For many entrepreneurs, securing adequate funding is the most difficult challenge in starting or growing a small business. Their dream of innovation and independence often hinges on access to capital. While the funding landscape offers numerous options, from traditional bank loans to venture capital and crowdfunding, the process can be complex and fraught with pitfalls. A single misstep can lead to rejection, wasted time, or even accepting unfavorable terms. So entrepreneurs must be careful about the mistakes to avoid when seeking small business funding.

So, understanding and actively avoiding common mistakes becomes just as crucial as having a solid business plan. Lenders and investors are looking for confidence, clarity, and a strong understanding of your financial needs and repayment capabilities. By preparing thoroughly and strategically, you can significantly increase your chances of securing the funding your small business needs to thrive.

What’s the Importance of Having a Clear Business Plan In Case of Receiving Funds?

A clear business plan is not just a requirement for securing funding. It is a practical guide that determines how effectively funds are used after they are received. Without a defined plan, businesses often struggle with misallocated spending, unclear priorities, and slow decision-making.

Clarifies how funds will be used

A strong business plan clearly outlines where the money will go and why each expense matters. This prevents impulsive spending and keeps the business aligned with its long-term goals.

Common areas a business plan should cover include:

-

Product or service development

-

Hiring and team expansion

-

Marketing and customer acquisition

-

Operational costs and infrastructure

-

Emergency or contingency reserves

When spending decisions are mapped in advance, founders are less likely to waste capital on low-impact activities.

Builds credibility with funders

Investors and lenders want confidence that their money will be handled responsibly. A clear plan shows that the entrepreneur understands the market, has realistic growth expectations, and has considered potential risks.

A well-structured plan helps demonstrate:

-

Market knowledge and competitive positioning

-

Realistic revenue and cost projections

-

Risk awareness and mitigation strategies

-

A clear path toward profitability or sustainability

This credibility can influence not only approval but also funding terms and valuation.

Acts as a control and tracking tool

Once funding is secured, the business plan becomes a reference point. It helps founders track progress, measure results, and adjust strategy when needed.

If challenges arise, the plan makes it easier to answer key questions:

-

Are we off track because of execution or assumptions?

-

Do we need to adjust timelines or spending priorities?

-

Are results aligned with what was promised to funders?

