Have you ever come across a letter from PO Box 4115 Concord CA, and wondered what it was all about? You’re not alone. Many people receive mysterious communications from this address, leaving them scratching their heads in confusion.

What many don’t realize is that this PO Box is linked to several debt collection agencies, including the notorious Portfolio Recovery Associates.

Here’s something important to know: these agencies are known for pursuing old debts, some of which might not even be valid anymore. This can lead to unnecessary stress and worry for those who find themselves on the receiving end of their correspondence.

But here’s the good news: our article is designed to demystify PO Box 4115 and provide you with practical tips on how to handle any issues arising from interactions with entities operating out of this address.

By diving into our guide, you’ll learn about your rights, how to fight back against questionable debt claims, and ways to protect yourself from potential scams. Ready to clear up the mystery? Keep reading!

Understanding Portfolio Recovery Associates

Portfolio Recovery Associates plays a key role in debt collection, buying unpaid debts and trying to collect them. They often reach out through mail, using addresses like PO Box 4115 Concord CA for communication.

Role of Portfolio Recovery Associates

Based in Minneapolis, Minnesota, Portfolio Recovery Associates holds a significant spot in the consumer credit system. This agency steps into the picture after individuals fall behind on their payments.

Their main job is to buy debts from creditors for less than the original amount owed and then try to collect the full debt from consumers. They work with various types of debt, including credit card bills, payday loans, and other personal debts.

Portfolio recovery uses different strategies to reach out to people they believe owe money. One common method involves sending letters or making phone calls. For communications, they use addresses like DEPT 922, PO Box 4115 Concord CA.

Their role extends beyond just attempting to collect debts; they also report unpaid debts to credit bureaus, affecting the credit scores and financial health of individuals. This action makes dealing with them crucial for anyone looking to improve or maintain their financial standing. In addition, you can also read an article on Po Box 7251 Sioux Falls.

Why Portfolio Recovery Uses Dept. 922 PO Box 4115 Concord CA for Communication

Portfolio Recovery Associates picks Dept. 922 PO Box 4115 Concord CA for all its mail. This method helps them manage letters and payments from people they are collecting debts from.

It makes sure everything goes to one place, so nothing gets lost. Also, using a PO Box keeps their own location private and secure.

This address, known as 3747770716072, DEPT 922, PO Box 4115 Concord CA, is linked directly with Portfolio Recovery Associates. Having a specific department number lets them sort through mail quickly.

They can figure out what each letter is about without opening it first. This system speeds up how they handle debt collection, making it easier for them to respond to consumers’ concerns or process payments faster.

Dealing with Debt Collection from Portfolio Recovery

Getting a letter from Portfolio Recovery can feel scary. You have options to manage or even fight this debt, making the situation less overwhelming.

