Need money fast? Many people use payday loans. These loans give cash quickly but can cause serious issues. One option is ELoanWarehouse, known for quick processing.

ELoanWarehouse charges very high interest rates, between 400% and 700%. Such rates can make repayment very hard. In this write-up, I break down the risks of payday loans, especially from ELoanWarehouse, and compare them with regular banks.

You will see why other alternatives might be safer and less costly.

Keep reading for smart ways to handle money trouble.

Understanding Payday Loans: ELoanWarehouse vs. Traditional Lenders

Payday loans from services like ELoanWarehouse are meant for small amounts. Borrowers use them to cover expenses until the next payday. They are due in just 2 to 4 weeks, which makes budgeting tough.

Banks and traditional lenders offer longer repayment periods. They also review your credit history and track past money management. Payday lenders usually do not check these details.

ELoanWarehouse lets you apply online with few checks. This speeds up the process when you need cash fast. The low scrutiny comes at a steep cost; interest rates skyrocket at high levels like those noted in interest rates.

The next section outlines key features of ELoanWarehouse payday loans.

Key Features of Payday Loans ELoanWarehouse

These payday loans are known for fast approval and a simple application. Applicants do not require a pristine credit score, which makes them a fallback option when funds run low.

High Interest Rates and Short Terms

Payday loans carry extremely high APRs, typically from 400% to 700%. This means you end up paying far more than you borrow. The terms are brief; some loans run from 6 to 12 months. In many cases, you need to repay quickly, sometimes within weeks.

The steep rates and short durations can trap borrowers in debt. Many struggle to catch up with payments on time.

Statistics show that 20% of payday loan users default, versus 3% for traditional bank loans. This gap highlights the risks. Borrowers sometimes overestimate their ability to repay on such terms.

The high fees and tight schedules mean many borrowers fall behind.

Ease of Application and Approval

The application process is fast and simple. It takes four steps. First, you complete an online form. Next, you sign your documents digitally. Then, the approval comes swiftly. Users often receive funds within hours.

If you qualify, funds can be deposited in as little as 12 hours or by the next business day.

ELoanWarehouse aims to widen access. They do not verify military status or similar ties. This policy helps many secure funds when faced with urgent needs like medical bills.

The quick process helps you address pressing financial issues without delay.

Risks Associated with ELoanWarehouse Payday Loans

Taking a payday loan from ELoanWarehouse may seem simple. Yet, steep fees and short repayment periods can lead to serious problems.

Debt Traps and Financial Vulnerability

Loans from ELoanWarehouse risk trapping borrowers in cycles of debt. High interest rates and frequent rollovers can inflate a $500 loan to $1,250 with just three extensions.

Borrowers may spend much of their year handling debt. The strain of repayment takes a heavy toll.

Maria’s case highlights the danger. With four renewals on her loan, she ended up paying an extra $1,160. Such cases illustrate the debt trap many face.

Breaking free from this cycle is a real challenge.

Lack of Consumer Protections

The risk of debt traps is compounded by weak consumer protections. Many borrowers note that companies like ELoanWarehouse do not clearly explain loan terms. Hidden details often reside in fine print.

Often, these important details hide in fine print.

In some states, such as Texas, lenders may charge fees that exceed 600% APR. This drives costs sky high. Lax rules fail to protect borrowers from these hidden charges.

The Consumer Financial Protection Bureau (CFPB) works to protect consumers. Their efforts face hurdles due to variations in state laws on lending and interest rates.

