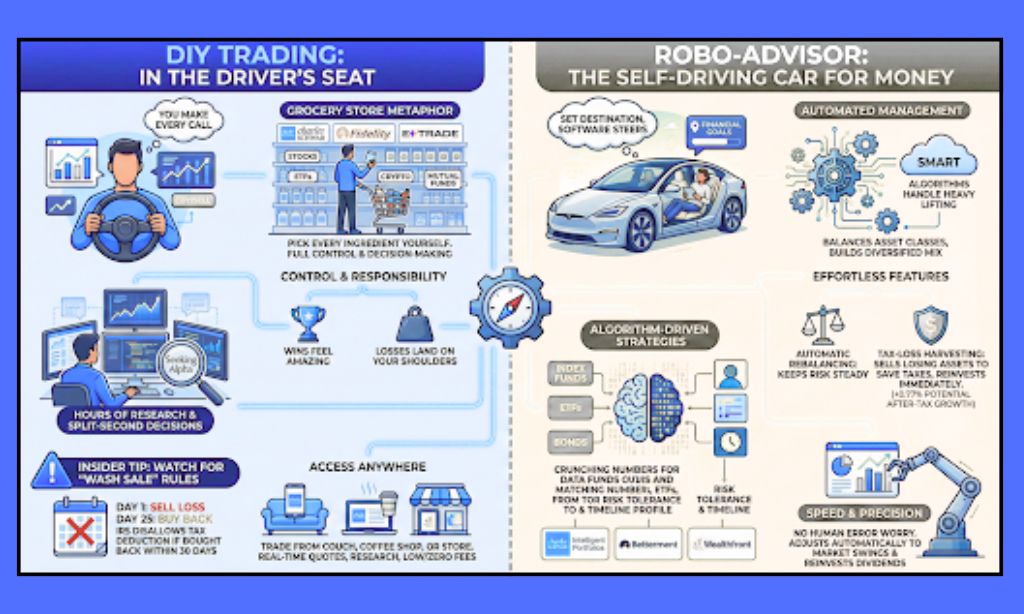

Have you ever stared at an investment app and felt completely stuck? You know you need to put your money to work, but choosing how to do it is the hard part. It’s a common dilemma. Today, most new investors face a big choice right out of the gate. Do you hire a digital pro to handle it all for you, or do you roll up your sleeves and do it yourself? Deciding between Robo-Advisors vs DIY Trading is the first major step toward building your financial future.

Robo-Advisors vs DIY Trading

I have been there myself, weighing the ease of automation against the thrill of picking my own stocks. It’s not just about money. It’s about your time and your peace of mind. We are going to break down the real differences between robo-advisors and DIY trading. I will share the exact details you need to decide which path fits your life right now.

