Hey there, are you curious about how some countries are jumping ahead in the tech game, especially with blockchain? It can be tough to keep up with all the fast changes in the digital economy, and you might wonder how a small nation like Switzerland is making big waves with innovative technologies.

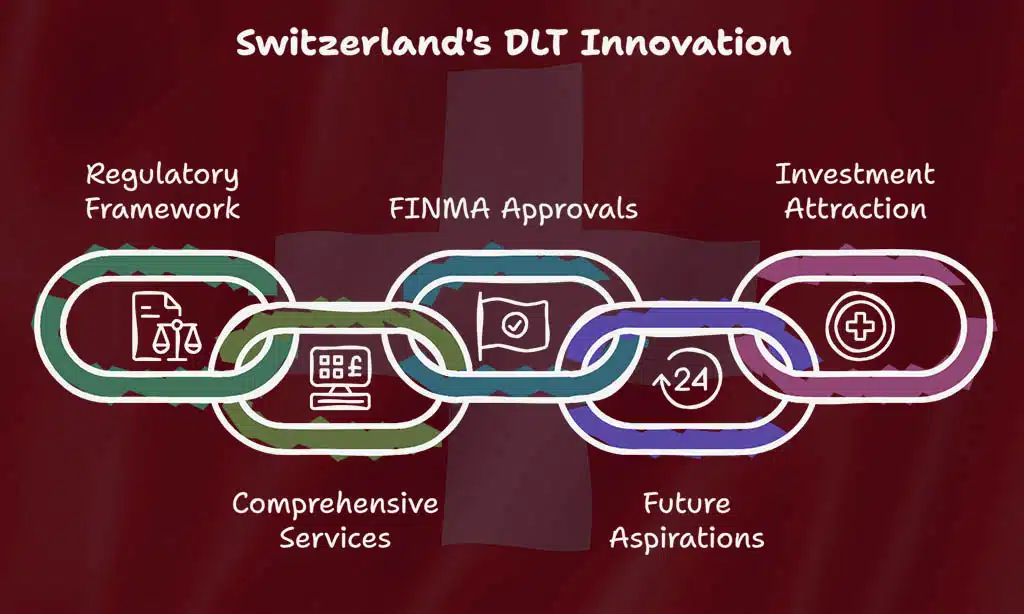

Guess what, Switzerland is a powerhouse in the blockchain world, and here’s a cool fact: they even passed a special law called the DLT Act in 2020 to boost blockchain growth. This shows their drive to lead in blockchain technologies.

In this post, we’ll break down six simple ways the Swiss government supports this exciting field, from clear rules to partnerships with the Swiss Blockchain Federation. Stick around to see how they do it!

Key Takeaways

- Switzerland passed the DLT Act in 2020, with key changes starting on February 1, 2021, and fully active by August 1, 2021, to support blockchain rules.

- The Swiss government set up DLT Trading Venues, with FINMA approving the Crypto Market Index Fund on September 29, 2021, and licensing SIX Digital Exchange AG.

- Blockchain startups get help with a FinTech license for deposits up to CHF 100 million and a sandbox exemption under CHF 1 million since 2016.

- Tax rules favor blockchain, with Zug raising crypto tax payment limits from CHF 100,000 in 2021 to CHF 1.5 million in 2023.

- Switzerland boosts global ties with projects like Mariana on November 2, 2022, alongside Singapore and the Eurosystem for cross-border digital currency.

Legal Clarity Through the DLT Act

Dig into this, folks, the Swiss government has paved a clear path for blockchain with the DLT Act. On December 14, 2018, the Swiss Federal Council dropped a key report on the legal framework for distributed ledger technology and blockchain.

Then, on September 25, 2020, the Swiss Parliament gave a big thumbs-up to the DLT-Law. This wasn’t just talk; by February 1, 2021, changes to the Swiss Code of Obligations and Federal Act on Intermediated Securities kicked in.

Later, on June 18, 2021, the rest of the provisions started rolling out, fully active by August 1, 2021. Talk about moving fast in the digital economy!

This law isn’t just paper, it’s a game-changer for crypto service providers. It brings in DLT-Securities right into the Swiss Code of Obligations, making things crystal clear. Plus, it sorts out how cryptocurrencies are handled during insolvency proceedings in Switzerland.

For anyone in the Crypto Valley Association or eyeing innovative technologies, this means less guesswork and more action. It’s like getting a green light on a busy road, so businesses can zoom ahead with confidence in regulatory compliance.

Stick with us to see how this shapes the future!

