In response to mounting pressure from potential U.S. tariffs, South Korea has unveiled a bold fiscal move to bolster its semiconductor sector — a key pillar of its economy. The government announced an additional 6.7 trillion won ($4.9 billion) in funding to safeguard its chipmakers against external trade shocks and intensifying global competition. This support will be implemented through 2026.

The decision underscores the country’s urgency to act amid “growing uncertainty” over U.S. trade policies, especially those proposed by former President Donald Trump, who has re-emerged on the political scene with aggressive economic tactics.

The new investment raises South Korea’s total planned semiconductor support from 26 trillion won to 33 trillion won ($24.1 billion), making it one of the country’s most comprehensive public funding efforts for a single industry in recent history.

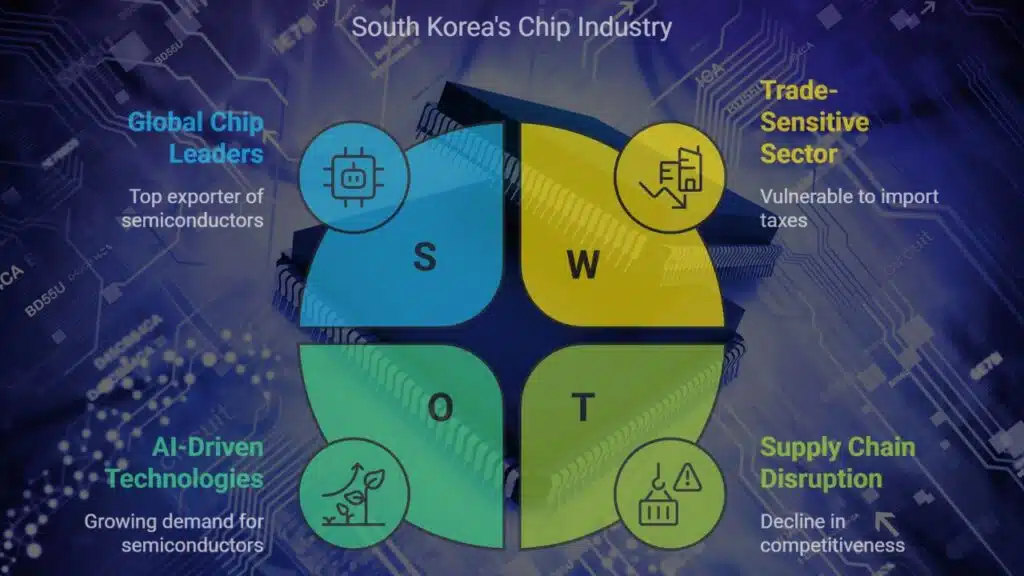

Why South Korea’s Chip Industry Matters Globally

Semiconductors are South Korea’s top export, accounting for nearly 20% of its total outbound trade in 2024. The nation is home to two global giants:

- Samsung Electronics – the world’s largest memory chipmaker

- SK Hynix – the second-largest memory chip supplier globally

These companies supply critical components for smartphones, servers, automotive electronics, and emerging AI-driven technologies. A disruption in their supply chain or decline in competitiveness could ripple across industries worldwide.

Recently, stock prices for Samsung and SK Hynix dropped due to fears of U.S. import taxes, illustrating how sensitive the sector is to trade-related developments.

U.S. Tariff Threats Loom: What’s at Stake?

On April 2, Donald Trump announced sweeping tariff proposals targeting imports from key global trading partners, including South Korea, China, Mexico, and Germany. Among them was a 25% tariff on South Korean semiconductors and pharmaceuticals.

Although these duties were suspended for 90 days, industry leaders and policymakers remain on edge. The short grace period has been described as a “critical window” to safeguard the nation’s most strategic industry and preempt economic fallout.

“The grace period offers a vital opportunity for our companies to regain footing and prepare for potential long-term disruptions,” said Finance Minister Choi Sang-mok.

Government’s Comprehensive Support Plan: What’s Included?