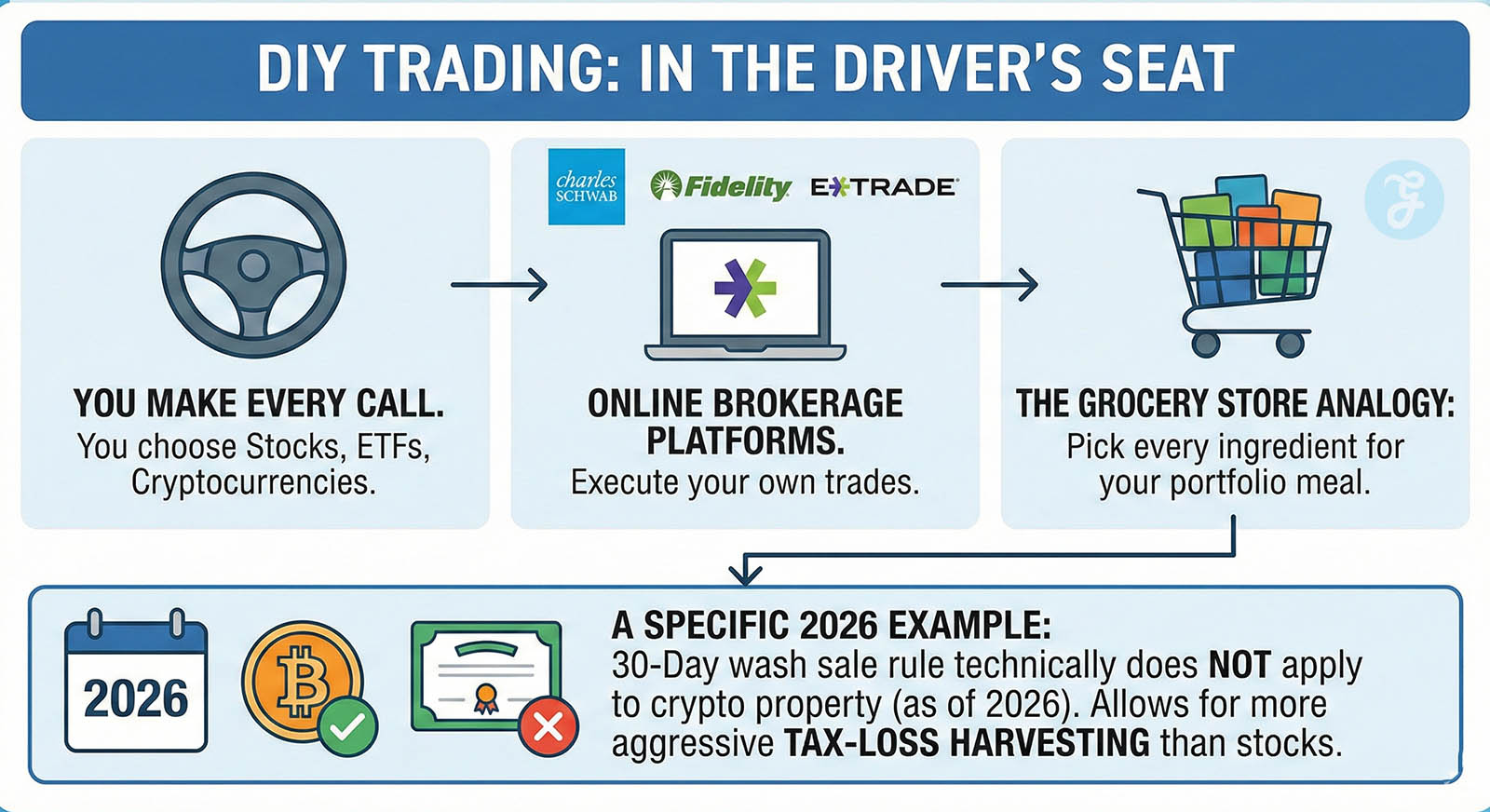

What Is DIY Trading?

DIY trading puts you in the driver’s seat. You make every single call on your investments using online brokerage platforms like Charles Schwab, Fidelity, or E*Trade. Imagine walking into a grocery store where you pick every single ingredient for your meal—that is exactly what this is.

You choose the stocks, ETFs, and cryptocurrencies, noting that as of 2026, the 30-day wash sale rule still technically does not apply to crypto property, allowing for more aggressive tax-loss harvesting than with stocks.

Full Control and Decision-Making

You call the shots with do-it-yourself investing. If you want to buy stocks in a specific electric vehicle company or pick bonds offering higher yields, you just do it. There is no middleman saying no.

You can adjust your asset allocation anytime. You might add more tech ETFs one day or trim your mutual fund holdings the next if you think the market is turning. Discount brokers put these powerful tools right at your fingertips.

But here is the reality check.

Every buy or sell on the stock market is yours alone. A win feels amazing, but losses land squarely on your shoulders. Some days require hours of investment research on sites like Seeking Alpha. Other days call for split-second decisions when the market gets rocky.

Insider Tip: Many DIY investors forget about “wash sale” rules. If you sell a stock at a loss to save on taxes but buy it back within 30 days before or after the sale (a 61-day total window), the IRS disallows that loss deduction. It’s a common pitfall that automated platforms usually avoid for you.

Access to online brokerage platforms

Online brokerage platforms make it incredibly easy to jump into the stock market. You can trade from your couch, your favorite coffee shop, or even while waiting in line at the store. Companies like Charles Schwab and Vanguard have opened doors for diy investors with apps that are actually fun to use.

