For investors seeking a blend of growth potential and professional fund management, equity mutual funds present an attractive option, especially in a rising market. These funds are ideal for those who want to benefit from stock market opportunities without the pressure of picking individual stocks.

Equity funds pool money from multiple investors and invest in a diversified portfolio of company shares, making it simple for anyone to begin their stock market journey.

What are equity mutual funds?

Equity mutual funds invest in shares of various industries and companies across sectors and market capitalisations. These funds are well-managed by experts who use their knowledge to zero in on shares that are likely to grow in value.

Since equity funds gather money from many investors and invest in different companies, the risk of losing money from one underperforming share is reduced.

Equity fund benefits

Equity funds come with various advantages:

- Scope for earning high returns: Over time, equity funds generally offer better returns as compared to fixed deposits or other low-risk options, particularly for long-term investments.

- Diversification: Spreading investments across many stocks helps reduce the impact of poor performance from any single stock.

- Professional management: Professional fund managers carry out in-depth research and evaluation to make better investment decisions for investors.

- Liquidity: Equity funds are extremely liquid. Investors can redeem their units on any business day at the existing Net Asset Value (NAV).

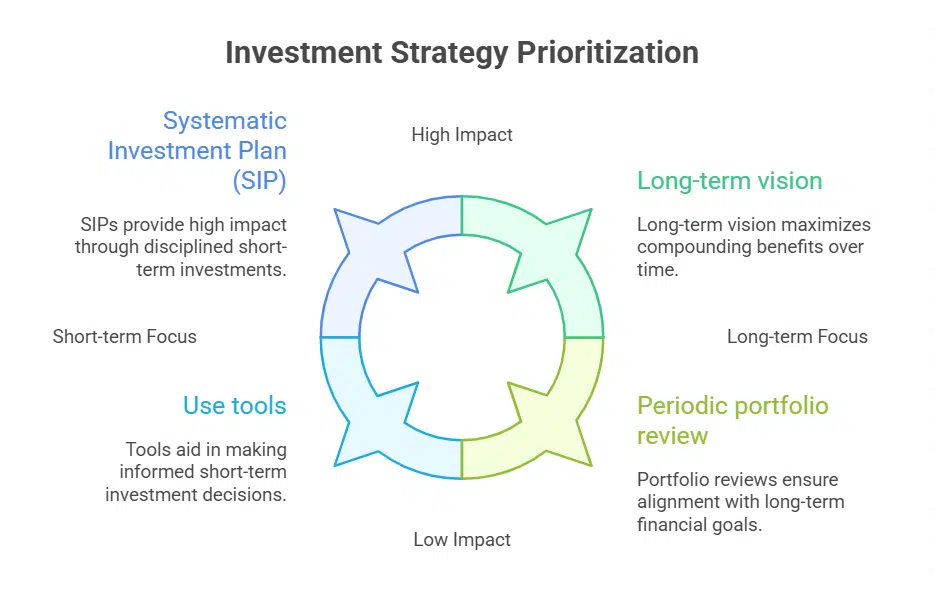

Strategies for maximising returns

Investors must learn to maximise their returns, and the following are some of the ways to achieve that:

- Systematic Investment Plan (SIP): SIPs invest a fixed amount of money at regular intervals, promoting financial discipline and minimising the impact of market volatility.

- Long-term vision: Equity funds are ideal for long-term investors, usually those who remain invested for five or more years, to ride out market cycles and enjoy the compounding effect.

- Periodic portfolio review: Investors should periodically review and rebalance their portfolios to ensure alignment with their risk tolerance and financial objectives.

- Use tools: Tools like a mutual fund return calculator can project returns for different investment amounts and durations. This helps investors make informed decisions.

Choosing the ideal mutual fund

Choosing the best mutual fund requires looking at the historical performance of the fund, expense ratio, background of the fund manager, and alignment with investment goals. Investors must compare multiple funds within the same category to identify those that consistently outperform their benchmarks.

They must also consider how much risk they can bear and how long they are willing to stay invested. Large-cap funds, for example, are less volatile than small-cap funds, but the latter may offer higher growth potential with increased volatility.

Conclusion

Equity funds are a suitable method for accumulating wealth, particularly in a growing market. By understanding their structure and advantages and applying strategic investment techniques, investors can maximise the benefits of equity mutual funds. To succeed in the long term, investments must align with personal financial objectives and risk tolerance.