The banking landscape has shifted dramatically over the last decade. Gone are the days when your only option was the brick-and-mortar branch down the street. Today, the battle of neobank vs traditional bank is reshaping how we save, spend, and manage our money. While traditional banks offer the comfort of physical stability and decades of history, neobanks (or “challenger banks”) promise sleek apps, lower fees, and significantly higher interest rates.

But which one actually deserves your loyalty?

In 2026, the gap between these two models is both widening and blurring. Neobanks are becoming more robust, and traditional banks are racing to improve their digital tools. Whether you are a tech-savvy freelancer, a business owner, or someone just looking to maximize their savings, understanding this comparison is crucial for your financial health.

In this guide, we will break down the fundamental differences, pros, cons, and future trends of these two banking models to help you decide.

What is a Traditional Bank?

A traditional bank is a financial institution with a physical presence—including branches and ATMs—that is fully licensed to offer a wide range of financial services. These institutions, like JPMorgan Chase, Bank of America, or Wells Fargo, have been the backbone of the global economy for centuries. They operate on a model that combines face-to-face customer service with digital offerings, serving everyone from high school students to massive multinational corporations.

The Full-Service Model

Traditional banks are essentially “one-stop shops” for finance. Unlike most fintech startups, they don’t just offer checking accounts. They provide mortgages, auto loans, small business financing, wealth management, safe deposit boxes, and notary services. Because they possess their own banking charters, they hold your money directly and are subjected to rigorous federal and state regulations. This allows them to lend money directly to you without needing a middleman.

The Trust and Physical Presence

The biggest selling point for traditional banks remains “trust” and “access.” If your account is hacked or you have a complex wire transfer issue, you can walk into a branch and speak to a manager. For many consumers, seeing a physical building provides a psychological sense of security that an app simply cannot replicate. Furthermore, their funds are directly insured by the FDIC (in the US) or similar bodies globally, often with higher limits for wealthy clients through sweep networks.

Here’s a detailed table showing the traditional banking overview.

| Feature | Description |

|---|---|

| Physical Presence | Extensive network of brick-and-mortar branches and ATMs. |

| Product Range | Comprehensive: Mortgages, auto loans, credit cards, investing, insurance. |

| Customer Service | In-person, phone, and digital; ability to resolve complex issues face-to-face. |

| Regulation | Highly regulated with direct banking charters and insurance. |

| Target Audience | Everyone, specifically those needing loans, cash services, or complex financial products. |

What is a Neobank?

A neobank is a fintech company that operates exclusively online without physical branch networks. Examples include Chime, Revolut, Monzo, and SoFi. These companies were born in the digital age, prioritizing user experience (UX), speed, and low costs over the “stuffy” formality of legacy institutions. It is important to note that many neobanks are not “banks” in the legal sense but technology companies that partner with chartered banks to offer services.

The Digital-First Efficiency

Neobanks run on modern technology stacks, unburdened by the clumsy legacy systems that slow down traditional banks. This allows them to innovate rapidly. Opening an account with a neobank often takes less than five minutes and requires no paperwork. Their apps are designed with a hyper-focus on the user, offering features like early direct deposit, automated savings tools (like rounding up purchases), and real-time spending notifications that traditional bank apps often struggle to match in quality.

The Partner Bank Model (BaaS)

Most neobanks do not hold a banking charter themselves. Instead, they partner with smaller, regional banks (like The Bancorp Bank, Stride Bank, or Sutton Bank in the US) to hold customer deposits. This “Banking-as-a-Service” (BaaS) model means your money is still FDIC-insured (usually up to $250,000), but the neobank handles the app and customer service while the partner handles the compliance. This structure allows neobanks to keep overhead costs incredibly low, passing those savings on to you.