These digital platforms offer access to everything in one place:

- Individual Stocks

- ETFs (Exchange-Traded Funds)

- Mutual Funds

- Options Trading Tools

I once bought an index fund while waiting for my coffee order. The whole process took less than five minutes. Most brokers now offer real-time quotes, deep research reports, and goal-setting features.

Fees have dropped drastically too. Most major US brokers now charge zero commission on stock and ETF trades. Think of these websites as massive investment superstores open 24/7. You can browse and buy whatever you want without a salesperson pressuring you.

What Is a Robo-Advisor?

A robo-advisor is like a self-driving car for your money. You set the destination (your financial goals), and the software steers the car, managing things like index funds and asset allocation for you.

These digital platforms use complex math models to build and maintain your portfolio. You don’t have to pick a single stock.

Automated portfolio management

Automated portfolio management uses smart algorithms to handle the heavy lifting. These systems scan the stock market to build a diversified mix of assets. They balance your asset classes without you lifting a finger.

Many platforms like Charles Schwab Intelligent Portfolios or Betterment offer this as their core service. You simply share your risk tolerance and timeline. The platform takes over from there.

Passive investing gets even easier with automatic rebalancing. If one part of your portfolio grows too big, the software trims it and buys more of the underperforming assets to keep your risk level steady.

Tax-loss harvesting is another massive perk often bundled here. The system automatically hunts for these chances, though some platforms require a minimum balance (often $50,000) to activate automated tax-loss harvesting. It then immediately reinvests that money into a similar fund to keep your strategy on track. This can potentially add roughly 0.77% to your after-tax returns annually, according to data from industry leaders like Betterment.

Algorithm-driven investment strategies

Algorithms crunch thousands of data points faster than any human could. They use this info to build a solid blend of index funds, ETFs, and bonds that matches your specific profile.

For example, Wealthfront’s robo-advisor creates portfolios by selecting low-cost investment securities that align with your answers about goals and risk.

I tried one of these services a few years ago. I watched my investments adjust automatically during a volatile week. The platform balanced my portfolio after market swings and reinvested my dividends without me having to log in once.

It felt like having a registered investment advisor in my pocket. You get speed and precision without the worry of human error.

Pros of DIY Trading

Every move is yours to make. From picking specific index funds to trading the latest tech stocks, you steer your own ship. This approach fits people who love to learn and want to save every penny on fees.

Greater flexibility and control

DIY trading opens the door to total freedom. You can buy stocks or ETFs on your own schedule. If you read a report at midnight and want to place a trade for the next morning, you can.

This control means you pick assets based on your personal values or hunches. Maybe you only want to invest in green energy companies. A robo-advisor might not let you be that specific, but a DIY account will.

You can also react quickly to stock market news. Instead of watching an algorithm adjust your funds quarterly, you can sell a position instantly if the fundamental story changes.

Lower fees in many cases

This is the biggest financial argument for doing it yourself. Many online brokerage platforms now charge zero commissions for buying and selling stocks and ETFs.

You also avoid the management fee that robo-advisors charge. That fee is usually 0.25% to 0.35% for digital tiers, though several major platforms like Fidelity Go now offer $0 management fees for accounts under $25,000. It sounds small, but on a $100,000 portfolio, that is $250 to $500 a year that stays in your pocket if you go DIY.

Plus, you can choose funds with rock-bottom costs. For instance, Fidelity offers “ZERO” index funds with a 0% expense ratio. That means more of your money stays invested in the stock market instead of getting eaten up by costs.

Access to a wide range of investment tools

The stock market is huge, and DIY investing gives you the keys to the whole kingdom. Online brokers offer access to thousands of investment tools that robo-advisors simply don’t support.

You can use stock screeners to find undervalued companies. You can read detailed third-party reports from Morningstar or CFRA. You can even explore options trading if you want to hedge your bets.

From my experience, having access to these tools makes you a smarter investor over time. You learn how expense ratios work and how to build a portfolio construction that withstands volatility. These digital platforms give everyday investors the same data that professional financial advisors use.