Fighting the Debt

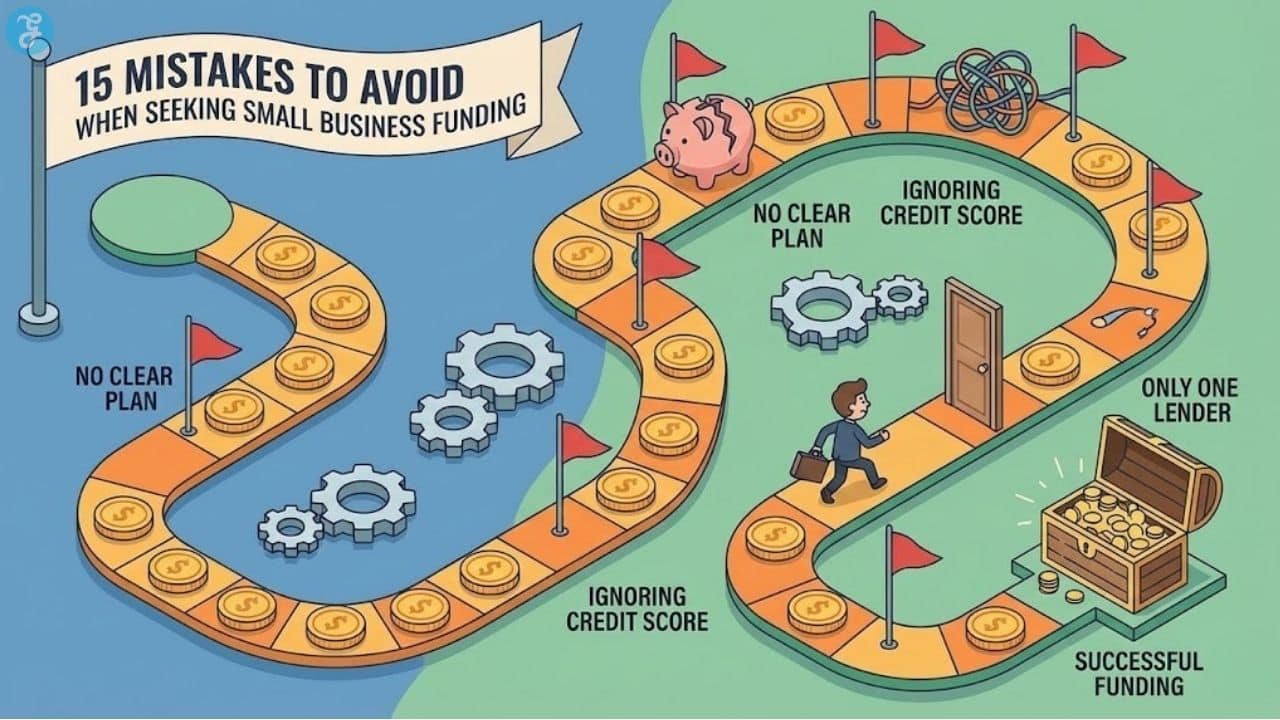

Fighting debt can feel like a daunting task. Yet, it’s crucial to know your options and rights under the law.

- Validate the debt: Ask Portfolio Recovery Associates for a debt validation letter. This proves they have the legal right to collect and ensures the amount is correct.

- Check the statute of limitations: Debts have an expiration date based on state laws. If your debt is too old, they may not be able to sue you for it.

- Negotiate a settlement: You might settle your debt for less than what you owe. Portfolio Recovery sometimes accepts lower payments, making it easier on your wallet.

- Consider a “Pay to Delete” agreement: Recently, Portfolio Recovery has offered this option, where they remove negative information from your credit report once you pay off the debt.

- Respond to lawsuits promptly: Ignoring court summons leads to default judgments against you. Always reply, and consider seeking legal advice.

- Explore bankruptcy: It’s a serious step, but bankruptcy can offer a fresh start if you’re overwhelmed by debt.

- Know your rights under the FDCPA: This act protects you from abusive practices by debt collectors. They can’t harass or lie to you about your debt.

- File complaints when necessary: If Portfolio Recovery violates consumer protection laws, report them to bodies like the Consumer Financial Protection Bureau or the Federal Trade Commission.

Understanding the Statutes of Limitations on Debt

The statutes of limitations on debt refer to the time frame within which a creditor or debt collection agency, like Portfolio Recovery Associates, can legally sue you to collect a debt.

This period varies by state, ranging from three to ten years for most types of debts. Once this statute expires, your debt is considered “time-barred,” meaning it’s too late for them to initiate legal proceedings against you.

Understanding this timeline is critical, especially if Portfolio Recovery contacts you about old debts. If the statute of limitations has passed, they cannot force you through court action to pay.

However, acknowledging the debt or making a payment can restart the clock. Always check your state’s laws and consult with an attorney if necessary before taking any action on alleged debts. If you want, you can also read PO Box 81129 in Austin Texas.

Options for Resolving Debt with Portfolio Recovery

Dealing with debt can be stressful, especially when facing a large company like Portfolio Recovery Associates. Yet, there are clear steps you can take to manage or even resolve your debt with them. Let’s explore these options:

- Verify the Debt: Always start by making sure the debt is actually yours. Ask Portfolio Recovery to provide proof of the debt. This means they need to send documents that show how much you owe and why.

- Negotiate a Settlement: Often, you can settle the debt for less than what you owe. Reach out to Portfolio Recovery and offer a lump sum that is lower than your total debt. They may accept this to close the account quickly.

- Set Up a Payment Plan: If paying off your whole debt at once is too much, try setting up a payment plan. Portfolio Recovery usually agrees to monthly payments that fit within your budget.

- Consider Bankruptcy: In some cases, filing for Chapter 7 bankruptcy might be an option. This can help eliminate certain debts, including ones from portfolio recovery, but talk to an attorney first.

- Know Your Rights Under FDCPA: The Fair Debt Collection Practices Act protects you from unfair collection practices. Learn about it so you know what Portfolio Recovery can and cannot do.