Here’s a detailed table showing the neobanking overview

| Feature | Description |

|---|---|

| Physical Presence | None. 100% mobile and web-based operations. |

| Product Range | Focused: Checking, high-yield savings, peer-to-peer payments, crypto access. |

| Customer Service | Chatbots, in-app support, and email; rarely phone support. |

| Regulation | Usually tech companies partner with chartered banks for compliance. |

| Target Audience | Digital natives, gig workers, travelers, and fee-conscious savers. |

Neobank vs Traditional Bank: The Core Differences

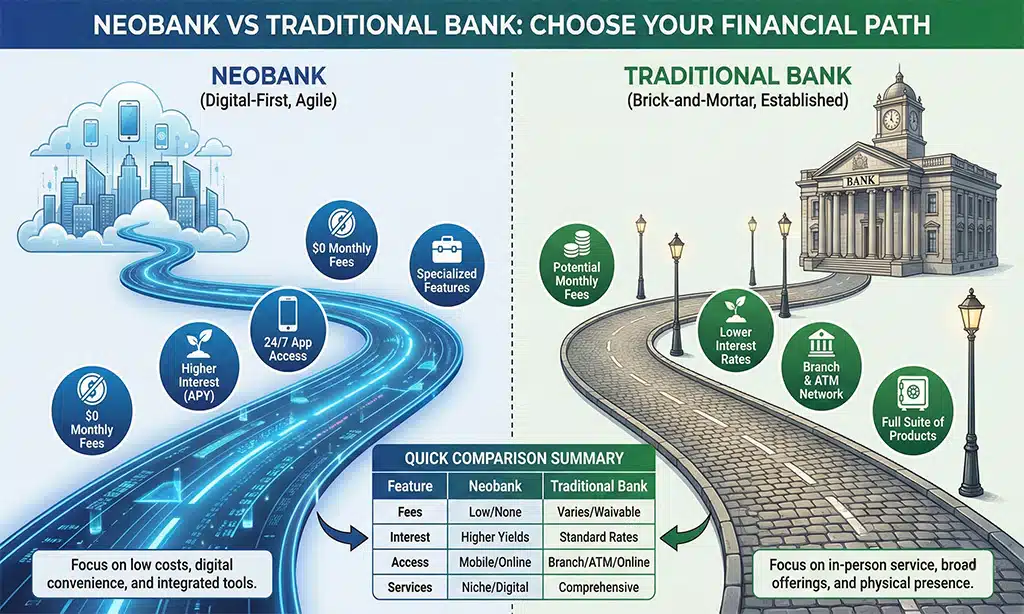

The debate of neobank vs traditional bank ultimately comes down to four main factors: cost, interest rates, convenience, and service depth. While traditional banks rely on interest margins and fees from a wide array of products, neobanks often rely on “interchange fees” (the small fee merchants pay when you swipe your card) and premium subscription models. This fundamental difference in business models creates stark contrasts in the customer experience.

Fees and Account Costs

Neobanks are the clear winners when it comes to day-to-day costs. Traditional banks are notorious for “maintenance fees” (e.g., $12/month unless you have a minimum balance) and steep overdraft fees (often $35 per occurrence). Neobanks rarely charge monthly maintenance fees, and many have eliminated overdraft fees entirely. For a customer living paycheck to paycheck, a neobank can save hundreds of dollars a year in avoided penalties.

Interest Rates and Yields (APY)

Because neobanks do not have to pay for electricity, rent, and staff for thousands of physical branches, they have significantly lower overhead. They often pass this surplus to customers in the form of High-Yield Savings Accounts (HYSA). In early 2026, it is common to find neobanks offering 4.00% to 5.00% APY on savings. In contrast, many traditional big banks still offer a meager 0.01% to 0.05% on standard savings accounts.

User Experience and Technology

Neobanks build their entire identity around the mobile app. The interface is usually intuitive, fast, and packed with “gamified” features to help you save. Traditional banks have improved their apps significantly, but they often feel cluttered because they are trying to cram decades of complex banking products into a single screen. Neobanks also tend to offer better integration with other modern fintech tools, crypto wallets, and gig-economy platforms.

The head-to-head comparison between the traditional bank and the neobank with 2026 data is shown in the table below.

| Comparison Factor | Traditional Banks | Neobanks |

|---|---|---|

| Monthly Fees | Common ($5–$25), often waivable with a high balance. | Rare ($0), sometimes subscription for premium tiers. |

| Overdraft Fees | High ($30–$35). | Usually $0 or “Spot Me” features up to a limit. |

| Interest Rates (APY) | Low (0.01% – 0.50%) for standard accounts. | High (4.00% – 5.00%+) for savings. |

| ATM Access | Own branded ATMs + fees for out-of-network. | Large partner networks (Allpoint, MoneyPass); usually fee-free. |

| Cash Deposits | Easy (at branch or ATM). | Difficult (requires retail partners like 7-Eleven/Walmart + fees). |

| Global Usage | High foreign transaction fees (usually 3%). | Often fee-free currency exchange at interbank rates. |

Pros and Cons of Traditional Banks

When evaluating the neobank vs traditional bank choice, it is vital to respect the “legacy” power of traditional institutions. They aren’t dinosaurs; they are fortresses of capital. If you need complex financial help, their stability is unmatched.

