Tax time in Australia often feels like a national sport. As the end of the 2025-2026 financial year approaches, the race is on to gather receipts and maximize returns. With the cost of living remaining a significant pressure, ensuring you claim every cent you are legally entitled to is a financial necessity.

However, many Australians leave money on the table simply because they do not realize what they can claim. From the evolving rules around working from home to the specific rates for vehicle use, knowing the landscape can significantly boost your refund.

How to Claim Tax Deductions

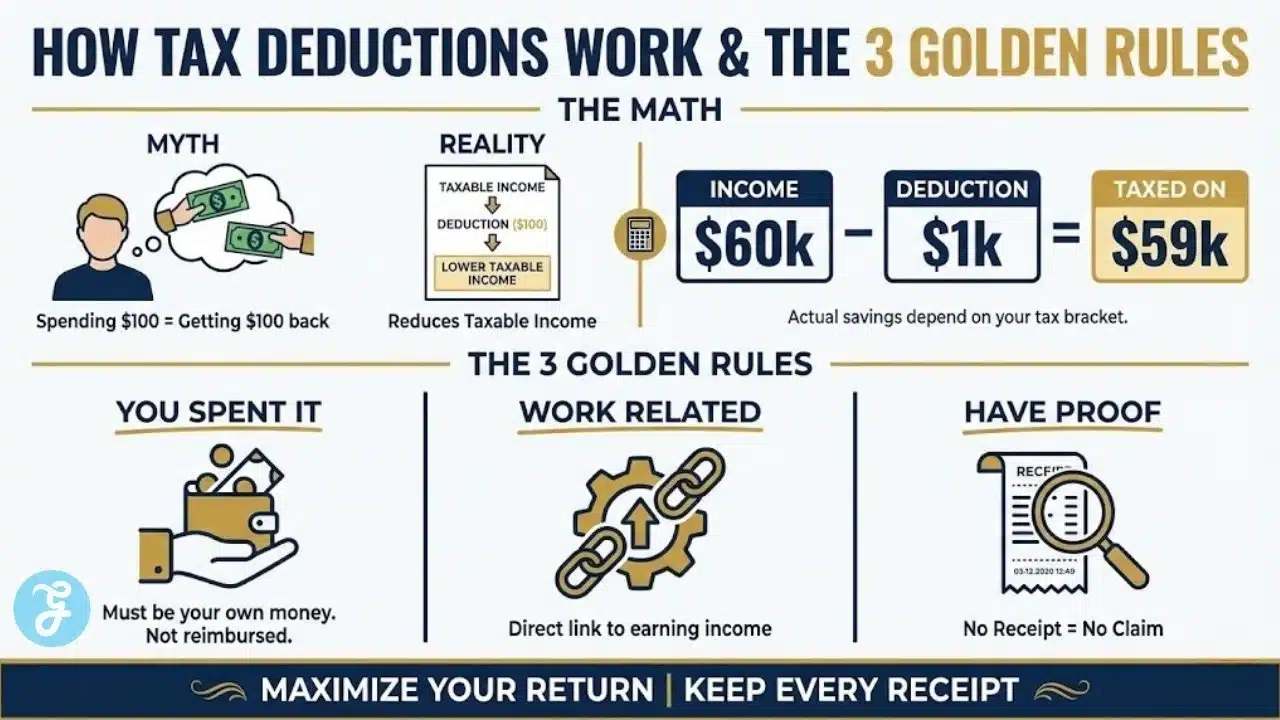

To legally claim a deduction, the ATO has three simple “golden rules” you must follow. If your claim doesn’t meet these three criteria, it will likely be rejected.

- You must have spent the money yourself: You cannot claim a deduction if your employer paid for the item or if they reimbursed you for the cost later. It must be an expense that came out of your own pocket and stayed there.

- It must be directly related to your job: There must be a clear link between the purchase and how you earn your income. You cannot claim private expenses like normal clothes, food, or commuting costs. If you use an item for both work and personal life (like a phone), you can only claim the percentage used for work.

- You must have a record to prove it: The general rule is simple. No receipt means no claim. You need written evidence, such as a receipt or invoice, showing what you bought, when you bought it, and how much it cost. Bank statements are sometimes okay for small items, but keeping the actual receipt is always the safest bet.