15 Mistakes to Avoid When Seeking Small Business Funding

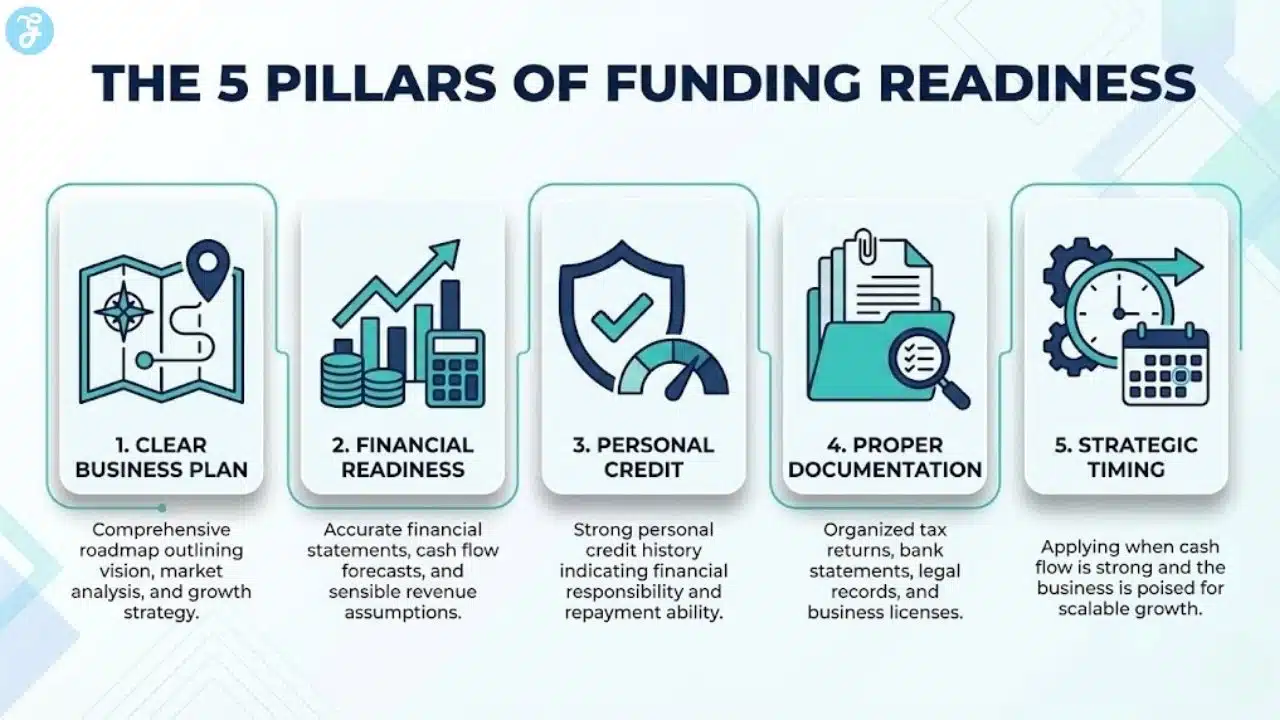

1. Not Having a Clear Business Plan

One of the most fundamental mistakes is approaching lenders or investors without a well-developed, clear, and compelling business plan. Your business plan is your roadmap; it outlines your vision, mission, market analysis, operational structure, marketing strategy, and financial projections.

Lenders and investors need to see a roadmap. Walking into a meeting with just an idea or a loose verbal strategy is a red flag.

Why is it a mistake? It suggests you have not thought through the execution, risks, or market fit.

How to avoid it: Create a comprehensive business plan that details your business model, target market, competitive analysis, and exactly how the funds will be used to generate growth.

2. Failing to Understand Your Financial Needs

Many entrepreneurs make the mistake of asking for too much or too little money. Requesting too much might make you seem unrealistic or irresponsible, while asking for too little could leave you underfunded and struggling later. You need a detailed breakdown of how every dollar will be used, a realistic budget, and a clear understanding of your cash flow.

This means accounting for startup costs, operating expenses, working capital, and a contingency fund.

3. Ignoring Your Personal Credit Score

Your personal and business credit scores are paramount in the funding process, especially for traditional loans. Many small business loans rely heavily on the owner’s personal credit history.

- Why it is a mistake: A low personal score can disqualify you from prime loans or saddle you with sky-high interest rates.

- How to avoid it: Check your credit report months before applying. Dispute errors and pay down high-interest personal debt to boost your score.

