If 2025 was the year we experimented with AI, Q1 2026 is the quarter we operationalize it. The “growth-at-all-costs” era is a distant memory. The “efficiency” era of 2024–2025 has now matured into something far more interesting: the Autonomy Era. As we look at the roadmap for the rest of 2026, a clear divide is forming. On one side are the legacy SaaS trends trying to retrofit chatbots into their UIs. On the other are the next-generation players who aren’t selling software tools anymore—they are selling competence.

For founders, CTOs, and investors, the playbook has changed. Seat-based pricing is dying a painful death. Vertical SaaS is no longer just about “niche” but about “depth.” And the biggest competitor you face in Q1 2026 might not be another vendor, but your customer’s own internal AI agents.

Here are the 8 trends defining the SaaS landscape right now, in Q1 2026.

1. Agentic AI: From “Copilot” to “Colleague”

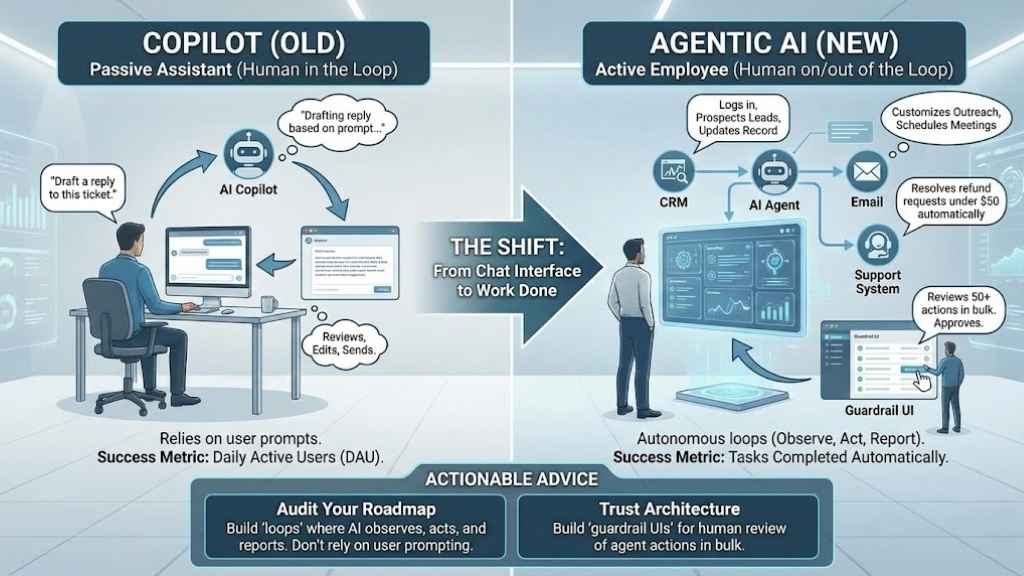

The most significant shift in Q1 2026 is the graduation of AI from a passive assistant to an active employee. We are moving from Copilots (which require a human in the loop) to Agents (which require a human on the loop, or out of the loop entirely).

The Shift

In 2024, you sold a CRM that helped a sales rep write an email. In 2026, you are selling an Agent that is the sales rep. This agent logs in, prospects leads, customizes outreach, schedules meetings, and updates the Salesforce record—all without human intervention.

- Copilot (Old): “Draft a reply to this ticket.”

- Agent (New): “Resolve all refund requests under $50 that match our policy.”

Why It Matters Now

Customers are suffering from “Chatbot Fatigue.” They don’t want another chat interface to talk to; they want the work done. SaaS winners in 2026 are measuring success not by “Daily Active Users” (DAU) but by “Tasks Completed Automatically.”

Actionable Advice:

- Audit your roadmap: If your AI features rely on the user prompting the system, you are already behind. Build “loops” where the AI observes, acts, and reports.

- Trust Architecture: Agents fail. You must build “guardrail UIs” where users can review agent actions in bulk (e.g., a manager approving 50 AI-drafted refund responses in one click).

2. The Death of the “Seat”: Rise of Outcome-Based Pricing

As AI reduces the need for human headcounts, the traditional “Per User Per Month” pricing model is collapsing. If your software makes a team of 10 as efficient as a team of 100, charging by the seat effectively penalizes your customer for using your product.

