Do cash flow gaps stall your small business? You juggle rent, payroll, and supplier bills with tight funds. You even turn down good deals when you lack working capital.

A 2016 Small Business Credit Survey shows 61% of employer firms face cash flow problems. This post lists seven signs you need a working capital loan, guides you through cash flow checks, line of credit options, and credit score tips to fuel business expansion.

Read on.

Key Takeaways

- A 2016 Small Business Credit Survey found 61% of employer firms face cash flow gaps. You need a working capital loan or line of credit to cover rent, payroll, and supplier bills.

- Seasonal sales dips (as much as 30%) and late customer invoices can stall operations. Pre-arranged financing or invoice advances keep cash flowing through lean months.

- Turning down deals—like Sara’s bakery losing a 500-unit wedding cake order—shows you lack working capital. Loans let you buy stock, hire staff, and grab growth.

- A credit score above 700 and a clear loan-use plan speed approval. Online apps and lenders such as SBG Funding can fund equipment or short-term needs in under 24 hours.

How Are Cash Flow Gaps Affecting My Business Operations?

Owners track cash flow gaps in QuickBooks or Excel to spot trouble fast. Long accounts receivable cycles can eat into working capital and stall business operations. Founders often tap personal savings or swipe credit cards to cover rent, utilities, or supplier bills.

Those moves push up fixed costs and shake business stability. A SBA study shows 61 percent of small employer businesses faced these financial challenges last year.

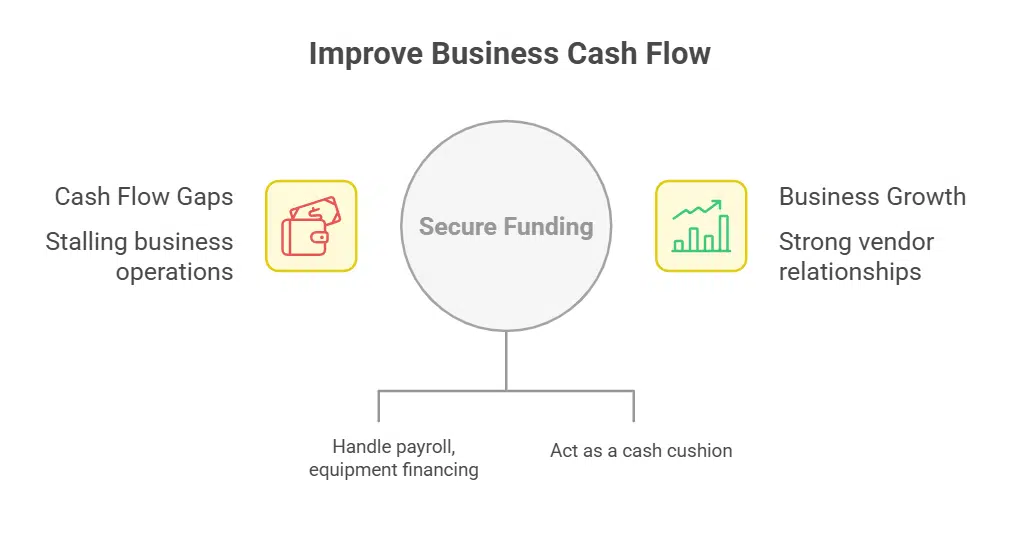

Seasonal dips and surprise expenses can worsen cash flow problems overnight. A business line of credit or small business loan can act as a cash cushion. Setting up a working capital loan before a crunch lets you handle payroll or equipment financing.

That extra funding fuels business growth and keeps vendor relationships strong.

How Do Seasonal Sales Fluctuations Impact Business Stability?

Sales in off months can drop by 30 percent. That slip can hurt cash flow fast. You may struggle to pay rent and vendor bills. A small shop might lack funds to restock inventory. Cash flow problems can derail day-to-day operations.

Monitoring industry trends with Excel forecasts or QuickBooks reports gives early warning. Short-term planning can spot those cash shortfalls before they bite.

Pre-arranging financing keeps a buffer in lean months. A business line of credit or a short term loan gives a financial cushion. External financing acts as a safety net against seasonal shortfalls.

Relying on high interest credit cards can raise your costs and risk stability. A small business loan or working capital loan carries lower rates than card debt. Expenses like payroll and inventory stay covered.

