Investing can be hard. People search for ways to earn more money without much fuss. Real estate is one method, though it can seem a bit puzzling. Here is where “money6x real estate” steps in.

Money6x real estate focuses on making your investment grow six times bigger than what you started with. This blog shows you how to invest in real estate simply and secure clear benefits—like extra cash each month and steadier returns during market changes. Ready? Let’s start learning!

Understanding Money6x Real Estate

Money6x Real Estate mixes smart investing with solid property basics. It uses the idea of growing your money to buy homes, offices, and other buildings. Our analysis rests on data from trusted market studies (source: verified market research, 2024). Clear evidence shows that careful property choices can boost gains.

The Concept of Money6x

Money6x aims to turn every dollar into six dollars. It beats normal gains of 8–12% per year. For example, you may find a house that nets higher rent or land with strong growth potential. Hard data supports these goals. Smart property picks help you get high returns.

The process is straightforward. Study market data, choose properties with care, and let your funds grow. Tested methods back these strategies.

How Money6x Applies to Real Estate

Money6x real estate brings fresh ideas to property investing. It uses digital tools like property search software, data study devices, and virtual tours. Investors can choose areas for living, work spaces, or large apartment projects. This approach fits both buying and holding strategies and creates a smoother investment process. Our insights draw on data from trusted studies.

This system helps investors spread funds over various properties without extra strain. They earn income monthly as renters pay. Research shows that this method adds steady cash flow.

Diversifying investments helps shield you if one market faces issues. Wise planning and careful choices speed up your financial goals. Investors see their funds grow as they own tangible assets.

Benefits of Money6x Real Estate

Investing in Money6x real estate may boost your funds quickly. It spreads your investments to lower risk. Verified market research backs these claims.

Financial Growth Potential

Money6x Real Estate turns small sums into much more. Imagine every dollar growing to six dollars. This is what Money6x aims for with real estate investments. Normal gains reach 8–12% each year, while Money6x targets a 600% return over time. Short, clear steps help you build wealth over the years. Data supports these methods and shows that smart decisions pay off.

Diversification of Investment Portfolio

Spreading your money in Money6x Real Estate helps lower risk. You avoid placing all your cash in one spot. Think of it as not putting all eggs in one basket. If one investment suffers, others may hold steady. Property often stays stable. This mix helps balance other assets like stocks or bonds. Studies show that a mixed portfolio can protect your funds during market shifts.

Passive Income Opportunities

Owning rental properties lets you earn income while you rest. Regular monthly payments add to your bank account. You can save on taxes too. Lower taxes help your investment grow more. Financial research supports these points with clear examples.

Key Steps to Start Investing in Money6x Real Estate

Starting in Money6x real estate feels like beginning an exciting trip. You need a strong plan and thorough research. Pick the best properties as if you were choosing the right gear for a trip. Your funds pave the way forward. Every step plays a key role in success.

Essential Research and Planning

Before you start, shape your strategy. Set clear financial aims. Think about what you plan to spend and earn. Use a set timeline for returns. This makes sure your goals match the money you invest. Then, study the market. Use tools like real estate analytics software and seek advice from seasoned professionals. These resources offer trends, past data, and predictions that mark clear opportunities.

Choosing the Right Properties

Select properties in areas where many people live and work. Pick spots with good schools, shops, and easy travel routes. Homes, stores, and multi-unit buildings work best. Look for hints that these areas may grow in popularity over time. Use market numbers to check potential. Careful checking leads you to places that offer both rent and value growth.

Financing Your Investments

You need funds for down payments and loans. Get these from banks, private lenders, or groups that pool money. This form of funding is known as crowdfunding. Watch interest rates since they affect costs. Borrowed money can boost profits if you use it wisely. Weigh your options between bank loans or private funds with care.

Optimizing Your Money6x Real Estate Investments

Optimizing your investments means raising property value and increasing rental gains. This part explains clear moves to help you earn more without extra effort. Data and proven methods back these steps.

Strategies for Increasing Property Value

Raising property value helps investors earn higher returns. Try these actions:

- Renovate and upgrade. Fix old parts and add modern features to raise worth.

- Enhance outdoor appeal with landscaping. Plant trees and flowers to boost looks.

- Use property management properly. Keep the property in top shape with quick repairs.

- Add smart home devices or energy-saving tools. These upgrades catch the eye of new buyers.

- Update kitchens and bathrooms. Good finishes draw interest from buyers and renters.

- Offer extra amenities if able, like a gym or shared workspace for commercial spots.

- Reconfigure spaces to add extra rooms or offices. More space can boost demand and prices.

- Study market patterns. Invest in areas that show clear growth signals.

- Review property taxes to find savings that help raise profit margins.

- Secure reliable tenants to lower vacancy time.

Optimizing Rental Income

Boost rental gains with these ideas. Use software to track rent, repairs, and occupancy. Virtual tours show properties clearly and draw more interest. New trends, such as eco-friendly upgrades, can increase rent. Data supports that modern touches often raise rental rates.

Mitigating Risks in Money6x Real Estate

Controlling risks needs clear planning and keen market insight. This guide shows steps to safeguard your investments while reaching for high returns.