Top 12 Tax Deductions in Australia for 2026

Here are the Top 12 Tax Deductions in Australia for 2026:

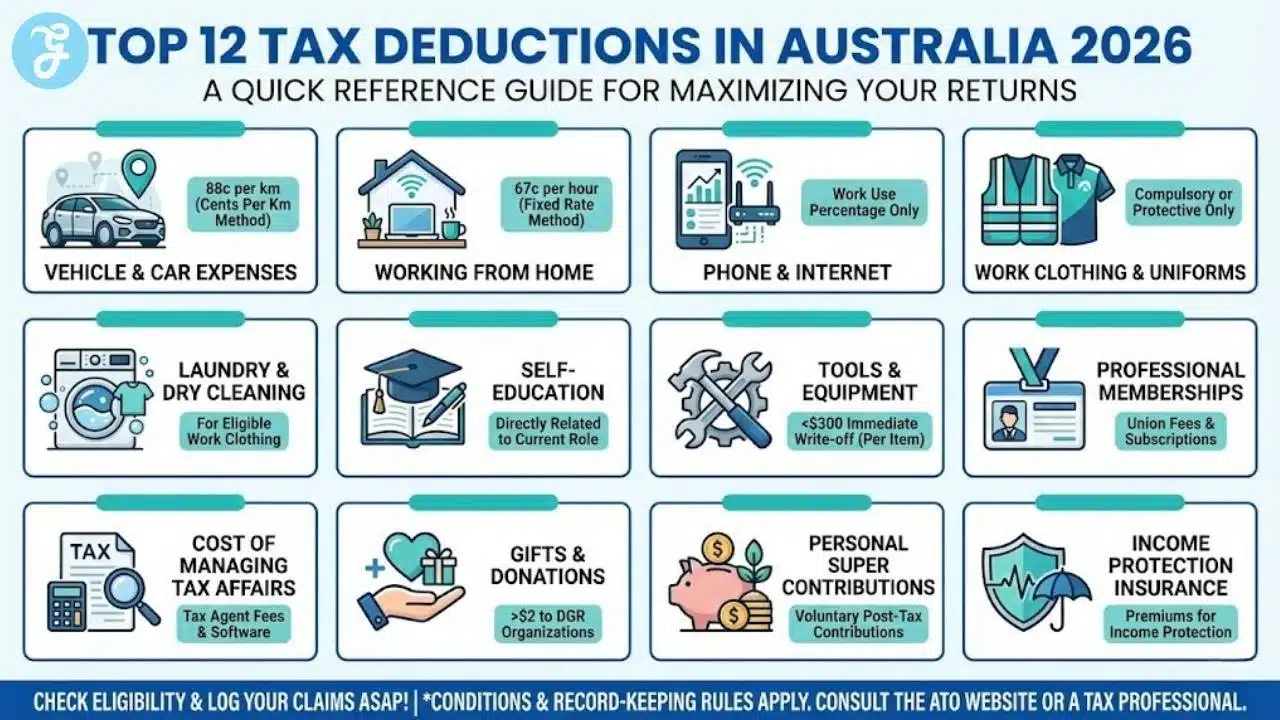

1. Vehicle and Car Expenses

For many employees, their car is an essential tool of the trade. If you are required to use your personal vehicle for work duties (excluding your regular commute), this is often the largest deduction you will make.

The Cents Per Kilometer Method

For the 2026 tax year, the rate is 88 cents per kilometer. This method allows you to claim up to 5,000 business kilometers per vehicle. It is simple because the 88 cents covers all running costs (fuel, registration, insurance), so you do not need receipts for those individual expenses. You do, however, need to show how you calculated your business kilometers.

The Logbook Method

If you drive more than 5,000 kilometers for work, the logbook method is usually superior. You must keep a valid logbook for 12 continuous weeks to establish the business-use percentage of your car. Once established, you can claim that percentage of all actual expenses, including fuel, interest, and depreciation.

Things to Consider: Switching between methods is allowed from year to year. Choose the one that yields the best refund for your current driving habits.

Pro Tip: Download a GPS logbook app. It automatically tracks your trips and classifies them, which is much easier and more accurate than a paper diary.

2. Working From Home Expenses

With hybrid work now a permanent fixture, home office deductions remain a key claim. You generally have two choices.

The Fixed Rate Method

The fixed rate is currently 67 cents per hour worked from home. This covers energy, phone usage, internet, and stationery. The trade-off is that you cannot claim separate deductions for your phone or internet bills if you use this rate. You must have a record of actual hours worked, such as a timesheet. Estimates are not accepted.

The Actual Cost Method

This involves calculating the specific work-related portion of your electricity, internet, and cleaning bills. It also allows you to claim the decline in value of office furniture. While this method requires more rigorous math, it is often better for those with dedicated home offices and high running costs.

Things to Consider: To use the actual cost method, you generally need a dedicated work area. You cannot claim occupancy costs like rent or mortgage interest unless your home is your “principal place of business,” which is rare for employees.

Pro Tip: If you buy expensive equipment like a standing desk, the Actual Cost method often wins because you can depreciate those assets separately. Under the Fixed Rate method, furniture wear and tear is not included.

