Hey there, are you feeling buried under a mountain of student loan debt? You’re not alone, pal. So many folks are juggling payments, stressing over interest rates, and wondering if they’ll ever break free.

It’s like carrying a heavy backpack that just won’t come off, right?

Here’s a little ray of hope, though. Did you know there are actually eight different Student Loan Forgiveness Programs out there waiting to help? That’s right, real options like Public Service Loan Forgiveness and Teacher Loan Forgiveness could lighten your load.

Stick with me, and I’ll walk you through each one, step by step, to see if you qualify for debt relief. We’ll chat about federal student loans, repayment plans, and more. Curious to ditch that burden? Keep reading!

Key Takeaways

- Public Service Loan Forgiveness (PSLF) wipes out federal student loans after 120 payments, or 10 years, for full-time public service workers.

- Teacher Loan Forgiveness (TLF) offers up to $17,500 in debt relief for teachers in low-income schools after 5 years of service.

- Income-Driven Repayment (IDR) plans like SAVE forgive loans after 20 or 25 years, and it’s tax-free until the end of 2025 due to the 2021 American Rescue Plan.

- Military Service Loan Forgiveness can repay up to $50,000 for National Guard members and counts service time toward PSLF.

- State programs, like Mississippi’s Winter-Reed Teacher Loan Repayment, pay up to $6,000 yearly for teachers in specific areas.

Public Service Loan Forgiveness (PSLF)

Got a job in a government agency or a nonprofit group? You might qualify for the Public Service Loan Forgiveness (PSLF) program, a fantastic chance to wipe out your federal student loans.

This plan forgives your entire loan balance, tax-free, after you make 120 qualifying payments, which adds up to 10 solid years of work. Stick with full-time employment in a qualifying public service job, and you’re on your way to financial freedom.

Here’s the deal, though, you need the right kind of loans to make this work. We’re talking Direct Loans or certain Federal Family Education Loans (FFEL). If you’ve got those, and you’re serving the community through your career, this could be your ticket out of student debt.

Imagine shedding that burden after a decade of hard work, pretty sweet, right? Keep track of those payments, stay in a qualifying role, and watch that debt disappear.

Teacher Loan Forgiveness (TLF)

Hey there, let’s chat about a sweet deal for teachers with student loans. If you’re working full-time in a low-income school or an educational service agency, you might snag Teacher Loan Forgiveness (TLF).

This program can wipe out up to $17,500 of your debt. Isn’t that a breath of fresh air? But, hold on, you’ve gotta stick with it for five straight years of teaching. No skipping out early, okay? It’s like planting a garden; you nurture it daily to see the blooms.

Stick with eligible loans like Federal Direct or Stafford Loans for this perk. Sadly, you can’t double-dip with Public Service Loan Forgiveness (PSLF) for the same teaching gig. Pick your path wisely, friend.

Imagine shedding that debt weight while shaping young minds in special education or other critical areas. Curious about qualifying schools or how to start? Let’s keep this convo rolling with the nitty-gritty on applying for teacher loan forgiveness.

Income-Driven Repayment (IDR) Forgiveness

Struggling with federal student loans? Income-Driven Repayment (IDR) plans could be your lifeline, adjusting payments based on what you earn. These plans, like the Saving on a Valuable Education (SAVE) Plan, Pay As You Earn (PAYE), Income-Based Repayment (IBR), and Income-Contingent Repayment (ICR), offer a light at the end of the tunnel.

Stick with qualifying payments for 20 or 25 years, and the remaining balance on your Direct Subsidized Loans, Unsubsidized Loans, or certain Direct Consolidation Loans gets wiped out.

Imagine that weight lifting off your shoulders after years of steady effort!

Here’s the scoop on how it breaks down. The SAVE Plan forgives undergraduate loans after 20 years and graduate loans after 25. PAYE cuts the debt after 20 years for new borrowers post-July 1, 2014, or 25 for others.

IBR matches that timeline, while ICR sets forgiveness at 25 years for everyone. Plus, thanks to the 2021 American Rescue Plan, this federal student loan forgiveness stays tax-free until the end of 2025.

So, keep making those payments on your federal direct loans, and you might just see that balance drop to zero!