How Traditional Lenders Differ from Payday Loan Providers

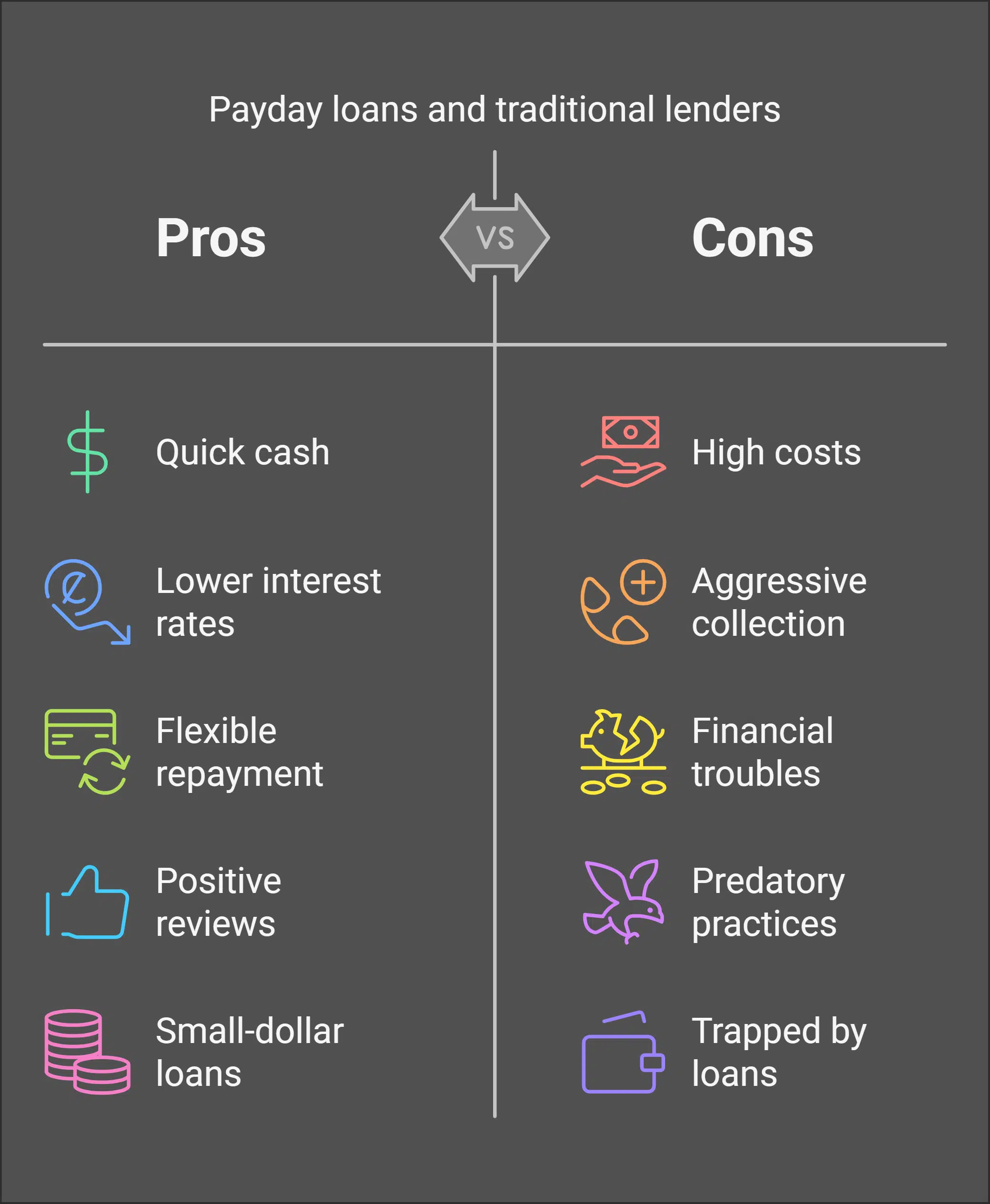

Traditional lenders and payday loan providers serve different needs. Banks allow longer repayment and charge much lower rates. In contrast, payday lenders require rapid repayment at a steep cost.

Lower Interest Rates and Flexible Terms

Credit unions provide small loans at a maximum of 28% APR. They offer far better deals than payday lenders. Their repayment terms stretch over a longer period, easing the burden.

Other options include early wage access with fees as low as $1 to $5. Credit cards may offer no interest for 15 to 18 months. These choices help save money and ease repayment.

Stricter Eligibility Requirements

Banks and credit unions require more details before approving loans. They check your credit score, income, and outstanding obligations. This scrutiny makes it harder to qualify, but it helps avoid future debt problems.

Membership in a credit union is also required.

When you apply for personal loans, lenders review additional details. They check your payment history and total borrowing. This review boosts their confidence before giving you a loan.

The stricter process may be challenging, yet it prevents larger debt issues later.

Alternatives to Payday Loans

Exploring other methods of obtaining cash can reduce high costs. Credit unions and personal loans often provide friendlier terms. Apps such as Earnin and Dave offer money advances without steep fees.

Credit Unions and Personal Loans

Credit unions present a gentler option for small loans. They charge low fees and cap rates at 28%. This approach is far less expensive than payday alternatives.

Such options suit those who need cash without incurring huge fees.

Banks and online personal loans offer another solution. They charge lower interest and allow longer repayment. Borrowers end up with reduced overall costs.

Both alternatives help safeguard your finances compared to high-cost payday loans like those from ELoanWarehouse.

Apps Like Earnin and Dave

Earnin and Dave provide creative money solutions. They grant cash advances before payday without high fees. Earnin allows you to access earned money early. They do not add interest or fees; they simply request voluntary tips.