3. Mobile Phone and Internet

If you do not use the 70-cent fixed rate method, you can claim mobile phone and internet expenses separately. This is useful for workers who are on the road or use their personal phone for business calls.

The key is apportionment. You cannot claim your entire monthly bill. You must determine the percentage of work use versus personal use. The ATO accepts a four-week diary as evidence to establish this percentage for the whole year.

Things to Consider: Be careful with bundled plans. If your internet bill includes cable TV, you must exclude that cost before calculating your work percentage.

Pro Tip: Save a PDF of one itemized bill per year and highlight the work calls. This provides the “reasonable basis” the ATO looks for.

4. Work Clothing and Uniforms

Clothing claims are a common audit target. You cannot claim “conventional clothing” (business suits, black trousers) even if your employer requires you to wear it.

Compulsory Uniforms

To be deductible, a uniform must be distinct from your organization and compulsory to wear. This usually means it features a logo or is a specific design registered with AusIndustry.

Protective Clothing

You can claim items that protect you from injury or illness, such as steel-capped boots, non-slip shoes for nurses, fire-resistant clothing, and high-visibility vests.

Things to Consider: The “conventional clothing” rule is strict. If you could reasonably wear the item for a night out, it is likely not deductible.

Pro Tip: Check if your uniform is on the Register of Approved Occupational Clothing. If it is, you can claim it even if it is non-compulsory.

5. Laundry and Dry Cleaning

If you have eligible work clothing (as described above), you can claim the cost of cleaning it. The ATO allows a claim for laundry expenses for washing distinct uniforms or protective gear.

For claims up to $150, you do not need written receipts, but you must use a reasonable basis (e.g., $1 per load for work-only washes). If your costs exceed $150, you need written evidence.

Things to Consider: This deduction only applies to eligible clothing. You cannot claim the laundry rate for washing your standard office wear.

Pro Tip: If you use a dry cleaner, keep the receipts even if the claim is under $150. Physical proof eliminates questions during an audit.

6. Self-Education Expenses

Investing in your own skills is deductible if the course connects directly to your current employment. The education must maintain or improve skills required for your current role, or be likely to result in an income increase.

You can claim course fees, textbooks, stationery, and even the decline in value of a computer used for study. You cannot claim the cost of a course designed to get you a new job or switch careers.

Things to Consider: You cannot claim repayments made towards Higher Education Loan Program (HELP) debts.

Pro Tip: Don’t forget travel. You can claim the cost of travel from your home or work to the place of education and back.

7. Tools and Equipment

If you buy tools to help earn your income, the cost is deductible.

Items Costing $300 or Less

You can claim an immediate deduction for the full cost in the year you buy them. This applies to laptop bags, calculators, software, or hand tools.

Items Costing More Than $300

You must claim the decline in value (depreciation) over the asset’s effective life. This applies to laptops, tablets, or power tools. Remember to only claim the work-related percentage of use.

Things to Consider: The $300 limit applies per item. Buying four different tools that each cost $200 allows you to write them all off immediately, provided they aren’t part of a set.

Pro Tip: If buying multiple smaller items, purchase them in separate transactions. This clarifies that they are separate assets eligible for the immediate write-off.

8. Professional Memberships and Union Fees

Fees paid to professional associations and trade unions are fully tax-deductible. This includes annual practicing certificates, registration fees, and union dues. Subscriptions to professional journals or magazines are also deductible.

Things to Consider: Social club fees are generally not deductible, even if you use them for networking.

Pro Tip: Look for your annual tax statement from your union in July. It summarizes exactly what you paid during the financial year.

9. Cost of Managing Tax Affairs

Any fee you pay to a registered tax agent to prepare and lodge your tax return is tax-deductible in the year the fee is paid. This also covers travel costs to visit your accountant and the cost of tax reference materials.

Things to Consider: You claim the deduction in the year the money is spent. If you pay your accountant in August 2025 for your 2025 return, you claim that deduction in your 2026 return.

Pro Tip: If you buy tax software to file your own return, that purchase price is also fully deductible.

10. Gifts and Donations

You can claim a deduction for donations of $2 or more to approved Deductible Gift Recipient (DGR) organizations. You cannot receive a material benefit in return (e.g., raffle tickets or charity dinners do not count).

Things to Consider: Crowdfunding campaigns often do not have DGR status unless run by a registered charity. Personal cause donations are usually not deductible.

Pro Tip: Most charities will email you a consolidated tax receipt at the end of the financial year. Search your inbox for “tax receipt” in June.

11. Personal Superannuation Contributions

You can make voluntary personal contributions to your superannuation fund and claim them as a tax deduction. This effectively taxes that money at 15% rather than your marginal tax rate. For the 2026 financial year, the concessional contributions cap is $30,000 (including employer contributions).

