Sustainability is no longer just a buzzword—it’s a necessity in today’s investment landscape. With the energy sector at the forefront of the green revolution, investors have an unprecedented opportunity to align their financial goals with environmental impact.

This guide explores strategies for a sustainable portfolio in the energy sector, providing actionable insights to maximize returns while championing renewable initiatives.

From clean energy investments to ESG-focused companies, these strategies pave the way for both ethical and financial success.

8 Proven Strategies for a Sustainable Portfolio in Energy Sector

As the global push for renewable energy intensifies, investors need robust strategies to navigate the evolving landscape. This section delves into the key approaches to building a sustainable energy portfolio, offering practical steps and insights into the most promising opportunities. By leveraging these strategies, you can contribute to a cleaner future while securing financial stability in the energy sector.

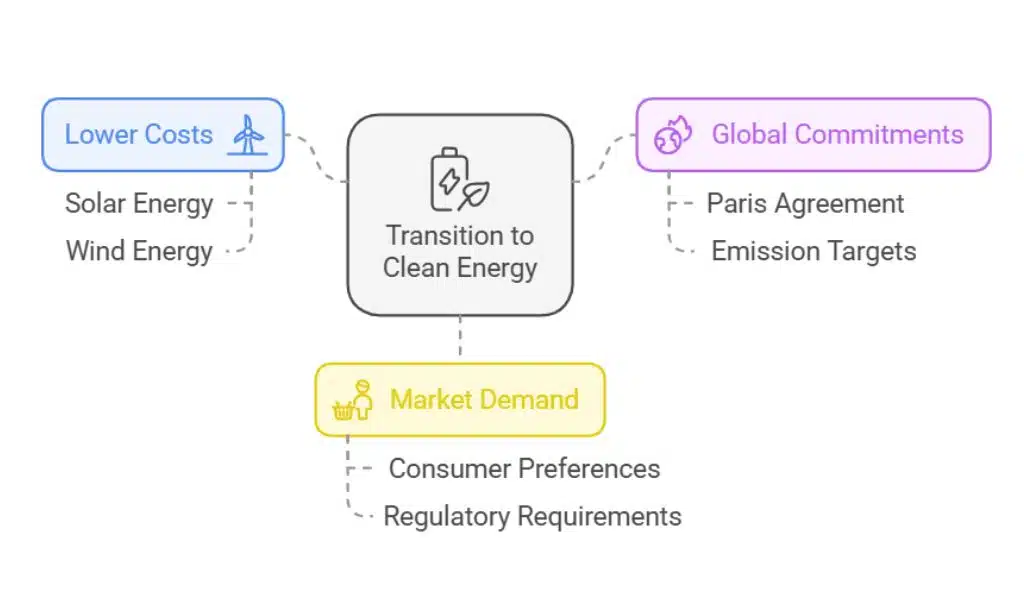

1. Understand the Transition to Clean Energy

The shift toward renewable energy sources is reshaping the global economy. As this transition gains momentum, adopting strategies for a sustainable portfolio in the energy sector becomes vital. For instance, focusing on solar and wind energy investments, which accounted for 60% of new global renewable capacity in 2023, can ensure long-term growth.

Why This Transition Matters

- Lower Costs: Solar and wind energy have become some of the cheapest energy sources globally.

- Global Commitments: Initiatives like the Paris Agreement emphasize reducing greenhouse gas emissions and promoting renewable energy.

- Market Demand: Businesses are adopting clean energy to meet consumer preferences and regulatory requirements.

Key Insights

- In 2023, global investment in renewable energy exceeded $1.7 trillion, marking a record high.

- Solar energy now accounts for nearly 60% of new global renewable capacity additions.

Renewable Energy Growth Projections

| Year | Solar Energy Growth | Wind Energy Growth | Global Renewable Market Value |

| 2025 | 15% | 12% | $2 trillion |

| 2030 | 18% | 14% | $3 trillion |

2. Invest in Renewable Energy Stocks

Leading companies like NextEra Energy and Vestas Wind Systems are driving the renewable sector forward. Incorporating these stocks into your portfolio aligns with your financial goals while supporting sustainable energy initiatives—a cornerstone of strategies for a sustainable portfolio in energy sector.

Companies Driving the Sector

- NextEra Energy (NEE): A leader in renewable energy production in the U.S., focusing on wind and solar.

- Orsted (ORSTED): A global pioneer in offshore wind energy projects.

- Vestas Wind Systems (VWS): A leading manufacturer of wind turbines with a strong global presence.

Benefits of Investing

- High-growth potential due to increasing global demand.

- Stability, as governments prioritize renewable energy.

- Positive environmental impact, aligning with ESG goals.

Performance Metrics for Top Renewable Energy Stocks

| Company | Revenue Growth (2024) | Market Share in Renewables | Stock Growth (YTD) |

| NextEra Energy | 12% | 18% | 16% |

| Orsted | 10% | 20% | 14% |

| Vestas Wind Systems | 11% | 22% | 15% |

3. Explore Green Bonds

Green bonds are an excellent option for investors looking to balance stable returns with positive environmental outcomes. These bonds fund renewable energy projects, energy-efficient buildings, and climate adaptation efforts.

