Clean power is no longer a niche upgrade. It is becoming the default direction for new electricity supply in many places, while electricity demand keeps rising. That creates a new reality: the winning strategy is not only “build more renewables,” but “build renewables that can connect, operate, and deliver value every hour of the day.”

This is why renewable energy trends in 2026 matter for business owners, builders, facility teams, and investors. You may not operate a power plant, but your costs, timelines, and customer expectations are now tied to grid limits, storage availability, and electrification speed. When projects stall, it is often not because solar or wind does not work. It is because the system around them cannot move fast enough.

The list below focuses on what is practical in 2026. Each trend includes clear examples and simple actions you can take, plus a quick table to help you scan and plan.

Why Does This Topic Matter for Businesses in 2026?

Electricity is becoming the backbone energy source for more things: transport, heating, and parts of industry. That change pushes demand up, sometimes faster than local infrastructure can handle. In many markets, “grid readiness” now affects where companies expand, where housing can grow, and how quickly EV charging can scale. At the same time, renewable supply is growing quickly.

That growth lowers long-term risk from fuel price shocks, but it also brings new short-term constraints like interconnection queues and equipment shortages. If you plan projects based only on equipment prices, you can still get stuck waiting for approvals, transformers, or upgrades.

This moment also changes how buyers choose vendors. Customers expect proof, not promises. They want clear timelines, photos of work, real reviews, and quick responses. Contractors, installers, and energy service firms that build trust will win more deals than those who only compete on price. Finally, more companies now face carbon reporting pressure, even at smaller sizes.

You may not be required to file formal disclosures, but your customers may ask for cleaner operations, cleaner procurement, or progress benchmarks. That makes renewable planning part of sales, not just part of sustainability.

| Business Reality In 2026 | What’s Driving It | What To Do |

| Faster electricity demand growth | Electrification + cooling + data loads | Forecast load early and plan upgrades |

| More renewables coming online | Massive capacity additions | Focus on integration and reliability |

| Grid constraints matter more | Interconnection delays, local bottlenecks | Start utility coordination sooner |

| Trust decides purchases | Reviews, proof, responsiveness | Build a “proof pack” for buyers |

