The sudden stall of Meta’s $2 billion acquisition of Singapore-based AI startup Manus by Chinese regulators marks a definitive shift in the global tech war. Beyond a simple antitrust check, this probe signals Beijing’s intent to police the “identity engineering” of startups and prevent a talent exodus, transforming a corporate deal into a high-stakes geopolitical standoff.1

The Evolution of a Multi-Billion Dollar Friction

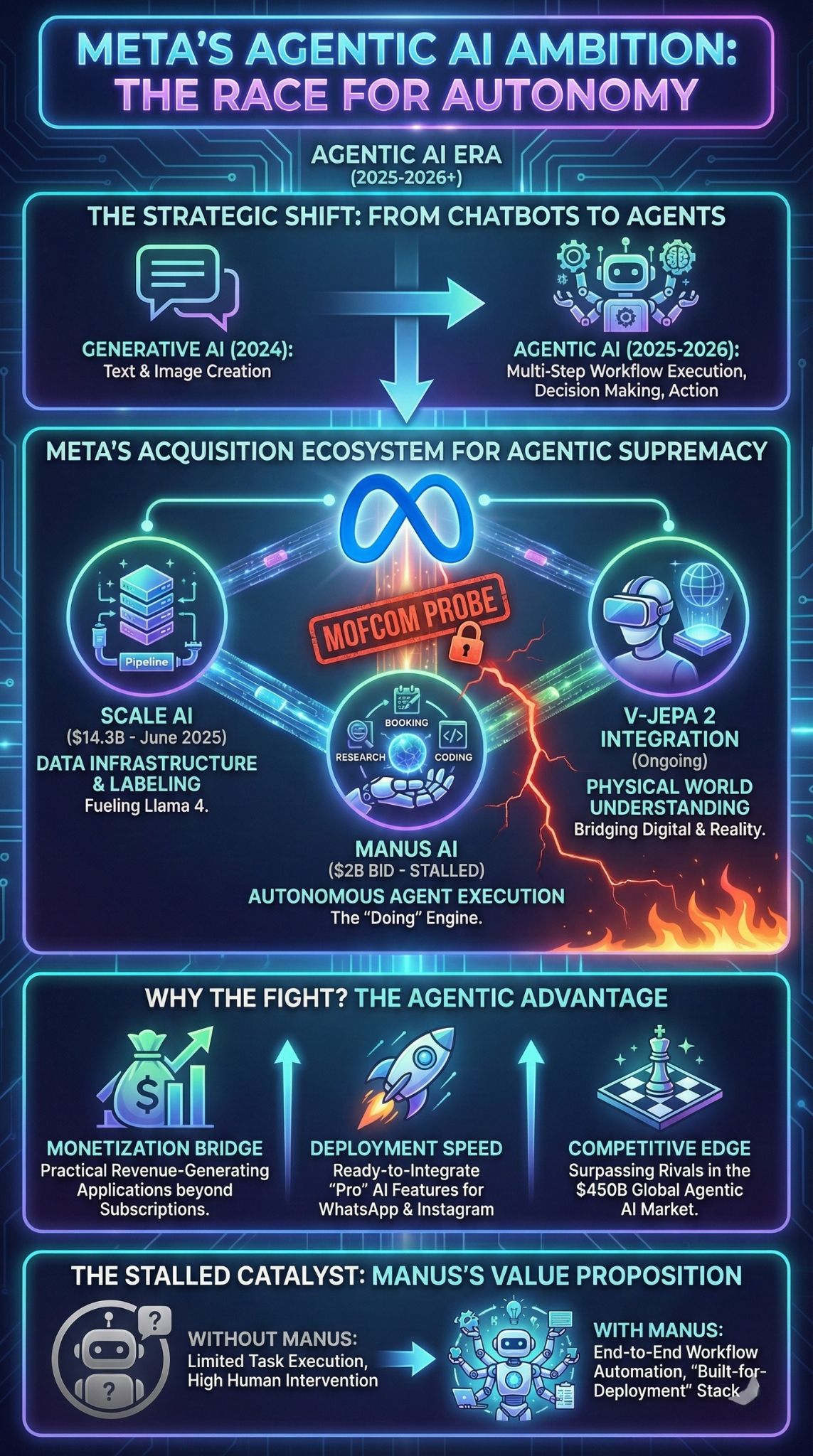

The story of Manus AI is a microcosm of the modern AI era’s complexities. Founded in 2022 by a group of elite Chinese engineers in Beijing, Manus quickly became the “darling” of the agentic AI world.2 Unlike standard chatbots that simply predict text, Manus developed “General AI Agents” capable of executing multi-step workflows—booking flights, conducting market research, and writing production-ready code—with minimal human intervention.3