You can focus on growth instead of scrambling for cash. It keeps vendors happy and secures stock for busy seasons.

What Growth Opportunities Am I Missing Without Extra Capital?

Sara’s bakery lost a chance for a 500-unit wedding cake order. Small firms often lack enough inventory or staff to meet big deals, and they must turn them down. Local stores can’t secure prime space for a second shop or a new warehouse.

Hard data shows 61% of small businesses face financial challenges that include missed growth. Many owners wait too long to apply and lose deals.

Lenders prefer firms with rising revenues and strong credit history. Entrepreneurs use working capital from a small business loan or an invoice advance to buy stock and hire extra hands.

Smart financing matters, it fuels business expansion, keeps cash flow steady and opens new doors. Ready companies often seek funds early, not under urgent need, to grab a sweet deal.

Applying now means faster loan application and fewer missed chances.

When Do I Need Additional Equipment or Inventory?

Asset gaps can slow real estate transactions. Old machines drive up repair costs and stall production. You file vendor payments late when a key tool breaks. This cash flow trouble flags a need for equipment financing or a working capital loan from SBG Funding.

Surpassing current storage space hurts product launches. Smart inventory tracking reveals low stock before you miss a sale. New lines require extra stock. A bank loan or a government-backed loan can cover that cost.

You upgrade gear for a growth project, then boost your return on investment. Solid vendor partnerships help secure better payment terms on new assets. That move drives business growth and supports business expansion.

Why Is Meeting Payroll Obligations Becoming Difficult?

Cash flow gaps often hit payroll hardest. Delayed supplier payments and late customer invoices can force you to delay or reduce wages. High overhead costs may outpace revenue, pushing fixed costs like rent and utilities to the back burner.

You might swap personal savings to cover wages, but that strains your own finances. Some owners cut hours or pause hiring to balance the books. These cash flow problems signal you may need a working capital loan or a line of credit.

Owners often spot payroll strain as a red flag for external financing. Short-term working capital loans or lines of credit can fill the gap. Accounts receivable financing clears cash flow blockages.

A higher fico score and clean financial statements speed up the loan application process. Local banks and credit unions may offer government loans, small business loans, or cash advances.

Good supplier relationships and low turnover rates boost lender confidence.

What Causes Increasing Payment Delays from Clients?

Cash flow gaps start when clients miss invoice due dates. Late accounts receivable stall monthly cash flow. The firm then struggles to cover payroll and pay suppliers on time. Many small business owners turn to high-interest credit cards or merchant cash advances.

Frequent use of revolving credit raises fixed costs and hikes interest rates.

Continued payment delays can force ventures to decline business opportunities. Some owners tap personal credit lines to bridge shortfalls. Accessible tools like QuickBooks and clear financial statements identify patterns fast.

Armed with this insight, companies can seek a working capital loan or business line of credit before cash flow problems worsen.

How Can I Manage Short-Term Financial Challenges?

Short-term loans and a business overdraft patch cash flow gaps fast. A survey shows 61% of small businesses face these challenges. You cover a tech repair or a sudden vendor bill with quick cash.

A working capital loan and invoice financing act like safety nets as you track your cash flow statement.

Review your balance sheet every week to spot drops in sales or spikes in fixed costs. Early action helps you catch shortfalls before they hurt operations. SBG Funding grants approvals within 24 hours, so you can pre-arrange financing and cut stress in your loan application process.

Signs That Expansion or Renovation Plans Require Funding

Your workspace swells, but your cash flow forecast shows flat lines, so you need a working capital loan for new machines or stock.

Your accounting software and spreadsheet tool flag missed vendor payments or pricey equipment financing, and that sign points to a cash injection for expansion.

How Do I Know When to Start Expansion or Renovation?

Growth hits a ceiling if cash flow or space runs short. Extra room can fuel new product lines and cut fixed costs.

- You turn away large orders when stock or floor space runs out. This hurt comes from cash flow problems and points to a working capital gap, so a working capital loan can fill it.

- Lack of shop room slows down your craft or service. A small business loan, or equipment financing, can help you lease a new bay or buy extra machines.

- Launching new product lines strains current desks and shelves. This push shows you are ready for business expansion and need more working capital.

