Building wealth is a goal for many, but in today’s rapidly changing world, the path to financial security requires a mix of traditional wisdom and modern strategies. Whether you’re just starting out in your career or looking to improve your financial situation, these practical tips can guide you in the right direction. In this article, we’ll discuss ten actionable steps to help you accumulate wealth over time.

1. Start Saving Early

One of the most important principles of building wealth is starting early. The earlier you begin saving, the more time your money has to grow. This is largely due to the power of compound interest, which allows you to earn interest on both your initial deposit and the interest that has already accumulated. Even if you can only save a small amount each month, the impact over the long term can be significant. You can learn more about compound interest from the resources such as Investopedia.

By prioritizing saving early, you are laying a strong foundation for your financial future. Setting aside a portion of your income regularly—whether it’s 10% or more—helps to ensure that you are building towards your long-term goals.

2. Establish a Budget

Creating and sticking to a budget is crucial for building wealth. It helps you understand where your money is going and identify areas where you can cut back. A detailed budget gives you control over your finances, allowing you to allocate funds to savings and investments, rather than spending impulsively.

Start by tracking your expenses for a month or two. Identify necessary expenses like rent or utilities, and discretionary ones like entertainment. Once you have a clear picture of your spending, set limits in each category. Budgeting also allows you to stay disciplined and avoid living paycheck to paycheck.

3. Invest in Low-Cost Index Funds

Investing in stocks can seem intimidating, but it doesn’t have to be. One of the simplest ways to grow your wealth is by investing in low-cost index funds. These funds track the performance of a specific market index, such as the S&P 500, offering a diversified portfolio that reduces risk. Index funds generally have lower fees than actively managed funds, meaning you can keep more of your investment returns.

Long-term investments in low-cost index funds have proven to be effective in building wealth over time. They provide steady returns and allow you to benefit from the overall growth of the market, without the need to pick individual stocks.

4. Set Clear Financial Goals

Setting specific, measurable financial goals gives you a roadmap to follow as you work towards building wealth. These goals should be both short-term (e.g., saving for an emergency fund) and long-term (e.g., retirement). Be clear about what you want to achieve, and break your goals down into smaller, manageable steps.

By setting clear goals, you can track your progress and stay motivated. Each milestone you reach will bring you closer to financial freedom. Whether it’s paying off debt or saving for a down payment on a home, goals provide direction and purpose in your wealth-building journey.

5. Automate Your Savings

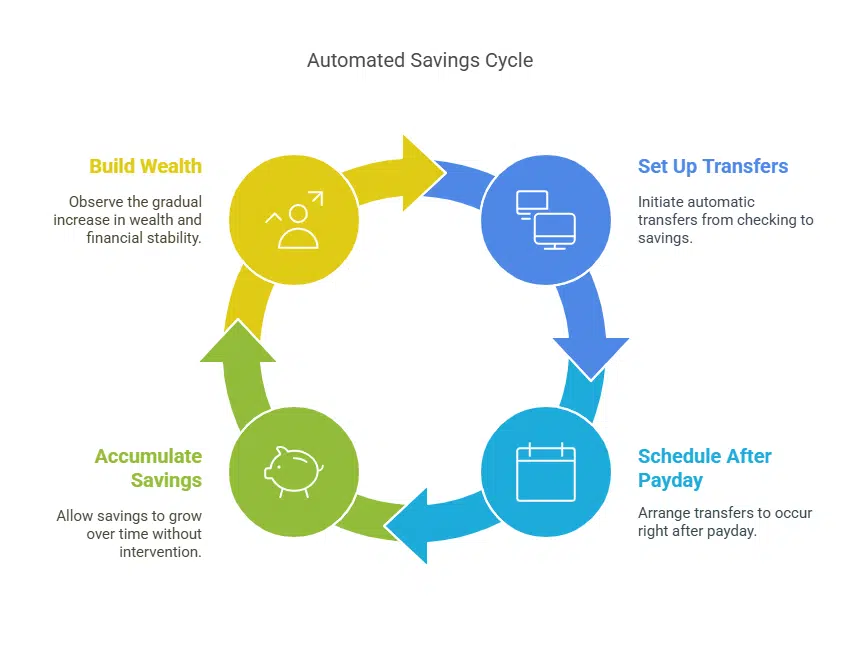

One of the easiest ways to ensure you save consistently is by automating your savings. Set up automatic transfers from your checking account to your savings or investment accounts. By automating the process, you can remove the temptation to spend the money before you save it.

This approach makes saving effortless. You can set it up to occur right after you get paid, ensuring that a portion of your income goes straight into savings without you having to think about it. Over time, the accumulated savings can add up, helping you build wealth steadily.

6. Take Advantage of Employer-Sponsored Retirement Plans

If your employer offers a 401(k) or other retirement savings plan, you should take full advantage of it. Many employers match a portion of your contributions, essentially giving you free money. Contributing to these plans is one of the easiest ways to save for retirement, and the money you invest grows tax-deferred, allowing you to keep more of your earnings.

In addition, most employer-sponsored retirement plans offer a variety of investment options, from low-risk bonds to higher-risk stocks. This allows you to create a diversified portfolio that suits your risk tolerance and investment horizon.

7. Build an Emergency Fund

Unexpected expenses are a part of life, whether it’s a medical emergency, car repairs, or a sudden job loss. To avoid dipping into your investments or going into debt, it’s essential to have an emergency fund. Most experts recommend saving three to six months’ worth of living expenses in a high-yield savings account (HYSA) or money market account.

Having an emergency fund gives you peace of mind and financial stability. It acts as a cushion, so you don’t have to rely on credit cards or loans in case of an emergency. Over time, you can build a larger safety net as your financial situation improves.

If you’re curious about how much interest you could earn on your emergency savings, a HYSA account calculator can help you estimate your potential earnings over time.

8. Minimize Debt

Debt is one of the biggest obstacles to building wealth. High-interest debt, such as credit card balances, can quickly accumulate and take a significant portion of your income. If you have debt, it’s crucial to prioritize paying it off. Start with high-interest debts, then move to lower-interest ones.

Avoid taking on new debt unless absolutely necessary, and aim to live within your means. A debt-free life provides more opportunities to invest and save for the future, rather than spending on interest payments.

9. Invest in Yourself

The best investment you can make is in yourself. Whether it’s acquiring new skills, earning a higher degree, or improving your physical and mental health, investing in personal development can increase your earning potential and overall quality of life.

By continuously learning and adapting, you position yourself for career advancement and better financial opportunities. Take advantage of courses, certifications, or workshops that will help you stand out in your field.

10. Leverage Passive Income Streams

Creating multiple streams of income can help accelerate your wealth-building efforts. Passive income streams, such as rental income, dividends, or royalties, allow you to earn money without actively working for it.

While building passive income takes time and effort upfront, it can provide a significant boost to your finances over time. Look for opportunities to invest in assets that generate passive income or start a side business that can eventually run with minimal involvement.

Conclusion

Building wealth is a long-term endeavor that requires discipline, patience, and strategic decision-making. By following these ten practical tips, you can set yourself up for financial success. Whether it’s starting early, automating savings, or investing in low-cost funds, every small step you take brings you closer to your financial goals.

Remember, the key to building wealth is consistency. Stick to your plan, adjust when necessary, and enjoy the journey to financial independence.