Cons of DIY Trading

Managing your own portfolio isn’t all wins and zero-fee trades. It requires significant time to sift through financial news. The ride can be bumpy, and your own brain might become your worst enemy.

Requires market knowledge and research

You need solid financial literacy to pick winning stocks or ETFs. Tracking the stock market daily isn’t a walk in the park; it takes patience and guts. Investment research requires you to pour over numbers from digital platforms and understand what they mean.

It’s not about guessing. Smart portfolio management uses real data.

Choosing your asset allocation means you have to understand company reports and risk tolerance stats. One day you might be scanning ETF performance graphs. The next, you need to understand how interest rates affect your bond holdings.

Higher emotional involvement with decisions

This is the silent portfolio killer. When you handle your own money, fear and greed take over.

Data from research firm DALBAR consistently shows that the average equity investor earned 16.54% in 2024, trailing the S&P 500’s 25.02% return by over 8% according to DALBAR’s latest behaviour report. Why? Because people tend to panic and sell when the market drops, and buy when it’s already high.

Emotions cloud your judgment. You might feel excitement and buy a hot new tech stock right before it crashes. Or fear might push you to sell a solid index fund during a temporary dip. Even with the best plan, human reactions shape every trade.

Pros of Robo-Advisors

Robo-advisors handle the boring stuff like rebalancing and tax-loss harvesting while you enjoy your weekend. With digital platforms doing the heavy lifting, the stress of managing money melts away.

Simplified, hands-off investing

You pick your goals, and the digital platform handles the rest. With a robo-advisor like Betterment or Wealthfront, you answer a few questions about your risk tolerance and timeline.

The system then spreads your money into a diversified mix of index funds. Portfolio management becomes automatic. You don’t need to check the stock market every day or worry about which ETF to buy.

Many people new to financial markets prefer this approach. It makes investing feel safer and more manageable. It supports passive investing strategies that are proven to build wealth over the long term.

Automatic rebalancing and tax-loss harvesting

Automatic rebalancing is a lifesaver. Over time, some of your investments will grow faster than others, throwing your portfolio off balance. A robo-advisor monitors this daily. If your stocks get too high, it sells some and buys bonds to keep your risk steady.

Then there is the tax benefit. Tax-loss harvesting works behind the scenes to lower your tax bill. The platform spots investments that have dropped in value and sells them to offset gains from winning trades.

This process can save you significant money at tax time without any effort on your part. It is a smart tax planning move that usually requires a lot of math for a DIY investor to pull off correctly.

Goal-based financial planning

Robo-advisors are great at helping you visualize the future. They help you set clear targets, like “Retirement in 20 Years” or “House Down Payment.”

They use digital platforms to match your risk tolerance with the right mix of funds. They also show you if you are on track. If you are falling behind, the system might suggest increasing your monthly deposit by $50.

Real-World Benefit: I found that goal-based tools stop you from treating your money like a casino. Instead of wondering “Did I beat the market?”, you start asking “Am I on track to buy that house?” It shifts your mindset to what actually matters.

Cons of Robo-Advisors

Robo-advisors can feel restrictive if you like to tinker. You also have to pay for the convenience, and those fees can compound over decades.

Limited customization options

Digital platforms like robo-advisors focus heavily on passive investing. They pick standard index funds that fit your broad profile. However, they rarely let you tweak the details.

Want to exclude oil companies from your portfolio? Some platforms allow this now, but many still don’t. Want to buy stock in a specific local company you love? You generally can’t do that inside a robo-advisor account.

You get a “set menu” rather than an “a la carte” experience. If you have deep financial literacy and strong opinions on the market, you might find these guardrails frustrating.

Management fees can add up

Management fees seem tiny at first glance. A 0.25% fee sounds negligible.

But let’s look at the math. If you have $50,000 invested, that is $125 a year. Over 30 years, assuming your money grows, that fee could add up to thousands of dollars in lost returns compared to a free DIY account.

You also have to pay the expense ratios of the ETFs the robo-advisor buys for you. These costs stack up. For folks who are comfortable with a simple three-fund portfolio, paying that extra management fee might not be worth it.