Total and Permanent Disability (TPD) Discharge

Hey there, if you’re unable to work due to a total and permanent disability, the Total and Permanent Disability (TPD) Discharge might be a lifeline. This program wipes out your federal student loans, giving you one less worry.

To qualify, you’ll need solid proof, like documentation from a physician, the Social Security Administration, or even the Department of Veterans Affairs. It’s a clear path to debt forgiveness if you’re in this tough spot.

Guess what? For veterans, this discharge can happen automatically, unless you decline it due to state tax concerns. After getting the relief, know that your finances might be watched for three years.

So, keep your records handy, and stay on top of any updates with your federal student loans. This isn’t just a break, it’s a fresh start for many facing hard times with health and money.

Closed School Discharge

Got a raw deal from a school that shut down? You might qualify for a Closed School Discharge on your federal student loans. This program helps if your school closed while you were enrolled, or within 180 days after you withdrew.

It’s a lifeline for borrowers stuck with debt from a place that vanished. Imagine paying for a ticket to a show that never happened, crazy, right? Well, this discharge can wipe that slate clean.

Think of it as a refund for a bad purchase. If approved, you could even get back money from past payments on those loans. All it takes is a discharge application sent to your loan servicer.

Make sure you act fast, though, to meet the rules. Don’t let that debt hang over you like a dark cloud. Check with your servicer about Closed School Discharge for federal direct loans today.

Borrower Defense to Repayment

Hey there, let’s chat about a lifeline for those tricked by shady schools. Borrower Defense to Repayment is a real option if your college misled you or broke the law. Think of it as a way to fight back against fraud.

If you got stuck with federal student loans due to false promises, you might wipe out that debt. Even better, you could snag a refund for payments you’ve already made.

Now, here’s the deal with making this work. You must submit a borrower defense claim to the U.S. Department of Education. Show them proof of the deceit, like fake job stats or lies about costs.

It’s like telling a judge your side of a bad deal. If approved, they can cancel your remaining balance and maybe return your hard-earned cash. Stick with this process, and you could escape that unfair loan burden.

Military Service Loan Forgiveness

Serving in the military comes with big challenges, but it also opens doors to some solid perks for your federal student loans. If you’re active-duty personnel or a veteran, you can tap into Military Service Loan Forgiveness options.

Even better, National Guard members might snag up to $50,000 in repayment help for their loans. That’s a hefty chunk to wipe off your debt, right?

Plus, your time in military service counts toward Public Service Loan Forgiveness (PSLF) eligibility, stacking up those qualifying payments while you serve. On top of that, the Servicemembers Civil Relief Act offers sweet interest rate reductions to ease the burden.

So, if you’re in uniform, take a peek at these benefits for your educational loans, and see how much relief you can grab!

State-Based Loan Forgiveness Programs

Hey there, let’s chat about a cool way to ease your student loan burden with state-based loan forgiveness programs. Many states offer help, especially if you work in high-need fields like healthcare or education.

Take Mississippi, for instance, with its Winter-Reed Teacher Loan Repayment Program. This gem pays up to $6,000 a year for teachers in specific areas. Isn’t that a sweet deal? If you’re an educator, this could be your ticket to slashing those federal student loans.

States craft these plans to pull in talent where it’s needed most, so your job might just pay off in more ways than one.

Now, let’s peek at another example to get you excited. The National Institutes of Health, tied to some state efforts, offers up to $50,000 yearly for health care professionals doing research.

That’s a huge chunk off your debt! Keep in mind, though, each state has its own rules for eligibility and perks. Some focus on nursing school grads, others on medical school folks.

Dig into your state’s options for programs like these. You might find a perfect match to help with those pesky private student loans or federal direct loans. Stick around, let’s keep exploring how to make this work for you!

How to Determine Your Eligibility for Forgiveness Programs

Figuring out if you qualify for student loan forgiveness can feel like solving a puzzle, but don’t worry, we’ve got your back! Stick with us to uncover the steps that could wipe out your federal student loans for good.