The New Economic Model

We are seeing a massive migration toward Hybrid Pricing:

- Platform Fee: A base cost for access and security.

- Outcome/Usage Fee: A variable cost based on value delivered.

Examples of Outcome Metrics in 2026:

- Customer Support SaaS: Price per resolved ticket (not per agent seat).

- Recruiting SaaS: Price per qualified candidate interview.

- Fintech: Price per processed invoice.

| Pricing Model | 2024 Status | 2026 Status | Why? |

| Per Seat | Standard | Declining | AI reduces headcount; vendors lose revenue. |

| Flat Rate | Rare | Niche | Doesn’t capture upside of AI value. |

| Usage-Based | Growing | Standard | Aligns cost with AI compute costs. |

| Outcome-Based | Experimental | High Growth | Customers only pay for results. |

Actionable Advice:

- Don’t switch overnight. Start by adding a “consumption” layer to your Enterprise tier. Use Q1 to test which “outcome metric” your customers actually trust.

3. Vertical SaaS 2.0: The “Deep Layer”

Horizontal SaaS (like generic project management or CRMs) is being eaten alive by Vertical SaaS 2.0. These aren’t just skins on a database; they are “Industry Clouds” pre-trained with proprietary workflows and data models.

The “Blue Collar” Boom

The biggest growth in Q1 2026 isn’t in marketing tech; it’s in unsexy industries. Construction, logistics, manufacturing, and dentistry are adopting “Deep SaaS” that handles everything from inventory to compliance.

- Why General Tools Fail Here: A generic CRM doesn’t know that a construction bid requires a specific compliance document for that county. A Vertical SaaS agent does.

- The Moat: The moat is no longer the software; it’s the proprietary data used to train the vertical agents.

Real-World Application:

Imagine a SaaS for HVAC repair companies. In 2026, it doesn’t just schedule appointments. It listens to the customer call, diagnoses the likely part needed, checks inventory, orders the part from a supplier, and dispatches the tech with the right manual pre-loaded on their tablet.

4. The Rise of the “Micro-Unicorn” (One-Person Enterprises)

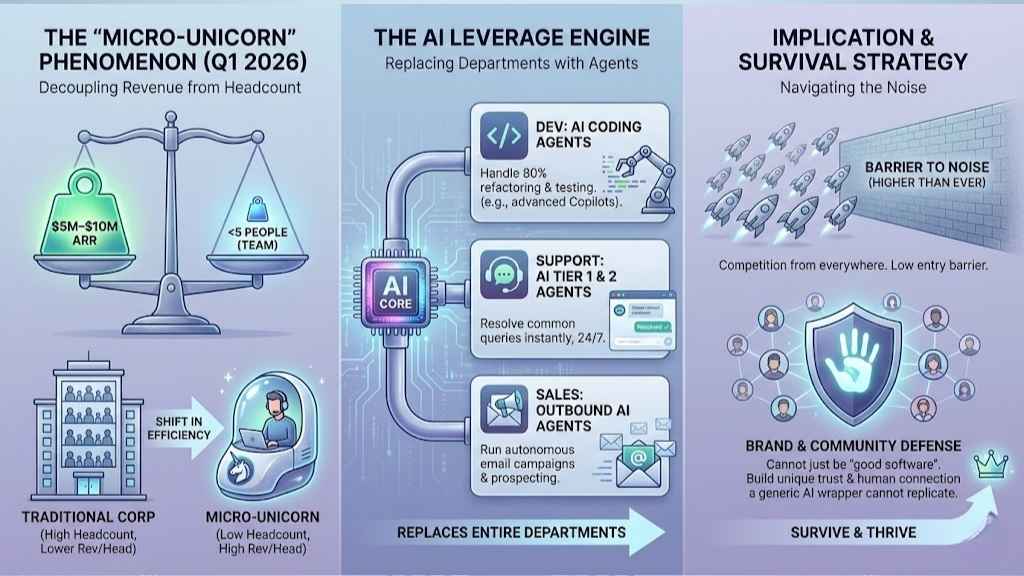

We are witnessing the decoupling of Revenue from Headcount. In Q1 2026, we are seeing startups hitting $5M–$10M ARR with teams of fewer than five people.