The $4.9 billion in new funding is part of a broader supplementary budget totaling 12 trillion won ($8.4 billion). According to the Ministry of Economy and Finance, the semiconductor package will include:

Infrastructure Investment

- Installation of underground power transmission lines at chip manufacturing clusters.

- Development of high-tech industrial parks designed for fabless and foundry collaboration.

- Expansion of clean water and power facilities necessary for high-yield semiconductor production.

Workforce & Talent Development

- Training programs in partnership with universities to address the critical shortage of skilled semiconductor engineers.

- Scholarships and incentives for engineering students and professionals to join the sector.

- Establishment of “semiconductor colleges” focused on R&D, fab design, and advanced materials.

Research & Development Boost

- Increased grants for next-gen memory chips, AI chips, and automotive semiconductors.

- State-backed investments in developing local alternatives for imported materials and equipment.

- Support for fabless startups and SMEs contributing to the chip ecosystem.

Private Investment Incentives

- Government subsidies and tax breaks to encourage private sector investment in domestic chip fabrication and expansion of overseas facilities, especially in the U.S. and Southeast Asia.

- Easier access to low-interest loans for capital-intensive chip projects.

“The government will boldly support investments and actively partner with companies to ensure we remain competitive,” Minister Choi added.

The Bigger Picture: Global Trade War or Negotiation Strategy?

While the suspension of tariffs provides temporary relief, tensions remain high. Trump’s latest announcements, made on “Liberation Day”, have jolted global markets and added ambiguity to future trade relations.

The former U.S. President has vowed to eliminate trade deficits and bring back American manufacturing, positioning the tariffs as part of a broader nationalist agenda. South Korea, which logged a $66 billion goods trade surplus with the U.S. in 2024, is clearly in Washington’s crosshairs.

“Duties targeting specific sectors such as semiconductors and pharmaceuticals remain on the horizon,” Choi warned.

Auto Sector Also Under Pressure

The semiconductor initiative follows last week’s unveiling of a $2 billion emergency support package aimed at South Korea’s auto sector, which is also facing tariff threats. In 2024, automobile exports to the U.S. totaled $42.9 billion, with major manufacturers like Hyundai and Kia at risk.

Unlike the chip industry, which benefits from a lack of viable U.S. substitutes, carmakers have less leverage and face immediate implications if tariffs are enforced.

Experts Say the Chip Industry Still Has Leverage

Despite the uncertainty, some analysts argue that South Korea’s semiconductor sector holds a strong bargaining position in ongoing trade talks.

“Unlike automobiles, semiconductors are products where the U.S. has little domestic production capacity,” explained Kim Dae-jong, economics professor at Sejong University.

He added that companies like Samsung and SK Hynix have already invested billions in U.S.-based fabrication facilities, which create jobs and foster economic cooperation — a point likely to be used in negotiations.

Diplomatic Backchannel Efforts and Next Steps

Trade diplomacy is expected to intensify over the coming weeks. South Korean Prime Minister Han Duck-soo, currently serving as acting president following the impeachment of Yoon Suk Yeol, held a phone call with Trump last week to discuss the matter.

Meanwhile, U.S. Treasury Secretary Scott Bessent confirmed that formal trade discussions with South Korea will begin next week. The talks are expected to focus on preventing abrupt disruption to critical supply chains while addressing U.S. concerns over trade imbalances.

“There is a possibility that tariffs may be negotiated sector by sector, or even adjusted item-by-item,” said Prof. Kim. “South Korea’s proactive investment and contribution to U.S. jobs may help soften Washington’s stance.”

South Korea’s Urgency is Justified

In a fast-evolving global trade environment, South Korea is not waiting to react — it’s preparing aggressively. With semiconductor supply chains at the heart of the world’s digital infrastructure, and geopolitical tensions escalating, ensuring the industry’s resilience is no longer optional — it’s essential.

As markets watch how the U.S. proceeds with its trade policy, South Korea is sending a clear signal: it will not let global uncertainty weaken its most vital industry without a fight.

The Information is Collected from MSN and Yahoo.