Reviewing federal loan qualifications

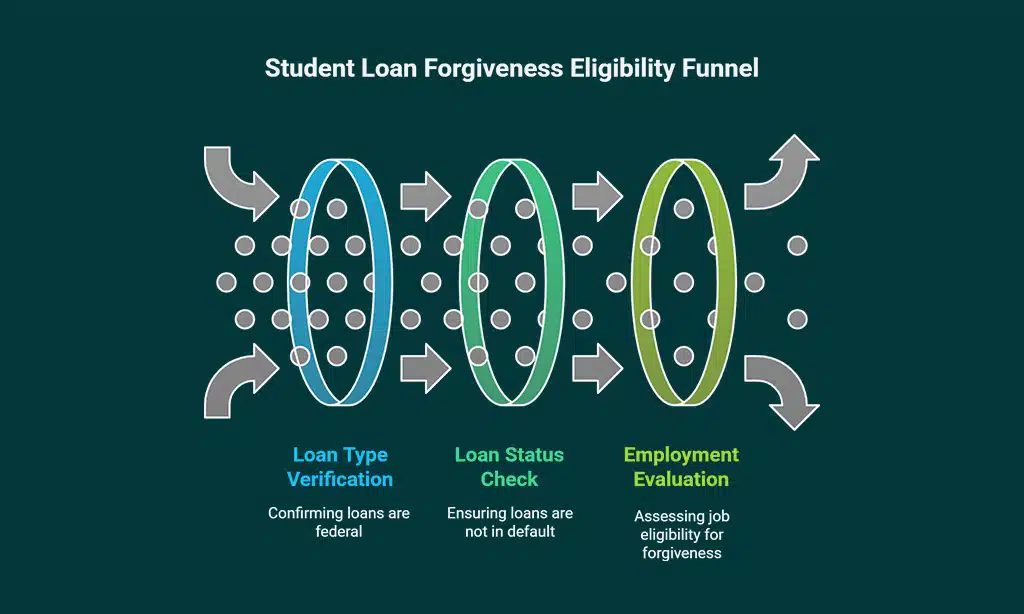

Hey there, let’s chat about sorting out your federal student loans for forgiveness. First off, you gotta check if your loans are the right kind, like Federal Direct Loans, since most programs don’t cover private student loans.

Dig into your loan details to confirm they’re not in default. If they are, no worries, just work on rehab or consolidation to get back on track for options like Public Service Loan Forgiveness (PSLF).

Stick with federal loans for the best shot at relief, as private lenders rarely offer this kind of help.

Evaluating employment or service requirements

Figuring out if your job fits student loan forgiveness can feel like solving a puzzle, but I’ve got your back. For programs like Public Service Loan Forgiveness (PSLF), you need to work full-time in a qualifying gig, such as a role with government or nonprofit organizations.

Same goes for Teacher Loan Forgiveness (TLF), where you must teach full-time at low-income schools or educational service agencies. It’s all about matching your career to the right slot.

Let me break it down a bit more for you, pal. Check if your employer is on the list for PSLF by using federal tools or resources tied to federal student loans. For TLF, confirm your school qualifies as low-income through official directories.

Missing this step could trip you up, so take a quick peek at your job details and see if they line up with these rules.

Steps to Apply for Student Loan Forgiveness

Hey, applying for student loan forgiveness doesn’t have to be a headache, and the first step is grabbing all your federal student loan papers, like your account statements from the Department of Education.

Stick around to catch the full guide on getting this done right!

Gathering required documentation

Digging up the right papers for student loan forgiveness feels like hunting for buried treasure, but don’t sweat it, I’ve got your back. Start by grabbing proof that fits your program, like medical records for Total and Permanent Disability (TPD) Discharge.

You’ll need solid documentation from a physician, the Social Security Administration, or the Department of Veterans Affairs to make your case.

Got a Closed School Discharge on your mind? Then, reach out to your loan servicer with the correct forms, showing your school shut down. Keep every record handy, whether it’s for federal student loans or specific plans like Public Service Loan Forgiveness (PSLF).

Trust me, having it all ready saves a ton of headaches down the road!

Submitting applications correctly

Hey there, let’s chat about getting those student loan forgiveness applications in tip-top shape. Submitting them the right way is like hitting the bullseye, and it can make a huge difference for programs like Public Service Loan Forgiveness (PSLF) or Borrower Defense to Repayment.

Stick to the rules, and you’re already ahead of the game.

Focus on proper documentation, as it’s your golden ticket to approval with the U.S. Department of Education. Double-check every form for federal student loans, whether it’s for a Closed School Discharge or another plan.