The Leverage of AI

These “Micro-SaaS” founders are using AI to replace entire departments:

- Dev: AI coding agents (like Devin or updated GitHub Copilots) handle 80% of the refactoring and testing.

- Support: AI agents handle Tier 1 and Tier 2 support.

- Sales: Outbound AI agents run email campaigns.

The Implication for You:

Competition is coming from everywhere. The barrier to entry has never been lower. However, the barrier to noise has never been higher. To survive, you cannot just be “good software”; you must build a brand and community that a generic AI wrapper cannot replicate.

5. “Post-SaaS”: Internal Tools Replace Vendor Contracts

This is the silent killer of churn in 2026. Companies are asking: “Why pay $50k/year for this SaaS when our internal dev team can build a custom version in a weekend using Low-Code + AI?”

The Build vs. Buy Crisis

With tools like v0, Bolt, and advanced LLMs, a CTO can spin up a bespoke internal tool that perfectly matches their workflow.

- Vendor Risk: If your SaaS is just a “wrapper” around a database or a simple CRUD app, you will be replaced by an internal script.

- The Defense: You must provide Network Effects or Complexity that is too hard to build internally.

Actionable Advice:

Move upmarket or move “deeper.” Don’t sell simple forms. Sell complex integrations, compliance handling, and proprietary datasets that an internal tool cannot easily access.

6. Security as “Sovereignty” (The Shadow AI Fix)

Enterprise buyers in 2026 have a new non-negotiable requirement: Data Sovereignty. They are terrified of “Shadow AI“—employees pasting sensitive IP into public models.

BYOM (Bring Your Own Model)

Large enterprises now demand that SaaS vendors allow them to plug in their own private LLMs (hosted on their own VPCs) rather than using the vendor’s shared model.

- The Requirement: “Your app looks great, but we need it to run on our Azure instance using our private Llama 4 fine-tune.”

- The Trend: SaaS is becoming “Model Agnostic.” You provide the workflow/UI; the customer provides the intelligence/model.

Actionable Advice:

Invest in “Sovereign Cloud” architecture. If you can’t deploy your solution into a customer’s private VPC, you will lose the Enterprise deal in 2026.

7. The Great Re-Bundling (Platform Consolidation)

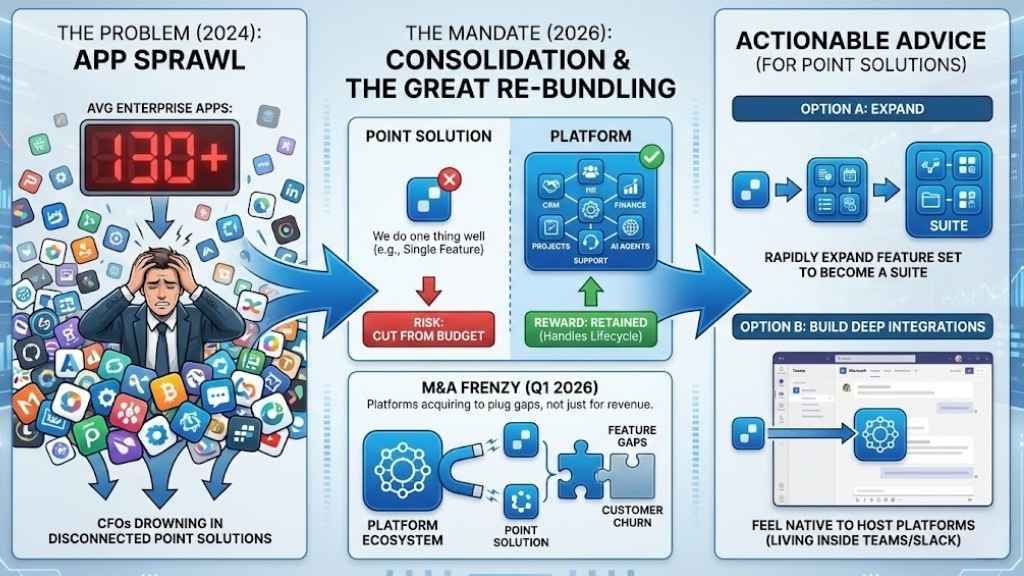

CFOs are on the warpath. The average enterprise was drowning in 130+ SaaS apps in 2024. In 2026, the mandate is Consolidation.