- Challenge the Lawsuit: If Portfolio Recovery sues you, don’t ignore it! You might have defenses available that could result in dismissing the lawsuit or reducing the amount owed.

- Ask About Forgiveness Programs: Sometimes, companies have programs that forgive part of your debt if you meet certain conditions—ask if Portfolio Recovery offers anything similar.

- Check The Statute of Limitations: Debts have an expiration date for legal action known as the statute of limitations—it varies by state. If your debt is old, Portfolio Recovery may not be able to sue you for it.

Legal Aspects of Debt Collection by Portfolio Recovery

Portfolio recovery takes the legal route to collect debts, and that’s a big deal. They might sue you if they think it’s worth their time and money.

Potential for Lawsuits by Portfolio Recovery

Portfolio Recovery Associates ranks among the top debt collectors for filing lawsuits in the U.S. They might take legal action against individuals to recover debts. Often, these cases can lead to a judgment without the debtor’s knowledge, making negotiations harder later on.

It’s crucial for anyone dealing with this agency to understand their rights under laws like the Fair Debt Collection Practices Act (FDCPA) and seek legal advice if necessary.

Receiving a lawsuit from Portfolio Recovery is more than just stressful; it could also affect your credit rating and financial stability. If they win the case, they may have the right to garnish wages or levy bank accounts—actions that can significantly disrupt personal finances.

Knowing how to respond to a lawsuit from them is key. This includes responding to court summonses on time and being aware of statutes of limitations on debt in your state.

What a Judgment by Portfolio Recovery Means

A judgment from Portfolio Recovery means they have won the case against you in court. This legal victory allows them to take steps like freezing your bank accounts, putting liens on any property you own, or garnishing your wages.

These actions can seriously affect your financial stability and peace of mind.

If this happens without your knowledge, it becomes tougher to negotiate or settle the debt. You might find yourself facing unexpected financial hurdles. Knowing how to deal with such a judgment early on can save you from these stressful situations and help you maintain control over your finances.

Handling a Portfolio Recovery Lawsuit

Facing a lawsuit from Portfolio Recovery Associates can be daunting. They’re known for being one of the most litigious debt collectors in the U.S. Here’s how to handle it:

- Stay calm and gather all your documents related to the debt. This includes any communication from Portfolio Recovery, payment records, and the original contract with the creditor.

- Check the statute of limitations on your debt. If the time limit has passed, Portfolio Recovery may not be able to sue you to recover the debt.

- Consider sending a debt validation letter. This forces Portfolio Recovery to prove that you owe the money and that they have the right to collect it.

- Explore consumer rights under laws like the Fair Credit Reporting Act and Consumer Financial Protection Bureau regulations. Understanding your rights can protect you against unfair practices.

- Respond to any legal notices or court summonses. Ignoring them can lead to a default judgment against you, making things worse.

- Think about hiring an attorney who specializes in debt collection cases. They can offer personalized advice and represent you in court if needed.

- Negotiate a settlement if possible. Sometimes, settling for less than what’s owed is an option, but assess your financial situation first.

- Document everything throughout the process. Keep a record of all communications and decisions made regarding your case.

Frequently Asked Questions about Portfolio Recovery Associates

Dive deep into our FAQ section to find answers about how Portfolio Recovery operates, making sense of their actions, and your best moves.

Actions Portfolio Recovery can take

Portfolio Recovery may decide to take legal action based on various factors, such as state laws and the amount you can pay. They look at each case carefully. If they see that it makes sense for them, they might file a lawsuit.

This starts with them or their lawyer putting together a complaint and taking it to court.

If you don’t respond to their lawsuit, things can get tough. They could freeze your bank accounts or put liens on any property you own. Even more, they could start taking money right out of your paycheck before you even see it.

So, if Portfolio Recovery sues you, working with them is key—especially if times have been really hard for you lately.

Resolving a Judgment Against You

Getting a judgment resolved requires immediate action. You could negotiate with the debt buyer, aiming for a settlement that’s less than what you owe. This is often achievable, especially if Portfolio Recovery Associates didn’t expect you to fight back.

If your budget allows, paying the full amount gets rid of the debt entirely, but it’s not always an option for everyone.

Exploring bankruptcy might be worth considering if your financial situation doesn’t allow for repayment or settlement. Bankruptcy can stop garnishments and levies, offering a fresh start.

