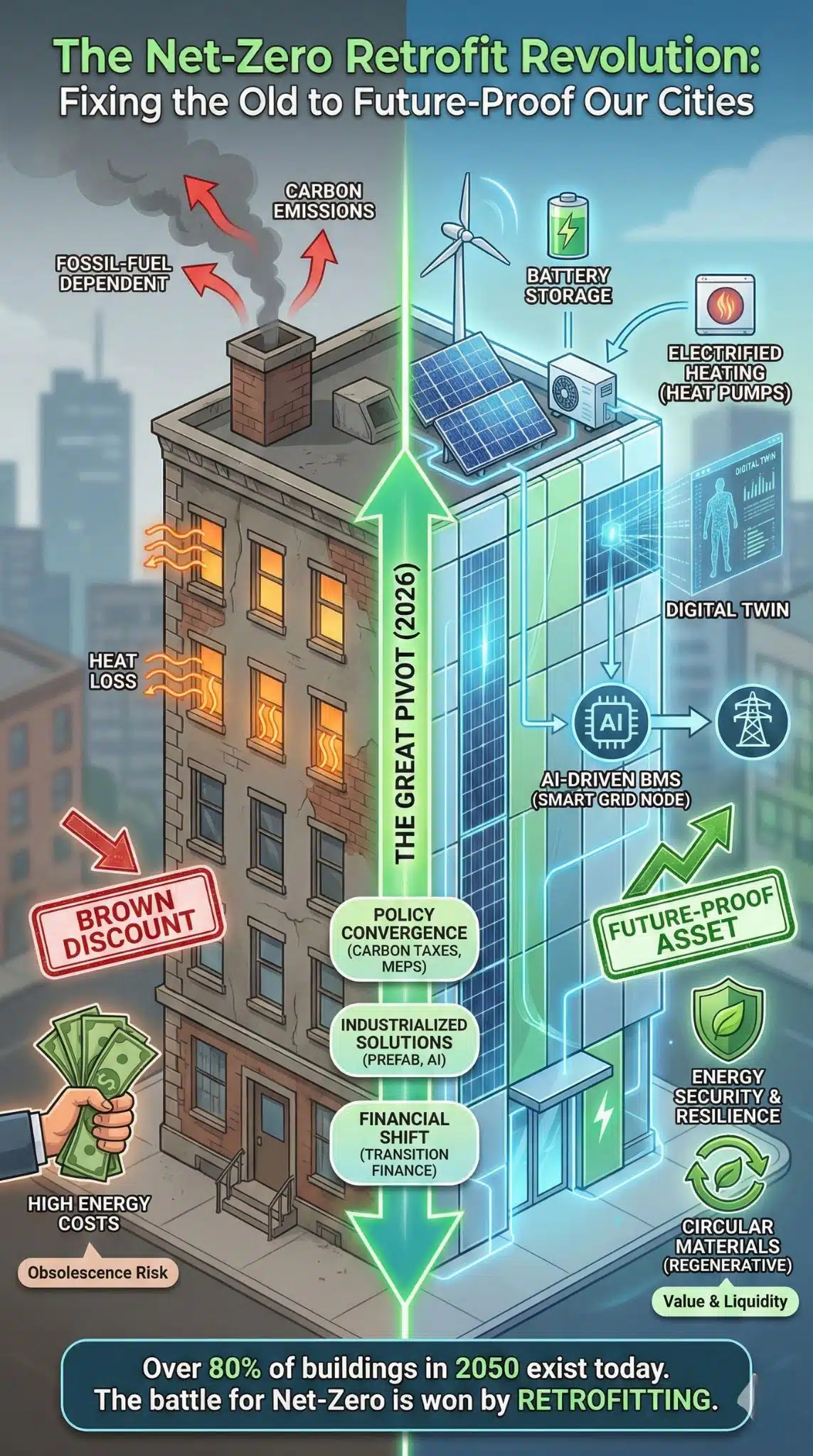

By early 2026, the global conversation on climate change has shifted decisively from “building new” to “fixing the old.” With over 80% of the buildings that will exist in 2050 already standing today, the battle for net-zero will be won or lost not in new developments, but in the retrofitting of existing urban stock. This is the essence of the net-zero retrofitting revolution, where climate ambition meets the hard reality of existing cities. This structural shift represents the largest capital mobilization in real estate history, fundamentally altering property values, urban aesthetics, and the technological fabric of our cities.

