Do you feel stuck in a maze of Japanese crypto exchanges, not sure where to start? You want to trade Bitcoin or Ether, but you fear hacks and hidden fees. You see ads for low trading fees, copy trading, trading bots, but wonder if they follow FSA rules and AML checks.

It can feel like a high-wire act without a safety net.

Japan’s Financial Services Agency enforces strict KYC, two-factor authentication, and cold wallet storage. That makes trading safer. We list the top five FSA-approved exchanges, and compare their fees, security, and ease of use.

We highlight bank transfers, credit cards, spot trading, and margin trading tools. Read on.

Key Takeaways

- Japan’s Financial Services Agency (FSA) registers all crypto platforms under the Payment Services Act, overseeing 280 active exchanges and $74.2 billion in daily trading volume.

- The top five FSA-approved exchanges—bitFlyer, Bitbank, Coincheck, GMO Coin, and OKCoin Japan—use KYC checks, AML screening, two-factor authentication, and cold wallet storage to secure user funds.

- bitFlyer (Trust Score 7.0) offers spot and margin trading in BTC and ETH; Bitbank (Trust Score 8.0) logs $85.7 million in 24-hour volume and low fees; Coincheck (Trust Score 5.0) posts $100 million in daily trades; GMO Coin (Trust Score 6.0) adds futures and CFD products; OKCoin Japan features automated bots and margin options.

- Key comparison points include fee structures (maker/taker, deposit/withdrawal), range of coins (from BTC and ETH to LINK, MonaCoin, and stablecoins), platform liquidity, user interface ease, and advanced tools like charting and trading bots.

What Makes a Crypto Platform “Regulated” in Japan?

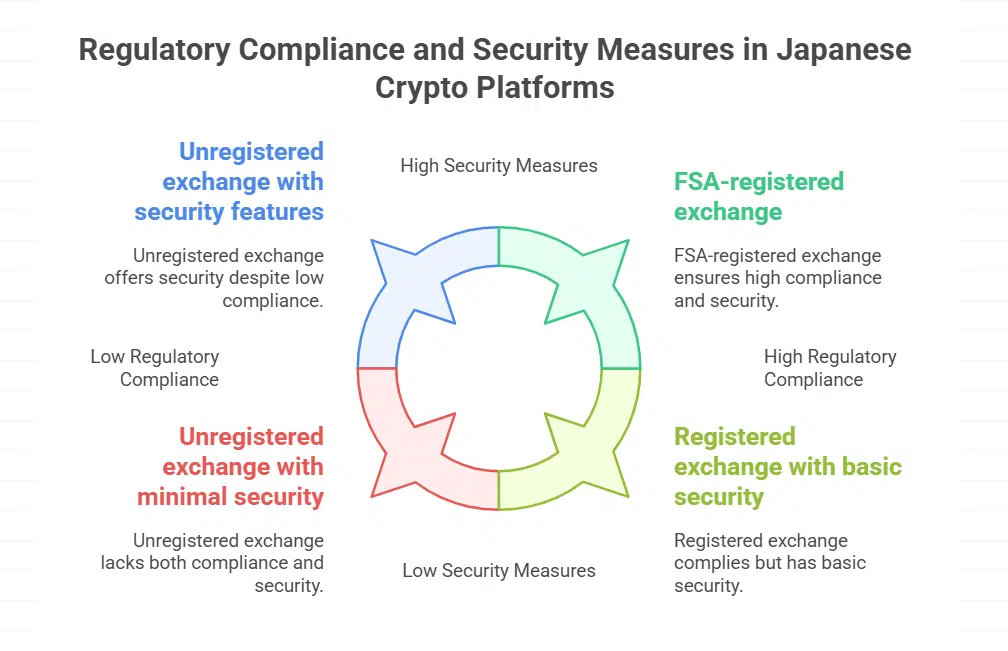

Japan labels crypto assets as legal property under the Payment Services Act. The FSA oversees every cryptocurrency exchange in the country. Sites must register with the FSA to open.

Platforms follow AML/KYC standards to stop money laundering. They check user identity with kyc verification and screen funds for risk. That setup drives strong regulatory compliance.

Exchanges add two-factor authentication and cold wallet storage for extra safety. Firms show proof of capital and hold virtual currency in secure ledgers. The FSA runs audits on approved operators.

Traders can use spot trading, margin trading, and other services only on registered sites. Users see clear fee lists and terms before they trade.

Top 5 Regulated Crypto Platforms in Japan

bitFlyer leads the pack with two-factor authentication and cold wallet storage, backed by regular security audits. Bitbank offers low trading fees, margin trading, and a sleek mobile interface.