Why Green Bonds Are a Great Option

- Stable Returns: Fixed income securities with relatively low risk.

- Social Responsibility: Directly finance eco-friendly projects.

- Tax Benefits: Many green bonds come with tax advantages for investors.

Example Projects Funded by Green Bonds

- Apple’s Green Bond Initiative: Funded renewable energy projects and energy-efficient manufacturing.

- European Investment Bank Bonds: Supported global climate adaptation projects.

Leading Green Bonds in 2024

| Bond Name | Issuer | Maturity Date | Coupon Rate | Focus Area |

| World Bank Green Bond | World Bank | 2032 | 2.75% | Renewable energy projects |

| Apple Green Bond | Apple Inc. | 2030 | 2.5% | Energy efficiency initiatives |

| EIB Green Bond | European Investment Bank | 2035 | 3.0% | Climate adaptation projects |

4. Focus on ESG-Compliant Companies

ESG-compliant companies focus on environmental, social, and governance practices, ensuring ethical operations and sustainable growth.

Key Features of ESG Investing

- Environmental Responsibility: Emphasis on reducing emissions, conserving resources, and adopting renewable energy.

- Social Equity: Practices that prioritize diversity, community development, and ethical labor standards.

- Strong Governance: Transparent decision-making and ethical leadership.

Top ESG Companies in the Energy Sector

- Iberdrola (IBE): Leading in renewable energy and sustainability initiatives.

- Enel (ENEL): Innovating in green technologies while maintaining strong governance.

- Ørsted: Transitioned from fossil fuels to become a global leader in wind energy.

ESG Ratings of Top Energy Companies

| Company | ESG Rating (MSCI) | Net-Zero Target |

| Iberdrola | AAA | 2040 |

| Enel | AA | 2050 |

| Ørsted | AAA | 2025 |

5. Diversify Across Energy Sub-Sectors

Diversification is critical to minimizing risk and maximizing returns in the energy sector. By investing in various sub-sectors, investors can capture growth opportunities across the industry.

Key Sub-Sectors

- Battery Storage: Essential for the efficient use of renewable energy.

- Smart Grids: Modernizing energy distribution systems for greater efficiency.

- Carbon Capture Technologies: Reducing emissions from industrial processes.

Table: Emerging Opportunities in Energy Sub-Sectors

| Sub-Sector | Growth Potential (2024-2030) | Key Players |

| Battery Storage | High | Tesla, Panasonic |

| Smart Grids | Medium | Siemens, Schneider Electric |

| Carbon Capture | Emerging | ExxonMobil, Shell |

6. Evaluate Emerging Technologies

Emerging technologies like hydrogen fuel cells and nuclear fusion offer groundbreaking opportunities in the energy sector. While they come with higher risks, their potential rewards can be transformative.

Promising Technologies

- Hydrogen Fuel Cells: Ideal for clean transportation and industrial use.

- Nuclear Fusion: Potentially limitless energy with zero emissions.

Advantages and Risks of Emerging Technologies

| Technology | Advantages | Challenges |

| Hydrogen Fuel Cells | Zero emissions, scalable | High production costs |

| Nuclear Fusion | Limitless energy, no waste | Long commercialization timeline |

7. Participate in Energy Sector Mutual Funds and ETFs

Energy-focused mutual funds and ETFs offer easy access to the renewable energy sector. These funds are professionally managed, making them a good option for beginners.

Recommended Funds

- iShares Global Clean Energy ETF (ICLN): Invests in global clean energy companies.

- Invesco Solar ETF (TAN): Specializes in solar energy stocks.

- SPDR S&P Renewable Energy ETF: Covers a wide range of green technologies.

Leading Energy ETFs

| ETF Name | Expense Ratio | 5-Year Return |

| iShares Global Clean Energy | 0.42% | 8.5% |

| Invesco Solar ETF | 0.69% | 10.3% |

| SPDR S&P Renewable Energy | 0.40% | 7.8% |

8. Monitor Government Policies and Incentives

Government policies can significantly impact the profitability of energy investments. Monitoring tax credits, subsidies, and renewable mandates is essential for making informed decisions.

Examples of Policies

- United States: Investment Tax Credits (ITCs) for solar and wind energy.

- Germany: Subsidies for energy-efficient buildings.

- China: Financial support for solar panel manufacturing.

Policy Impact by Region

| Country | Policy | Impact on Investors |

| USA | Solar ITC | Encourages solar investments |

| Germany | Energy-efficient subsidies | Boosts green construction |

| China | Solar subsidies | Reduces manufacturing costs |

Takeaways

Building a portfolio that champions sustainability requires thoughtful planning and execution. Adopting strategies for a sustainable portfolio in the energy sector allows you to balance financial growth with ecological responsibility.

By investing in renewables, ESG-compliant companies, and emerging technologies, you become an active participant in the global green revolution. Start implementing these strategies today to secure a brighter, greener tomorrow while achieving your investment goals.