Key Takeaways

- The “Brown Discount” Reality: In 2026, un-renovated commercial properties are seeing valuation drops of 15-25% as “brown discounts” overtake “green premiums.”

- Industrialized Solutions: The adoption of prefabricated “skins” and modular mechanical retrofits has reduced on-site renovation time by 40% compared to 2023.

- Policy Convergence: Major cities (NYC, London, Singapore) have moved from voluntary incentives to strict carbon taxation, forcing landlords to retrofit or face obsolescence.

- Energy Security Driver: The retrofit boom is no longer just about carbon; it is primarily driven by energy security and grid stabilization following the volatility of global energy markets in 2024-2025.

The Great Pivot: From New Builds to Deep Retrofits

The narrative of sustainable architecture was long dominated by gleaming, glass-wrapped skyscrapers boasting LEED Platinum status. However, as we settle into 2026, the focus has pivoted to the gritty reality of the “embodied carbon” crisis. Demolishing an old building to build a new “green” one is no longer viewed as sustainable; it is seen as a carbon bomb.

This shift was accelerated by the convergence of the European Union’s Energy Performance of Buildings Directive (EPBD) entering its enforcement phase and the maturation of tax credits from the U.S. Inflation Reduction Act. We are no longer in the pilot phase. The market has moved from boutique “Passive House” projects to mass-scale industrialized retrofitting. This transition is reshaping the construction industry, moving it away from bespoke craftsmanship toward a manufacturing-led approach, where buildings are measured, digitized, and fitted with prefabricated energy-efficient facades.

The Economic Tectonics: Stranded Assets vs. Future-Proofing

The most immediate impact of the retrofitting revolution is financial. Real estate economics have bifurcated. On one side are “future-proofed” assets—buildings with electrified heating, high-performance envelopes, and grid-interactive capabilities. On the other are “stranded assets”—fossil-fuel-dependent structures facing regulatory fines and insurance premiums that render them financially toxic.

In 2026, we are witnessing the death of the “Green Premium”—the idea that sustainable buildings are a luxury item fetching higher rents. Instead, the market is defined by the “Brown Discount.” Data from global real estate indices suggests that non-compliant buildings are trading at significant discounts, driven by the cost of required future capital accumulation (CapEx) to meet 2030 targets.

Comparative Analysis: The Financial Shift in Urban Real Estate (2023 vs. 2026)

| Metric | 2023 Landscape | 2026 Reality | Impact Analysis |

| Asset Valuation | Green buildings commanded a 5-10% premium. | Non-green buildings suffer a 15-25% valuation discount. | Sustainability is now a baseline requirement for liquidity, not a bonus. |

| Financing Cost | Green loans were niche products with slight rate reductions. | “Transition Finance” is the dominant lending category. | Banks are refusing to refinance properties without a funded decarbonization plan. |

| Insurance Premiums | Largely uniform across building types. | High divergence; non-resilient buildings face 30%+ hikes. | Insurers are pricing in climate risk and energy inefficiency as liability proxies. |

| ROI Horizon | 10-15 years (often considered too long). | 7-9 years (accelerated by energy costs and penalties). | Higher energy prices and carbon taxes have improved the retrofit business case. |

Technological Leapfrogging: The AI and Prefab Nexus

The speed of retrofitting has historically been its Achilles’ heel. Deep energy retrofits were intrusive, messy, and slow. 2026 marks the maturity of “Industrialized Retrofitting,” a concept pioneered by the Energiesprong movement but now adopted by mainstream construction giants.

Utilizing LiDAR scanning and drone photogrammetry, companies can now create a “Digital Twin” of an existing building within hours. These digital models feed directly into off-site manufacturing lines that produce insulated façade panels with integrated windows and ventilation ducts. These panels are shipped to the site and snapped onto the old building exterior like a phone case.

Furthermore, Artificial Intelligence has moved from a buzzword to a utility. AI-driven Building Management Systems (BMS) are now standard in retrofits, actively managing the load between rooftop solar, battery storage, and heat pumps to allow buildings to sell power back to the grid during peak demand. This transforms buildings from passive energy consumers into active grid nodes (Virtual Power Plants).