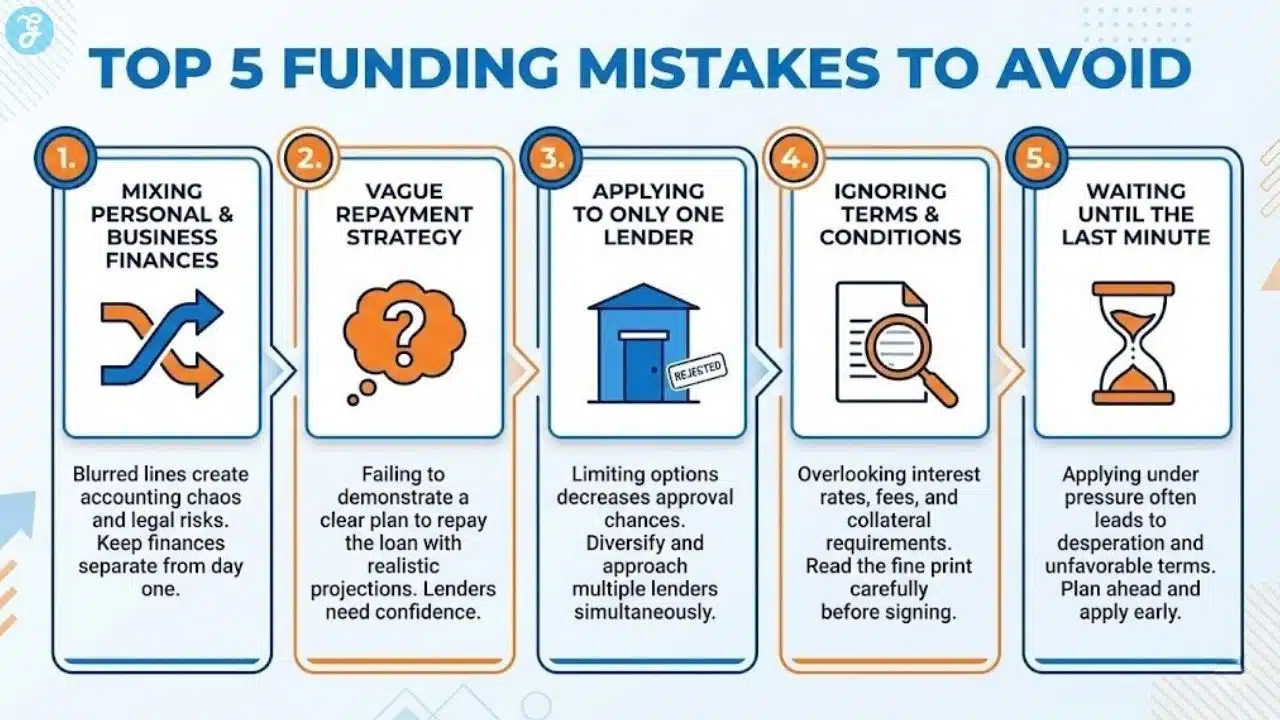

4. Only Applying to One Lender

Putting all your eggs in one basket is definitely a risky strategy. Different lenders have varying criteria, risk appetites, and product offerings. Relying on a single application can lead to disappointment if rejected, forcing you back to square one.

It’s always wise to research multiple funding sources, compare terms, and apply to several options simultaneously to increase your chances and find the best fit for your business.

5. Lacking Proper Documentation

Funding applications require extensive documentation, including financial statements (profit and loss, balance sheets, cash flow), tax returns, bank statements, legal documents (articles of incorporation, licenses), and personal identification.

Submitting an incomplete application or having disorganized paperwork not only delays the process but also reflects poorly on your professionalism and attention to detail.

6. Misrepresenting Financials or Business Prospects

Exaggerating revenues, understating expenses, or painting an overly optimistic picture of your business prospects is a critical mistake. Lenders and investors conduct thorough due diligence.

Any misrepresentation, intentional or unintentional, will be uncovered and will immediately erode trust, leading to rejection and potentially damaging your reputation for future funding efforts. Honesty and transparency are always the best policy.

Why it is a mistake: Mismatched funding can destroy cash flow. Short-term loans should fund short-term needs like inventory, while long-term loans should fund long-term assets like equipment or real estate.

How to avoid it: Research the differences between term loans, lines of credit, SBA loans, and equity financing to find the right fit for your specific need.

7. Not Having Collateral (When Required)

For many traditional small business loans, especially larger amounts, lenders require collateral to secure the loan. This could be real estate, equipment, or accounts receivable.

If you’re seeking a collateralized loan but don’t have suitable assets or aren’t prepared to offer them, your application will likely be denied. Understand the collateral requirements for different loan types before you apply.

8. Confusing Business and Personal Finances

Mixing personal and business finances is a common pitfall for new entrepreneurs. Lenders prefer to see a clear separation. Using personal accounts for business transactions makes it difficult to track revenue and expenses, assess profitability, and present a clear financial picture of your business. Establish separate business bank accounts and credit cards from day one.