Always consult with an attorney before making big decisions like this; they can guide you through options tailored to your specific circumstances. Engaging with legitimate debt settlement firms can also offer pathways to resolving judgments without overwhelming stress.

You May Find Interest: PO Box 4519 Skokie IL

Dealing with Portfolio Recovery without a Lawsuit

You can tackle debt collection from Portfolio Recovery head-on, without the stress of a lawsuit. Start by reaching out to them directly. Discuss your situation and express your willingness to settle the debt.

They often consider flexible payment arrangements before filing a lawsuit. This approach shows you’re taking responsibility and may prevent legal action.

Exploring settlement options is another smart move. Offer what you can afford; Portfolio Recovery might still accept it even if it is less than the full amount due. Remember, negotiating before they push for a judgment keeps you in control and avoids harsher consequences down the line.

It’s about finding common ground while protecting your financial stability.

Other Entities Operating from PO Box 4115 Concord CA

PO Box 4115 Concord CA isn’t just for portfolio recovery. It’s also a hub for other major collection agencies, each with its unique approach to debt recovery.

Premiere Credit of North America LLC

Premiere Credit of North America LLC stands out in the bustling world of consumer credit systems. As a key player, it specializes in debt recovery, ensuring that debts are collected efficiently and ethically.

This agency has made its mark by using innovative strategies to engage with individuals who owe money. It’s not just about collecting; it’s about finding solutions that work for both parties.

Located at PO Box 4115 in Concord, CA, Premiere Credit shares this address with other entities involved in financial recovery services. Their expertise and strategic location have positioned them as a respected leader among collection agencies.

They work closely with consumers to navigate the often complex journey of clearing up their financial responsibilities. Through clear communication and a commitment to professionalism, they aim to demystify the debt collection process for many.

National Credit Adjusters

National Credit Adjusters has a notable presence at PO Box 4115 in Concord, CA. They focus on buying unpaid debts and then work hard to collect what’s owed. This company stands out because of its dedication to tracking down outstanding balances.

It’s crucial to know that they’ve had some issues in the past with how they treat people who owe money. Reports have surfaced about them using harsh words and making too many phone calls.

This kind of behavior can make an already stressful situation even worse for people trying to manage their debts.

Knowing your rights is key if you’re dealing with National Credit Adjusters or any debt collector. The Fair Debt Collection Practices Act (FDCPA) gives everyone certain protections, like not having to put up with abuse or threats.

If things get out of hand, you have options like contacting the Better Business Bureau (BBB) or the Consumer Financial Protection Bureau (CFPB). These organizations can step in when collectors don’t play by the rules, helping keep everything fair and respectful.

National Credit Systems

National Credit Systems finds its home at PO Box 4115 in Concord, CA. This agency focuses on chasing down unpaid rent and other fees left behind by former tenants. They play a crucial role within the consumer credit system, ensuring that debts don’t just vanish.

Debt collections can seem daunting, but understanding how agencies like National Credit Systems operate makes navigating these waters smoother. They specialize in recovering funds that landlords and property managers often struggle to collect, acting as a bridge between old debts and new beginnings for both parties involved.

Read More: PO Box 340 Waite Park MN

Frequently Asked Questions about PO Box 4115 Concord CA

Ever wondered what’s up with PO Box 4115 in Concord, CA? It’s not just one company grabbing your attention—dive deeper to uncover who else sends mail from this mysterious box.

Understanding Different Departments: Dept 813, 922, 555, 322

Dept. 813 has ties to a company in Minneapolis, Minnesota. It’s not just any name on paper, but part of a bigger system that manages correspondence and operations specific to its location and purpose.

This department helps keep things organized and ensures mail reaches the right hands without getting lost in the shuffle.

Portfolio Recovery Associates finds its home with Dept. 922 at PO Box 4115 Concord CA, making this address crucial for anyone dealing with them. On another front, Dept. 555 is where you’d send mail if you needed to contact National Credit Systems.

As for Dept. 322, it’s also under Portfolio Recovery Associates’ wing, showing how diverse their operations are through these different departments. Each one plays a unique role in handling debt collections efficiently, proving that behind every number there’s a carefully structured process at work.

Conclusion

PO Box 4115 in Concord CA is a hub for debt collectors. This address involves companies like Portfolio Recovery Associates and others. They might send you mail from there. Remember, it’s crucial to know your rights and how to protect yourself.

Always check the facts before acting on any debt collection notices from this PO Box.