The Regulatory Pincer Movement

Governments have stopped asking nicely. The era of voluntary compliance ended when the data showed that voluntary measures failed to reduce urban emissions at the necessary pace.

In North America, cities like New York and Boston have begun issuing significant fines under laws similar to Local Law 97. In Europe, Minimum Energy Performance Standards (MEPS) are preventing the sale or rental of properties rated below specific energy bands.1 This “Pincer Movement”—strict regulatory floors combined with the ceiling of rising energy costs—has left asset owners with no choice but to intervene.

However, this has created a geopolitical divergence. While the EU and parts of North America push ahead with mandatory upgrades, emerging markets in Asia and Latin America are focusing on “Cooling Retrofits”—upgrades specifically designed to combat the lethal wet-bulb temperatures seen in the summers of 2024 and 2025. Here, the focus is less on heating efficiency and more on passive cooling, shading, and dehumidification.

Global Policy & Market Response Matrix

| Region | Primary Policy Driver | Market Response | Dominant Technology |

| Western Europe | EU EPBD (Mandatory Renovations) | Mass adoption of heat pumps; district heating expansion. | Prefabricated insulating facades. |

| North America | Local Emissions Caps (e.g., NYC, Vancouver) | Electrification of heating; death of natural gas in buildings. | Air-source heat pumps; induction tech. |

| Southeast Asia | Urban Heat Island Mitigation | Passive cooling regulations; green roof mandates. | Low-emissivity glass; reflective coatings. |

| UK | Energy Security Strategy | Insulation grants aimed at fuel poverty reduction. | Cavity wall & loft insulation; smart meters. |