Establishment of DLT Trading Venues

Hey there, folks, let’s chat about how Switzerland is paving the way with DLT Trading Venues. The Swiss government has set up a fresh licensing category under the FMIA for these platforms.

Pretty cool, right? They allow trading, clearing, settlement, and even custody of DLT-Securities. Imagine a one-stop shop for all your digital currency needs in the digital economy.

Back on September 29, 2021, FINMA gave a thumbs-up to the Crypto Market Index Fund. That’s a big win for crypto service providers!

Also, in 2021, FINMA approved SIX Digital Exchange AG and SDX Trading AG as central securities depositories and stock exchanges. And guess what? BX Digital is aiming for a FINMA license by 2024.

These steps show Switzerland’s push for innovative technologies. It’s like giving a green light to foreign investments while keeping regulatory compliance in check. So, how does this tie into helping startups? Let’s jump into the next topic on support for blockchain startups.

Support for Blockchain Startups

Hey there, did you know the Swiss government rolls out the red carpet for blockchain startups with fast-track licensing processes? Keep reading to uncover more cool ways they boost the digital economy!

Simplified licensing processes for innovative businesses

Starting a blockchain business in Switzerland is a breeze, folks. The Swiss government rolled out a cool three-pillar FinTech framework back in 2016. It cuts through the red tape for new companies.

With a simplified FinTech license, businesses can handle deposits up to CHF 100 million. That’s a big deal for crypto service providers looking to grow in the digital economy. Plus, there’s a sandbox exemption for non-interest-bearing deposits under CHF 1 million.

Talk about a sweet setup!

Guess what? They even exclude certain funds from being called deposits if forwarded within 60 days. This kind of proportionate regulation helps innovative technologies bloom without heavy burdens.

The Swiss Blockchain Federation must be thrilled with these moves. So, let’s peek at how tax policies also play a role in fueling blockchain growth.

Access to funding through government-backed initiatives

Hey there, readers, let’s chat about how the Swiss government helps blockchain folks get the cash they need. Through solid government-backed initiatives, they make funding accessible for startups in the digital economy.

Imagine having a piggy bank that’s always got some extra coins for your big ideas, that’s kind of what they do.

Guess what? The Swiss Blockchain Federation plays a huge role here, pushing Switzerland as a top spot for blockchain growth. They team up with policymakers to create paths for foreign investments and support crypto service providers.

At events like the Infrachain 18 conference, they showed off this leadership, proving they’re all in for innovative technologies. Stick with me to see how this fuels new projects!

Tax Policies Favorable to Blockchain Innovation

Tax rules in Switzerland give blockchain fans a real boost. Imagine getting a break while building in the digital economy; that’s what happens here. Cryptocurrencies face wealth tax, pegged to year-end rates set by the FTA.

Yet, if you’re an individual, capital gains on these digital assets often skip income tax, unless they’re business holdings. Isn’t that a sweet deal for crypto service providers?

Now, let’s chat about businesses and taxes in this space. Legal entities pay corporate income tax on cryptocurrency profits, plus an annual capital tax on their stash. For VAT, trading digital currency gets a pass, treated like legal tender.

In Zug, tax payments using crypto jumped from a limit of CHF 100,000 in 2021 to a whopping CHF 1.5 million in 2023. Talk about rolling out the red carpet for innovative technologies!

Promotion of Knowledge and Technology Transfer

Hey there, readers, let’s chat about how Switzerland boosts blockchain know-how! The Swiss government works hard to spread knowledge and share tech in this fast-moving digital economy.

They team up with schools and experts, making sure ideas flow from labs to real-world uses. Just look at Project Helvetia, showing how wholesale central bank digital currency can settle tokenized assets.

Pretty neat, right?

Speaking of cool projects, check out Project Mariana, which tackles foreign exchange trading with automated market-makers. The Swiss Blockchain Federation plays a big part too, pushing for more learning and growth.

They join hands with folks like professors Hans Gersbach and Martin Wrter to spark innovation. Plus, events like the Infrachain 18 conference, welcomed by Federal Councillor Ueli Maurer, bring everyone together to talk data security and new tech.

Stick around to see how these efforts keep paying off!

Collaboration with the Private Sector

Hey there, wanna know how the Swiss government teams up with businesses for blockchain magic? They join forces with companies, making cool projects happen faster, and trust me, it’s a game-changer!

Partnerships to test and scale blockchain applications

Let’s chat about how the Swiss government teams up with big players to grow blockchain ideas. They form strong public-private partnerships to test and scale new tools in the digital economy.