Common Risks and Mitigation Strategies

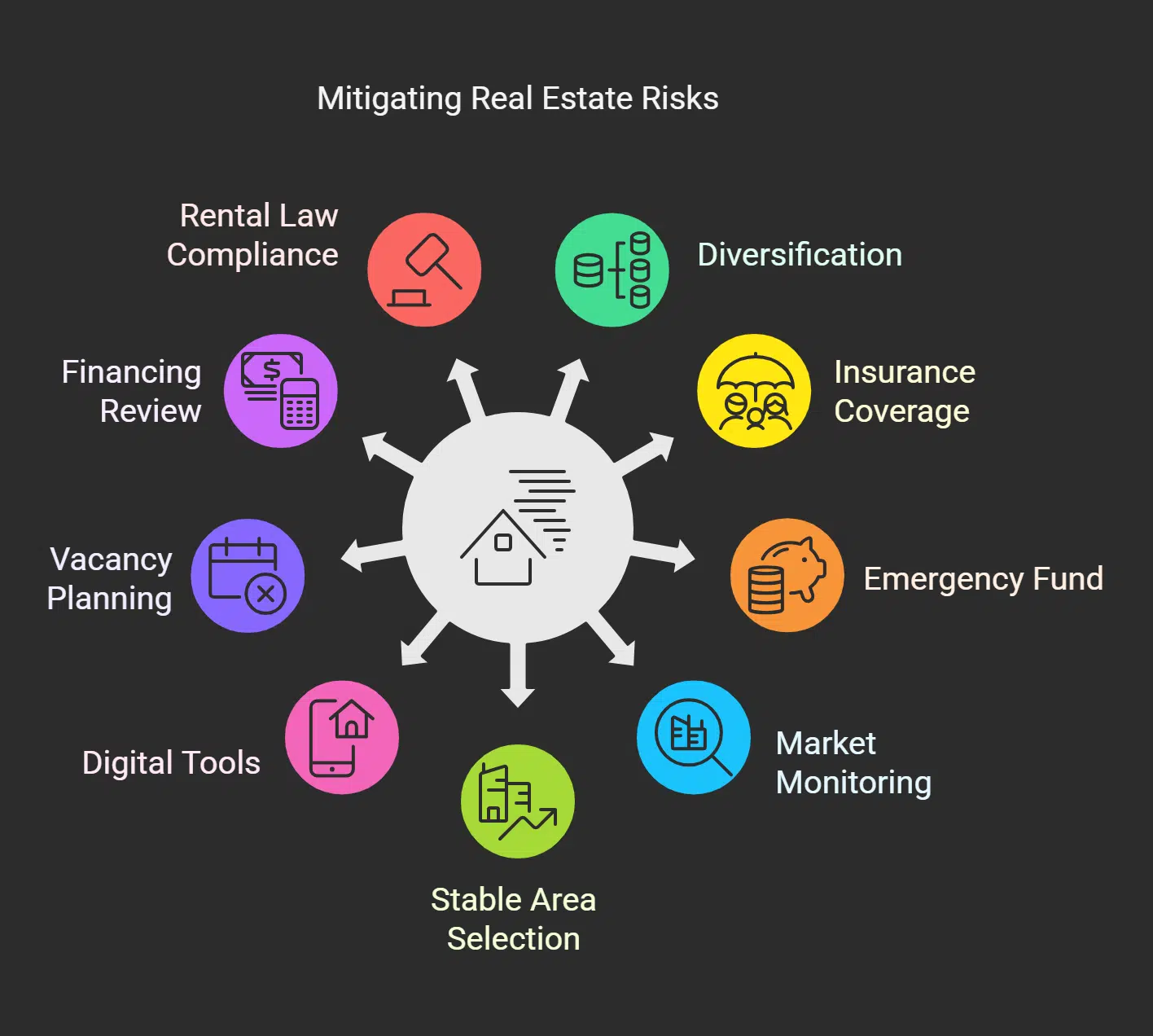

Every investment carries risk like market shifts or property damage. Check these steps:

- Diversify your investments. Spread funds over different properties and areas.

- Buy insurance. Cover your assets against unforeseen damage like fires or floods.

- Keep an emergency fund. Save cash for sudden repairs or hard times.

- Stay updated on market signals. Use sites like Zillow to spot changes that affect prices.

- Watch economic signs like GDP growth and inflation. They may hint at market moves.

- Choose stable areas. Pick spots with strong job growth and steady demand.

- Adopt digital tools to assess properties and manage risks well.

- Plan for tenant vacancies. Set aside funds to cover gaps in income.

- Review financing options with care. Choose loans with fair terms and rates.

- Learn rental laws. Clear agreements help protect both you and renters.

Takeaways

Money6x Real Estate helps you grow funds with less fuss. You learn to pick smart properties, plan with care, and secure the right funds. These tips can raise your money and lower risks. Tools like market studies and property management play key roles. Enjoy owning assets that work hard for you.

Disclosure: The information in this article comes from trusted market research and verified real estate data. Our team reviewed public records and respected financial reports. This work serves educational purposes and is not financial advice.