Dave offers advances up to $100 and skips credit checks. This makes it accessible to more users.

Such apps help break the cycle of debt. They use clear terms and offer budgeting tools. Earnin sets limits according to earnings. Dave provides modest sums to cover immediate needs without burdening you with large debts.

These methods shift borrowing toward fairness and clear conditions.

Comparing Borrowing Costs: ELoanWarehouse vs. Traditional Lenders

Here is a cost comparison: ELoanWarehouse versus traditional lenders.

| Type of Lender | Interest Rates | Example Loan Cost |

|---|---|---|

| ELoanWarehouse | 400% – 700% | A $500 loan can grow to $1,250 with three extra charges. |

| Traditional Lenders | Below 36% | Costs are much lower. |

| Credit Unions | Capped at 28% | Even cheaper for small-dollar loans. |

The table above shows a wide cost gap. ELoanWarehouse charges rates up to 700%, which makes a $500 loan balloon in cost. Traditional lenders and credit unions impose much lower fees. Their loans are easier to repay. Think hard before choosing your lender.

Customer Experiences with Payday Loans

Borrowers share varied stories. Some enjoy the rapid cash; others face high fees and tough repayment. These narratives show the true cost of payday loans.

Feedback on ELoanWarehouse Services

Many customers report problems with ELoanWarehouse. They mention APRs from 400% to 700%, which make loans expensive. Some share accounts of poor service and harsh collection tactics.

Reports from sources like the Better Business Bureau highlight these issues. Complaints frequently note unfair practices that burden borrowers.

Many feel stuck after taking these loans. They seek an easy fix but soon struggle with mounting fees and collection calls.

Even when cash is pressing, caution is wise before choosing ELoanWarehouse.

Borrower Satisfaction with Traditional Lenders

Borrowers often prefer traditional lenders. Banks and credit unions offer lower rates and flexible repayment. A well-managed plan fits a tighter budget.

While banks review your credit history, it helps them craft better offers. Credit unions are loved for small loans capped at 28% APR. Their payment plans follow your pay schedule, helping avoid missed payments.

Many users share positive reviews of these traditional options. Apps such as Earnin and Dave also get praise for straightforward terms.

These alternatives prove that safe borrowing exists. They can shield you from future financial challenges.

The Long-Term Financial Impact of Payday Loans

Payday loans may trap you in a cycle of debt. A $500 loan can swell to $1,250 after three rollovers. Many borrowers spend nearly five months a year in repayment. The impact on credit scores can be severe.

High interest rates make these debts difficult to settle.

Missed payments and defaults damage credit scores. Agencies such as TransUnion record these issues. A poor score can raise future borrowing costs.

With a 20% default rate, the risk is clear.

Now we examine how laws affect payday lending practices.

Regulatory Oversight: Payday Loans vs. Traditional Lending Practices

Rules for payday loans differ from those for bank loans. In 2017, the Consumer Financial Protection Bureau (CFPB) set guidelines to check repayment ability before lending.

The guidelines also capped the number of loan rollovers. In 2020, the rule was removed. Today, states such as New York and New Jersey enforce strong limits to curb high fees.

The Biden administration works on new measures, though progress is slow. Only 15 states cap rates at 36% or ban these loans. Your state may affect the safety of your borrowing.

Recommendations for Borrowers Seeking Short-Term Financing

Short-term financing needs care. Informed choices protect your finances. Practical advice can help you avoid trouble.

- Discuss with your lender the possibility of extended repayment plans if you struggle with timely payments. This option can ease your burden.

- Examine debt consolidation to manage multiple loans. Nonprofit groups can offer low-interest options.

- Try using budgeting apps like YNAB (You Need A Budget) to control spending and prioritize debts.

- Attend free credit counseling sessions from agencies like Money Management International. Expert advice can guide you in managing debt.

- Weigh alternatives to payday loans, such as credit unions or personal loans with lower rates and flexible terms.

- Consider cash advance apps such as Earnin or Dave, which provide funds without steep interest, giving you a safer buffer.

- Read every detail in the loan agreement. Knowing all terms helps you avoid surprises in fees and schedules.

- Keep the lines of communication open with your lender. Early contact when troubles arise can avert defaults and credit harm.

Takeaways

Payday loans from ELoanWarehouse carry great risks. They charge steep interest and can trap you in debt. Safer borrowing exists. Consider options that offer friendlier terms.

Make smart decisions to safeguard your finances and well-being.

Disclosure: This article was written by a financial expert who reviewed public data and official regulatory documents. The research relied on sources like the CFPB and the Better Business Bureau. The content is for informational purposes only and is not financial advice.