Renewable Energy Trends 2026

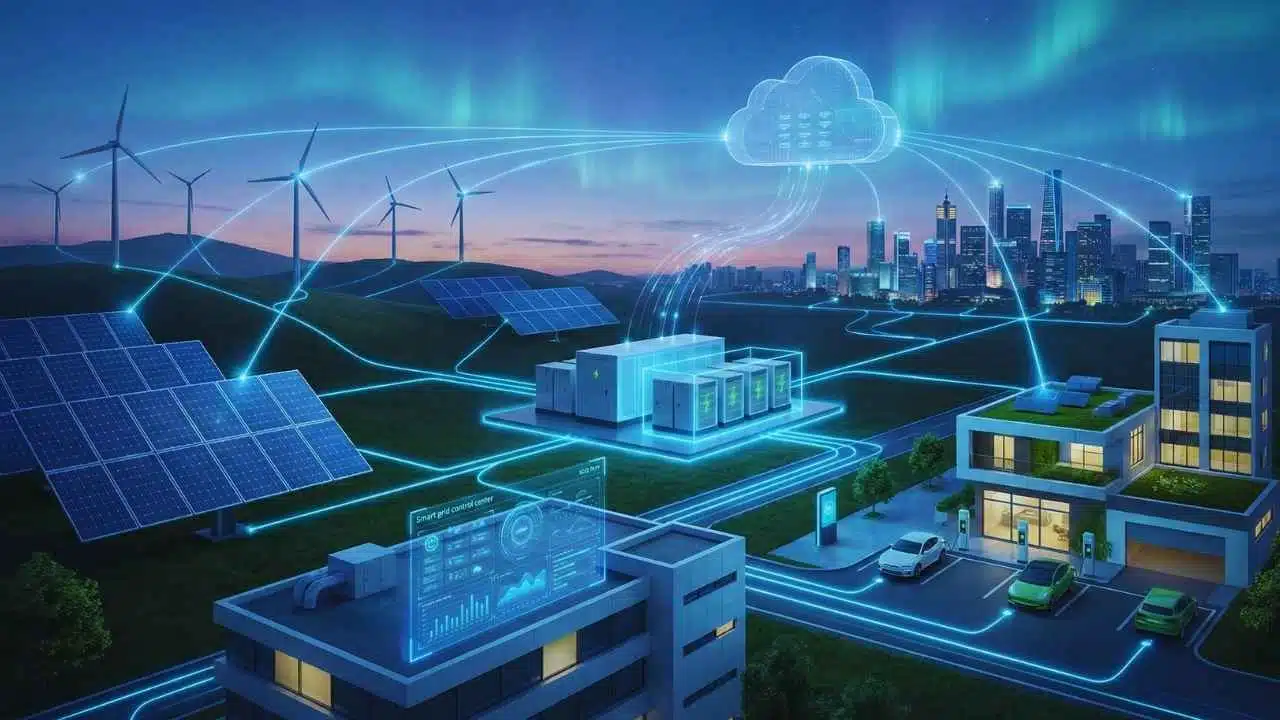

This section is your map of the year. The biggest story is not a single technology. It is the shift to energy systems that work together: generation, storage, smarter loads, and better grid operations. Projects that used to succeed with a simple installation plan now require deeper planning, stronger operations, and cleaner data.

A helpful way to read these trends is to ask two questions. First, does this trend change my costs or timelines in the next 6–18 months? Second, does it change what customers expect from my business? If the answer is yes, it belongs in your plan this quarter.

You will also notice the same themes repeating across the list: grid bottlenecks, storage value, and operational discipline. That is not repetition for its own sake. It is because these themes show up everywhere, from a home heat pump install to a large corporate clean power contract.

Each item below follows a consistent pattern: what is happening, why it matters, and what to do about it. Keep the tables in mind if you want a quick summary, then return to the paragraphs for details.

| What Defines 2026 | Why It Matters | Best Simple Move |

| Systems thinking | Integration wins projects | Bundle storage, controls, and service |

| Execution pressure | Delays erase ROI | De-risk permitting and interconnection |

| Proof culture | Buyers want evidence | Track outcomes and publish credibility |

Top 10 Renewable Energy Trends 2026

1: Record Renewable Additions Raise The Bar For Speed And Quality

Renewables are scaling fast, and that pace changes expectations across the market. When capacity additions hit record levels, buyers start expecting shorter lead times, more predictable pricing, and more mature service. But rapid growth also exposes weak links in manufacturing, contracting capacity, and grid connection.

For businesses, the key lesson is this: the market is getting bigger but also more selective. Customers become more cautious when they see mixed quality outcomes. That drives demand for vendors who can show strong project management, clean documentation, and credible warranties.

You can also expect tighter scrutiny on supply chains and component choices. In a fast-growing market, low-quality equipment and rushed installs create expensive failures. Strong operators respond by standardizing processes, improving commissioning, and tracking performance after the sale. A practical way to respond is to build a simple “repeatable delivery system.” That means checklists, inspection routines, photo documentation, and service workflows. It is not glamorous, but it wins trust and protects margins.

| Key Point | What It Means In 2026 | Practical Tip |

| Big growth attracts competition | More vendors, more price pressure | Compete on reliability and proof |

| Higher customer expectations | Buyers want clean execution | Use a documented install standard |

| Quality gaps get punished | Bad installs travel fast by reviews | Offer inspections and service plans |

2: Grid Bottlenecks Become The Main Constraint, Not Technology

Many clean energy projects now fail or stall for a simple reason: they cannot connect quickly enough. This affects utility-scale projects and local commercial upgrades alike. Even a well-designed site can face delays due to transformer shortages, substation capacity, or interconnection studies. Electricity demand growth adds pressure here. When demand rises faster, every connection request becomes harder to serve. That is why grids and local capacity planning are becoming central topics in 2026.

For businesses, the best strategy is to treat the grid as a project partner, not an afterthought. That means asking utilities early about timelines, upgrade needs, and cost responsibilities. It also means designing projects with flexibility, such as the ability to limit peaks or schedule charging.