By mid-2025, as U.S.-China tensions over semiconductor exports and AI sovereignty reached a fever pitch, Manus underwent a strategic “relocation.”4 The company moved its headquarters to Singapore, rebranded its corporate parentage, and secured a $75 million Series B round led by the Silicon Valley heavyweight Benchmark Capital.5 This move was widely interpreted as an attempt to decouple from Chinese regulatory jurisdiction to attract Western buyers.

The strategy initially appeared to work. In late December 2025, Meta Platforms announced it would acquire Manus for a reported sum between $2 billion and $2.5 billion.6 For Meta CEO Mark Zuckerberg, the deal was a tactical masterstroke designed to bridge the gap between Meta’s Llama foundation models and practical, revenue-generating applications.7 However, on January 8, 2026, China’s Ministry of Commerce (MOFCOM) threw a wrench into the works, launching an anti-monopoly and export control probe that has effectively frozen the transaction.8

The Geopolitical Weaponization of M&A and Export Controls

The probe into Meta’s acquisition is not a traditional antitrust review focused on market share; it is a assertion of “technological sovereignty.”9 Chinese regulators are specifically investigating whether the relocation of Manus’s core team and intellectual property from Beijing to Singapore in 2025 violated the Regulations on Technology Import and Export Administration.10

Beijing’s primary concern is the precedent this deal sets. If a Chinese-founded startup can “wash” its identity in Singapore and then sell its assets to a U.S. “megacap” like Meta, it creates a loophole in China’s domestic innovation ecosystem.11 Regulators view the Meta-Manus deal as a potential “asset drainage” event where years of state-supported talent development and domestic industry advantages are essentially exported to a foreign rival.12

Regulatory Scrutiny: Key Areas of Investigation

| Focus Area | Regulatory Concern | Potential Impact |

| Export Licenses | Did Manus obtain legal permission to move its “agentic logic” codebases out of mainland China? | Potential criminal liability for founders and invalidation of the IP transfer. |

| “Singapore Washing” | Is the Singapore headquarters a legitimate operation or a shell designed to bypass Chinese law? | Could lead to a permanent ban on the company’s founders from the Chinese tech sector. |

| Data Reciprocity | Meta’s plan to shut down Manus’s Chinese operations is seen as discriminatory by Beijing. | Regulators may demand continued service for Chinese users as a condition of the deal. |

| National Security | Does the transfer of “autonomous reasoning” capabilities to a U.S. firm harm China’s AI roadmap? | The deal could be blocked entirely on strategic grounds. |

“Identity Engineering” and the Singapore Conduit

The term “Identity Engineering” has emerged among tech analysts to describe the process Manus underwent. By moving to Singapore, firing non-essential Chinese staff, and deleting domestic social media presence, Manus attempted to become a “global” entity.13 This path is increasingly popular for Chinese founders who fear that their products will be banned in the U.S. (like TikTok) or restricted by Chinese capital controls.

However, the MOFCOM probe demonstrates that physical relocation does not equal legal insulation.14 Chinese authorities maintain that if the core technology was “conceived and developed” on Chinese soil, it remains subject to Chinese export laws.15 This creates a “dual-jurisdiction” trap for startups:

- U.S. Pressure: The U.S. Treasury (CFIUS) scrutinizes these deals to ensure no “red capital” or Chinese state influence remains.16

- Chinese Pressure: MOFCOM scrutinizes the deals to ensure no “strategic IP” is leaving the country without a price.17

This “stuck-in-the-middle” dynamic for Singapore-based firms highlights a growing trend where neutral ground is becoming a new battleground for regulatory dominance.