Projects like Helvetia show this in action, with Phase 1 proving that wholesale CBDC, a type of digital currency, can work well. Then, Phase 2 brought in giants like Citi, Credit Suisse, and UBS to push it further.

Cool, right?

Think of these efforts as a sandbox for testing toys before they hit the market. Another neat project, called Jura, focuses on making cross-border transactions smoother using the same wholesale CBDCs.

The Swiss government, along with groups like the Swiss Blockchain Federation, makes sure crypto service providers have a safe space to experiment. This teamwork keeps Switzerland ahead in innovative technologies, and it’s exciting to see what comes next!

Hosting blockchain-focused public conferences and events

Hey there, readers, let’s chat about how Switzerland shines by hosting blockchain-focused public conferences and events. Picture a big gathering like the Infrachain 18 conference, where ideas spark and connections grow.

These events bring together bright minds in the digital economy to share knowledge and push innovative technologies forward. It’s like a melting pot of brainpower, bubbling with fresh concepts for blockchain growth.

Switzerland doesn’t just stop at one event, though. With support from groups like the Swiss Blockchain Federation, they keep the conversation alive through regular meetups and talks.

These gatherings boost data security and privacy discussions while showcasing crypto service providers. They’re a goldmine for anyone eager to learn or collaborate on digital currency projects.

Stick around to see how this fuels progress!

Commitment to International Competitiveness

Hey there, wanna know how Switzerland stays ahead in the global blockchain race? They keep rules light, making it a breeze for companies to test new ideas without getting tangled in red tape.

Avoiding over-regulation to maintain innovation-friendly policies

Switzerland is paving the way to be a global leader in blockchain innovation, and they’re doing it with a smart game plan. The Swiss government shows real openness toward new developments, especially in the digital economy.

Instead of piling on heavy rules, they focus on proportionate regulation to keep things friendly for innovators. Think of it like giving a plant just enough water, not drowning it.

Their Federal Council prefers tweaking existing laws over crafting brand new ones, keeping the process light. This approach helps crypto service providers and startups thrive without red tape slowing them down.

It’s like clearing the path for a race, so runners can sprint ahead. Want to know more about their global edge? Let’s jump into their push for international competitiveness.

Encouraging cross-border blockchain collaborations

Hey folks, let’s chat about how Switzerland is teaming up with other countries to boost blockchain tech. They’re joining hands with places like Liechtenstein, France, Singapore, and even the Eurosystem to push the digital economy forward.

Think of it as a global potluck, where everyone brings a tasty idea to the table for innovative technologies.

On October 8, 2019, the Swiss National Bank signed a deal with the BIS for an Innovation Hub Centre, a big step for international standards. Then, on November 2, 2022, they kicked off Project Mariana with Singapore and the Eurosystem, aiming to test cross-border digital currency tools.

These partnerships spark fresh ideas, build trust in crypto service providers, and keep data security tight. How cool is that?

Takeaways

Well, there you have it, folks! Switzerland is rolling out the red carpet for blockchain growth with smart laws and cool projects. Isn’t it amazing how they back startups and keep rules fair? Their push for a strong digital economy is setting a high bar.

Stick around to see how this tiny nation keeps shaping the future of tech!

FAQs

1. How does the Swiss government help grow the digital economy with blockchain?

Man, they’re really paving the way for a strong digital economy! The Swiss authorities back innovative technologies like blockchain by crafting proportionate regulation that keeps things fair and safe. It’s like giving a green light to crypto service providers while still watching the road for bumps.

2. What role do groups like the Swiss Blockchain Federation play in this tech boom?

These folks, along with the Crypto Valley Association and Bitcoin Association Switzerland, are the cheerleaders of the industry initiative. They team up with the government to push for blockchain growth, making sure ideas turn into real projects.

3. Why is regulatory compliance such a big deal for blockchain in Switzerland?

Well, sticking to international standards is like having a solid handshake; it builds trust. The Swiss government sets clear rules for crypto service providers, so everyone plays fair. This keeps foreign investments rolling in without any nasty surprises.

4. How does Switzerland balance data privacy and data security in blockchain?

Hey, they’ve got this down to an art! The government works hard to protect data privacy and data security, making sure digital currency dealings don’t turn into a wild west show. It’s all about keeping your info safe while still letting innovative technologies shine.

5. What’s the deal with attracting foreign investments for blockchain projects?

Switzerland is like a magnet for global cash flow in this space. By supporting industry initiatives and maintaining proportionate regulation, they make it a sweet spot for investors eyeing digital currency and other cutting-edge tech. Plus, with groups like the Crypto Valley Association around, it’s a welcoming hub for new ideas and big bucks.