Social Equity and the Gentrification Risk

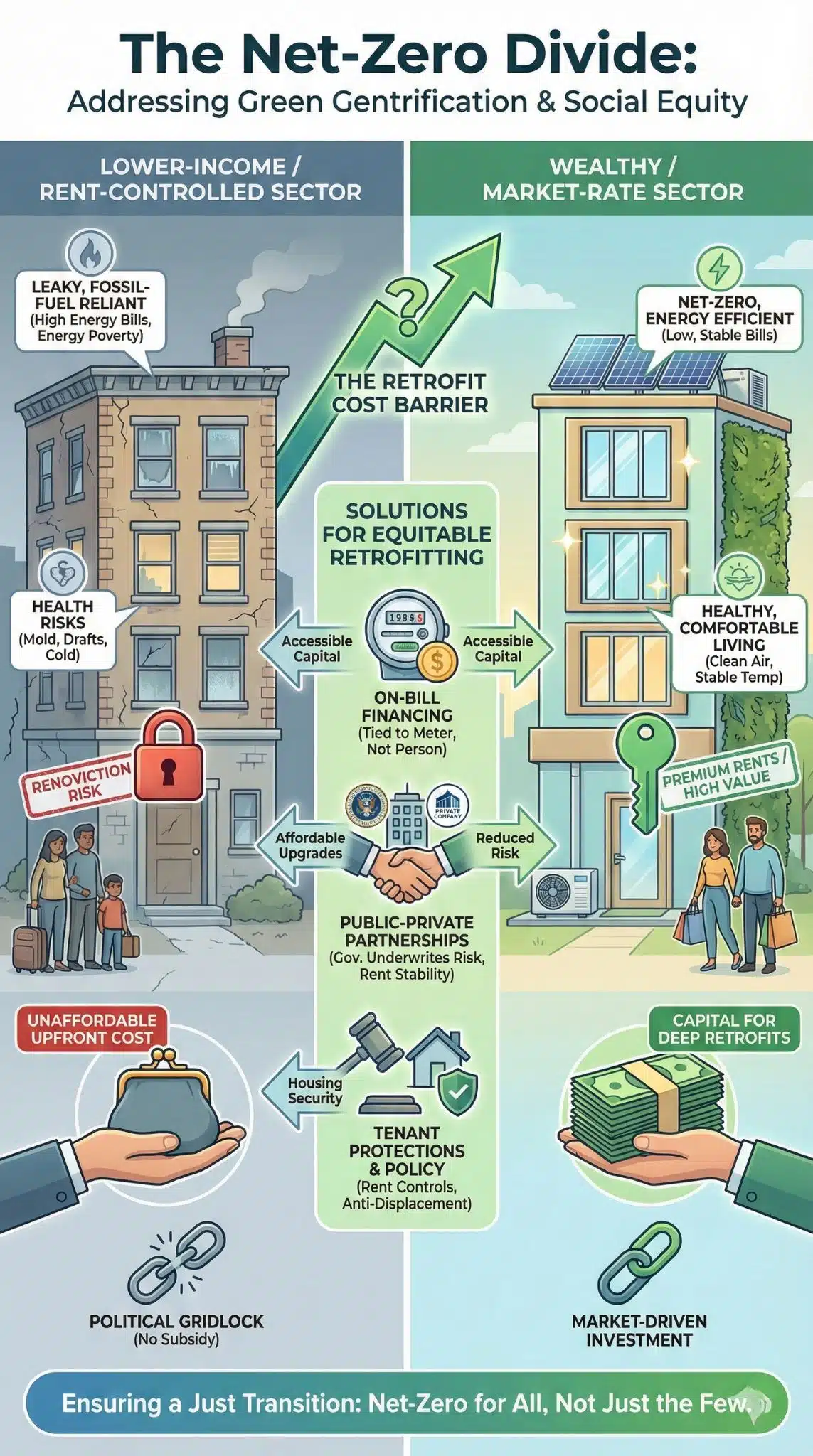

The “Why” of retrofitting is clear, but the “How” raises difficult social questions. A critical analysis of the 2026 landscape reveals a growing tension known as “Green Gentrification” or “Renoviction.”

As landlords invest millions in deep retrofits to meet regulatory standards, they inevitably seek to recoup these costs through higher rents. In rent-controlled sectors, this has led to political gridlock. Without substantial public subsidy, the cost of net-zero living remains out of reach for lower-income populations, creating a two-tier housing market: healthy, comfortable, net-zero homes for the wealthy, and leaky, expensive-to-run, fossil-fuel-reliant housing for the poor.

Successful models emerging in 2026 involve “On-Bill Financing” tied to the meter rather than the person, and public-private partnerships where the government underwrites the risk of retrofitting affordable housing in exchange for long-term rent stability.

Expert Perspectives: The Techno-Optimists vs. The Pragmatists

To understand the trajectory, we must look at the conflicting views within the industry.

- The Techno-Optimist View: Dr. Aris Thorne, a leading clean-tech analyst, argues, “We are on the verge of the ‘Solar Singularity’ for buildings. With the crash in price of Perovskite solar cells in late 2025, every retrofitted surface will soon generate power. The building will pay for its own renovation within five years.”

- The Pragmatist View: Conversely, Sarah Jenkins of the Urban Housing Institute cautions, “Technology is not the bottleneck; labor is. We have a massive shortage of skilled installers. You can manufacture all the heat pumps you want, but if you don’t have the certified electricians and plumbers to install them, the revolution stalls. We are seeing lead times for retrofits stretch to 12 months due to workforce gaps.”

Future Outlook: The Era of “Regenerative” Real Estate

Looking ahead to 2030, the concept of Net-Zero will likely be viewed as insufficient. The vanguard of the industry is already moving toward “Net Positive” or “Regenerative” retrofits—buildings that clean the air, sequester carbon in their materials (using bio-based insulation like hempcrete or mycelium), and generate more energy than they consume.

The next frontier is the “Material Passport.” By 2028, we expect most major cities to require a digital log of all materials used in a retrofit, ensuring that when the building is eventually modified again, those materials can be recovered and reused, closing the loop on the circular economy.

The Net-Zero Housing Revolution of 2026 is not just a technical upgrade; it is a rewriting of the social contract between citizens, their shelters, and the environment. The “static” building is dead; the “dynamic,” living building has arrived.

Final Thoughts

The Net-Zero Retrofitting Revolution of 2026 is the fundamental re-underwriting of the global built environment. As the “Brown Discount” widens and climate policy tightens, the choice for asset owners is binary: adapt or face obsolescence. This transition represents the greatest economic opportunity of the decade, transforming static structures into dynamic, living participants in the energy grid. Ultimately, the future belongs to those who recognize that a building’s value is now inextricably linked to its environmental performance.