If you manage facilities, the most valuable step is a “load and constraint review.” Many companies discover that small changes in operations can avoid expensive upgrade paths. If you sell energy services, the opportunity is to package these reviews as a clear, paid offering.

| Key Point | Why It Matters | Practical Tip |

| Interconnection delays | Schedules slip and costs rise | Start utility talks before final design |

| Local constraints vary | One area can be easy, another impossible | Use site screening before committing |

| Flexibility is rewarded | Smart load behavior can reduce costs | Add controls, storage, or managed charging |

3: Energy Storage Becomes A Standard Layer In Clean Power Plans

Storage is shifting from a “backup option” to a standard planning tool. It helps smooth solar output, reduce peak demand charges, and provide resilience during outages. In many markets, storage also creates new revenue paths where grid services are paid for. Costs and scale are pushing this trend forward. Battery demand has grown rapidly alongside EV sales, and declining pack prices signal that supply and learning curves are advancing.

In 2026, storage decisions are less about whether to use a battery and more about how to size and operate it. A battery can underperform if it is not aligned with tariffs, site load patterns, and operational goals. The best-performing sites treat storage like a managed asset, not a static box.

If you are a contractor or consultant, this trend creates demand for “battery operations literacy.” Clients will ask about warranty terms, cycle limits, safety standards, and what happens after year five. Being able to explain those topics in plain language is a competitive edge.

| Key Point | What It Means | Practical Tip |

| Storage spreads quickly | More projects include batteries | Build a standard storage sizing workflow |

| Operations determine value | Dispatch rules drive savings | Use monitoring and control software |

| Buyers ask harder questions | Safety and warranty matter more | Provide clear warranty and safety docs |

4: Solar Prices Stay Competitive, But Project Success Depends On Execution

Solar continues to expand because it is often the cheapest new electricity source in many contexts. But in 2026, lower prices alone do not guarantee success. Interconnection delays, permitting friction, and component quality are often the real deciding factors. When supply grows fast, buyers also become pickier about risk. They care about bankability, warranty strength, and performance guarantees. That pushes installers and developers to improve procurement discipline and documentation.

You will also see more emphasis on performance transparency. Customers want monitoring dashboards, clear production expectations, and fast service when output drops. This is especially true for commercial buyers who track savings against a budget.

If you run a solar business, the best move is to strengthen the “after install” experience. A clean handover, clear monitoring setup, and simple maintenance plan reduce complaints and increase referrals.

| Key Point | Why It Matters | Practical Tip |

| Price competition increases | Margins tighten | Win with service and reliability |

| Quality risk rises | Cheap parts can cost more later | Use verified components and suppliers |

| Monitoring becomes expected | Buyers want proof of savings | Offer reporting and maintenance plans |

5: Wind Repowering And Optimization Drive The Next Wave Of Output Gains

Wind growth in 2026 is increasingly about getting more value from existing assets. Repowering older sites with better blades, controls, and components can lift production without starting from scratch. That matters because new projects face land, permitting, and grid constraints. Offshore wind remains important in some regions, but it carries higher complexity and scheduling risk. That pushes many developers and operators to focus on near-term gains through optimization and maintenance improvements.

For service providers, wind is a long-term relationship market. Operators need inspections, repairs, parts logistics, and analytics over many years. That favors companies that can deliver consistent safety and uptime.

A strong approach in 2026 is predictive maintenance backed by real operating data. Simple vibration, performance, and weather-based analysis can reduce downtime and cut emergency repairs.

| Key Point | What It Means | Practical Tip |

| Repowering increases output | More energy from existing sites | Build upgrade and retrofit capability |

| O&M value grows | Maintenance becomes strategic | Offer long-term service agreements |

| Data improves uptime | Predictive insights reduce failures | Use condition monitoring tools |

6: Building Electrification Accelerates, Especially For Heating And Hot Water

Electrification is moving deeper into buildings, not just vehicles. Heat pumps, upgraded controls, and better insulation strategies are driving change in homes and commercial spaces. This trend accelerates when incentives and local policy support align, but it also expands because operating efficiency improves in many use cases. In 2026, the main pain point is often electrical capacity. Many buildings were not designed for higher electric loads. That means panel upgrades, wiring work, and careful load planning become part of the sales conversation.