9. Lack of Clear Repayment Strategy

Lenders want to know how you plan to pay them back. A vague “we’ll make enough money” isn’t a strategy. You need a robust repayment plan supported by realistic financial projections, cash flow analysis, and a clear understanding of your revenue streams.

Always be ready to demonstrate how your business’s operations will generate the necessary funds to meet debt obligations.

Why it is a mistake: Taking on debt without knowing exactly where the cash for the monthly payments will come from creates severe stress.

How to avoid it: Run a cash flow analysis to ensure your business can absorb the new loan payment even if revenue stays flat or dips slightly.

10. Ignoring Alternative Funding Options

Many entrepreneurs focus solely on traditional bank loans, often overlooking a wealth of alternative funding sources.

Why it is a mistake: Big banks have the strictest approval rates. You might be rejected there, but easily approved by a credit union, CDFI (Community Development Financial Institution), or online lender.

How to avoid it: Diversify your search. Look into fintech lenders and local community banks that may be more eager to support local small businesses.

Depending on your business stage, industry, and needs, options like SBA loans, lines of credit, crowdfunding, angel investors, venture capital, peer-to-peer lending, equipment financing, or invoice factoring might be more suitable or accessible. Research all avenues before deciding.

11. Not Researching the Lender

Just as lenders research you, you should research them. Different lenders specialize in different industries, loan sizes, or business stages. Applying to a lender that doesn’t typically fund businesses like yours is a waste of time.

Understand their typical client profile, interest rates, terms, and the types of businesses they prefer to support.

12. Poor Presentation and Communication

First impressions matter. Whether it’s a meticulously organized application package or a confident pitch to investors, your presentation and communication skills are vital. Sloppy paperwork, unclear explanations, or an inability to articulate your business vision effectively can undermine even the best business concept.

You should always practice your pitch, ensure your documents are professional, and communicate clearly and concisely.

13. Waiting Until the Last Minute

Seeking funding is not an overnight process. It can take weeks or even months from initial application to funds disbursement. Waiting until your business is in a desperate financial situation to seek funding puts immense pressure on you and makes it harder to negotiate favorable terms.

Why it is a mistake: Desperation smells risky to lenders. It also forces you to accept predatory terms because you do not have time to shop around. The worst time to ask for money is when you are days away from missing payroll.

How to avoid it: Apply for a line of credit when your cash flow is strong. You do not have to use it, but it will be there as a safety net when you need it.

14. Lack of Collateral Awareness and the Terms and Conditions

Before signing any loan agreement or investment contract, thoroughly read and understand all terms and conditions. Pay close attention to interest rates, repayment schedules, fees (origination, late payment, prepayment penalties), collateral requirements, personal guarantees, and any covenants.

Rushing this step can lead to unexpected costs or obligations that negatively impact your business down the line. If unsure, seek legal or financial advice.

Collateral is an asset, like equipment or real estate, that secures the loan.

Why it is a mistake: Applying for a secured loan without having valuable assets to pledge will lead to an instant rejection. Conversely, pledging your personal home for a risky business loan is a massive personal gamble.

How to avoid it: Understand what assets you have available and be clear about what you are willing to risk. If you have no assets, look specifically for unsecured loans.

15. Giving Up After One Rejection

The path to securing funding can be challenging, and rejections are often part of the process. A common mistake is getting discouraged and giving up after a few setbacks.

Why it is a mistake: Different lenders have different risk appetites. One rejection does not mean your business is unfundable. Always remember: A “no” from one bank is not a “no” from everyone.

How to avoid it: Always ask why you were rejected. Use that feedback to fix the issue, such as improving credit or fixing cash flow, and try a different type of lender.

Learn from each rejection, ask for feedback, refine your plan, improve your financials, and reapply or seek alternative sources. Persistence and resilience are key traits of successful entrepreneurs.

Quick Funding Readiness Checklist Before You Apply

Even if you avoid the 15 mistakes, you will get better results when you run a fast “pre-application audit.” This short checklist helps you spot weak points that lenders and investors notice immediately, so you can fix them before you submit anything.