Things to Consider: You must lodge a “Notice of intent to claim or vary a deduction” form with your super fund and receive an acknowledgment letter before you file your tax return.

Pro Tip: Check myGov to see your “unused cap” from previous years. You might be able to carry forward unused amounts and contribute more than $30,000 this year.

12. Income Protection Insurance

Premiums you pay for income protection insurance are tax-deductible. This insurance pays you a stream of income if you are unable to work due to illness or injury.

Things to Consider: Premiums for life insurance, trauma insurance, or critical care cover are generally not deductible. If your policy is bundled, you must ask your insurer for a breakdown to claim only the income protection portion.

Pro Tip: Paying your annual premium in a lump sum before June 30 allows you to bring the deduction into the current financial year.

How Do Tax Deductions in Australia Work

It is a common myth that a tax deduction gives you all your money back. Many people believe that if they spend $100 on work boots, the ATO will put that $100 back into their pocket. Unfortunately, that is not how it works.

Think of a tax deduction as a way to lower the amount of income you are taxed on. If you earn $60,000 a year and claim $1,000 in deductions, the ATO treats you as if you only earned $59,000.

The actual money you get back depends on your tax bracket. If you pay 32.5 cents tax on every dollar you earn, a $100 deduction will save you $32.50 in tax. Essentially, you are getting a percentage of the cost back, not the full price.

Audit-Proof Your Deductions: Records, Red Flags, And Simple Systems

Claiming more is great, but keeping your claims defensible is what protects your refund. The ATO doesn’t just look at totals. It looks at patterns, consistency with your job, and whether your evidence matches the story your return tells.

Common ATO Red Flags To Avoid

Some claims get extra attention because they’re often overstated. Keep these areas tight:

- Work-from-home hours that feel inflated (especially if your role is mostly on-site).

- Car claims that look like commuting (home-to-office is usually not deductible).

- Uniform and laundry claims for “normal” clothing (black pants and business shirts rarely qualify).

- Phone/internet claims at 80–100% work use without a clear diary or itemized support.

- Large deductions with no matching income change (e.g., claiming big self-education costs but your role doesn’t use those skills).

If you’re making a larger-than-usual claim, add stronger documentation and a short note to yourself explaining why it was necessary for your job.

The “Clean Evidence” Checklist

Aim for evidence that answers three questions: what, when, and why it’s work-related.

- Receipts or invoices with the supplier name, date, and amount

- Proof of payment (bank/credit card record)

- Work-use calculation (logbook, diary, or percentage method)

- Supporting context (roster, contract clause, email request from your manager, or a policy)

A quick screenshot of an email that confirms you must use your own phone or attend a course can be surprisingly helpful.

A Simple System You’ll Actually Stick To

Keep it lightweight so you don’t quit in July.

- Create one digital folder named “Tax 2025–26” with subfolders: Car, WFH, Phone/Internet, Education, Tools, Donations.

- Snap receipts immediately and upload weekly. Set a 10-minute calendar reminder every Sunday night.

- Track WFH hours in real time using a timesheet app or a basic spreadsheet. Don’t estimate later.

- Save one “sample month” for usage bills (phone/internet) and keep a 4-week diary to justify your work percentage.

If you build the habit now, tax time becomes a quick review instead of a stressful hunt for missing proof.

Quick Refund Checklist

Before you lodge your 2025–26 return, run a fast refund check. Match every deduction to a receipt, invoice, or log. If you cannot explain the work link in one sentence, tighten the claim or leave it out.

Keep Claims Consistent

Compare this year’s deductions to last year’s totals. A small lift is normal, but a big jump should have a clear reason, like a new role, extra travel, or study required for your current job. Save a short note with your records so your story stays consistent.

Easy Deductions People Miss

Many taxpayers forget small, repeatable claims that add up:

-

Work-related subscriptions, licences, and professional journals

-

Depreciation on laptops, monitors, and tools used for work

-

Prepaid income protection premiums paid before 30 June

-

Tax agent fees paid after lodging last year’s return

-

Eligible DGR donations with valid receipts

Evidence That Holds Up

Aim for proof that shows what you paid, when you paid it, and why it is work-related. Keep a 4-week phone or internet diary if you claim a percentage.

Last Check Before Lodging

Review your work-use percentages, then file with confidence. Strong records protect your refund and reduce audit stress.

Final Thoughts?

Navigating the 2026 tax return requires a balance of maximizing legitimate claims and maintaining rigorous records. The ATO’s data-matching capabilities are better than ever. The best approach is to keep a digital folder throughout the year. Snap photos of receipts, save PDF invoices, and update your logbooks in real-time. By being organized, you ensure that when June 30 rolls around, you are ready to claim everything you deserve without the stress.