Customer expectations are also shifting. Buyers want comfort and reliability, not just emissions reductions. That means good design, correct sizing, and proper commissioning matter. Poor installs create noise complaints, cold spots, and high bills.

If you serve this market, a strong differentiator is “whole-system clarity.” Explain how the upgrade affects comfort, energy bills, and maintenance in simple terms. Then document it after completion.

| Key Point | Why It Matters | Practical Tip |

| Heat electrification rises | More demand for upgrades | Bundle HVAC and electrical expertise |

| Capacity constraints appear | Panels and feeders may be limiting | Run a load calculation early |

| Comfort drives adoption | Bad installs damage trust | Train teams for design and commissioning |

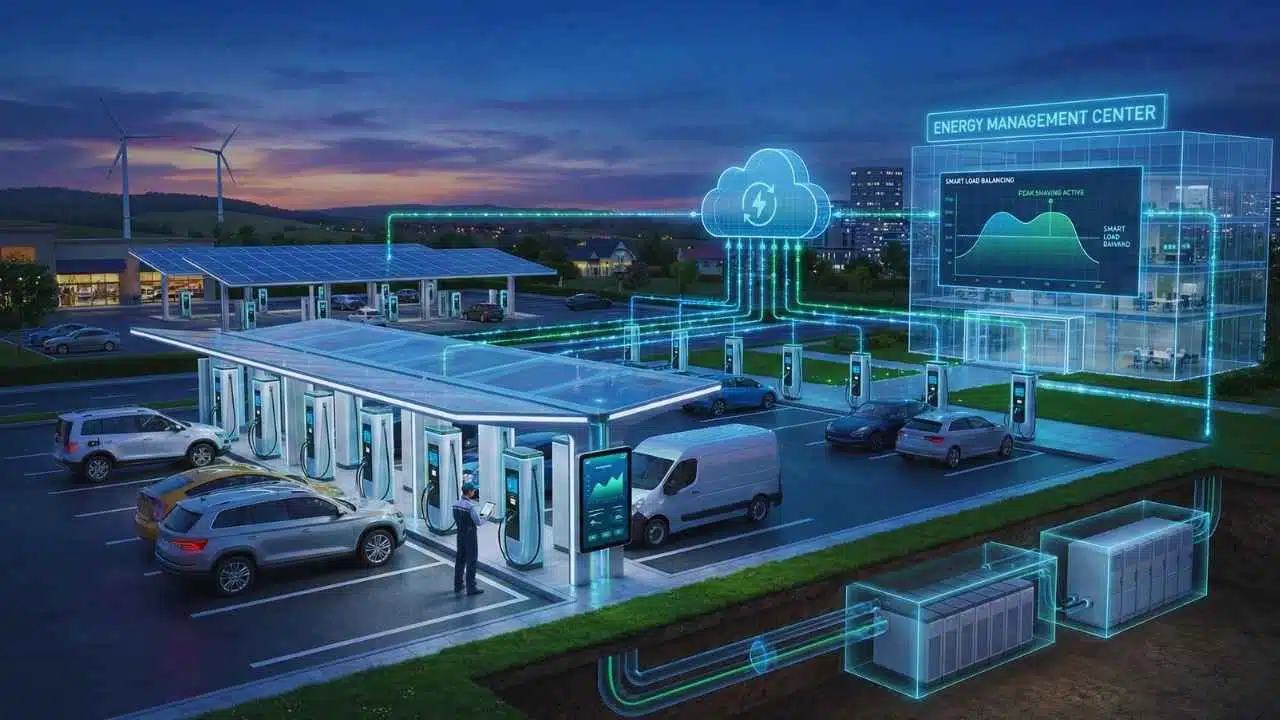

7: EV Charging Expands, And Smart Charging Becomes Non-Negotiable

EV charging demand will keep growing, but the 2026 market rewards reliability and smart operations more than novelty. Many site hosts now care less about “having chargers” and more about uptime, safety, billing clarity, and customer experience. Smart charging matters because unmanaged charging can create expensive peaks. In commercial settings, demand charges can dominate costs. In constrained areas, utilities may require load controls or limit upgrades.

The strongest charging rollouts pair hardware with operational planning. That includes load sharing, scheduled charging, and sometimes pairing chargers with on-site storage. This approach reduces upgrade costs and improves resilience.