1) Confirm Your Funding Goal And Timeline

Be specific about what success looks like and when you need the capital.

-

What you need: a dollar amount (range is fine), purpose, and deadline

-

Why it matters: the “wrong” timeline pushes you into expensive products or rushed terms

-

Quick test: if the funding is delayed by 30–60 days, can you still operate?

2) Prepare A One-Page Use-Of-Funds Summary

Create a simple breakdown that matches your business plan and budget. Keep it tight and realistic.

| Category | Example Uses | Notes To Include |

|---|---|---|

| Product / Inventory | materials, initial stock | unit costs, reorder cycles |

| Marketing | ads, content, PR | CAC targets, test budget |

| Hiring | contractor, part-time help | role, start date, impact |

| Operations | tools, rent, logistics | monthly burn rate |

| Reserve | emergency buffer | how many months covered |

A clean use-of-funds table reduces confusion, prevents under/over-borrowing, and makes you look organized.

3) Validate Your Numbers With Three “Stress Checks”

Funders rarely reject founders for ambition. They reject founders for fragile assumptions. Run these quick checks:

-

Revenue stress: What happens if revenue is 20% lower than expected?

-

Cost stress: What happens if costs are 15% higher than expected?

-

Timing stress: What happens if customer payments arrive 30 days late?

If any of these scenarios push you into negative cash flow, adjust the request amount, cut nonessential spend, or pick a different funding product.

4) Organize Your Core Documents Into A Single Folder

Having documents ready prevents delays and signals professionalism. Include:

-

Last 6–12 months of bank statements (or as much history as you have)

-

P&L and balance sheet (even if founder-prepared early on)

-

Cash flow forecast (next 6–12 months)

-

Business registration, licenses, EIN/tax ID (where applicable)

-

A short business overview (what you do, who you serve, how you make money)

5) Choose The Funding Type That Matches The Job

A common hidden problem is using a product that fights your cash flow.

-

Use short-term financing for short-term needs (inventory cycles, bridging invoices).

-

Use long-term financing for long-life assets (equipment, buildout, expansion).

-

Consider equity when cash flow is too early/volatile for fixed monthly payments.

If you can clearly explain why the chosen funding type fits your business model, you reduce lender doubt and improve your odds of approval.

Bottom Line

Treat funding like a system: clear purpose, clean documents, realistic projections, and the right product. This pre-check takes an hour, but it can save weeks of rejections and renegotiations.

Funding Application Snapshot Pack

Add a short “snapshot pack” right after your checklist so funders can verify your story fast. Include:

-

One-page business summary (problem, solution, customer, pricing, traction)

-

Use-of-funds breakdown (what, how much, when, expected result)

-

6 to 12 month cash flow forecast (base case, conservative case)

-

Evidence folder (contracts, invoices, LOIs, testimonials, pilot results)

-

Ownership and legal basics (registration, licenses, cap table if applicable)

Key Metrics Funders Want Fast

| Metric | What It Proves | Simple Way To Show It |

|---|---|---|

| Monthly Burn Rate | How long cash lasts | last 3 months average expenses |

| Gross Margin | Profit per sale | revenue minus direct costs |

| CAC And Payback | Marketing efficiency | cost to acquire and months to recover |

| DSCR | Debt safety | net operating income vs payments |

| Cash Buffer | Resilience | months of runway in the bank |

Final Pre-Submit Checks

-

Match deposits to stated revenue.

-

Explain any unusual spikes in spending.

-

Prepare a 30-second repayment answer tied to cash flow.

Paving Your Way to Funding Success

Securing small business funding requires meticulous preparation, strategic thinking, and a proactive approach. By consciously avoiding these 15 common mistakes, you can streamline your application process, present a more compelling case, and significantly increase your likelihood of obtaining the capital needed to transform your entrepreneurial vision into a thriving reality.