Coincheck secures user data with know-your-customer checks and strict anti-money laundering rules under the Payment Services Act. GMO Coin attracts spot traders with a user-friendly app, leveraged futures trading, and full FSA compliance.

OKCoin Japan adds automated trading bots and recurring buys across top digital assets. All five cryptocurrency exchanges follow FSA standards and fight money laundering. Japanese investors find confidence in a market of 280 active exchanges and a $74.2 billion daily trading volume.

Overview of Each Platform

We compare five top crypto exchanges in Japan. Each entry shows volume, features, fees, and security.

- The bitFlyer exchange records zero in 24-hour trading volume and a –100% change, yet it keeps FSA approval. It locks accounts with two-factor authentication and cold storage. Traders run spot trading in BTC and JPY pairs. It handles margin trading and offers a mobile app. It processes fiat deposits and withdrawals via bank transfer.

- Bitbank presents a clean user-friendly layout and low trading fees. It meets FSA guidelines for AML regulations and KYC verification. Most funds stay in an offline hardware wallet. Users trade spot markets for major altcoins and run margin trading. It accepts multiple payment methods including JPY transfers.

- Coincheck stores assets in deep cold storage and uses two-factor authentication for every login. Its mobile app supports recurring buys and spot trading in BTC, ETH, and other cryptos. The platform follows FSA rules and AML regulations. It links with PayPay for quick fiat deposits.

- GMO Coin, part of GMO Internet Group, records zero in 24-hour volume and shows a –100% dip after recent changes. FSA cleared this exchange and set strict AML policies. Traders can use CFD products, futures, and margin trades for advanced tactics. Customers enjoy JPY transfers and e-wallet options. A hardware wallet and two-factor authentication protect each account.

- OKCoin Japan blends a simple layout with advanced trading bots and chart tools. The FSA oversees every action, so users trust its compliance with AML rules. Spot trading covers dozens of cryptos, and margin options help active investors. The site offers low fees on BTC, ETH, and BNB Chain pairs. Mobile notifications and direct JPY deposits keep orders timely.

BitFlyer

bitFlyer holds a license from the financial services agency (FSA) as a regulated bitcoin exchange in Japan. The trading platform handles cryptocurrency trading for buying, selling, and holding various tokens.

It meets strict regulatory compliance guidelines, so users feel safe, given frequent audits. It uses two-factor authentication (2fa) and cold wallet storage to lock down funds.

Low trading fees attract both new traders and day traders. The system offers spot trading on major digital assets. You can trade bitcoin (BTC), ethereum (ETH), and other tokens. A Trust Score of 7.0 rates its reliability as solid.

The site runs fast, even during busy market hours.

Bitbank

Bitbank runs under Japanese law and holds a license from the Financial Services Agency. It demands full KYC verification to fight money laundering. Traders jump into cryptocurrency trading once they pass ID checks.

Users can handle spot trading with ease. This platform meets strict regulatory compliance and acts like a secure fortress for digital cash.

This Japanese crypto exchange keeps fees low, and it offers two-factor authentication (2fa) plus cold wallet storage for safety. Users see eight cryptocurrencies priced in JPY. The site logs $85,655,019 in 24-hour trading volume and holds a trust score of 8.0.

Customer support chats in Japanese to clear doubts fast.

Coincheck

Coincheck works under the Financial Services Agency. The FSA ensures regulatory compliance for all crypto exchanges in Japan. It holds a Trust Score of 5.0, based on industry ratings.

Traders can buy digital assets directly with Japanese yen.

It handles AML and KYC checks for every account. The platform posted a 24-hour trading volume of about $100,038,531. Users enjoy a simple spot trading view and low trading fees. The system uses two-factor authentication and cold storage for fund safety.

GMO Coin

GMO Coin ranks as a top regulated crypto platform under FSA rules. Clients can buy Bitcoin and other digital assets using Japanese Yen (JPY). It holds a 6.0 Trust Score, showing moderate reliability.

Platform users explore futures trading for advanced strategies.

It secures funds with two-factor authentication (2fa) and cold wallet storage. KYC verification moves fast, so you can start cryptocurrency trading quickly. The site meets strong regulatory compliance standards set by the Financial Services Agency.

OKCoin Japan

Cryptocurrency trading covers spot, margin, and cfd deals in japanese yen (JPY). Traders link bank accounts for quick fiat deposits and withdrawals. They tap copy trading and automated trading bots for smarter strategies.

OKCoin Japan trades bitcoin (BTC) and other digital assets. It lacks a public trust score. Regulatory compliance comes through an active license with the financial services agency (FSA).

The site locks coins in cold wallet storage and uses two-factor authentication (2fa). Clients find a clean layout and small fees on spot and cfd markets. API tools show margin requirement details and forex style charts.

Lack of 24-hour volume numbers may prompt traders to research further. Live chat and email support answer questions fast.