Why Stick with the Old Guard? (Pros)

- Relationship Banking: If you have a long history with a bank, they may be more likely to approve a mortgage or auto loan even if your credit score is borderline.

- Full Service Menu: You can get a cashier’s check, open a safety deposit box, notarize a document, and invest in a CD all in one building.

- Crisis Management: If you are a victim of identity theft, sitting across the desk from a human manager can be much more reassuring and effective than typing into a chatbox.

- Cash Handling: For business owners who deposit cash daily, a branch is non-negotiable.

Where They Fall Short (Cons)

- “Death by a Thousand Cuts”: Monthly service fees, wire transfer fees, and paper statement fees add up.

- Poor Savings Growth: Keeping your emergency fund in a big bank’s savings account means you are effectively losing money to inflation.

- Slower Innovation: New features often take years to roll out due to heavy regulatory bureaucracy and old IT systems.

The pros and cons of the traditional bank system are shown in the table below.

| Pros | Cons |

|---|---|

| Face-to-face support at branches. | Low interest rates on savings. |

| Full lending (mortgage, auto, business). | High fees (overdraft/maintenance). |

| Easy cash handling for deposits. | Slower innovation cycles. |

| Brand stability and perceived safety. | Bureaucratic processes for simple tasks. |

Pros and Cons of Neobanks

Neobanks are the disruptors, but they are not perfect. Their lack of physical support can be a nightmare during a fraud investigation or system outage. We must weigh the specific advantages and drawbacks to make an informed decision based on actual financial needs rather than just trends.

Why Switch to the Challengers? (Pros)

- High Yields: Earning 4.5% or more on your idle cash is a massive financial advantage over time.

- Financial Wellness Tools: Features like “get paid 2 days early,” automatic savings buckets, and credit builder cards are standard.

- Travel Friendly: Many neobanks (like Revolut or Wise) offer multi-currency accounts that let you spend abroad like a local without hidden fees.

- Instant Setup: You can open an account from your couch on a Sunday night in minutes.

The Hidden Risks (Cons)

- Customer Service Gaps: If your account is frozen due to a flagged transaction (a common complaint), you are often at the mercy of an email ticket system or a chatbot.

- Limited Lending: Most neobanks cannot offer you a mortgage or a car loan directly.

- Cash Deposit Hassles: Depositing cash often involves going to a drugstore and paying a fee (e.g., $4.95) to load money onto your card.

The pros and cons of the neobank system are shown in the table below.