Key Differences Between DIY Trading and Robo-Advisors

| Feature | DIY Trading (Schwab, Fidelity) | Robo-Advisor (Betterment, Wealthfront) |

| Annual Fee | $0 (No advisory fee) | 0.25% – 0.35% (Standard) |

| Entry Cost | $0 Minimum (usually) | $0 – $500 Minimum |

| Tax Strategy | Manual (Risk of wash sales) | Automated (Often requires $50k+ balance) |

| Behavioural Gap | High (Average lag vs Market: ~8%) | Low (Algorithm-enforced discipline) |

| Feature | DIY Trading (Schwab, Fidelity) | Robo-Advisor (Betterment, Wealthfront) |

Level of involvement

Active investors need to pay attention. DIY trading puts the burden on you. You check the data, weigh your risk tolerance, and decide whether to invest in index funds or try options trading.

Research tools on platforms like Charles Schwab make it easier, but you still have to pull the trigger.

Robo-advisors offer a “hands-off” lifestyle. You set your preferences once. Then, automated strategies handle rebalancing and tax planning without you needing to log in for months.

Costs and fees

Robo-advisors charge for their service. This cost covers the automation, the rebalancing, and the tax features. You are paying for a service that saves you time.

DIY investing is often free of management fees. If you buy broad market ETFs like VOO or VTI, your only cost is the tiny expense ratio of the fund itself (often as low as 0.03%).

However, DIY investors can face other costs. If you get into options trading or need premium data subscriptions, those expenses can pile up quickly.

Educational resources and tools

Most DIY investing platforms give you a massive library of resources. You get video tutorials, stock screeners, and webinars with real experts. Charles Schwab and Fidelity are famous for their detailed market breakdowns.

Automated advisors focus on simplicity. Their educational content is usually about high-level concepts like “why you should stay invested” or “how compounding works.”

They provide quick quizzes to check your risk tolerance and interactive charts showing your projected growth. Both styles offer calculators for retirement planning, but DIY platforms give you the raw data to do your own deep dive.

Factors to Consider When Choosing

Your choice hangs on how much time you have and how much you trust yourself. Sometimes, a digital platform feels just right. Other days, you might wish you had more control.

Your investment goals

What are you actually investing for? If you want to beat the market and chase high returns with individual tech stocks, you need a DIY account. A robo-advisor will never let you concentrate your money in just a few high-growth companies. But if your goal is steady, reliable growth for retirement, a robo-advisor shines. It prevents you from making rash decisions that could derail your long-term plan.

What are you actually investing for?

If you want to beat the market and chase high returns with individual tech stocks, you need a DIY account. A robo-advisor will never let you concentrate your money in just a few high-growth companies.

But if your goal is steady, reliable growth for retirement, a robo-advisor shines. It prevents you from making rash decisions that could derail your long-term plan.

Your level of financial knowledge

Jumping into DIY investing requires a learning curve. You need to understand what an expense ratio is. You need to know the difference between an ETF and a mutual fund.

If terms like “asset allocation” or “tax-loss harvesting” make your eyes glaze over, a robo-advisor is likely the safer bet. It handles the complexity for you so you don’t have to become a financial expert overnight.

Your time availability for managing investments

Be honest about your schedule. DIY investing takes time. You need to research positions, track earnings, and log in to rebalance your portfolio.

If you have a demanding job or a busy family life, you might not have the bandwidth for that. Robo-advisors use digital platforms to handle your money 24/7. They don’t sleep, and they don’t get too busy to rebalance your account.

The Bottom Line

You have seen the perks and downsides of both DIY investing and robo-advisors. It really comes down to a trade-off between control and convenience.

If you love reading market news and want to save every penny on fees, a DIY account at a broker like Charles Schwab is a fantastic tool. But if you would rather spend your free time doing anything other than managing a spreadsheet, a robo-advisor is well worth the small fee.

My advice? Start with what makes you comfortable today. You can always open a small DIY account on the side to learn the ropes while a robo-advisor handles your serious retirement savings.

The most important step is just getting started. Your financial future is waiting, so pick a path and take that first step with confidence.