Key Features to Compare Among Regulated Platforms

Grab this quick chart to spot the strengths that matter.

| Feature | Why You Need It | What to Check |

|---|---|---|

| Security Measures | Shields accounts from hacks and theft |

|

| FSA Compliance | Lets you trade under Japan’s rulebook |

|

| Fees & Interface | Cuts costs, boosts convenience |

|

| Crypto Selection | Opens new trade chances |

|

| Liquidity | Lowers slippage, speeds orders |

|

Security Measures

Traders in Japan prize two-factor authentication (2fa) in cryptocurrency trading accounts. Exchanges like Coinbase set up 2fa and stash most digital assets in cold wallet storage. BTCC uses cold vaults offline to guard user deposits.

Kraken adds strong encryption and 2fa to its platform.

Gemini operates under a full-reserve exchange model to keep funds safe. Security certificates such as SOC 1 Type 2 and SOC 2 Type back its stance. Many users link hardware wallets to their cryptocurrency wallets for extra cover.

These checks meet cryptocurrency compliance standards.

Compliance with FSA Regulations

Japan’s FSA makes strict rules for crypto trading. Every exchange must register to comply with anti-money laundering rules and KYC standards. Platforms use KYC verification to confirm each user’s identity.

They lock most coins in cold wallet storage. They add two-factor authentication to guard accounts.

Japanese crypto exchanges hold insurance funds to cover hacks. They earn trust scores that show real trading volume. Regulatory compliance adds peace of mind for digital assets. Users can make fiat deposits and withdrawals in yen.

User Experience and Fees

bitFlyer and Bitbank use clean layouts. Each menu button pops with a bright icon. You can tap to view bitcoin (BTC) charts or send yen. Platforms let you place spot trading orders in a few taps.

They support two-factor authentication (2fa) and cold wallet storage. They limit login risk with SMS or authenticator apps. You get a clear path from deposit to trade. The flow feels like an oiled machine.

Fees vary across exchanges. Some charge low trading fees and they pack no surprise costs. Most list maker and taker rates right beside order screens. They add a small fee for fiat deposits and withdrawals.

You pay a bit extra for margin trading or cfds. Cheap fee tiers can save you plenty. Good platforms keep costs clear, like a glass window.

Supported Cryptocurrencies

Japan’s top exchanges list key digital assets. bitFlyer supports bitcoin, ethereum, and litecoin, alongside monacoin and bitcoin cash. bitbank lists 18 tokens, such as ripple, stellar, link and dai.

Coincheck offers 14 coins and stablecoin pairs for JPY spot trading. GMO Coin adds 10 assets, including XRP and EOS. OKCoin Japan trades a dozen tokens like TRX and LTC.

Platforms must register with the FSA and follow AML and KYC rules. All ledgers trade under the Payment Services Act. Other venues list many more tokens. BTCC lists over 300, Coinbase offers more than 240, and Kraken hosts over 200.

Bitget adds over 550 digital assets. Decentralized exchanges can list thousands, but they lack FSA oversight.

Takeaway and Tips for Choosing the Right Platform

A clear FSA license adds trust to a trading site. Explore platform security, like vault storage and two-factor checks. Measure fees for spot trading, margin trades, and asset swaps.

Check if the site offers tools like market graphs, automated bots, or auto investments. Start small, like testing the waters, then grow your stake. Track fiat deposits, log tax info, and keep your wallet records.

FAQs on Regulated Crypto Platforms in Japan

1. What are the top regulated crypto exchanges in Japan?

In Japan, FSA-approved platforms include bitFlyer, Coincheck, Platform C, Platform D, and Binance Japan. They lead in trading volume and user-friendly interface.

2. How do these Japanese crypto exchanges protect my assets?

They follow strict regulatory compliance; they run two-factor authentication (2fa), cold wallet storage, and thorough KYC verification. Think of it as locking your coins in a high-tech vault.

3. Can I trade various products on these platforms?

Yes, you can do spot trading, margin trading, futures trading, derivatives trading, and even join initial coin offerings (ICOs). Each platform offers advanced trading tools and market sentiment data.

4. Are automated trading bots and copy trading allowed?

Some regulated crypto exchanges let you deploy automated trading bots or copy trading strategies. Always check each platform’s policy, since fees and features differ.

5. How do I deposit and withdraw Japanese yen?

Most crypto platforms accept fiat deposits and withdrawals by bank transfer. Some offer debit cards too. Fees stay low, so you spend less getting your money in and out.

6. Do I need to report my crypto gains in Japan?

Yes. Crypto profits count as miscellaneous income. You report gains from spot trading, margin trades, staking rewards, and ICO investments. Then you pay tax on your net gains.