Platform vs. Point Solution

- Point Solution: “We do one thing really well.” -> Risk: Cut from the budget.

- Platform: “We handle the entire lifecycle.” -> Reward: Retained.

M&A Frenzy:

We are seeing high M&A activity in Q1 2026. Major platforms are acquiring successful point solutions not for their revenue, but to plug “feature gaps” and prevent customers from leaving the ecosystem.

Actionable Advice:

If you are a point solution, you need to either:

- Expand your feature set rapidly to become a “suite.”

- Build deep integrations so you feel native to the platforms (e.g., living entirely inside Microsoft Teams or Slack).

8. Composable Architecture & API-First Distribution

The final trend is the disappearance of the User Interface (UI). In an agentic world, software talks to software.

Headless SaaS

If an AI agent is doing the work, it doesn’t need a pretty dashboard. It needs a robust, well-documented API.

- The Trend: “Headless” CMS and Commerce have been around, but now we have Headless CRM and Headless ERP.

- Why: Customers want to build their own custom “Control Centers” and just use your SaaS as the backend engine.

Actionable Advice:

Your API documentation is now your most important marketing asset. Ensure your API can support “Agentic” requests (high volume, complex logic) without breaking.

How to Adapt Your 2026 Roadmap

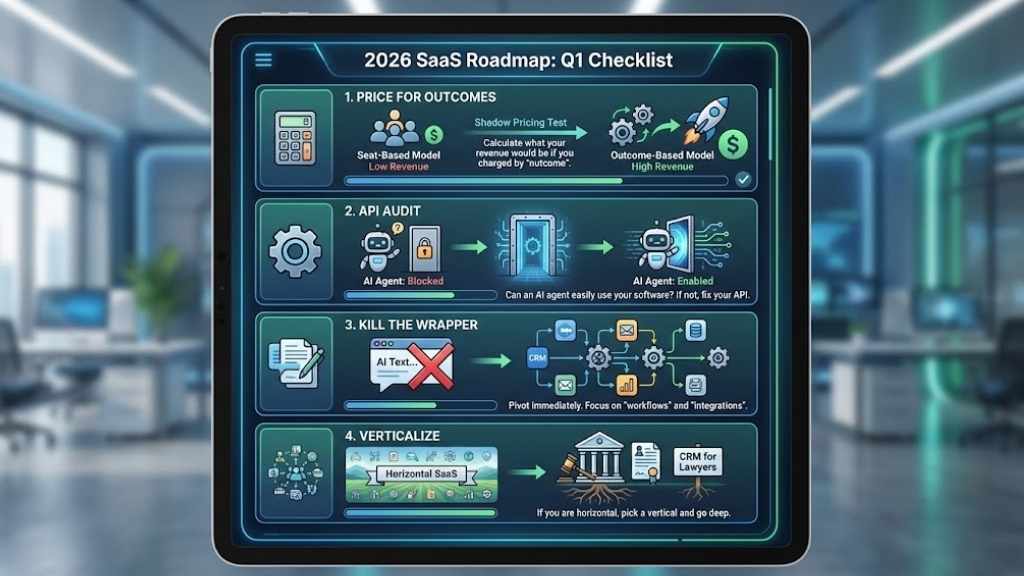

If you are a SaaS leader, here is your immediate Q1 checklist:

- Price for Outcomes: Run a shadow pricing test. Calculate what your revenue would be if you charged by “outcome” rather than seat.

- API Audit: Can an AI agent easily use your software? If not, fix your API.

- Kill the Wrapper: If your main value prop is “we use AI to write text,” pivot immediately. Focus on “workflows” and “integrations.”

- Verticalize: If you are horizontal, pick a vertical (e.g., “CRM for Lawyers“) and go deep.

Final Words

Q1 2026 is a reality check for the SaaS industry. The hype of “GenAI” is over; the reality of Agentic AI is here. The winners will be the companies that are brave enough to kill their old business models (like seat-based pricing) before their competitors do. The era of selling “tools” is ending. The era of selling “outcomes” has begun.