| Pros | Cons |

|---|---|

| High interest rates (4%+ APY). | Poor customer support (chatbots/email). |

| Minimal/no fees for daily use. | Hard to deposit cash (retail fees apply). |

| Superior app/UX experience. | Limited lending products (no mortgages). |

| Quick setup with no paperwork. | Stability concerns (startups vs. giants). |

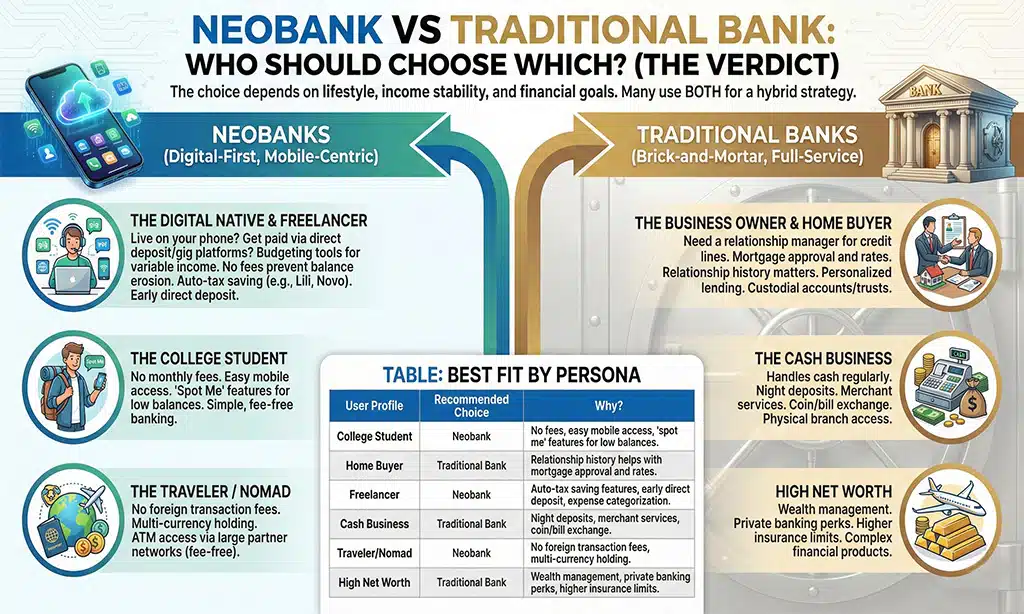

Who Should Choose Which? (The Verdict)

The choice between a neobank and a traditional bank is not binary; it depends entirely on your lifestyle, income stability, and financial goals. For many people in 2026, the answer is actually “both.” Using a neobank for daily spending and a traditional bank for long-term savings or lending is a popular hybrid strategy.

The Digital Native & Freelancer

If you live on your phone, get paid via direct deposit or gig platforms, and rarely touch cash, a neobank is likely the better choice. The budgeting tools help manage variable income, and the lack of fees prevents your balance from being eaten away during lean months. Neobanks like Lili or Novo specifically cater to freelancers by automatically setting aside tax money from every deposit.

The Business Owner & Home Buyer

If you run a business that handles cash, or if you are planning to buy a home soon, you need a traditional bank. You need a relationship manager who understands your business model to approve a line of credit. You need a bank that can issue a mortgage. While some neobanks offer mortgages now, the process is often less personalized. Families also benefit from traditional banks for setting up custodial accounts or trusts.

Future Trends in Banking (2026 & Beyond)

As we move deeper into the late 2020s, the line between neobank vs traditional bank is blurring. Traditional banks are launching their own “digital-only” brands to compete with fintechs. Conversely, successful neobanks are maturing; some are applying for their own banking charters (like Varo did years ago) to stop relying on partners and to offer more robust lending products.

The Rise of AI & Hyper-Personalization

By the end of 2026, expect AI to play a massive role. Neobanks are leading the charge with AI financial assistants that don’t just track spending but proactively suggest how to save. Traditional banks are catching up, using AI to detect fraud more accurately and offer personalized loan rates. The “static” bank account is dying; the future is a proactive financial partner.

Traditional Banks Going “Phygital”

Legacy institutions are closing branches at a record pace—data shows the US branch network shrank by over 14% between 2017 and 2025. However, they aren’t disappearing. They are adopting a “Phygital” (Physical + Digital) strategy. Branches are becoming smaller “advice centers” rather than transaction halls. You’ll go to a branch to discuss a loan strategy with a human, but you’ll use a kiosk or app for everything else.

The table below shows the future outlook from 2026-2030.

| Trend | Prediction |

|---|---|

| Branch Closures | Traditional banks will continue to reduce their physical footprint, focusing on advisory hubs. |

| Super Apps | Neobanks will evolve into “Super Apps,” integrating shopping, crypto, and travel booking. |

| Acquisitions | Big banks will likely acquire successful mid-sized neobanks to absorb their tech. |

| AI Banking | AI will replace most Level 1 customer support in both models, making human access a premium luxury. |

Final Thoughts

The decision of neobank vs traditional bank is no longer about choosing between “new” and “old.” It is about choosing between agility and depth.

If you prioritize high interest on your savings, zero monthly fees, and an app that makes finance easy and transparent, a neobank is a fantastic tool for your daily life. However, if you need a mortgage, frequent cash deposits, or face-to-face reassurance during a crisis, the traditional bank remains the king of stability.

For the smartest financial setup in 2026, consider the hybrid approach:

- Open a Neobank Account: Use this for your daily spending and emergency fund to take advantage of the 4.00%+ APY and budgeting tools.

- Keep a Traditional Account: Maintain a fee-free (or minimum balance) checking account at a major bank. Use this for depositing cash, writing checks, and maintaining a relationship for future big loans.

By leveraging the strengths of both, you ensure your money is working hard for you while remaining safe and accessible.