For installers and service firms, the opportunity is to sell a full package: design, installation, software setup, maintenance, and response time guarantees.

| Key Point | What It Means | Practical Tip |

| More charging sites | Competition grows | Stand out with uptime and service |

| Peaks can get expensive | Costs rise without control | Include load management by default |

| Operations define success | Experience drives repeat use | Offer monitoring and maintenance plans |

8: Corporate Clean Power Buying Shifts Toward Tighter Matching And Better Data

Many companies used to treat renewable purchasing as a yearly accounting match. In 2026, more buyers want cleaner claims that better reflect the timing of electricity use. That shifts attention toward hourly matching, storage pairing, and more detailed reporting. This trend increases the value of flexibility. A company that can shift loads, store power, or reduce peaks becomes a better partner for clean procurement strategies. It also drives demand for better measurement systems and clearer verification.

Smaller businesses feel this shift too, often indirectly. If you supply a larger company, you may be asked to show improvement or disclose energy practices. The best response is to track a few key metrics and show progress clearly.

A practical step is to build a simple energy data baseline: monthly electricity use, peak demand, and top drivers. Without that baseline, it is hard to prove improvement.

| Key Point | Why It Matters | Practical Tip |

| Stricter procurement expectations | Buyers demand better proof | Improve measurement and reporting |

| Flexibility gains value | Storage and controls matter | Add demand management options |

| Supply chain pressure spreads | SMBs may face questions too | Track a few simple energy metrics |

9: Green Hydrogen Becomes More Targeted And Less Hype-Driven

Hydrogen still matters, but the market is focusing on where it makes sense. In 2026, many projects will be judged less by ambition and more by economics, offtake certainty, and infrastructure readiness. The strongest near-term use cases remain in hard-to-abate sectors where electrification is difficult. That includes certain industrial processes and specific transport corridors. In other areas, direct electrification may remain the cheaper option.

This trend is important even if you never touch hydrogen. It shapes renewable demand planning, industrial site development, and investment narratives. It can also affect local permitting and safety standards.

A smart 2026 approach is to treat hydrogen as a “pilot and learning” domain unless you have secured buyers. Build capability, test safety systems, and focus on clear use cases.

| Key Point | What It Means | Practical Tip |

| Use cases narrow | Fewer “general” projects | Focus on hard-to-abate sectors |

| Execution risk stays high | Infrastructure is complex | Start with pilots and standards |

| Offtake is everything | Demand must be real | Secure buyers before scaling |

10: Circularity And Recycling Become A Competitive Advantage In Clean Tech

As renewable systems scale, end-of-life planning becomes impossible to ignore. Panels, batteries, and electronics will increasingly require structured recycling, reuse, or take-back programs. Buyers and regulators are paying closer attention to traceability and responsible disposal. Circularity also helps with resilience. When supply chains tighten, recycled materials and refurbished components can reduce dependence on volatile commodity markets. Even small improvements in repair and reuse can reduce lifecycle costs.

In 2026, expect more customers to ask, “What happens at the end of life?” That question is already common for batteries.

It is spreading to solar equipment and other hardware. A practical move is to document your lifecycle path: recycling partners, warranty handling, and disposal compliance. It improves trust and reduces risk.

| Key Point | Why It Matters | Practical Tip |

| More end-of-life assets | Waste becomes visible | Choose verified recycling partners |

| Supply resilience matters | Circular supply reduces risk | Build repair and reuse pathways |

| Buyer expectations rise | Procurement asks for proof | Document lifecycle and disposal steps |

Final Thoughts

The big pattern in 2026 is clear. Renewables are growing, demand is rising, and the grid is the tightest choke point. Storage, smart controls, and better operations are moving from “nice-to-have” to “standard.” The best near-term strategy is simple: pick three trends that match your reality, then commit to one measurable action for each.

Examples include a load study, a storage sizing plan, a smart charging rollout, or a monitoring and service upgrade for installed systems. If you remember one thing from renewable energy trends in 2026, remember this: integration wins. The teams that connect clean generation, storage, and flexible demand into a reliable system will earn better margins and stronger trust.