Miss a step, and it’s like forgetting the key to your front door. Stay sharp, follow specific procedures, and boost your chances big time.

Common Mistakes to Avoid While Applying

Steer clear of paying big bucks for help with student loan forgiveness. Federal programs like Public Service Loan Forgiveness (PSLF) are totally free, so don’t fall for scams promising quick fixes with high fees.

Save your cash, and apply directly through official channels for federal student loans.

Another trap is refinancing federal direct loans with private lenders. Doing this can lock you out of federal forgiveness options, like Borrower Defense to Repayment or Total and Permanent Disability (TPD) Discharge.

Think twice before switching to private student loans, as you might lose your shot at relief.

Alternatives If You Don’t Qualify for Forgiveness

Hey there, if student loan forgiveness isn’t an option for you, don’t lose hope just yet. Look into income-driven repayment plans, which adjust your monthly payments based on what you earn.

They can make federal student loans more manageable, even if they don’t wipe out the debt. Or, think about deferment and forbearance to pause payments during tough times. These tools give you some breathing room, like a short timeout in a rough game.

Also, check out refinancing or federal loan consolidation to lower your rates or simplify payments with private student loans or federal direct loans. It’s like reorganizing a messy desk to find what works.

For nurses, the NURSE Corps Loan Repayment Program can cover up to 85% of unpaid student debt if you qualify. Keep pushing, there’s always a way to tackle this mountain!

FAQs About Student Loan Forgiveness Programs

Got questions about student loan forgiveness? Let’s tackle some common ones with clear answers, just like chatting over coffee. Are you curious if federal student loans are your only shot at relief? Good news, most programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF) focus on Federal Direct Loans.

If you’ve got private student loans, though, you’re often out of luck for these plans. What about taxes on forgiven amounts? Thanks to the 2021 American Rescue Plan, forgiveness is federal tax-free until the end of 2025.

That’s a big relief, right?

Still wondering about defaulted loans? Here’s the scoop, if your loans are in default, forgiveness isn’t an option until you fix them. You gotta rehabilitate or consolidate those loans to qualify for programs like Borrower Defense to Repayment or Total and Permanent Disability (TPD) Discharge.

Think of it as cleaning up a messy room before inviting guests over. How do you start with something like Closed School Discharge? Check if your school shut down while you were enrolled.

If so, you might wipe out that debt. Stick around for more tips on these topics!

Takeaways

Hey there, let’s wrap this up with a quick nod to your student loan journey. Struggling with federal student loans can feel like climbing a steep hill, but these eight forgiveness programs might just be your shortcut.

Check out options like Public Service Loan Forgiveness or Teacher Loan Forgiveness to see if you fit the bill. Don’t let debt hold you back, take a peek at your eligibility today.

Grab this chance to lighten your load and breathe a bit easier!

FAQs on Student Loan Forgiveness Programs

1. What’s the deal with student loan forgiveness, and can I really get it?

Hey, student loan forgiveness is like a lifeline for folks drowning in debt from federal student loans. It’s real, and programs like Public Service Loan Forgiveness (PSLF) could wipe out your balance if you work in certain jobs, like for the government or nonprofits. Stick with me, and let’s see if you qualify for this sweet relief.

2. How does the Public Service Loan Forgiveness Program work for me?

If you’ve got federal direct loans, the Public Service Loan Forgiveness Program is your ticket. Work full-time in a public service gig for 10 years, make 120 on-time payments, and poof, your debt could vanish.

3. Can teachers snag any breaks with something like Teacher Loan Forgiveness?

Absolutely, educators, listen up! The Teacher Loan Forgiveness (TLF) plan can forgive up to $17,500 on your federal student loans if you teach in low-income schools for five straight years. It’s like a thank-you note for shaping young minds.

4. What if my school shut down? Is there help with Closed School Discharge?

Yep, if your school closed while you were enrolled, Closed School Discharge might erase those federal student loans. It’s a bummer to lose your campus, but at least you won’t be stuck paying for nothing.

5. I’ve heard of Borrower Defense to Repayment. What’s that about?

If your school misled you or broke the law, Borrower Defense to Repayment, also called Borrower Defense Discharge, could cancel your federal student loans. Think of it as fighting back against a shady deal. Check with the feds to see if your case fits.