- Rising demand from regular clients can outstrip capacity. This jam in inventory management or supplier relationships signals the time for growth projects.

- Running out of tools or machines halts your daily craft. Equipment financing steps in to clear that hurdle and keep profits rolling.

- Clear goals in your financial statements help set the right pace. Use your balance sheet and cash flow statement to spot the perfect funding moment.

- Tracking customer needs on sales logs can unearth hidden market gaps. These clues guide you toward renovation or expansion planning.

- Internal hurdles, like slow board reviews or policy checks, can stall your next move. Jump these roadblocks to seize business opportunities fast.

- Late loan bids can leave you in the dust, missing key chances. Act early on your loan application process to lock in space or upgrades.

What Financing Options Support Business Growth Projects?

Financing powers expansion projects. Capital helps you scale quickly.

- SBG Funding term loans have set payments, fixed rates, and no hidden fees. Approval arrives in under 24 hours, and funds can hit your account the same day.

- Lines of credit from SBG Funding stay open to draw on as needed. You pay interest only on amounts used, and you avoid high fixed costs.

- Equipment financing covers items like machines, vehicles, or computers. You get new tools now and repay over time while you use the gear.

- Business debt consolidation loans bundle multiple balances into one. You cut down on fees, improve cash flow, and free up money for growth.

- SBA loans from the Small Business Administration bring low rates and long terms. PlainsCapital lenders help you sort out application steps.

- Working capital loans fill short term cash gaps. You can cover payroll, vendor payments, or tax bills without tapping savings.

- Online small business loan apps take minutes to finish. You upload financial statements from QuickBooks or Xero, hit submit, and often see funds the same day.

- Angel investors and venture capital firms invest in exchange for equity. You gain cash for big expansion plans, but you share some control.

How Can I Tell If My Credit Score Is Good Enough for a Loan?

Small business owners can pull a credit score report from major bureaus like Experian or TransUnion to gauge readiness for business financing. Scores above 700 often secure competitive rates on a small business loan.

Lenders look for a history of on-time vendor and supplier payments. Too many high-interest card balances may signal a reliance on plastic and raise red flags in the loan application process.

SBG Funding checks your credit without leaving a mark, so you can shop rates risk-free. Keeping personal and business credit separate helps shield your personal score from new working capital loan hits.

Strong credit also fuels business growth. Money lending firms favor solid profiles during the small business loan vetting phase. That edge speeds approval for equipment financing or new inventory purchases.

Why Is Having a Clear Loan Utilization Plan Important?

A clear loan utilization plan ties a working capital loan to business goals. It shows lenders how extra capital will drive business growth or fund equipment financing. It maps cash flow needs, vendor payments, and project costs like new equipment or a second location, using financial statements for proof.

This strategy boosts your fico credit scores and strengthens your small business loan application.

Clear strategies cut time from the loan application process and avert cash flow problems. They help you spot financial challenges early and refine budgets with tools like cash flow analysis and inventory management software.

Consulting a financial advisor or accountant lets you refine forecasts, avoid late tax payments, and sharpen your plan. This choice limits unnecessary debt and drives long term stability.

Takeaways

Your cash flow can get strong with a working capital loan. A solid credit score opens doors to better rates. You can patch gaps in payroll and vendor payments. Growth plans can take off when you add equipment.

Review your financial statements each month. Use accounting software to track performance. Seek that loan before your business stalls.

FAQs

1. What is a working capital loan and how can it help my business?

A working capital loan fills day-to-day cash flow gaps. It covers vendor payments, inventory management, and fixed costs so your business growth stays on track.

2. What signs show my business needs a working capital loan?

You chase bills, face cash flow problems, or juggle financial statements. Late vendor payments and stalled equipment financing are red flags.

3. How do I check business stability before I apply?

You need solid financial statements, steady revenue, and good supplier relationships. A clear credit score and cash flow history prove financial stability to lenders.

4. What role does my credit score play in the loan application process?

Lenders scan your credit score to set rates. A high score wins better terms, lowers costs, and boosts your ROI.

5. How can a working capital loan support business expansion?

It can fund new inventory, cover equipment financing, and seize hot business opportunities. You leverage cash to grow smart and keep your business finances healthy.