay Informed on Legislative Changes:

Tax laws change frequently. Regularly consult the Irish Revenue website or subscribe to reputable financial newsletters to stay updated on any new opportunities or modifications. - Use Digital Tools:

Take advantage of tax software and mobile apps to track expenses, scan receipts, and even calculate potential savings in real time. - Consult a Tax Advisor:

For complex cases, professional advice can ensure you maximize every available deduction and remain compliant with current tax regulations.

Case Studies and Real-Life Examples

Case Study 1: Comprehensive Medical and Pension Deductions

John, a mid-career professional, maintained detailed records of his medical expenses and pension contributions throughout the year.

By meticulously documenting and claiming these deductions, he reduced his taxable income by an impressive margin. His proactive approach not only provided immediate tax relief but also contributed to long-term financial security through enhanced pension savings.

Case Study 2: Self-Employed Success Story

Sarah, a freelance graphic designer, leveraged every eligible business expense, from software subscriptions to travel costs.

Her detailed record-keeping resulted in significant deductions, lowering her net taxable profit substantially. This case exemplifies the power of careful documentation and strategic tax planning in maximizing tax deductions in Ireland.

Case Study 3: Rental Income Optimization

James, a landlord with multiple rental properties, carefully tracked all expenses associated with property management.

His efforts to document repairs, maintenance, and management fees allowed him to offset rental income effectively, resulting in a healthier cash flow and reduced overall tax liability.

Takeaways

The landscape of tax deductions in Ireland for 2025 is robust and offers a wide array of opportunities for both individuals and businesses. Whether you’re seeking to alleviate the financial strain of medical expenses, boost your retirement savings through pension contributions, or optimize rental income, this guide provides you with the essential tools and insights needed to navigate the system effectively.

By breaking down each deduction into clear, manageable steps, and supporting them with real-life examples, interactive tables, and expert tips, you are now equipped to maximize your savings.

The proactive approach to tracking and claiming tax deductions in Ireland not only reduces your tax liability but also encourages disciplined financial planning and investment in your future.

Remember, the key to success lies in organization, staying informed, and seeking professional guidance when needed. As you prepare for the 2025 tax year, let this guide serve as your comprehensive roadmap to achieving significant savings and financial stability.

Embrace the power of tax deductions in Ireland, and turn the complexities of the tax system into opportunities for lasting economic benefit.