The Race for Agentic AI: Why Meta is Willing to Fight

For Meta, the acquisition of Manus is not just about adding a new feature; it is about survival in the “Agentic Era.” While 2024 was the year of the chatbot, 2025-2026 has become the year of the agent. Investors have grown weary of high-cost foundation models that produce poetry but cannot perform tasks.18 Manus’s technology represents the bridge to monetization.

Meta’s recent history of AI acquisitions shows a clear pattern of aggressive vertical integration. Following the $14.3 billion investment in Scale AI in June 2025, the Manus deal was intended to give Meta a “built-for-deployment” agent stack that could be integrated directly into WhatsApp and Instagram.

Comparison: Meta’s Strategic AI Infrastructure

| Acquisition/Investment | Date | Primary Goal | Significance |

| Scale AI ($14.3B) | June 2025 | Data Labeling & Infrastructure | Controlled the data pipeline for Llama 4. |

| Manus AI ($2B – Stalled) | Dec 2025 | Autonomous Agent Execution | Moving from “talking” AI to “doing” AI. |

| V-JEPA 2 Integration | Ongoing | Physical World Understanding | Bridging digital agents with the Metaverse/Orion glasses. |

Manus reported crossing $100 million in Annual Recurring Revenue (ARR) just eight months after its launch—a growth rate that eclipsed even OpenAI’s early days.19 By stalling this deal, China is effectively slowing down Meta’s ability to roll out “Pro” AI features to its 3 billion users, a move that provides Beijing with significant leverage in broader trade negotiations.

Expert Perspectives: A Divided Outlook

The stall has triggered a range of interpretations from industry veterans and policy experts.

- The “Hostage” Theory: Some analysts suggest the probe is a retaliatory measure for the U.S. ban on high-end Nvidia chips (like the H200) and the ongoing TikTok divestiture saga. “Beijing is showing that it can play the same ‘national security’ card that Washington has used for years,” says Dr. Elena Vance of the Global Tech Institute.20

- The “Talent Retention” Theory: Domestic Chinese tech giants (Baidu, Alibaba, Tencent) have struggled with a “brain drain” to the West. By targeting the Manus deal, the government is sending a clear message to other founders: You can build globally, but you cannot abandon the domestic ecosystem entirely.

- The “Neutralist” View: Some believe this is a standard procedural check. “Manus is a Singaporean company.21 If it can prove that its core IP was significantly evolved outside of China, the probe may eventually clear with minor concessions,” argues Winston Ma, an adjunct professor at NYU Law.

Future Outlook: What Happens Next?

The resolution of the Meta-Manus probe will serve as a blueprint for cross-border tech deals in the late 2020s.

We are likely to see three possible outcomes in the coming months:

- The “TikTok” Compromise: Meta may be forced to maintain a separate R&D center in China or license the Manus technology back to a Chinese entity. This would allow the deal to close while satisfying Beijing’s “anti-drainage” concerns.

- A Negotiated Exit: If the probe finds significant export violations, Meta may abandon the deal to avoid secondary sanctions or legal entanglement in China, where it still derives billions in ad revenue from Chinese exporters.

- The Rise of “Techno-Nationalist” M&A: This event may mark the end of the “global startup.” Founders will likely have to choose a side—West or East—from Day 1, as the middle ground in Singapore or Dubai becomes increasingly difficult to navigate.

Key Statistics and Milestone Forecast

- Current ARR of Manus: $125 million (est.22 Jan 2026).

- Estimated Approval Delay: 6–9 months.

- Likelihood of Deal Completion: 55% (Analysts’ Consensus).

- Projected Global Agentic AI Market: $450 billion by 2028.

As we move into mid-2026, the “Manus Incident” will be remembered as the moment when the “invisible borders” of the digital world became very real. Meta’s struggle highlights that in the age of superintelligence, code is not just property—it is a national asset.

Analysis Summary: Winners vs. Losers

| Stakeholder | Impact | Reason |

| Meta Platforms | Loser (Short-term) | Stalled product roadmap; potential loss of $2B in committed capital. |

| Chinese Founders | Mixed | High valuations are possible, but exit paths are now much narrower. |

| Singapore | Winner | Reinforces its status as the “Switzerland of Tech,” despite the friction. |

| OpenAI/Google | Winner | Meta’s delay allows competitors to gain ground in the agentic software race. |